Register to continue reading for free

Spain Retail: are consumers curing their entrenched pessimism?

As the new pandemic wave seems to be fading away in Spain, indicators are improving. In the last two months with data available (March and April) Footwear Imports and the Textile, Clothing and Footwear (TCF) Retail Index performed much better than in 2020. Adding to list of good news is the consumers and retailers' confidence at their maximum scores since March 2020. With the online retail being at its maximum as well, the question now is whether omnichannel strategies from physical operators will be strong enough?

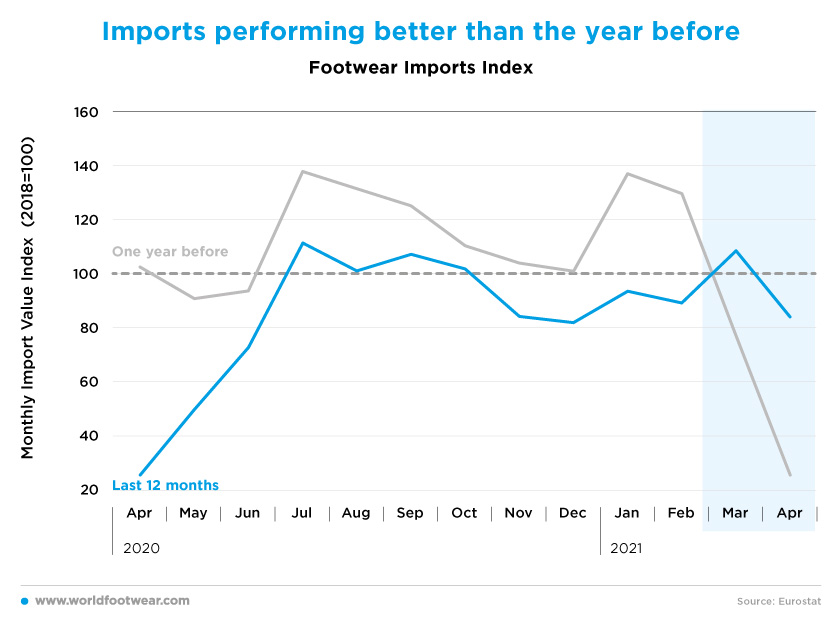

Imports performing better than the year before

In Spain, COVID-19 took its toll in January and February, both on sales and on footwear imports, without changing the seasonal pattern from the previous pre-pandemic year.Then in the following two months as the new pandemic wave faded away, footwear imports and the Textile, Clothing and Footwear (TCF) Retail Index performed much better than in 2020.

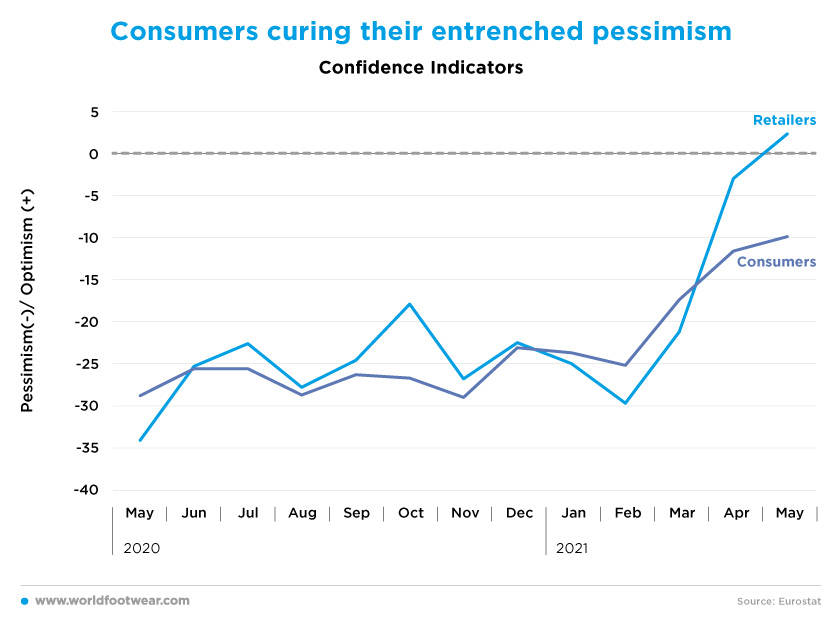

Consumers curing their entrenched pessimism

Such improvement in both indicators is the result of consumers, as well as retailers, confidence being at their maximum scores since March 2020 when the pandemic checked in for the first time and increasing continuously since February this year.This is all the more important as according to a McKinsey consumer survey, with data collected between the 23rd and the 27th of February 2021, Spain was among the most pessimistic (17% optimistic against 31% pessimistic) European countries in terms of consumer confidence and in regards of the country’s economic recovery (despite the overall pessimism had been decreasing as compared to November 2020).

