Register to continue reading for free

Germany Retail: retailers’ troubles are far from over

Confidence indicators are a red flag for retail at the moment, especially on the retailers’ side. The slow decline in inflation is likely to have a negative impact on consumer prices in the clothing and footwear segment, which will undoubtedly continue to limit consumers’ purchasing power; even the fall in import prices is not entirely positive news, as it will take time to translate into reality. Only the online channel seems to be more optimistic about the times ahead

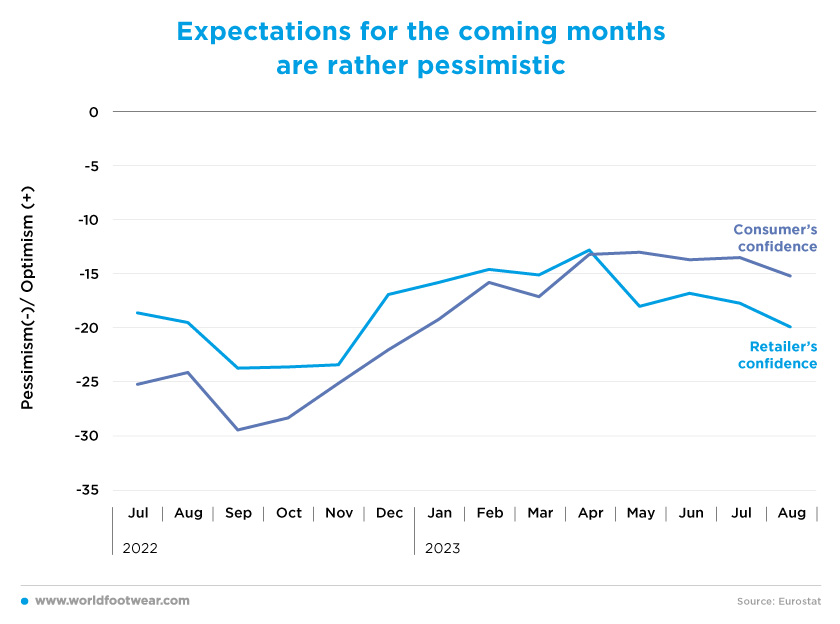

Expectations for the coming months are rather pessimistic

The consumer confidence indicator (by Eurostats) in Germany followed an upward trend from September last year through April, removing half of its pessimistic stance (minus 17 negative points). But since then, the mood has stabilised, if not started a new downward trend in August.

In addition, the consumer sentiment indicator (by GfK Institute) underlines this deterioration path, since it was expected “to fall in July due to a decline in economic and income expectations”, which, according to GfK consumer expert Rolf Buerkl, “is the first setback for the indicator after eight consecutive increases (and) indicates that consumers are once again more uncertain”. After falling again in August and September, he predicts that “the chances that consumer sentiment can sustainably recover before the end of this year are dwindling more and more” (shoeintelligence.com).

The fact is that retail performance in Germany is strongly tied to confidence indicators. The German Retail Federation (HDE)’s own consumer barometer shows that “the recovery of the consumer climate has already weakened more and more in recent months (and) is coming to a halt, marking a turning point in September”. Despite the “positive trend in consumers’ propensity to buy, (it is) recovering slowly and starting from a low level”.

Although consumers remain seemingly optimistic about the economic outlook, retailers’ confidence (by Eurostats) has worsened since April, returning to where it was a year ago in August, losing 8 negative points. The Munich-based Ifo Institute reported that “the economic downturn is clouding the mood in the German retail sector. The industry assessed its business situation in August as negative on balance”. “The further cooling of the economy is hitting retailers, who have recently also been burdened by weakening consumer demand”, concluded Ifo researcher Patrick Höppner.

