Register to continue reading for free

Germany Retail: a bleak horizon for both the physical and online retail

Consumers seem to have definitely pulled the rug out from under footwear companies, as can be seen by the wave of insolvencies observed in the footwear sector in recent months, in addition to the store closures recorded in 2022. And the online channel is having no better luck, with sales progressively losing the momentum of the positive results recorded in the summer of last year. Overall, the future of retail looks set to remain a little gloomier in the coming months

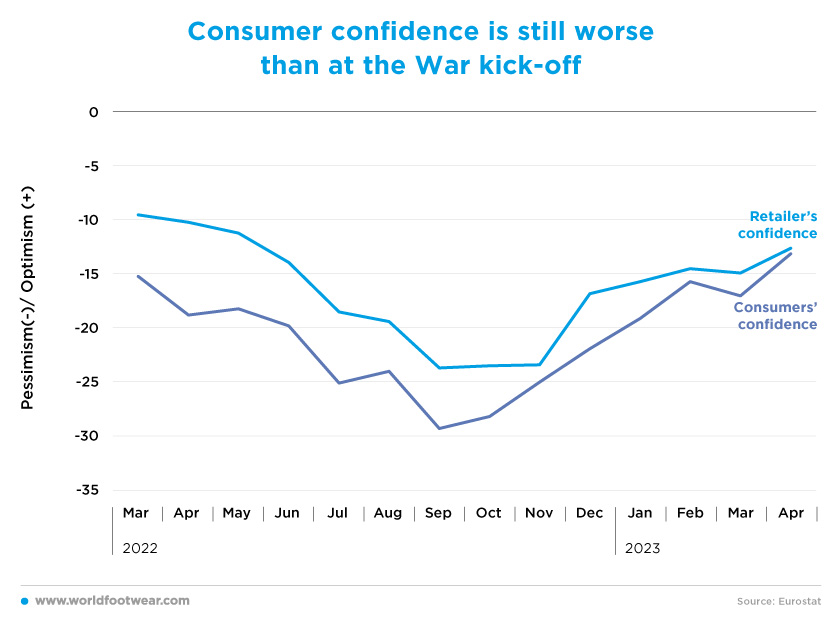

Consumer confidence is still worse than at the War kick-off

Consumer confidence in Germany (seasonally adjusted by Eurostat) has steadily recovered between September last year and April. However, it remains clearly on pessimistic ground, with a negative net balance 13 points below the neutral line and 7 negative points distant from the score at the start of the war in Ukraine in February 2022. With some delay, retailers’ confidence followed suit.

Based on its consumer barometer for April, the German Retail Association (HDE) explained that “the positive trend in consumer sentiment is now almost coming to a standstill” and expressed caution about the future as real wages are not expected to increase “significantly” (fashionunited.de)

Consumer expert Rolf Buerkl from the market research group GfK said that onwards their “forward-looking consumer-sentiment index forecasts confidence to tick up to minus 24.2 in June from a revised minus 25.8 in May, the strongest level since April 2022.” Nevertheless, it is not showing a clear upward trend at present, and considering its “low level in historical terms (…) private consumption won’t make any significant contribution to overall economic development in Germany this year” (wsj.com).

