Register to continue reading for free

Japan Retail: mixed signs cast a shadow over a clear outlook for the rest of the year

The growth rate of footwear consumer prices has largely outpaced that of the overall prices. This is not a good sign for the footwear sector, as discretionary items are always the first to be discarded by consumers, but it is not all bad news. The truth is consumer confidence has rebound at the start of the year, private consumption has shown some resilience and the return of tourists is a welcoming sign. Perhaps most surprising is the fact that the volume of imports has not been affected by the weakening of the yen. It remains to be seen how the outlook will unfold

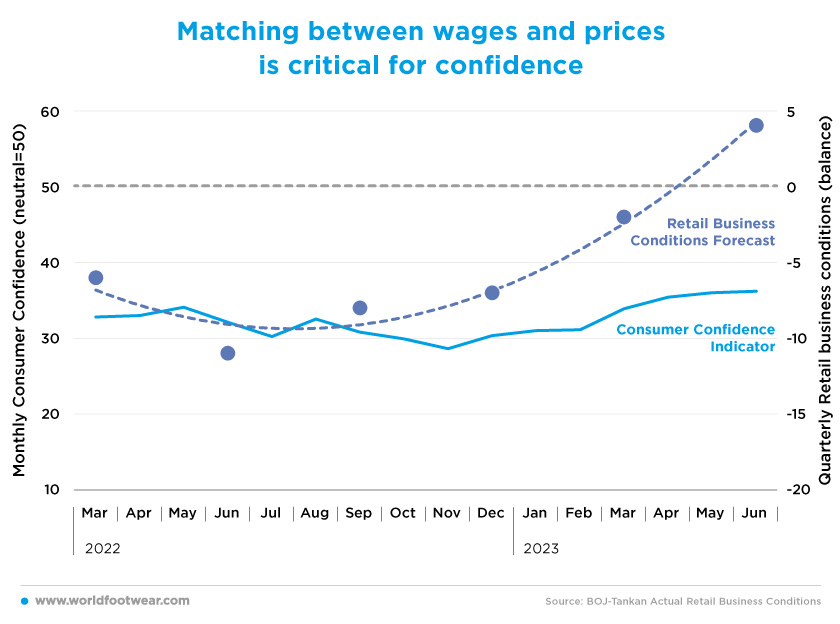

Matching between wages and prices is critical for confidence

Consumer confidence (by the Cabinet Office’s survey of households) improved continuously in Japan from December onwards, registering a gain of 7 ½ percentage points from pessimism last June, 3 ½ percentage points better than a year earlier.

At the start of 2023, there was a rebound in consumer confidence, despite concerns about higher prices in fuel and daily necessities. However, when prices climb, consumer sentiment tends to weaken if the wage growth doesn’t match the prices. Still, as pointed out by Akiyoshi Takumori, Chief Economist at Sumitomo Mitsui DS Asset Management, the “nominal wages including bonuses were[actually] pretty good in December. This certainly had a positive effect on consumption trends” (japantimes.co.jp).

Thereafter, the Cabinet Office attributed the improvement in consumer sentiment [in the second quarter] to the shift from the COVID-19 pandemic to “normal times” and the ongoing effects of the government’s measures to reduce electricity and gas bills (japannews.yomiuri.co.jp).

And in response to improving consumer confidence, the growth of overall retail sales rose by about 7 percentage points year-over-year in May, also fuelling a sustained recovery in the retail business conditions forecasted in June (by BoJ-Tankan).

