Register to continue reading for free

Spain Retail: leaving COVID-19 fears behind

Despite the spread of the Omicron variant in the last quarter of 2021, the TCF retail sales index shows overall a slow, but positive trend, and retailers’ confidence has not returned below pre-pandemic levels. Consumers are less optimistic, but the results are not substantially worse than two years ago. At the same time, they have embraced e-commerce, which seems to have demarcated itself from the course of the pandemic

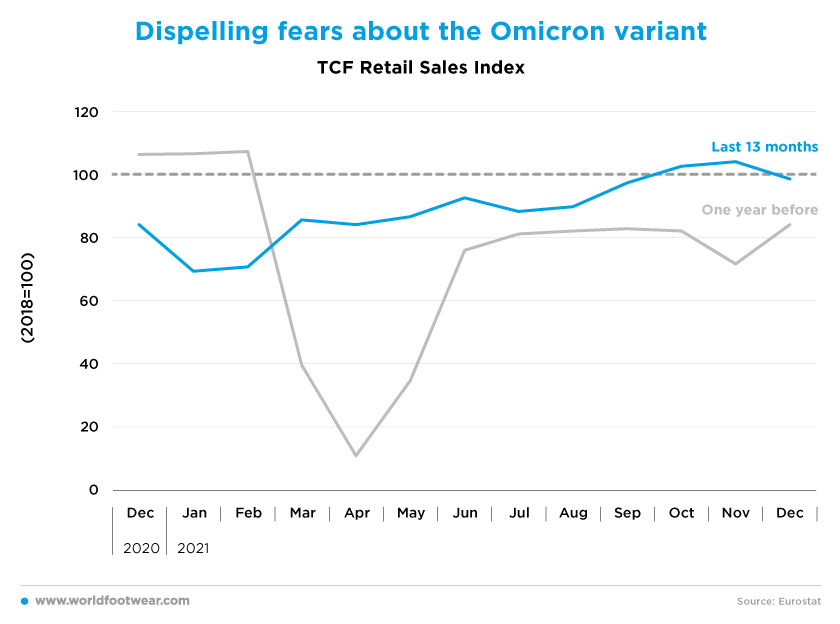

Dispelling the fears about Omicron

Doubts concerning Textile, Clothing and Footwear (TCF) retail sales have prevailed in Spain until October 2021, despite its slow movement displaying a positive trend."The data reveals that the recovery of consumption in the fashion sector in Spain has come later than expected and with less force maintaining a certain weakness in domestic consumption. Everything indicates that the fashion sector will not recover entirely in 2021”. In fact, the report shows fashion consumption grew by 23.5% during the first half of 2021, although still 25% below 2019", explains Tatiana Valoira, author of the report 'Fashion Sector', published by EAE Business School (www.justretail.news, February 2022).

Nonetheless, for most of the last quarter, sales were even 2.5 points to up 4 points to the 2015 baseline. Even the slight setback in December, due to the threat presented by the surge of the Omicron variant, is not comparable to the fears felt by buyers during the same period of 2020.

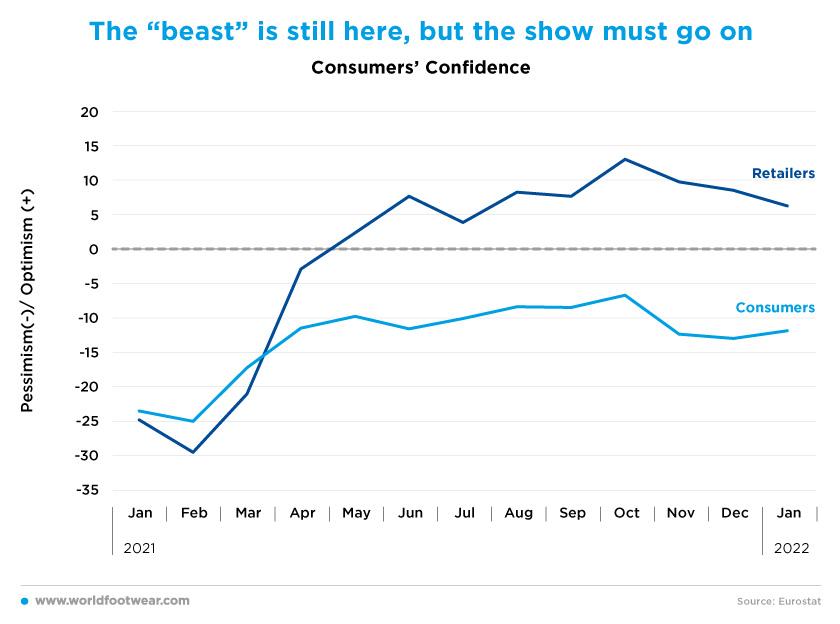

The "beast" is still here but the show must go on

Eurostat’s confidence indicators for the Spanish market seem to prove that the "wild beast" can still bite, but the show must go on anyway.After suffering a blow in November 2021, consumers’ pessimism, which is measured by the negative balance of survey responses, stabilized between minus 10 and minus 15 points. The result is not substantially worse when compared with the same period before the COVID-pandemic occurrence.

In addition, in the last three months through January 2022, retailers have refused to give up the optimism built since May: positive scores have remained higher than the ones observed in the same period two years ago.

Sources from the footwear brand Camper indicated that, in 2020, turnover fell by 28% to 120 million euros, although they are hoping to revert it and close 2021 with growth of 22%, reaching 146 million euros, while forecasting revenue of 175 million euros for 2022 (elpais.com, December 2021).