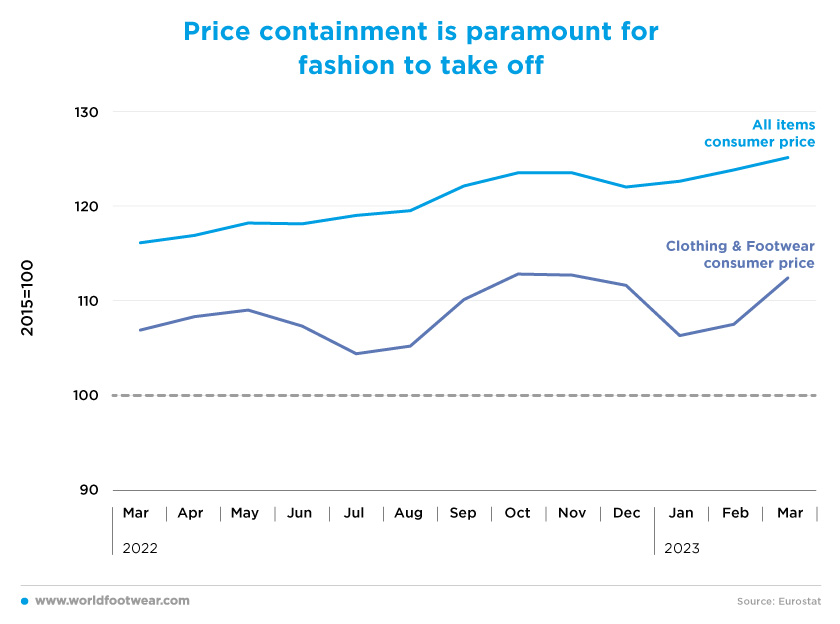

Price containment is paramount for fashion to take off

Despite the steady dissipation of consumer pessimism, according to the Munich-based Ifo Institute, for the first time since Spring 2021, the index of German companies’ price expectations stood below 20 in May. Consequently, the slowdown in price increases is expected to accelerate in the coming months (fashionunited.de). These conditions seem to be paramount for consumers expecting their real wage to finally increase, thus moving away from pessimism, which will boost trade retail.

This was not the case in the first quarter. “The persistence of high price increases continued to be a burden on the German economy at the start of the year (…). This was particularly reflected in household final consumption expenditure, which was down by 1.2% in the first quarter of 2023”, said the Federal Statistical Office said (edition.cnn.com).

Comparing the trend of consumer prices for All items with Clothing and Footwear (Eurostat), both are rising, but the increase has been much faster for general prices. In March, C&F prices increased by 5.1%, while general prices jumped by 7.8%. This translates not only into a big impact on the volume of sales in the category but also on consumers’ need to divert more of their income from fashion items towards more urgent needs.

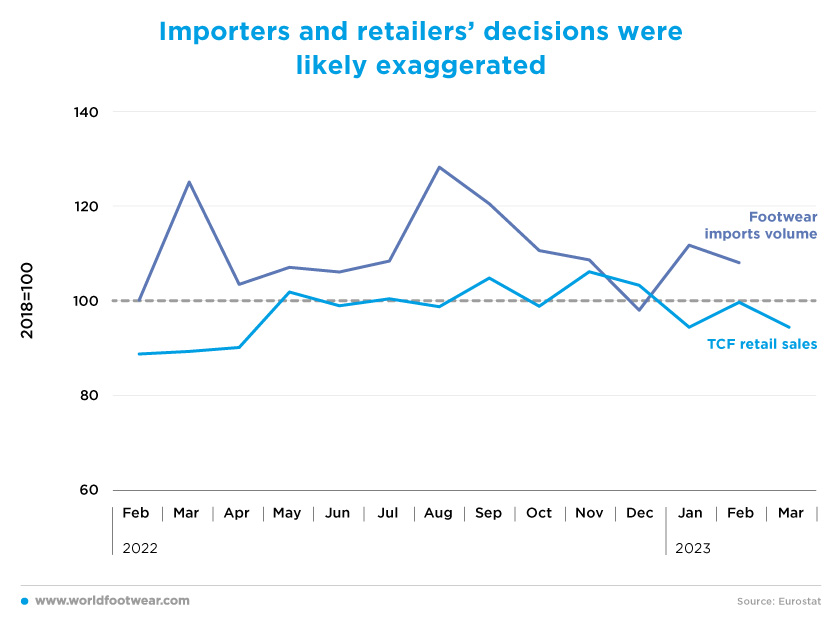

Importers’ and retailers’ decisions were likely exaggerated

The trend of footwear imports in volume (by Eurostat) after Summer ´22 is another token of frustration about the retail’s performance in the upcoming months. The sharp brake of footwear imports in volume terms after August ’22 apparently indicates that both footwear importers and retailers have realised that their previous supply decisions were most likely exaggerated.And it seems they were quite right. The TCF Retail sales index (by Bundesbank) went actually down the 2018 baseline in the first quarter of this year. As pointed out before, this index incorporates a significant TCF price increase, meaning that volume retail sales were even more depressed, at least from the first quarter onwards.

