Register to continue reading for free

Spain Retail: depressed retail and online sales gaining share

The TCF retail Sales Index in Spain is showing some resistance to getting back to the pre-pandemic levels, even if some recovery took place over the second half of 2020. One positive sign seems to come from internet retail, which is gaining share since September 2020. The concern raises as this is being done at the expenses of physical retail. If one needs hope and goods news, those might come from some relative optimism from the consumer side, which might be followed by the retailers. The next few months will be key to see if they persist

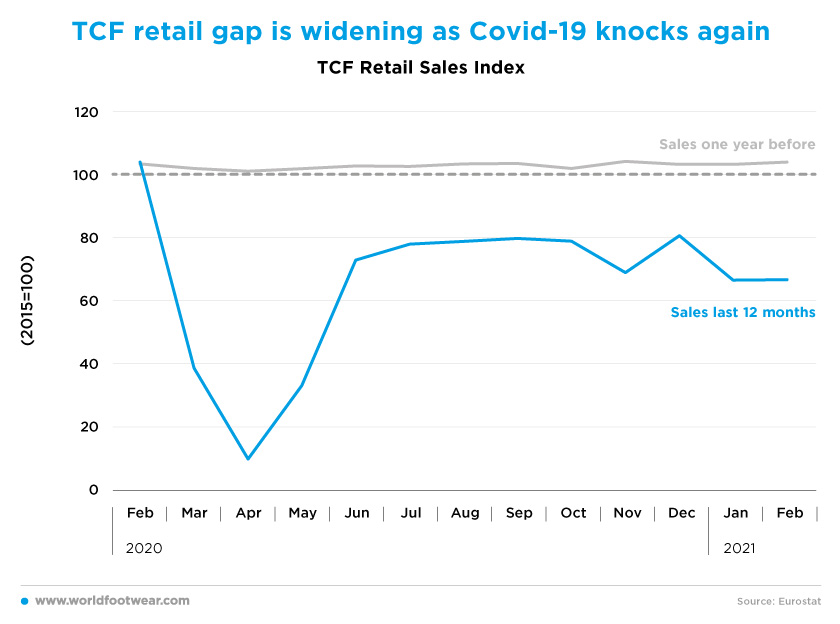

TCF retail gap is widening as COVID-19 knocks again

In our previous World Footwear Retail Flash for Spain, we pointed out a specific fact about this market: the existence of a resistance gap of 20 points to the 2015 Textile, Clothing and Footwear (TCF) retail baseline, after the recovery from the 1st COVID-19 wave. Since then, the retail business depressed again through February 2021, losing more than 15 additional points. The exception was the performance over the Christmas season (December).

Such conditions of the retail market are reflected in the results recently announced by the Spanish companies. Tempe, footwear and accessories distributer for the group Inditex’s brands (and 50% owned by the latter), announced a revenue drop of about 30% in 2020 with EBIT down by 43% from 2019. Spanish-based fashion company Desigual also announced declining sales (-39%) in 2020, with a loss of 93 million euros for the year.

Behind the worsening of the business conditions are new pandemic waves registered in Spain in November 2020 and again in January and February 2021. The adverse retail effect is noticeable, even though it is not so pronounced when compared with the first wave.

As it stands, unless the virus is substantially contained, footwear retail will hardly overcome the resistance gap, let alone return to the baseline.

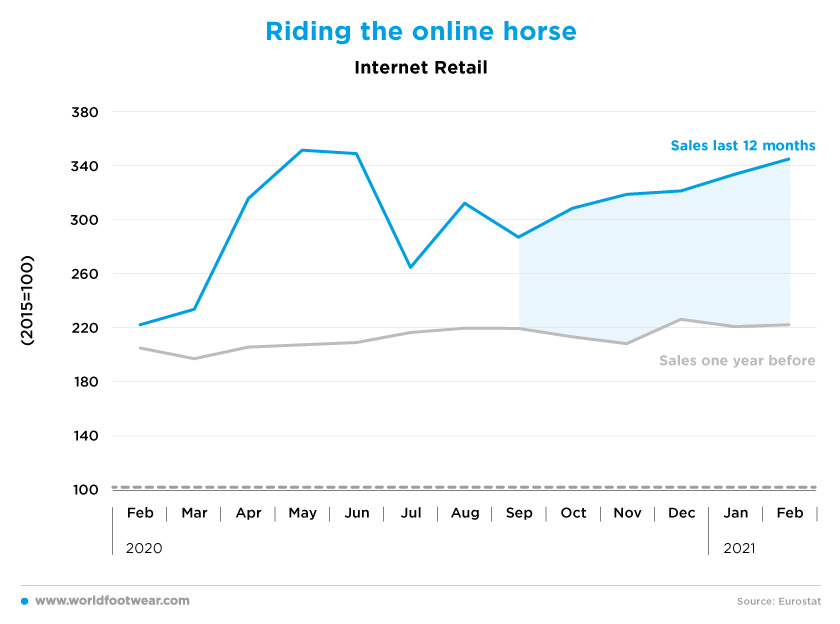

Riding the online horse

In the meanwhile, internet retail is gaining share since September at the expense of physical retail, hitting 240 points above the 2015 baseline and 55 percentage points more than the pre COVID-19 level.

