Register to continue reading for free

Spain Retail: sales increase in the first quarter despite tricky macro-environment

Following an abrupt drop in consumers’ confidence in March due to the war in Ukraine, on top of an alarming inflationary climate, Spanish consumers appear to regard the current situation as temporary. In fact, retail sales of clothes and accessories have increased by 19.1% in the entire first quarter of 2022, despite less generous discounts thanks to this year’s cost inflation. Margin protection is certainly at the top of retailers’ agenda now. Meanwhile, the online and physical retail are somehow at a truce

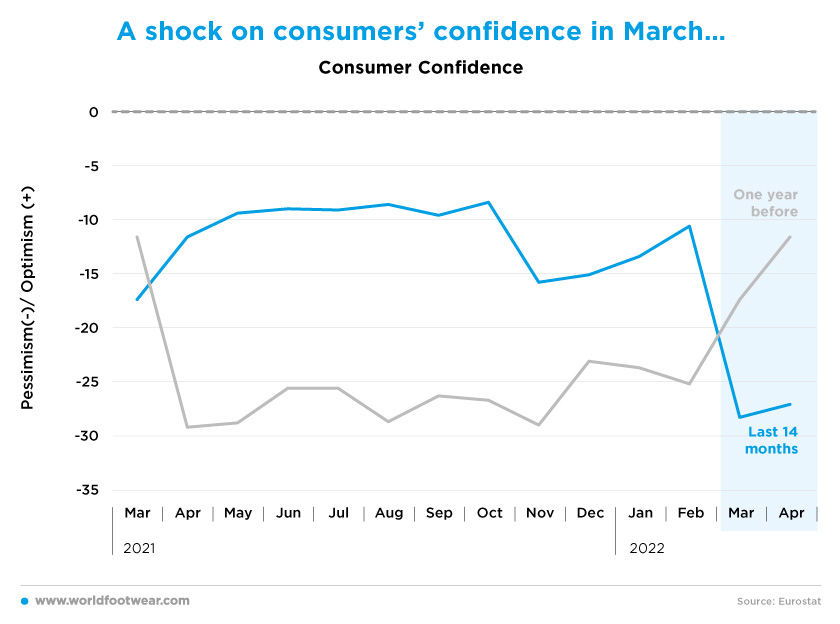

A shock on consumers’ confidence in March…

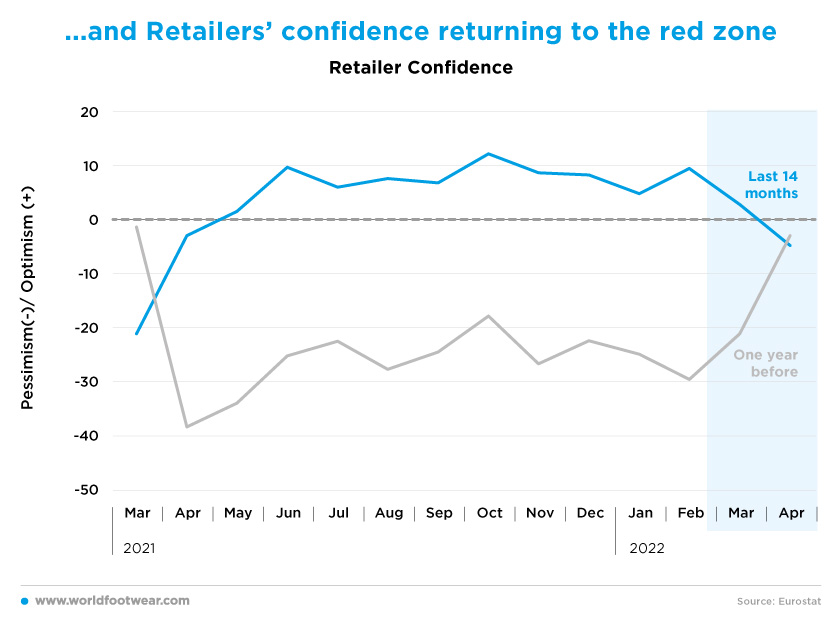

“The new crisis due to the cost increases and the incertitude on the Ukraine war had a direct effect on the households’ ability-to-spend and, therefore, on consumption”, commented the Spanish Trade Confederation. “The trade industry is living a moment of maximum vulnerability while still having not reached the recovery after two years dragging the effects of COVID-19”, they added (www.efe.com, 29th of April).

... and retailers’ confidence returning to the red zone

The Consumer Prospects Report, based on a survey conducted by Kantar Consultancy about consumer confidence in the first quarter, explained that “the stability of both income and employment of those occupied has not changed, so the household’s economic situation was not substantially altered”. Thus, “the majority of consumers regard the present situation as temporary” (www.elperiodico.com, 27th of April).

