Register to continue reading for free

Japan Retail: retail recovery didn't take place and confidence might be endangered if prices go up

The expected retail boost from the Olympic games never took place in Japan, and the retail index is still below the normal pace registered before the pandemic. With the lifting of the State of Emergency things are expected to improve. If retailers are still lacking confidence, consumers seem to have improved their mood. However, with a rising expecting about the growth of prices, this could negatively impact the good mood of consumers and further deteriorate the confidence of retailers

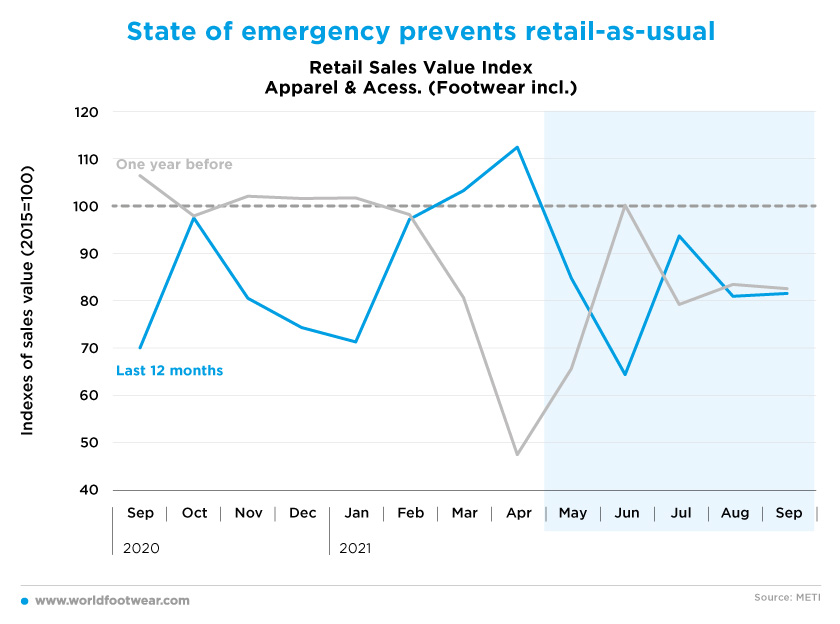

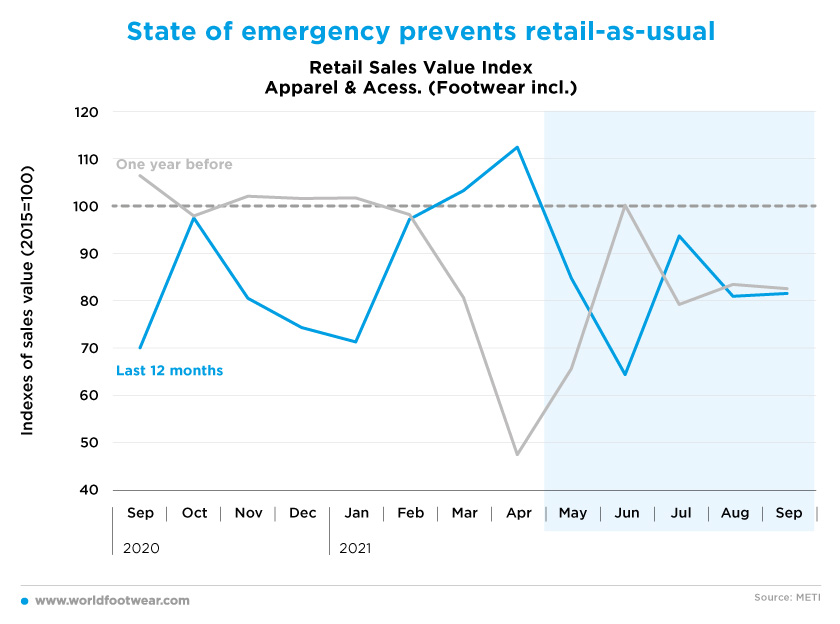

State of emergency prevents retail-as-usual

Retail sales of apparel and accessories (footwear included) have not returned to the 2015 reference baseline since May this year. The Corona virus upsurge severely hurt the retail boost expected to come out of the Olympic games, as the new State of Emergency came into effect in Great Tokyo in July. As a result, the last two readings of the Retail Index (August-September) were still some 20 percentage points (pp) under the 2015 baseline, the gap to reach the normal pace registered in Japan before the pandemic.

According to NHK news (26th of October), the Japan Department Stores Association says sales at Japan's department stores fell for the second straight month in September as the coronavirus State of Emergency led to a decline in customers. Clothing dropped by 5.6% from a year earlier. People refrained from going out and some stores restricted the entry of shoppers. Yet the Association says "sales and the number of shoppers have been recovering since mid-September" amid the decline of COVID-19 infections, and the trend is continuing into October with the lifting of the State of Emergency.

Citing the Economy Ministry's data as of the 28th of October (as Japan Times reported) “higher outlays on clothing, accessories and general merchandise in September helped receipts at retailers rise 2.7% from the previous month, while analysts had expected a 1.5% increase from August. Sales gained 1.2% in the quarter compared with three months earlier, the fastest increase in a year. The stronger-than-expected gain suggests overall consumption may not have declined last quarter as much as expected”.

