Register to continue reading for free

Germany Retail: despite some good news, retailers continue to worry

German retailers’ worries are not over. Despite a slight uptrend in the Textile, Clothing, and Footwear (TCF) Retail index, in line with the recent positive trend in consumer confidence indicators, their concerns go well beyond nominal performance and focus on whether inflation will continue to erode margins. Put simply, passing on costs to customers or closing down altogether is still keeping them up at night. As the first quarter is traditionally slow, and the volatile geopolitical situation could change at any moment, we are cautious about making near-term forecasts

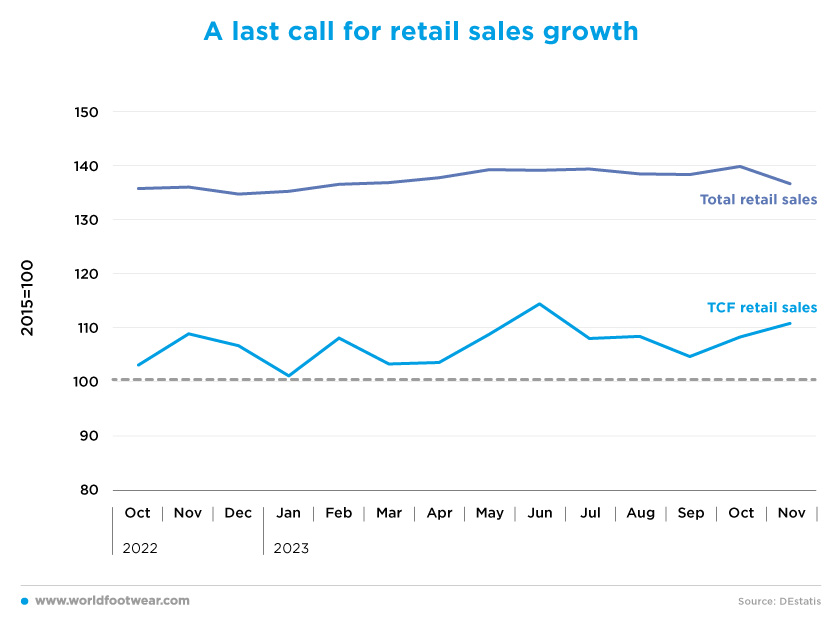

Last call for retail sales growth

The Textile, Clothing, and Footwear (TCF) Retail index (seasonally adjusted, by the Bundesbank) has been on a slight upward trend since October last year. In November 2023, it was almost 2 percentage points higher, after 5.2 percentage points higher in October, year-over-year. The data from DEstatis (the Federal Statistics Office) for the same period is somewhat flatter, but converges in both October and November. The evidence for this category in November is better than for overall retail, which declined by more than 3 percentage points compared to the previous month.

At the start of the fourth quarter of 2023, opinions about retail (both online and offline) were not at all positive. The German Retail Association (HDE) predicted that for the year as a whole, “sales (including food) would rise by 3.0% in nominal terms and fall by 4% after adjusted for prices”. Alexander von Preen, President of the association, said that “the industry is feeling the economic impact of the war in Ukraine and the subsequent inflation as well as the further decline in purchasing sentiment because of the Middle East conflict”, while complaining that “often the cost factors (are) not yet matching the new situation”. Rents, in particular, “are still not realistic”, he added.

Furthermore, according to the HDE (einzelhandel.de), “retailers across Germany had also a bleak outlook for the Christmas shopping season”, expecting for November and December, a 1.5% nominal growth compared to the same period last year, in fact, a decline by 5.5% when adjusted for consumer inflation (shoeintelligence.com). And although HDE Managing Director Stefan Genth noted “a festive mood with the Advent season and the numerous Christmas markets”, a survey by the association showed that more than 50% of companies were dissatisfied with their sales, in the clothing and shoe retail sector in particular. Weak Christmas business and low customer frequencies compared with the previous year, especially in the city centres, where “clothing and footwear are the most sought-after goods” (80% of young people in an HDE survey).

Just one week before Christmas Eve, Stefan Genth pointed out that “for most retailers, disappointment predominates” (…) while “the weeks ahead until the turn of the year are crucial for the success of the Christmas business, (because) business usually picks up again just before and after the holidays”.

But the truth is that despite this last call for retail sales growth at the end of last year, there was too little time left for such an endeavour.