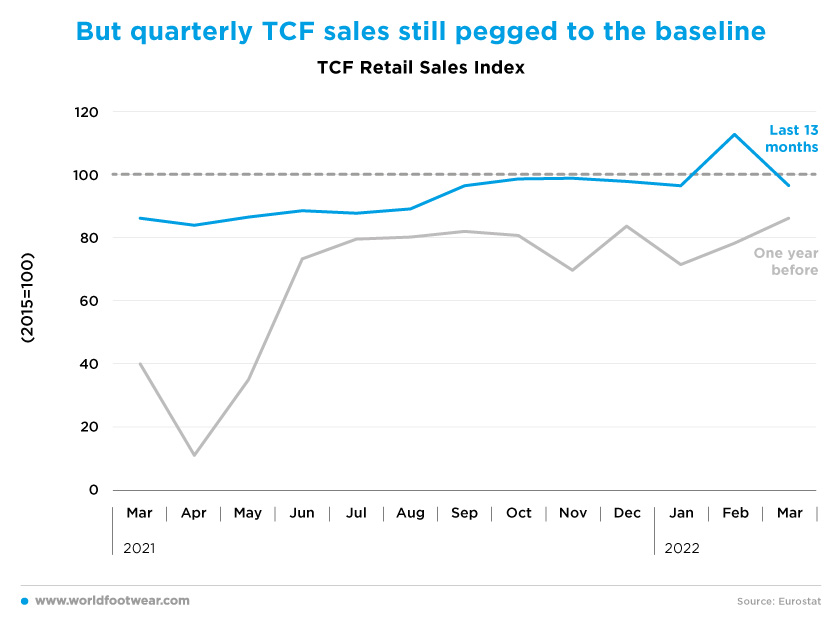

But quarterly TCF sales still pegged to the baseline

The truth is, TCF retail resisted well enough the Omicron wave impact in January. In addition, more than reflecting the worsening of consumer confidence, its quite pronounced break in March seems to signalize the return to the clear tendency to the 2015 baseline, observed since September 2021. The February retail score (about 13 percentage points (pp) above the baseline) is an outlier explicable by the winter sales effect, which are now more attractive with inflation biting the disposable income of Spanish families. That is why, despite the big month-over-month retail slash in March, retail sales of clothes and accessories increased by 19.1% in the entire first quarter (www.efe.com, 29th of April).

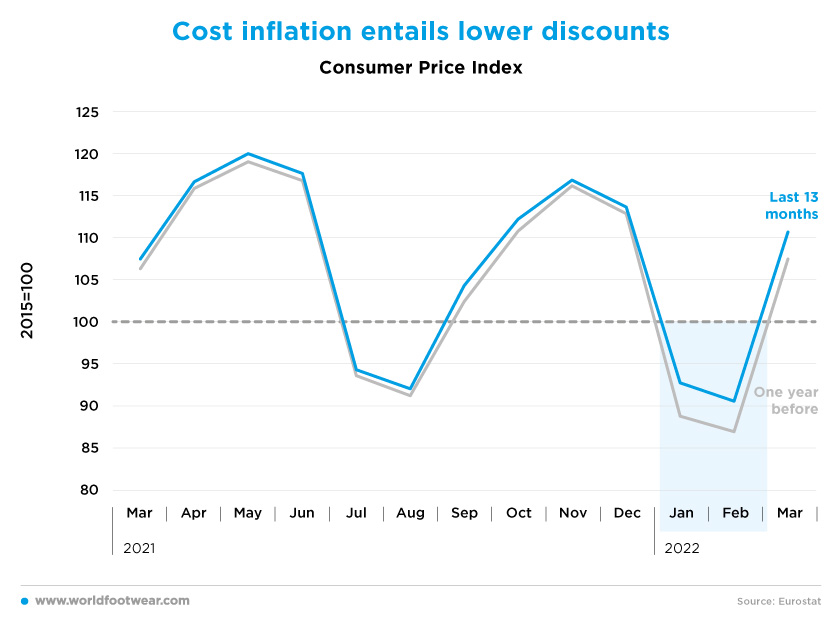

Cost inflation entails lower discounts

Margin protection is certainly at the top of retailers’ agenda now, yet “contemplating stable prices with selective mid-one single digit and not global increases, and with no impact on volume as evidenced by the sales figure at the beginning of the first quarter of 2022”, suggested Óscar García Maceiras, the new Inditex CEO, which meant an average price increase of 2%, both in Spain and Portugal, as revealed during the presentation of results by the company's top executives. (es.fashionnetwork.com, 16th of March).