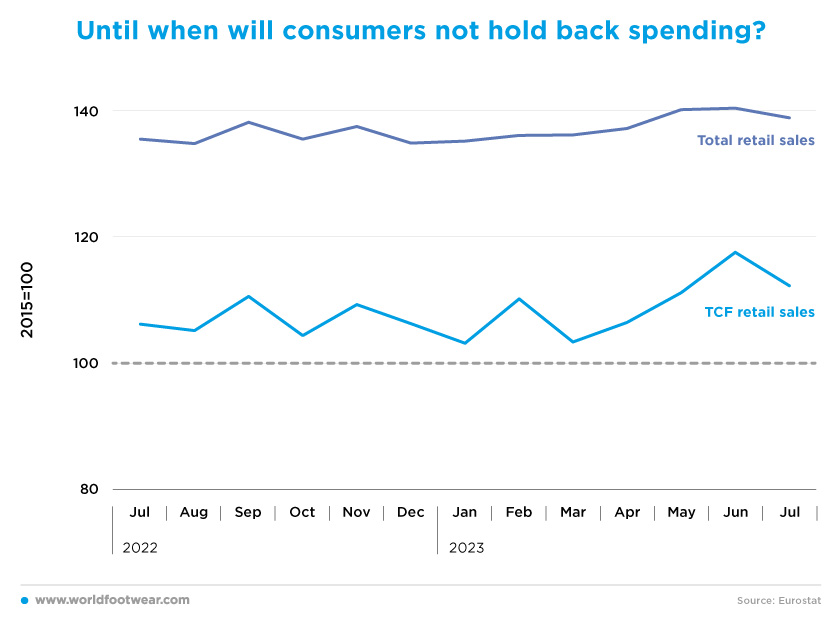

Until when will consumers not hold back spending?

Therefore, in the short term, confidence may be weakening, but as long as consumers still anticipate an increase in disposable income in the coming months due to “strong wage increases and a somewhat slowing pace of price increases”, retail can still be sustained; that is, before “private households hold back on spending”, which is in contrast to what the Central Bank has postulated.

Based on the very same arguments, KfW’s Chief Economist Fritzi Koehler-Geib “anticipated a pickup in consumption in the second half of 2023”. In fact, in July, the Bundesbank’s overall retail sales value index (seasonally adjusted) was still around three and a half percentage points higher than the previous year.

For the same period, TCF’s retail index (Textile, Clothing and Footwear, same BuBa source) apparently behaved even better, increasing by 6 percentage points over last year. Unfortunately, the figures given by the DEstatis source, corresponding to a similar period between April and July, instead point to a downward trajectory, which probably means that only the statistics office has updated its figures.