Luis González, Merkal’s general director since 2020, highlighted, as well, that the 2021 record was positive with a growth of 37%, as compared to the year of the pandemic and [only] 6% below 2019. For 2022, the company is forecasting growth of 10% (www.moda.es, January 2022).

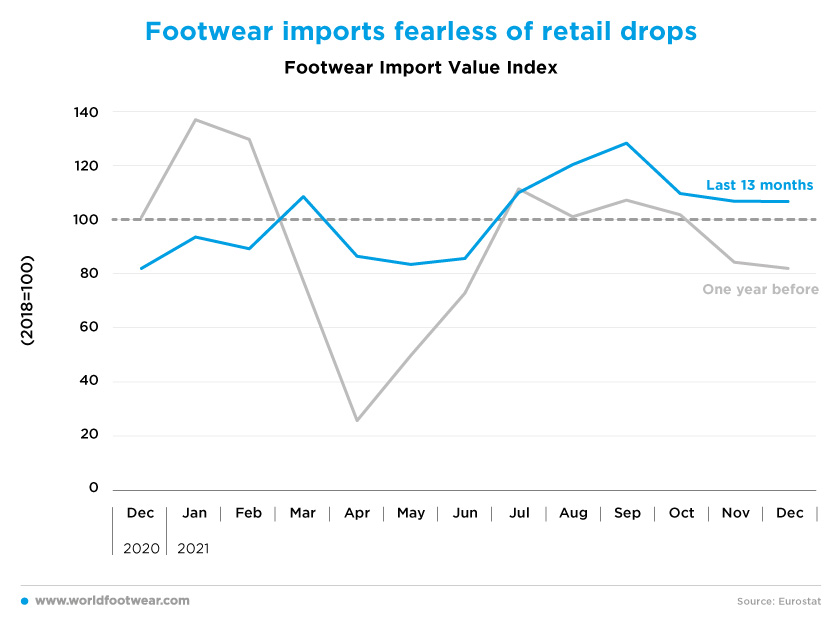

Footwear imports fearless of retail drops

In the last quarter of 2021, Spanish footwear imports were quite in line with the fair confidence mood exhibited by both consumers and retailers.The decline in imports since September is not news, as compared with the moment witnessed two wears ago, before the COVID-19 pandemic. However, now, imports stood higher on the upside of the baseline every month, closing December at around 7 percentage points better, despite the pandemic.

So, odds for TCF retail sales in the first quarter of 2022 are to be back up the baseline. If not, the pandemic might not be the cause.

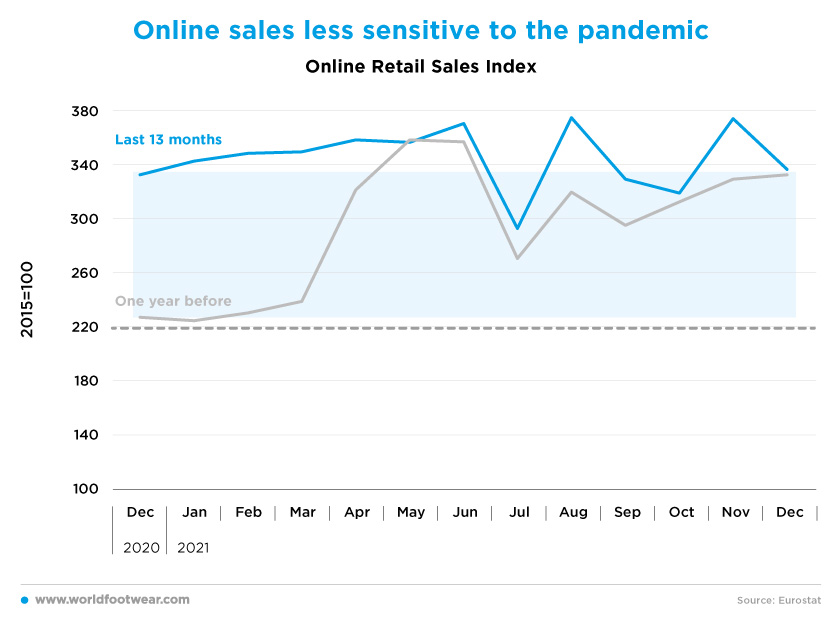

Online sales less sensitive to the pandemic

No monthly data exists in Spain on Clothing & Footwear online retail, but this is a top category (63% of e-commerce consumers in 2020), so, it is supposed to correlate with the overall internet retail index.According to the Postnord study E-commerce 2020, 44% of Spanish consumers have shopped online more often during the coronavirus pandemic, comprising the highest proportion among all [European] countries surveyed. Several countries – such as Spain –, which figured among the least digitalized in Europe, are now at the top regarding the number of people shopping more online due to the pandemic. The Spanish e-commerce market has become one of the fastest-growing in Europe: currently, 90% of the population shops online.

In the last semester of 2021, online retail exhibited a quite volatile trajectory, ultimately slipping down in December. Should any COVID-19 related anxiety have increased due to the spread of the Omicron variant, online retail would have presumably grown, alongside online TCF sales. The fact that such did not occur in December can be interpreted as another sign that consumers are not enough concerned about the pandemic situation.

Yet, it is very likely that online demand will never return to the pre-pandemic level (more than 100 percentage points below in December), which shows that Spanish consumers have definitely embraced e-commerce. Perhaps this helps explain the strategy of the footwear brand Camper: “We don’t need to expand further, much of the growth will come from the digital area, supported by physical stores”, commented Miguel Fluxà from Camper to the El Pais newspaper. It was in the online channel that Camper felt the pandemic’s effects and the change in consumer habits, going from selling 30% before 2020 to 50% of the total turnover: 73 million euros this year.