Register to continue reading for free

Germany Retail: war and inflation raise concerns for retail

Despite the lifting of COVID-19 restrictions in February, the declining trend of the TCF (Textile, Clothing, and Footwear) Retail Sales Index is clear and is aligned with the plunge in consumer confidence. The war in Ukraine and the high inflation are playing a major role in the severe blow inflicted on both consumers’ and retailers’ confidence. Meanwhile, footwear consumer prices have slightly increased in March, and it is foreseeable that companies continue passing on higher costs to consumers in the near future

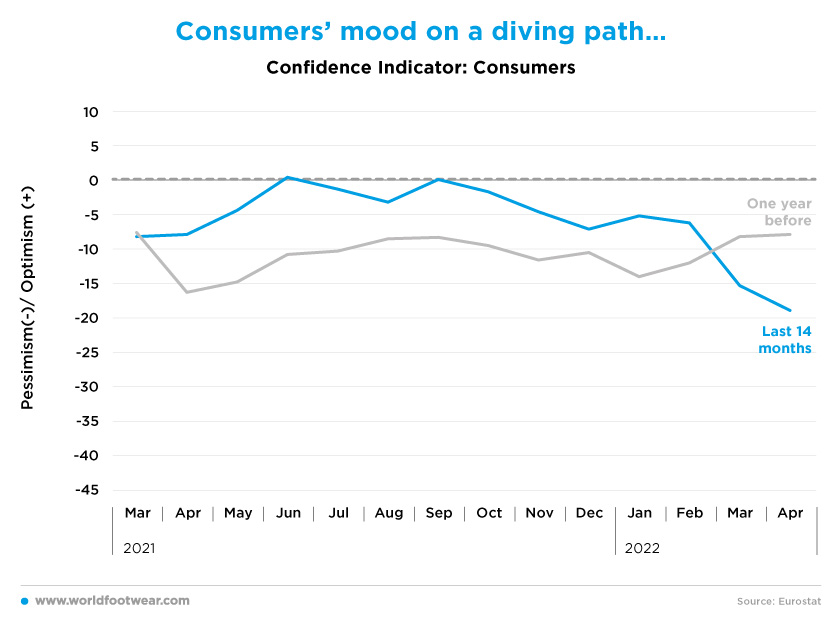

Consumers’ mood on a diving path…

Based on a recent survey summing up the 2021 performance of owner-run shoe retailers in Germany, Brigitte Wischnewski, President of the Federal Association of the German Footwear Retail Trade (BDSE) reported that “75% of shoe stores were unable to reach their previous year’s figures, and only about 10% of companies were able to increase their turnover. Overall, the footwear retail trade posted a 2% drop in turnover, with smaller firms tending to come off worse than larger ones” (fdra.org).

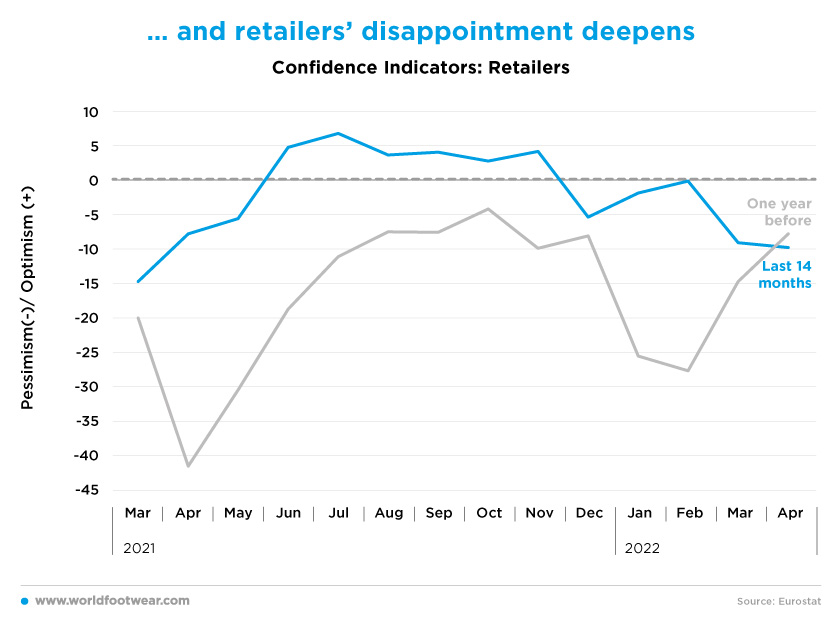

The statement just shows how much retail is sensitive to the changes in confidence, either from the consumers’ side or the retailers’ one. Data demonstrates that the German consumer mood has been in the red since last year’s October, trailing a clear worsening trend, while the retailers’ pessimistic stance since January had ups and downs. However, in March and April, both sides appeared to be more pessimistic than in the previous months, with negative balances by consumers closing at -19% and retailers meeting halfway at -10% (Eurostat). The two figures are worse than the one of April 2021, when the pandemic was still in the picture.