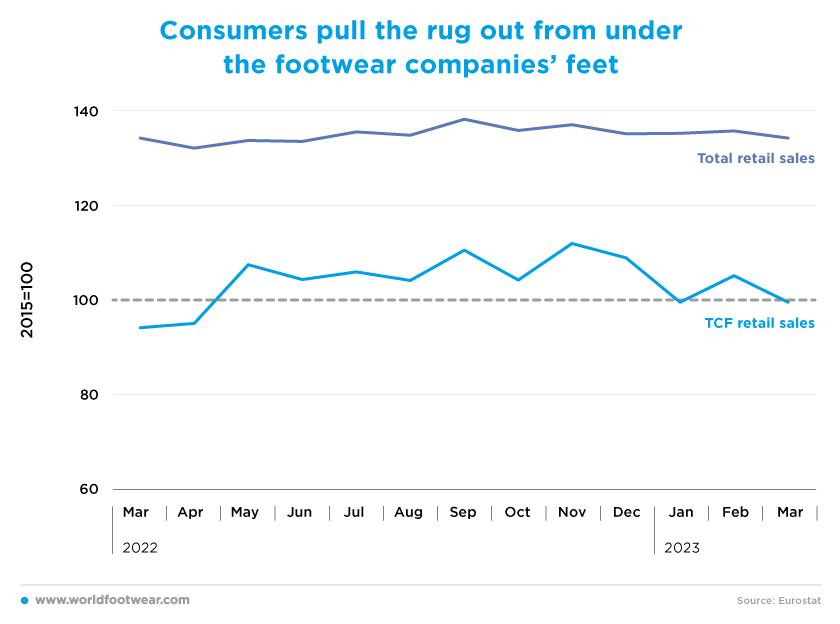

Consumers pull the rug out from under the footwear companies’ feet

The income and expenditure transfer against the TCF category is also visible through the comparative performance between the overall retail sales index and the turnover of TCF retail sales (both seasonally adjusted, by the Bundesbank).

The result was a “string of insolvencies of footwear companies across Germany in recent months”, as well as a “total of 1 500 (or 13% of the total in 2021) shoe stores shutting down in the country in 2022”, the general manager of the Textile Shoes Leather Goods (BTE) trade association, Rolf Pangels, said early in March. The bankruptcy filing of shoe companies such as Reno, Görtz, Pölking, and Shoepassion and the application for protective insolvency by the Ara group’s subsidiaries Klauser and Salamander, speak for themselves (shoeintelligence.com).

The shoe manufacturer and retailer EOD explains well the “slaughter” of the footwear companies with consumers pulling the rug from under their shoes: “economic difficulties are caused by the consequences of the Corona pandemic and the economic crisis due to the Russian war of aggression in Ukraine”, while “the increasing reluctance of customers to purchase due to the sharp rise in inflation, (made it) impossible to compensate for the sales losses (…)”. (groundies.com).

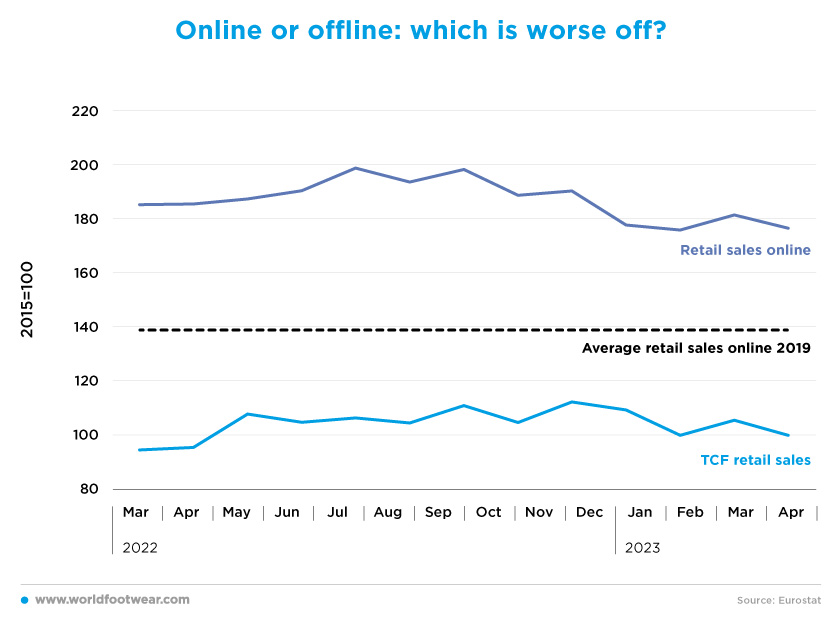

Online or offline: which is worse off?

Online retail in general has not fared any better. After achieving promising scores during Summer ´22, nearly reaching a gain of 60 percentage points above 2019 average online sales (before the COVID-19 pandemic), it’s progressively losing steam. In March, online sales closed almost 9 percentage points below the same month last year, shrinking the gain over 2019 to less than 40 percentage points, to which high inflation must still be discounted.

In the same month, TCF retail sales in all channels (by Bundesbank), despite its decline, were comparatively better, still 5 percentage points up year-over-year, also in nominal terms.

However, data from a recent survey by BEVH, the Federal Association of E-commerce and Mail Order Trade, looks much gloomier: while e-commerce sales dipped by 15.0 % from January to the end of March, as compared to the same quarter of 2022, fashion sales including shoes dropped by 20.8% and online footwear sales fell by 24.8%. As a result, just 24.6% of the members surveyed are optimistic and believe that the crisis will be over in 2023 (shoeintelligence.com).