Register to continue reading for free

Germany retail: COVID-19 still looms on retail performance

As of December 2021, the German TCF retail index is far from providing a crystal-clear reading. A sudden improvement in the last month of the year contrasts with mixed feelings on confidence and insights from various sources. The decline in footwear prices during that month, despite the unexpected inflation surge by 5.3%, adds up as another contradictory sign. While the picture is not quite transparent yet, it is safe to presume that the online shopping category is leaning towards pandemic-neutral growth

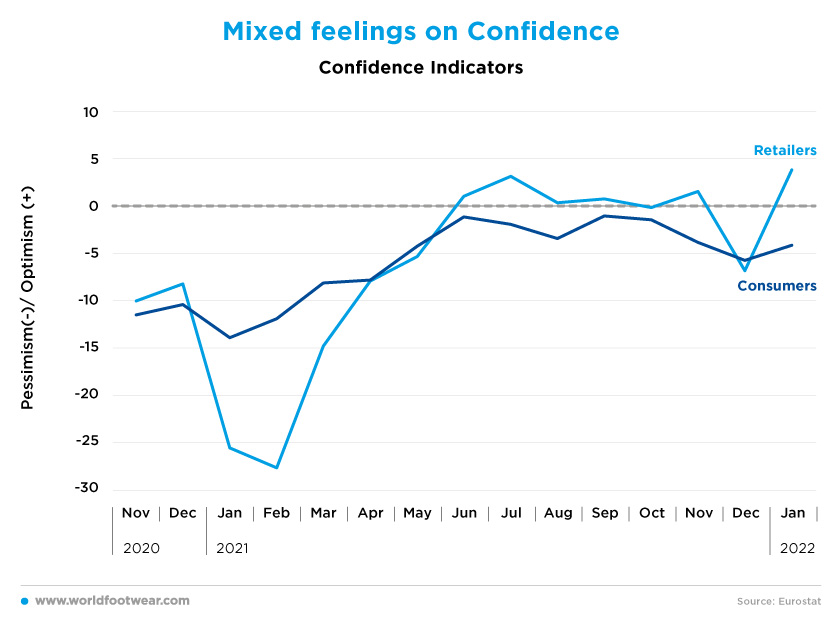

Mixed feelings on confidence

Confidence indicators in Germany in the second semester of 2021 are exhibiting mixed feelings, despite both consumers and retailers feeling better off, as compared with 2020 and 2019.However, whereas consumers seem convinced to have fewer and fewer reasons to be feeling optimistic, retailers have revealed some restraint regarding their sentiments, except for a short-lived moment of panic in December thanks to the spread of the Omicron variant. Still, in January 2022, the retailers’ confidence resumed a stance above the optimist frontier, perhaps even overshooting with 4 points plus.

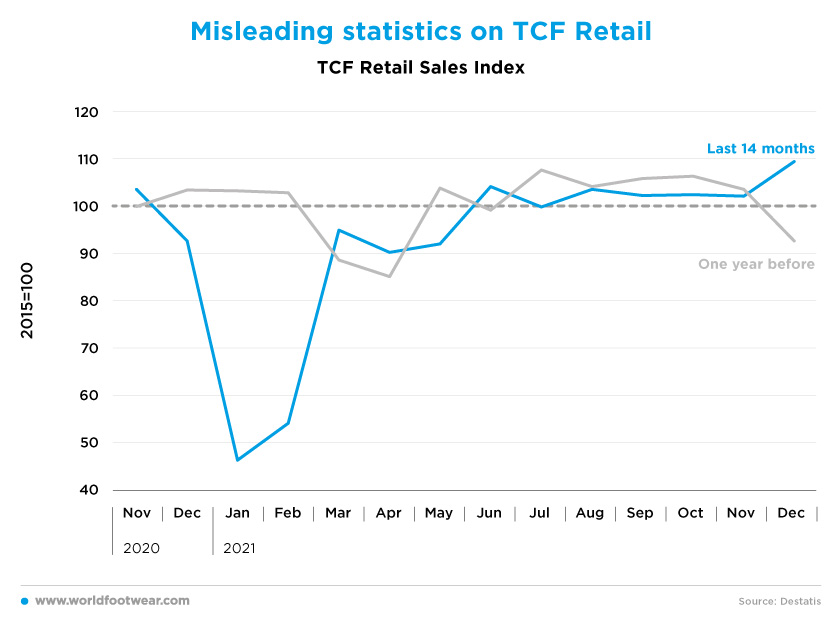

Misleading statistics on TCF Retail

The German TCF (Textile, Clothing & Footwear) seasonally-adjusted retail index (as recorded monthly by DEstatis) is far from being able to provide a crystal-clear reading, as of December 2021.Following the very modest performance in the months before, when compared with the two previous years, the sudden improvement in December is in sharp contrast with the return of coronavirus-related restrictions in many retail stores and the seasonal adjustment impact of shopping due to Christmas holidays (tradingeconomics.com, February 2022).