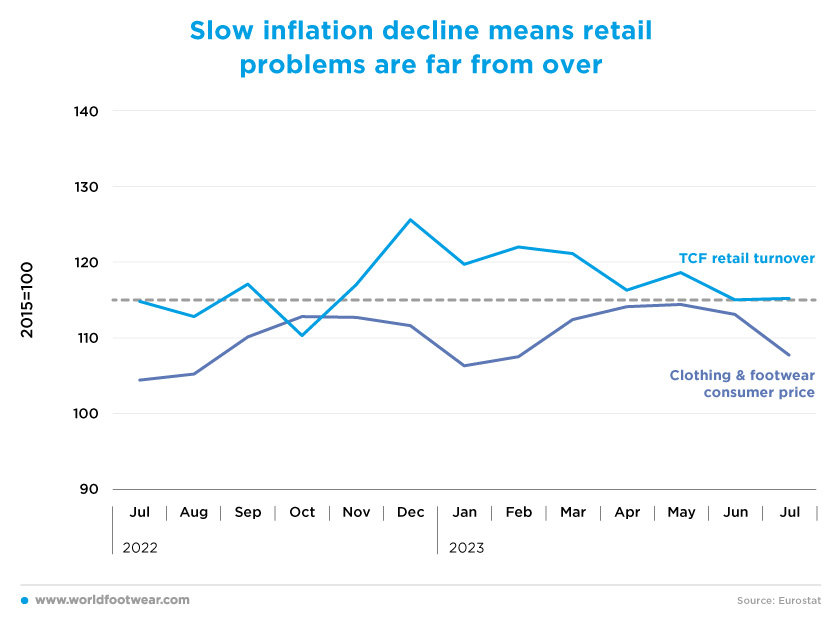

Slow inflation decline means retail problems are far from over

Assuming that the TCF retail numbers by DEstatis prevail, the negative impact of the upward trend in the consumer price index for clothing and footwear on their retail sales is quite clear, not to mention the restraining effect of global inflation on consumers’ purchasing power.

Generally speaking, retailers don’t make mistakes when it comes to retail growth at current prices, mainly because inflation will eat away at the illusion of prices. In fact, as inflation remains stubborn, German retailers expect to bring in 4% fewer sales in real terms this year than in 2022, said the retail association HDE, which revised downwards its forecast of a 3% drop.

“Economists expect the downward trend in headline inflation to gain pace in the coming months, (…) falling according to ING forecasts (from 6.4% in August) to around 3% by the end of the year”. However, the Ifo Institute suggests that “high inflation in Germany will decline rather slowly,” where TCF retail is concerned. The balance between clothing and footwear retailers that want to increase their prices and those wanting to lower them is not only higher or much higher than in retail as a whole, but it has still increased in July (fashionunited.de).

In short, this means that the long list of troubled retailers in the category is not about to end. According to the CEO, Angelika Schindler-Obenhaus, “Gerry Weber will (close) all unprofitable (122 of its 171) stores in Germany” by the end of September this year as part of its restructuring efforts, meanwhile “Görtz recently underwent a restructuring, with around half of its 160 stores closed or due to close in the near future” (shoeintelligence.com). Günther Kamp, managing director of the shoe retailer Schuhhaus Kocken also said that “the current difficult retail situation in the city centre, with consumers’ continued reluctance to buy, makes decisive action (request for proceedings) necessary” (fashionunited.de).

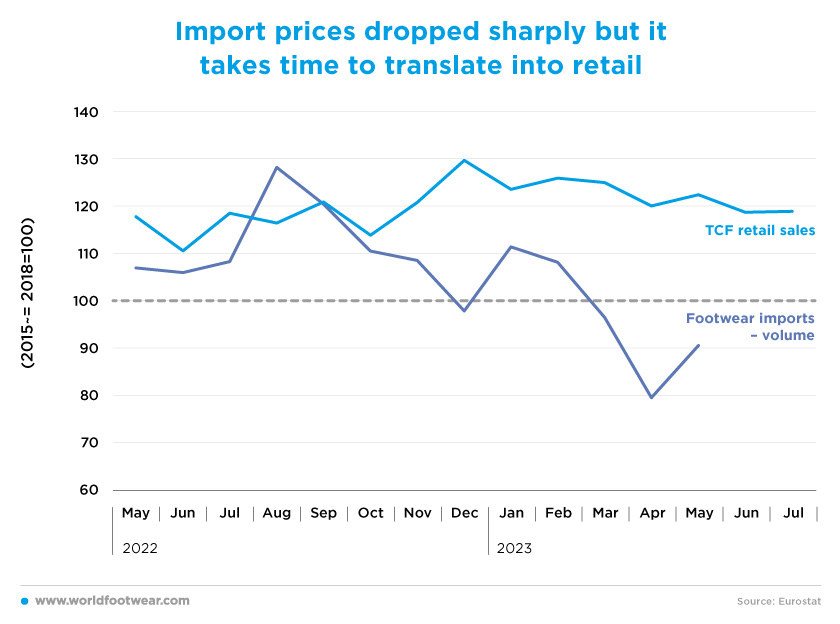

Import prices dropped sharply but it takes time to translate into retail

The outlook for retail, and in particular for (clothing and) footwear, can also be predicted by the behaviour of the volume of imports. This indicator for footwear has been in free fall since August last year, with a loss of around 38 percentage points at the end of May. Since footwear retail correlates with the entire category, this means that importers (and retailers), as of May, were not at all convinced that footwear retail would improve in the near future. The downward trend of the retail index proved them right.