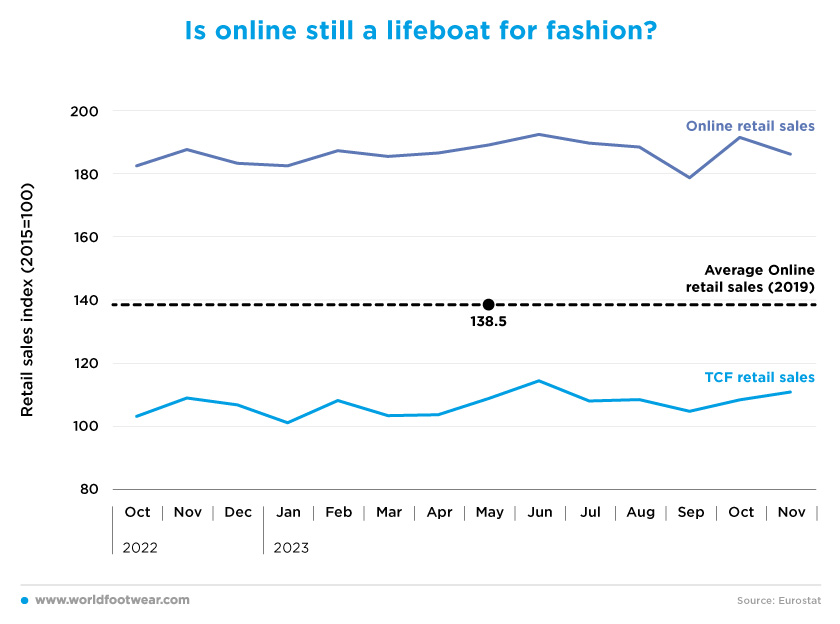

Is online still a lifeboat for fashion?

Since October 2022, the trend of the (all items) retail sales via the internet and mail order (seasonally adjusted, by Bundesbank) has been fairly flat, stabilising between 40 and 50 percentage points above the pre-Covid level. After reaching a minimum in September, it jumped 9 percentage points in October year-over-year and lost 1 ½ points in November compared with a year earlier. If this pattern were to be replicated in TCF Online retail, there would be no significant differences from TCF retail sales in stores (same source), which were only slightly up.

By contrast, a survey by the Federal Association of E-commerce and Mail Order Trade showed that sales fell by 12.5% from January to Cyber Weekend, an even worse performance for the year than in the difficult previous year. Germans once again spent less on the Internet at Christmas than last year, with total sales of goods from the beginning of October to the end of November (not adjusted for prices) down by 7.7% across all sectors. Even in the more online-intensive clothing and footwear category, sales declined by 4.1%, as compared with the previous quarters (bevh.org). In the third quarter alone, online footwear and clothing sales fell by 18.6% and 17.5% year-over-year, respectively, compared to overall online sales which were down by 13.9%.

Zalando, one of Europe’s leading e-commerce destinations for fashion and lifestyle, has seen its share price fall to a record low since its IPO in 2014, which reflects customers’ current reluctance to buy due to the impact of high inflation, economic uncertainty, high inventories, and sales with deep discounts (fashionunited.de).

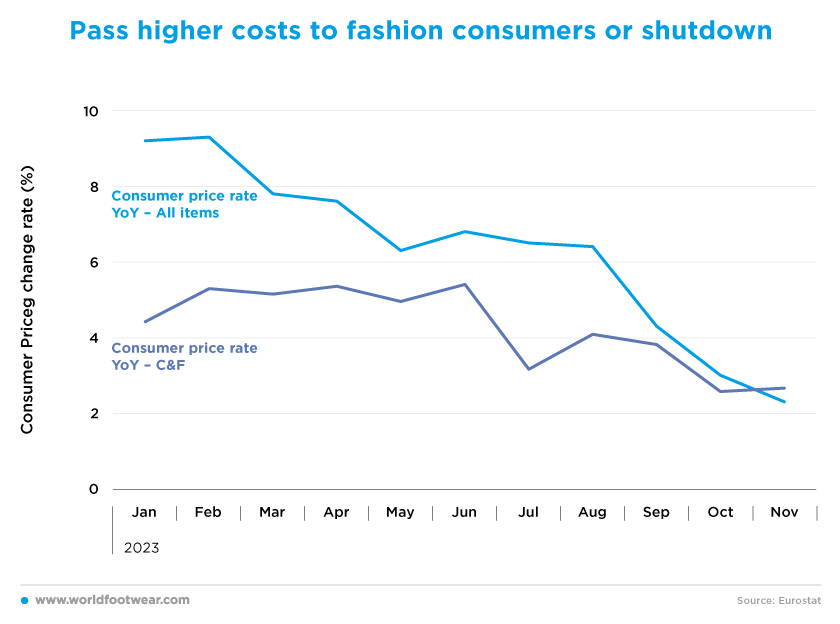

Pass higher costs to fashion consumers or shutdown

Therefore, retailers’ concerns about retail sales growth go well beyond its modest nominal performance, and focus instead on how much the inflation will continue to erode margins, as many of their costs, such as rents and wages, cannot be adjusted proportionately down.This problem is particularly acute for clothing and footwear retail because while consumer prices, in general, have fallen very quickly, from over 9% in January 2023 to 2.3% in November (harmonized consumer prices, by Eurostat), consumer prices in this category declined from 4.4% to 2.7% year-over-year, which means that their relative prices are now more expensive than general prices.