In October, H&M has announced an acceleration in digital investments, as the COVID-19 pandemic helped to speed up a shift towards online transactions. On top of it, according to the Spanish Union Comisiones Obreras, H&M informed them of the launch of a redundancy plan which will affect more than 1 000 people and the closure of 30 stores in Spain.

Footwear being a greedy online rider can offset some losses for those retailers who are agile enough to jump into the online wagon.

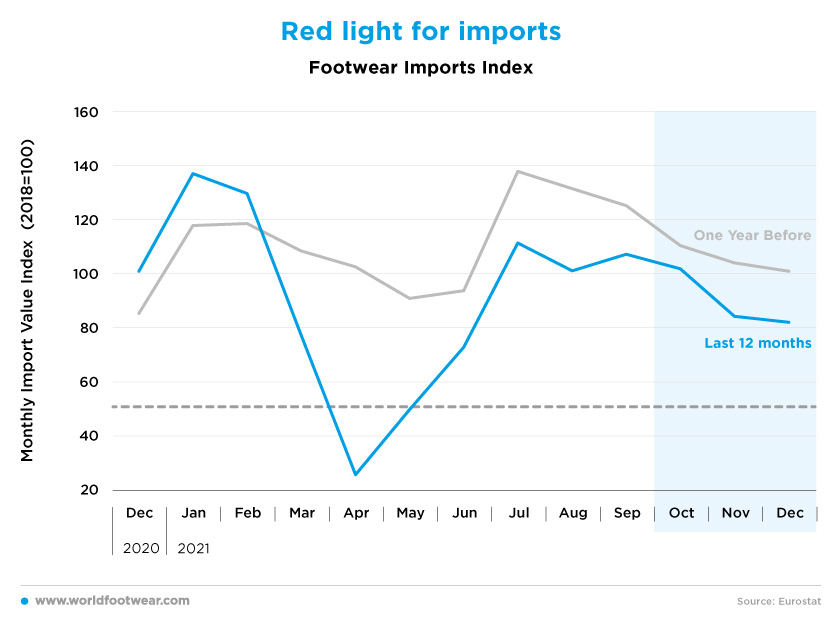

Red light for imports

Differently from retail, footwear imports data is (more) delayed and not seasonally adjusted. Nevertheless, the second semester trending down profile is not very different from the previous year. But with retail sinking along the resurgence of COVID-19 in November, the 2020-2021 import line has been always lower and footwear imports collapsed well beneath the 2018 baseline and quicker than normal in the last two months of the year.

It would be rather surprising in the first months of 2021 to see Spanish footwear importers to ignite the import engine again, as usual in previous years. Christmas was nothing but a soft pause within a bad business retail outlook, and if doubts existed about this, the third COVID-19 wave jumped on bord in early January 2021. In this scenario, stockpiling seems to make no sense.

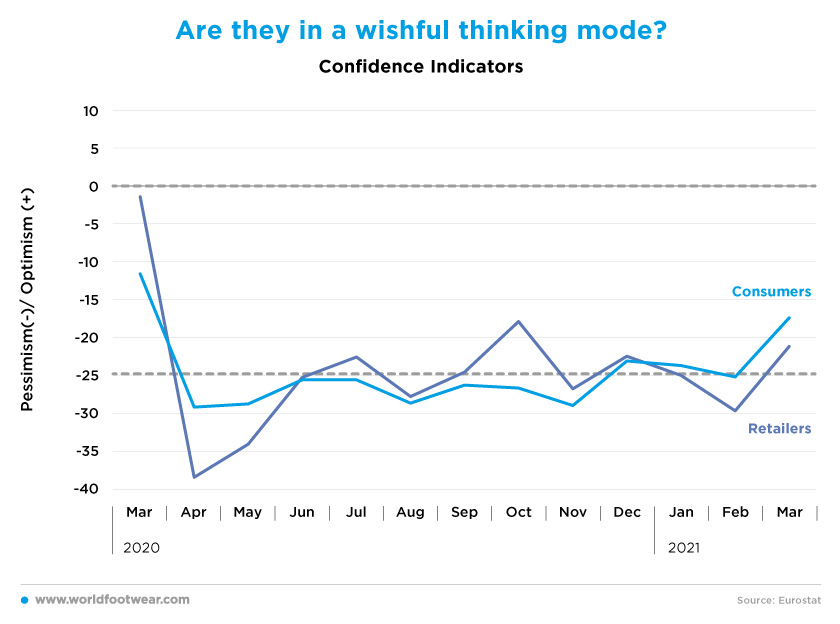

Are they in a wishful thinking mode?

Nevertheless the picture presented so far, the Spanish consumer is no longer translating new COVID-19 outbursts into proportional aggravated pessimism. If one looks into the confidence indicator in the first two months of the new year, it seems as if the consumers are now, in some way, used to live with COVID-19, and, vaccination probably contributed to a better mood registered in March. Retailers seem to follow the optimism of the consumers. May both be right.