… and retailers’ disappointment deepens

According to the German Retail Association (HDE), the HDE consumption barometer fell to “a new all-time low” in April. The main reason for this mood was the war in Ukraine, whereas the Corona crisis only played a minor role for the consumers surveyed, despite the continued high number of cases. “Only in the first corona wave in 2020 did the economic expectations show a lower level” emphasized the Market researchers involved in the HDE findings, explaining that “from a macroeconomic point of view, the war in Ukraine was, and is, a similarly drastic event as the spread of the coronavirus two years ago” (fashionunited.de).

In addition, the GfK consumer indicator for June is still at an all-time low. “Despite the further easing of corona-related restrictions, the Ukraine war and, above all, the high inflation are weighing heavily on consumer sentiment”, commented GfK consumer expert Rolf Bürkl. The GfK’s survey results show that the massive increase in energy prices and surging inflation rates are chipping into consumers' purchasing power and prompting a massive decline in income expectations to the lowest level in almost twenty years. “There will only be a sustainable trend shift in consumer sentiment if there are successful peace negotiations on the war in Ukraine”, he concluded (www.politico.eu)

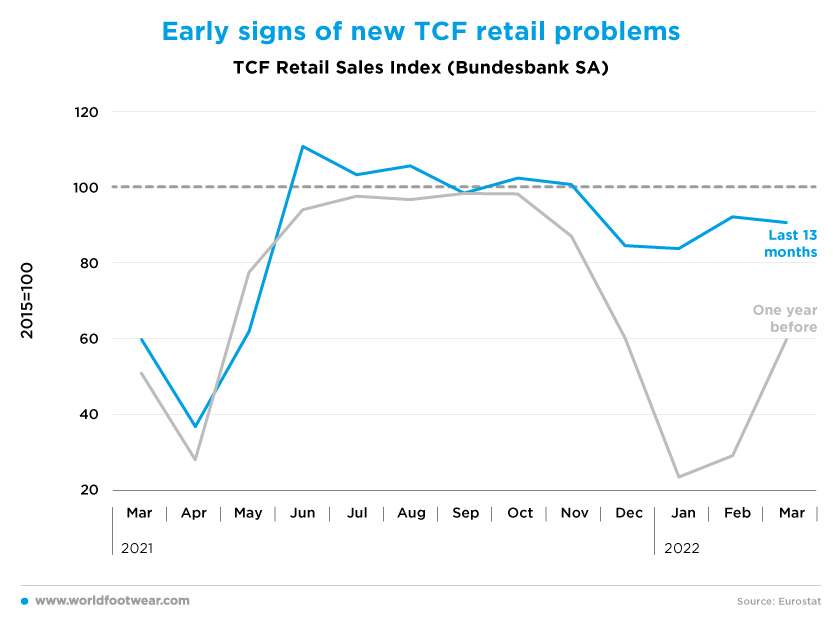

Early signs of new TCF retail problems

The alignment in Germany of the confidence indicators and the declining trend through March of the TCF (Textiles, Clothing, and Footwear) Retail Sales Index (by the Bundesbank), as well as its way down the 2015 baseline since December, is more obvious now. The divide between the lifting of Corona-related restrictions in February, and the severe blow inflicted on consumer sentiment in March due to the war in Ukraine and the high inflation, is well observed by the retailer indicator. Nonetheless, as of March, the TCF score (10 percentage points (pp) below the baseline) is not yet as dramatic as it might be suggested by the consumer confidence’s data.

Can online retail avoid the offline misfortunes?

In the same month (March), the seasonally adjusted retail sales via the Internet (Bundesbank) is also far from pointing to a consumer retrenching. Its slight decrease, as compared to the three previous months, is most likely the result of full suppression of the last COVID-19 restrictions rather than a big immediate effect of the new economic and war threats.

According to Bevh (the Federal Association of E-Commerce and Mail Order Germany), e-commerce sales of goods reached 22.8 billion euros from January to March, 8.2% above the same quarter of the previous year. However, the organization saw a clear turning point with the beginning of the Russian invasion of Ukraine: after the 24th of February, online retail demand fell significantly and, in some categories, sales have been below the corresponding level of the previous year since then. The growth rate was 11.5% up until the beginning of the war and after only 2.3%. “The full extent of the consumer uncertainty will only be able to be traced in detail in the coming months using market research tools” said Martin Groß-Albenhausen, Deputy General Manager of Bevh (fashionunited.de).

However, “(…) growth achieved in the online business, (…) still only plays a secondary role for the specialist trade: two-thirds of the retailers record an online turnover share of less than 10% of the total turnover”, explained the BTE (The Federal Association of German Textile, Shoe and Leather Goods Retailers) in a press release, on the occasion of the Shoe trade fair taking place in Düsseldorf (taketonews.com).