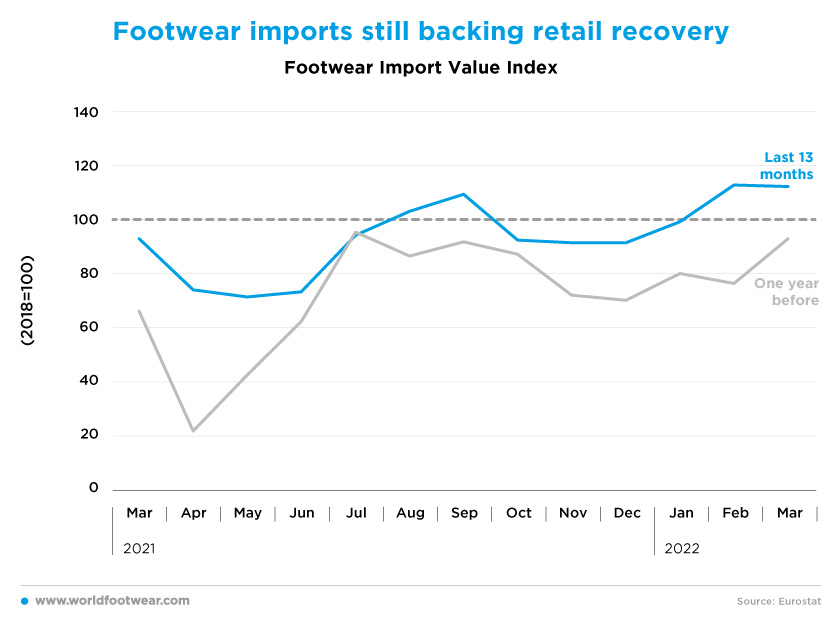

Footwear imports still backing retail recovery

Moreover, in February and March, the Spanish footwear imports behaviour well up the 2018 baseline (up by 12 pp) appears to be evidence of retail’s soon return to normalcy rather than a cautious retreat anticipating any dark clouds downstream.

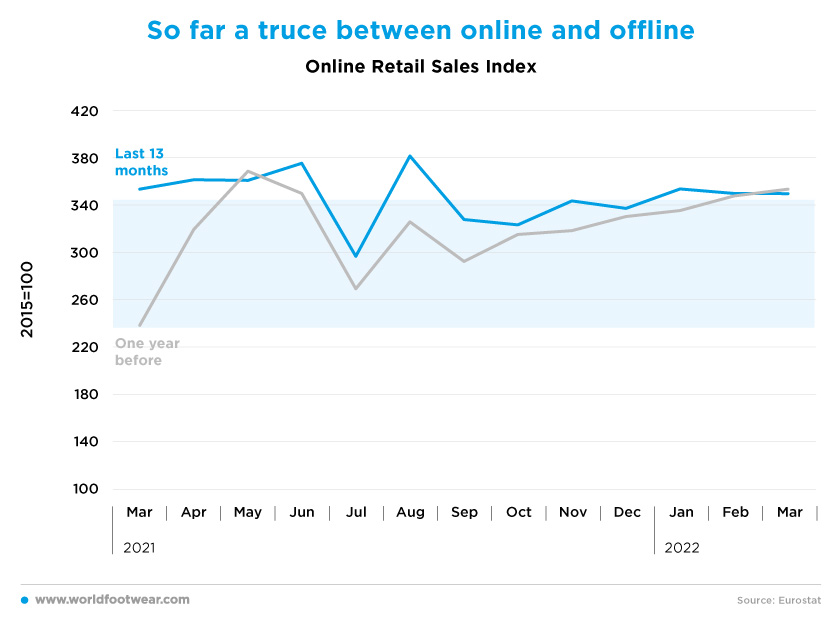

So far, a truce between online and offline

Now that physical retail is apparently becoming less sensitive to the ups and downs of the COVID-19 pandemic, the competitive advantage of online retail to circumvent health barriers is expected to be neutralized. The time has come to measure the real value of the online purchasing mode to support further share gains in overall retail without the COVID-19 booster. In the first quarter, the Online Retail Sales Index (if taken as a proxy for TCF internet sales) stabilized at around 110 pp, up from the score prevailing before the pandemic. Under the proxy assumption, a temporary truce on the battlefield between online and offline looks to be in place.

At the same time, specialized sources report that “online fashion consumption in Spain has not suffered the impact of the energy crisis, disruptions in the supply chain or the war in Ukraine”; additionally, according to the Fashion Research study, conducted by the fashion search engine Glami, a significant drop in online fashion sales is not expected in the coming months. Although 63% of consumers have observed an increase in prices in clothing and footwear, they regard it as "small" and it does not seem that it will stop their future purchases (revistadelcalzado.com, 5th of May).

But perhaps the share gains of e-commerce are about to resume. For small independent footwear retailers, at least, odds seem to be against physical retail. Eduardo Abad, UPTA España’s President, explained that “the manufacturers’ strategies bypass the small retailers through direct online sales or through both their platforms and grouped ones. They repeatedly launch online promotion campaigns, the prices of which are lower than the buying prices for small retailers, knowing these make their purchases six months in advance” (upta.es, 22nd of April).

And, in contrast to our proxy assumption, “the fashion e-commerce stood out increasing digital sales by 42% as compared to February 2021” according to the above-mentioned Comertia source (es.fashionnetwork.com, 7th of March).