According to the Federal Statistical Office (DEstatis), German inflation fell significantly in November, dropping to its lowest level since June 2021 and despite the “inflation rate will rise again temporarily to around 4% in December due to a base effect (…) it will fall to below 3% as early as the beginning of next year”, said Timo Wollmershaeuser, head of forecasts at Ifo.

However, if clothing and footwear prices continue to increase above general prices, retailers in the category are likely to continue to face decreasing sales volumes and their concerns will not go away. What’s more, the first quarter of the year is already a slow season for the category.

Such prospects could accelerate the current trend in the fashion retail business towards closure, whether through bankruptcy, as in the case of fashion chain Aachener, which has put seven stores at risk, or through voluntary store closures, as decided by Deichman. The Essen-based group announced that its footwear and streetwear subsidiary Onygo would cease operations by August 2024 at the latest. Shortly after, it concluded that “rising costs and declining sales made the business in the middle price segment not sustainable” and decided to cease the business operations of the MyShoes subsidiary, closing all 61 stores in Germany by the end of 2024.

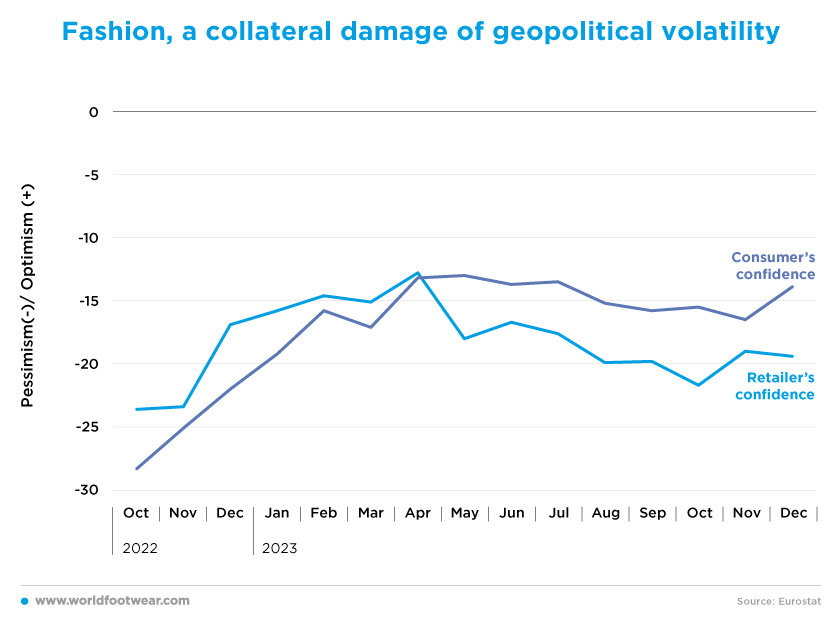

Fashion, a collateral damage of geopolitical volatility

April marked a clear turning point in the upward trend of the confidence indicators (by Eurostats) for both German retailers and consumers, driven by the risk of recession since the last quarter of 2022. However, while retailers’ pessimism deteriorated quickly as they struggled to cope with cost inflation and pass it on to customers, consumers’ sentiment was more hesitant, ending December with a negative balance of -13.9, only marginally (0.7 percentage points) worse than its April peak.

In addition, the HDE consumption barometer created by the Handelsblatt Research Institute (HRI) which reflects the expected consumer behaviour for the next three months, reached not only its highest level of the year in December, but also its highest level since November 2021. The propensity to save decreased, meaning that consumers are significantly more optimistic about the coming weeks than in previous months despite the uncertainties associated with the restrictions on the federal government’s budget imposed by the Constitutional Court, which could have a negative impact on disposable income (einzelhandel.de).

Similarly, the consumer research company GfK’s forecast for January on the consumer climate improved 2.5 points to -25.1 due, most importantly, to noticeable increases at the end of the year of expectations regarding income, considering wage increases that had already taken place or were about to. However. Rolf Bürkl, consumer expert at the Nuremberg Institute NIM warned that “it remains to be seen whether the current increase represents the beginning of a sustained recovery in consumer sentiment,” adding that the overall reading of the survey was still extremely low.

Considering the discretionary nature of goods, the upward trend in TCF retail (by the Bundesbank) has so far been fairly consistent with the recent trajectory of consumer confidence indicators. However, the volatile geopolitical situation in the world could change for the worse at any time and TCF Retail could again become collateral damage.