Nevertheless, since the pandemic effects on internet retail are so far neutralized, the evidence of a 34 pp online sales increase since March 2019 (before the COVID-19 pandemic) is a good starting point to evaluate the negative impacts on retail still to come.

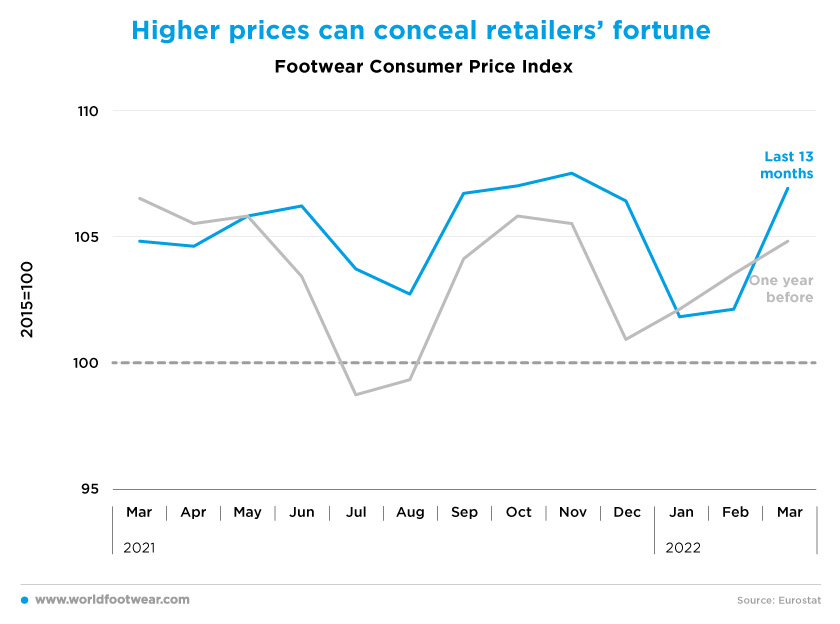

Higher prices can conceal retailers’ fortune

As both retail indicators are measured at current prices, caution is advised to minimize “small” retail nominal losses and the corresponding effective impact of war and inflation.Footwear consumer prices increased in March by about 5 percentage points, as compared to the previous two months (by the 2015 baseline). But a “modest” fall of retail at current prices, as reported, means a deeper dive, that is, a much-pronounced decline of footwear purchases in pairs.

Such caution is of the utmost importance in 2022 because, according to DIHK (the German Chambers of Industry and Commerce), it is now expected to see the inflation rate hit 7%, after initially forecasting a rise of 3.5% in its February projection, and nearly 40% of the roughly 25 000 companies surveyed are planning to pass on the higher costs to customers (reuters.com).

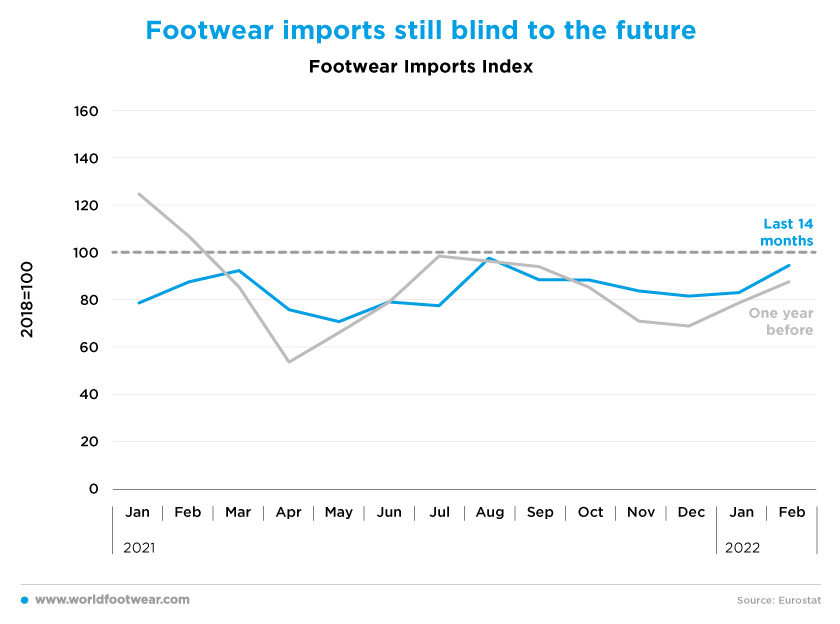

Footwear imports still blind to the future

Available records on February footwear imports do not display any negative effects caused by the Ukraine war. But despite being an antecedent to retail itself, import statistics are delayed from the retail ones. Therefore, the increasing dynamics of footwear imports seen in January and February are most likely replicating the same expectations on COVID-19 fading and retail upturn felt in the same first quarter last year.