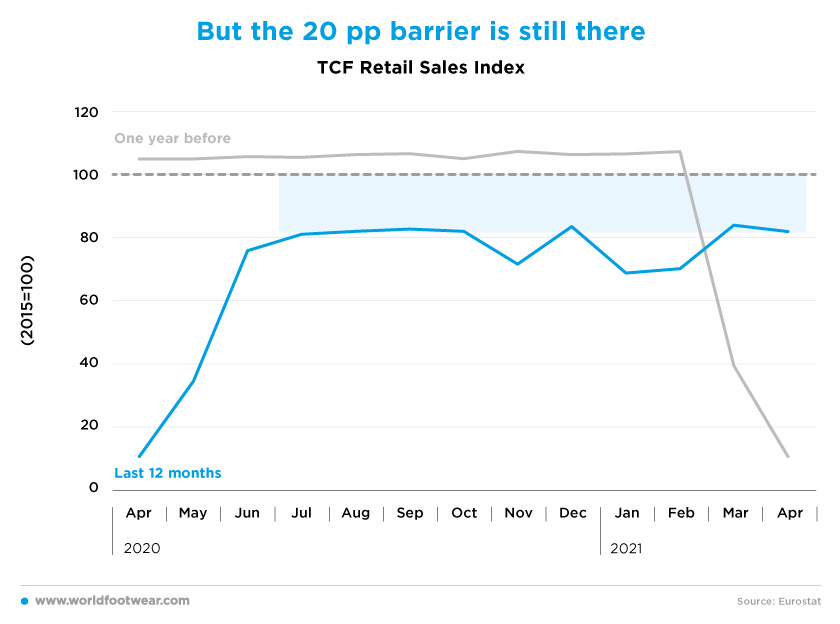

But the 20 pp barrier is still there

But so far, the TCF Retail Index doesn't seemed to be capable to break the 20 percentage points (pp) gap behind the 2015 baseline.As far as the global performance recently depicted by Inditex (as reported by shoe intelligence.com) helped by the reopening of stores can apply also to Spain, in the three months ended on the 30th of April, sales should have risen sharply compared to the year earlier while sill down compared to the first quarter of 2019. But taking the period from the 1st of May to the 6th of June store and online sales together were slightly above both the same periods of 2020 and 2019.

Whether the evidence for the next months will finally penetrate the 20 percentage points (pp) barrier is an interesting challenge on the path for the new normalcy.

Again, the already mentioned McKinsey consumer survey reports that Spanish consumers say they will prioritize shopping once COVID-19 subsides with a net positive intent of +37 pp to shop for non-necessities and a +52 pp to go to a shopping mall. Moreover, a spike in consumer spending on apparel, shoes and accessories is expected as planned by 35% of respondents.

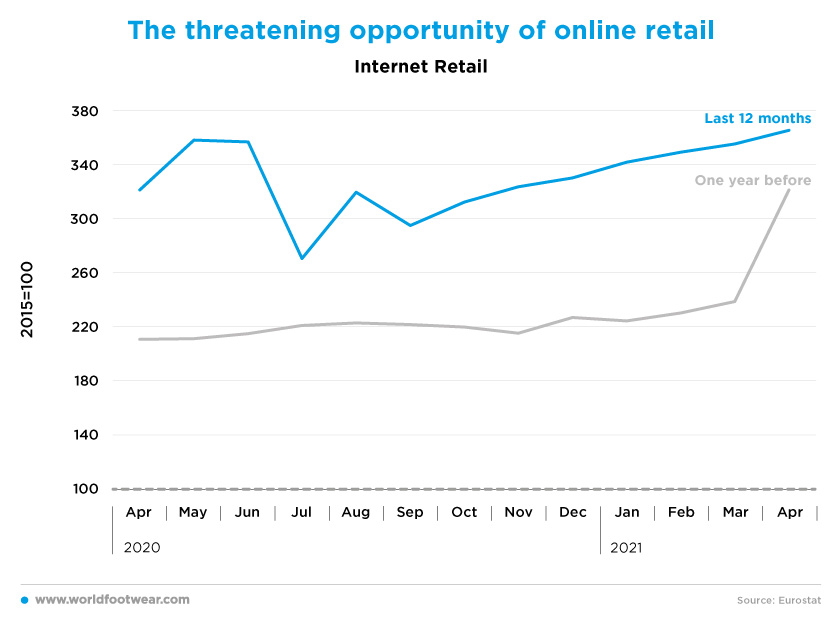

The threatening opportunity of online retail

The Online Retail Index is at its maximum value so far (265 pp above the 2015 baseline) and since September 2020 it clearly shows a steady increase through April this year.As the damages of the pandemic are now very far from its top level, one can expect that online purchases are already so much engrained on the consumer behaviour that it cannot be reverted in the new normal to come.

The McKinsey consumer survey referred to herein shows that among the 59% of consumers using the online channel to purchase footwear during the COVID-19, there was a 25 pp positive net intent to purchase footwear online after COVID -19 (62 % of respondents stating they expect to increase or maintain use minus 38 % stating they expect to decrease or stop use).

The question is whether omnichannel strategies from physical operators will be strong enough to preserve their overall margins from the increasing online monopolization by big marketplaces.