The German Retail Association (HDE) has stressed the same point. According to the HDE consumption barometer, “the propensity to buy reached an all-time low in February, after falling for the third month in a row”, conceding even that “the decline in the propensity to buy on this scale was still surprising” (fashionunited.de. February 2022).

The Federal Association of German Footwear and Leather Goods Industry (HDS/L) had pointed out in November that despite an improvement of the figures of the sector, with “much confidence placed on the end of 2021”, justified by the exports’ growth, the return to pre-pandemic business levels should only occur by early 2022 (fotoshoemagazine.com).

Even the German Statistical Office ‘blamed’ the textiles, clothing, shoes and leather goods (minus 17.1%) for the overall decline of retail sales in the month.

Taken altogether, a significant revision downwards of the December score is likely underway.

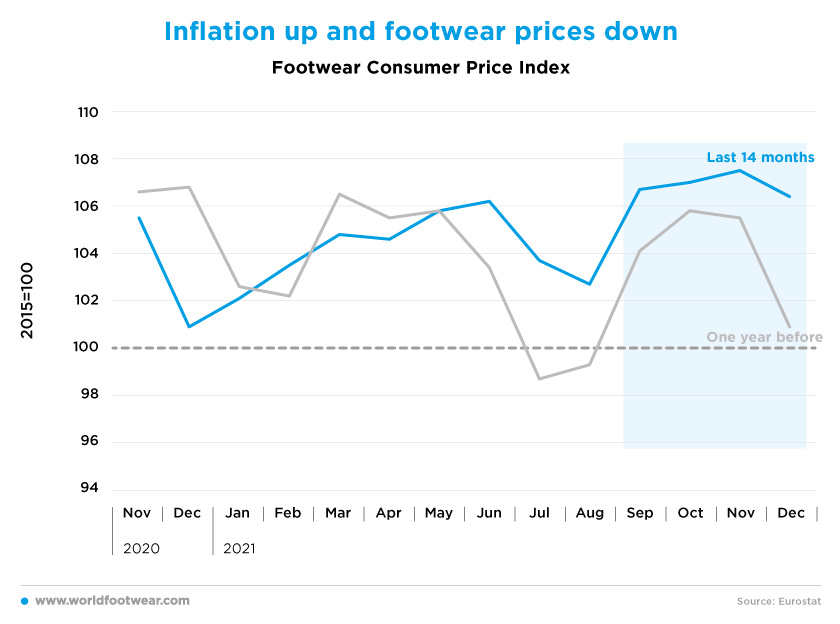

Inflation up and footwear prices down

In addition, the decline in footwear prices in December, despite the unexpected inflation upsurge of 5.3% year-on-year (the second record above 5% since the reunification of Germany in 1993), adds up as another contradictory sign.Such developments not only challenge the provisional monthly TCF retail score of December, but also feed concerns about consumers’ disposable income and retail prospects for the near future.