According to NHK news (26th of October), the Japan Department Stores Association says sales at Japan's department stores fell for the second straight month in September as the coronavirus State of Emergency led to a decline in customers. Clothing dropped by 5.6% from a year earlier. People refrained from going out and some stores restricted the entry of shoppers. Yet the Association says "sales and the number of shoppers have been recovering since mid-September" amid the decline of COVID-19 infections, and the trend is continuing into October with the lifting of the State of Emergency.

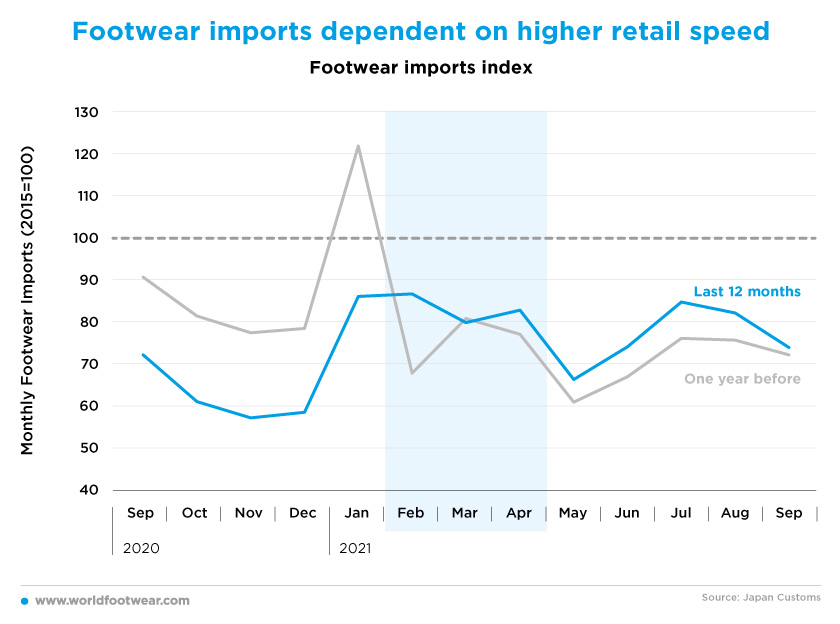

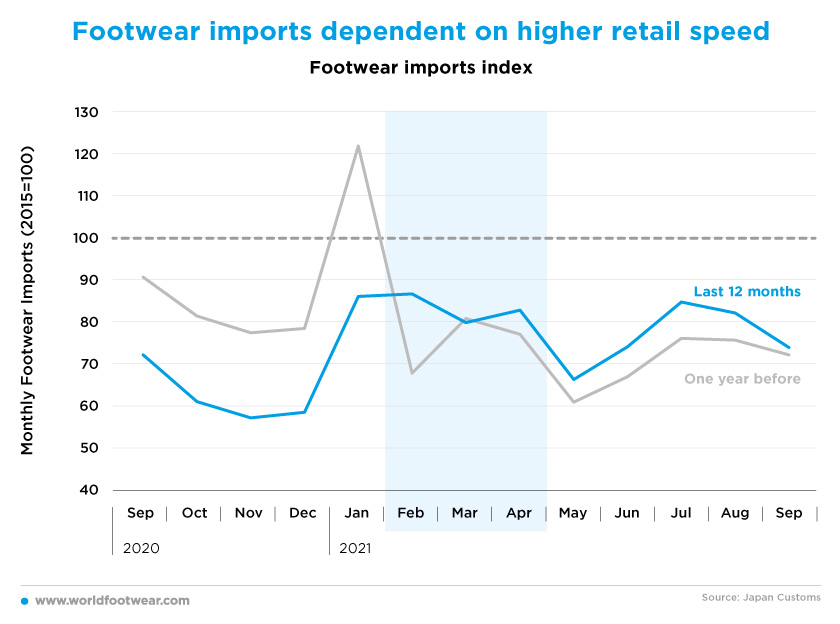

Footwear imports dependent on higher retail speed

Except for the February–April period, footwear imports have been following the usual seasonal pattern of Japan, albeit at a slightly higher level compared to last year thanks to the vaccination effect. Imports resumed the traditional downward slope after the July peak through December. Poor retail performance in August and September gave no push for a different pace of imports. But should the emergency lifting accelerate retail more than expected, importers could respond earlier than they are supposed to, that is before January 2022.

Citing the Economy Ministry's data as of the 28th of October (as Japan Times reported) “higher outlays on clothing, accessories and general merchandise in September helped receipts at retailers rise 2.7% from the previous month, while analysts had expected a 1.5% increase from August. Sales gained 1.2% in the quarter compared with three months earlier, the fastest increase in a year. The stronger-than-expected gain suggests overall consumption may not have declined last quarter as much as expected”.

For the last quarter of 2021 that’s apparently good news for retail as for importers, most importantly as the new elected Prime Minister Fumio Kishida promised measures worth tens of trillions of yen to help the post-pandemic recovery.