But behind the future course of imports, and ultimately the fortunes of retailers, is how much overall import prices will fall. “The inflation rate is likely to fall significantly in the next few months because external cost pressures have decreased”, said Ralph Solveen, senior economist at Commerzbank. Indeed, “German import prices decreased by 13.2% year-on-year, the sharpest drop since January 1987”.

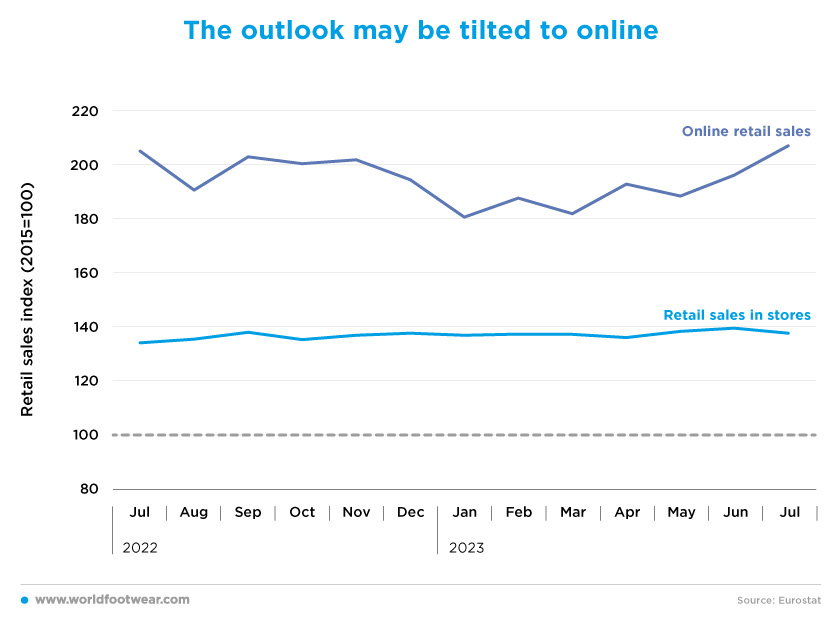

The outlook may be tilted to online

Although in the first half of the year, the German non-store retail index (seasonally adjusted, by Eurostats) followed a downward path, as compared to the previous one, July pointed to a recovery, closing with an increase of 2 percentage points year-over-year, at the current prices. This contrasts with the comparatively flatter development of retail trade (per Destatis).

As far as clothing and footwear retail is concerned, despite the category’s known significant weight in global digital sales, there is no monthly data available to compare with the evolution of the category in offline retail. Furthermore (at least according to Destatis’ figures), physical clothing and footwear retail is falling, in contrast to in-store retail in general.

Perhaps some indirect evidence can give us some clues about the trend of online clothing and footwear, namely whether it is performing substantially better than that of its dwindling brick-and-mortar retail.

The results for the second quarter published by online fashion platform Zalando (corporate.zalando.com) recognize that Gross Merchandise Volume (GMV) declined by 1.8% in a “temporarily challenging retail environment”, with revenue dropping by 2.5%, on a comparable basis to the same period of last year. On the other hand, as “losses in the last financial year continued to rise”, the online retailer Fashionette AG launched an aggressive savings plan, moving its premises to smaller and less expensive facilities and reducing business lines, among other cost cuts (fashionunited.de).

Despite their fragmented nature, both online fashion cases seem to have converged with the depressed trajectory of online retail in general in the first half of the year. But the two seem to believe better times are ahead, just like online retail. So far, this positive outlook has not been shared at all by offline clothing and footwear retailers.