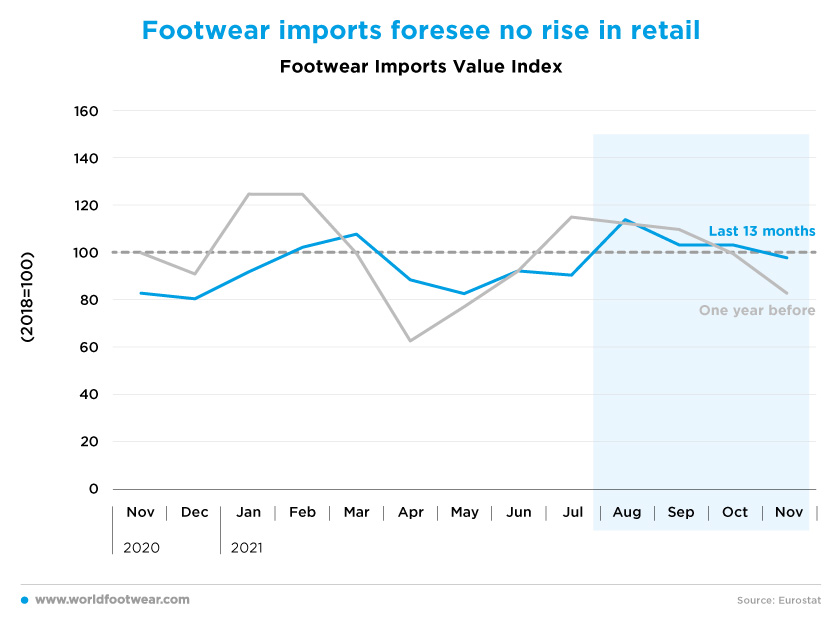

Footwear imports foresee no rise in retail

Footwear imports lost ground from August through November, similarly to the TCF retail sales. It is not uncommon: the same pattern was recorded in 2019, before the COVID-19 pandemic outbreak. Should provisional retail data for December be corrected downwards, footwear importers will have even fewer reasons to alter their imports-related decisions.As the Pantheon Macroeconomics says, “looking ahead of the vaccine passport legislation, other restrictions are expected to remain in place through most of February, weighting on the activity at the start of the first [2022] quarter” (marketwatch.com, February 2022).

The same projection was advanced by the German Retail Association (HDE), which sees no signs of change in consumers’ mood in the coming weeks: “Due to the sharp drop in the propensity to buy, restrained development in private consumption can be expected in the first quarter. A trend reversal is only to be expected once the current Coronavirus wave has ended and the incidence of infection has subsided”.

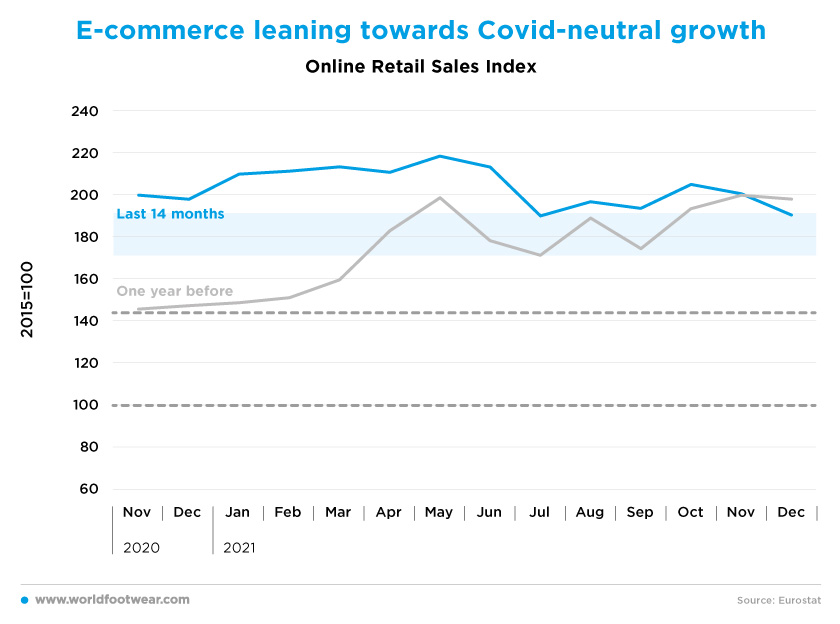

E-commerce leaning towards COVID-neutral growth

In the absence of monthly data on the TCF internet retail, we continue to use the overall online retail sales index as a substitute because TCF is the first category in online shopping in Germany: 40 million consumers, or 65% of all e-commerce consumers, use the internet to purchase in the category (Postnord, 2020).The e-commerce association BEVH is expecting goods online sales to grow by a further 12%, reaching more than 110 billion euros. In the years to come, the industry can expect growth rates of more than 10%. “E-commerce is increasingly being perceived as normal and customary. Its growth is stabilizing at a high level,” says BEVH President Gero Furchheim. In the exceptional state of the pandemic, digital trade conveys a sense of normality with the secure supply of goods. (fashionunited.de, January 2022)

Yet, despite COVID-19 waves and respective preventive measures correlating everywhere with a more intensive use of online shopping, the same failed to happen in Germany following the Omicron variant outburst since November 20201: “Online shopping also weakened falling 5.7% on month [in December], pointing to a broad-based fall in demand.” (marketwatch.com, February 2022).

A possible explanation may be found in the percentage of surveyed Germans who began to shop online more often due to the coronavirus pandemic, which was 29%, one of the lowest in Europe along with France and the Nordic countries (Postnord, 2020).

However, given the impact of COVID-19 at its maximum intensity, the online decline in December may relate to increasing pandemic fatigue. Thus, online shopping is now leaning towards pandemic-neutral growth in Germany: it will not exceed the 45 percentage points up reached in December 2021 but will not decline to less than the 25 percentage points reached in July 2020.