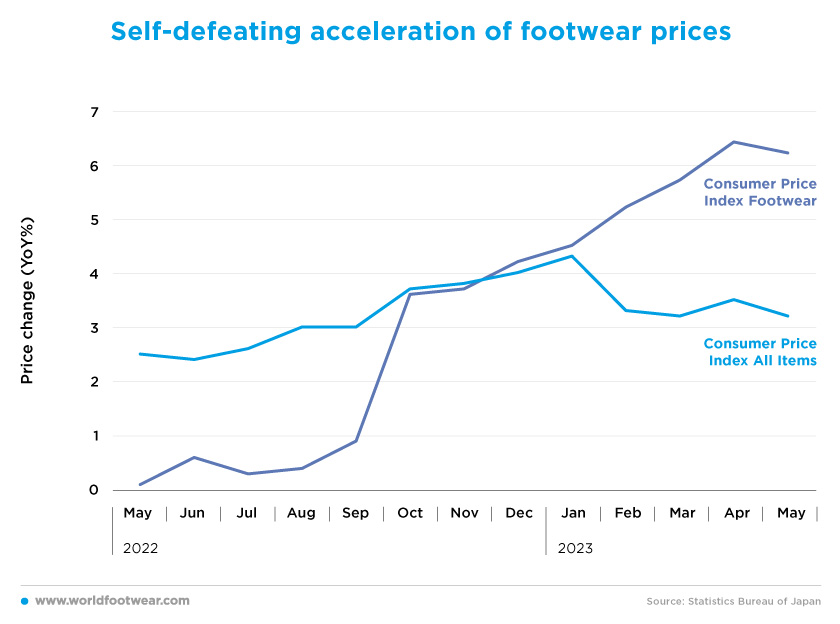

Self-defeating acceleration of footwear prices

Overall inflation in Japan has curbed to 3.5% in April and 3.2% in May, mainly due to Government subsidies on gas and electricity bills. But in the absence of higher wage growths, with businesses making up for the lost time in passing on higher costs and with a weak yen adding to the pressure (asia.nikkei.com), price levels continue to exceed acceptable Japanese standards.Excluding energy from the Consumer Price index, inflation continued to strengthen to hit 4.3% [in May], showing that the underlying price trend is continuing to gain momentum. The reading was the highest since 1981 (japantimes.co.jp).

However, the BOJ’s outlook is for the inflation path “to go down for a while, toward the end of this year, on declines in import prices”, spilling over to domestic prices. “From there on, we are forecasting some increase in the rate of inflation into ’24. If we become reasonably sure that the second part is going to happen, that could be a good reason for a policy change”, said the Governor of the Bank of Japan, Kazuo Ueda (japantimes.co.jp).

In any case, unlike other important world markets, in Japan, the growth rate of footwear consumer prices has largely outpaced that of the overall prices since December. Moreover, it has followed an accelerating path, reaching a maximum of 6.4% year-over-year in April.

According to Hideo Kumano, Chief Economist at Dai-ichi Life Research Institute, “expenditures on energy and food cannot be readily cut because they are essential to life. Spending on consumption such as leisure and clothing may be squeezed down the road” (asia.nikkei.com).

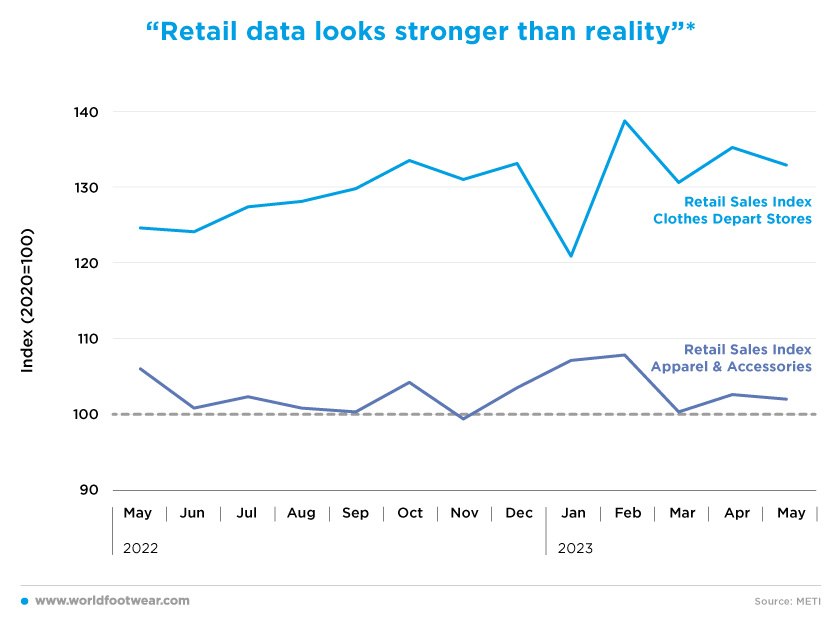

"Retail data looks stronger than reality"*

The baseline year for the available seasonally adjusted retail indices in the Apparel category has now been changed to 2020 by the METI source. Given that this baseline refers to the first year of the COVID-19 pandemic, the performance trend of the apparel and accessories index for the year ending May 2023 is almost stable at about 2 ½ percentage points, above the weak 2020 record.

Economist Yuichi Kodama, at Meiji Yasuda Research Institute, came to the rightful conclusion that “the[retail] data looks stronger than reality*, as the numbers are padded by inflation, but still it’s true that private consumption is more resilient than expected. Inbound tourism is doing really well and may return to the pre-pandemic level by year-end, which should be a big driver for the economy” (japantimes.co.jp). And the same may be true for Apparel & Accessories.

While there’s no reason to celebrate the loss of 4 percentage points of retail sales, as compared to the prior year - considering the steep price increase of the category in general, and that of footwear in particular (6.2% in May) - the 8 percentage points sales increase year-over-year of the category in Department stores is, on the contrary, quite positive, once price increases are discounted. This is where tourist demand should be placed.

Data from branded retail chains working with discretionary demand translates to this mixed performance. Shiseido’s sales at home, in Japan, rose by 8.4% in the first quarter (voguebusiness.com). However, in its highly successful home market, Fast Retailing’s (Uniqlo parent company) revenue climbed, but profits slipped by almost 2% in the first half of its fiscal year, as the weakening yen drove up the cost of sales (japantimes.co.jp).

Online may be pushing fashion retail now

Contrary to the declining change rate exhibited by Non-Store Retail through December (METI data, not seasonally adjusted, where e-commerce plays a big role), it reverted upwards since the beginning of 2023, registering a growth rate of 4.4% year-over-year, in May. On the other hand, the change rate of Apparel & Accessories Retail (not seasonally adjusted, same source) has been decelerating over the same period of time, becoming negative at the close of May (-3.7% year-over-year).

Although monthly data on the category inside Non-Store Retail is not available, the share of the fashion category in the total e-commerce market in Japan is estimated at 27.8% in 2023 (ecommercedb.com). Taking a somewhat leap in the dark, it seems that online apparel & accessories retail may now be much more dynamic than offline retail. Evidence on ASICS net sales in the first quarter ended on the 31st of March seems to demonstrate our assumption, with the trend of recovery in inbound increased by 61.9% in the Japan region (assets.asics.com).

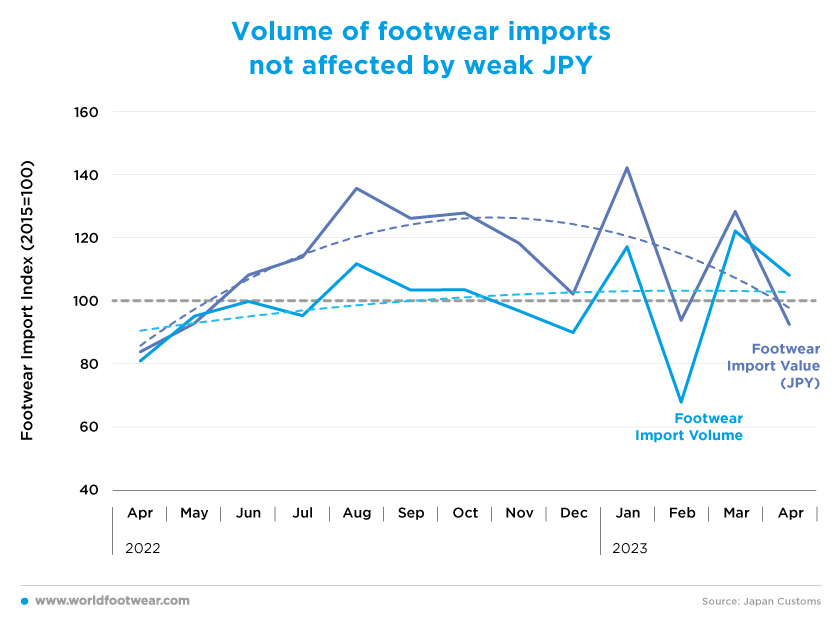

Volume of footwear imports not affected by weak JPY

Although, all other things being equal, a weak yen makes imports more expensive, that exchange rate effect has been neutralized by the slowdown in the prices of imported footwear at the origin. Footwear imports in value are now decreasing in a way that has made the volume of footwear imports up to April quite insensitive to the depreciation of the Japanese yen. The depreciation against the US dollar reached a seven-month low last June.The imported volume of footwear (not seasonally adjusted) is actually showing a fairly mild upward trend, in line with the very modest retail performance of the category Apparel & Accessories we noted earlier.