And, as the Japan Times reported on the 14th of October, during a press conference of the global retailer Uniqlo’s, the Chief Financial Officer Takeshi Okazaki highlighted that “in the second half, we expect restrictions to ease and normal business operations to resume, but the firm’s mainstay Uniqlo operations in Japan are expected to experience a drop from the strong demand seen a year ago, when loungewear and other stay-home items were snapped up en masse”. Going forward he said “the coronavirus pandemic has not ended. We just cannot tell what will happen and when”.

Such a softening of footwear price pressures in 2021 is quite friendly for consumers after the hike effects of the Consumption Tax in October 2019. But things can turn differently soon, and negatively impact the good mood of consumers and further deteriorate the confidence of retailers.

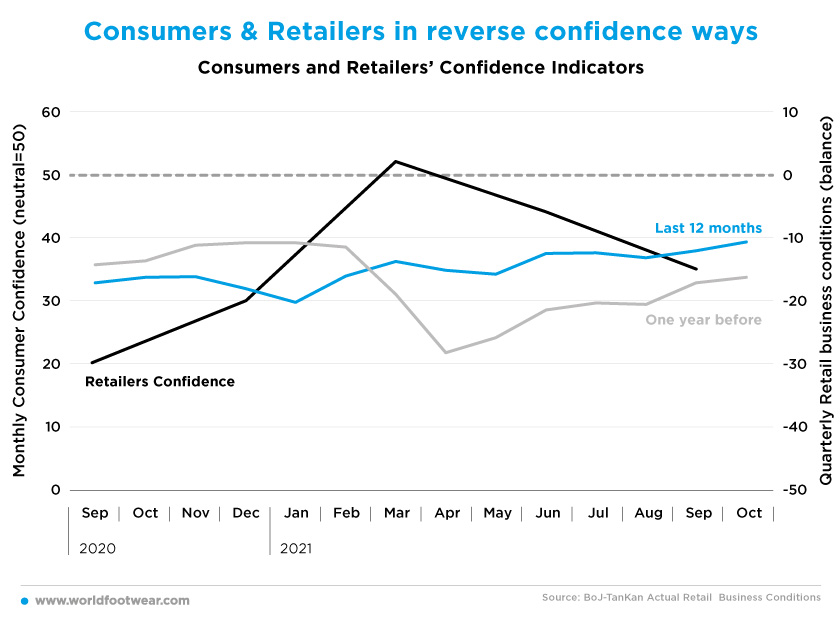

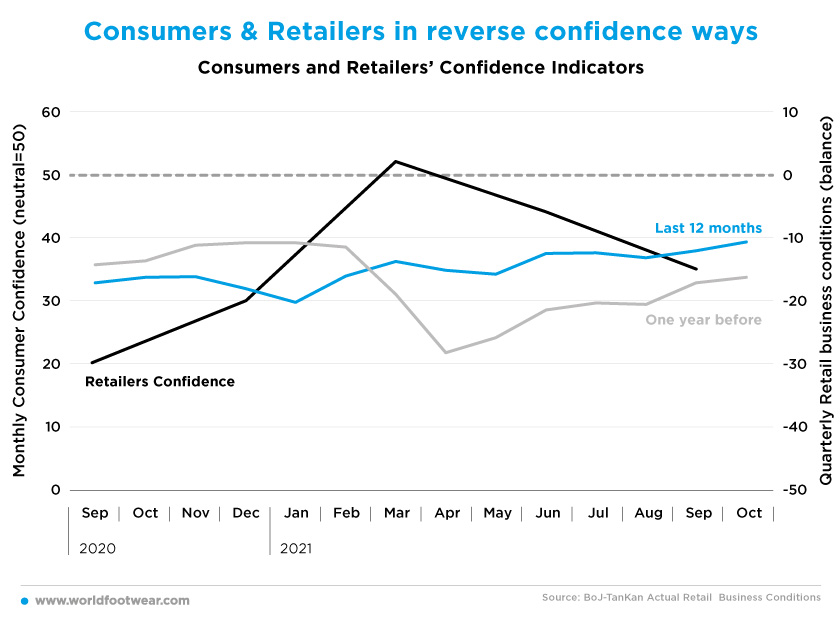

Consumers & Retailers in reverse confidence ways

Moreover, monthly data on consumers’ confidence, as of October 2021 are not only improving from the previous two months, but also 3 pp better off than the same month of 2019, matching indeed the best readings of the four last months before the pandemic came in. However, Tankan’s actual Business Conditions index for all retail enterprises as of the third quarter of the year, while 15 pp better off than a year before, goes still the reverse way of consumers, no matter the steady progress in vaccinations and hopes of a re-opening in economic activity.

And, as the Japan Times reported on the 14th of October, during a press conference of the global retailer Uniqlo’s, the Chief Financial Officer Takeshi Okazaki highlighted that “in the second half, we expect restrictions to ease and normal business operations to resume, but the firm’s mainstay Uniqlo operations in Japan are expected to experience a drop from the strong demand seen a year ago, when loungewear and other stay-home items were snapped up en masse”. Going forward he said “the coronavirus pandemic has not ended. We just cannot tell what will happen and when”.

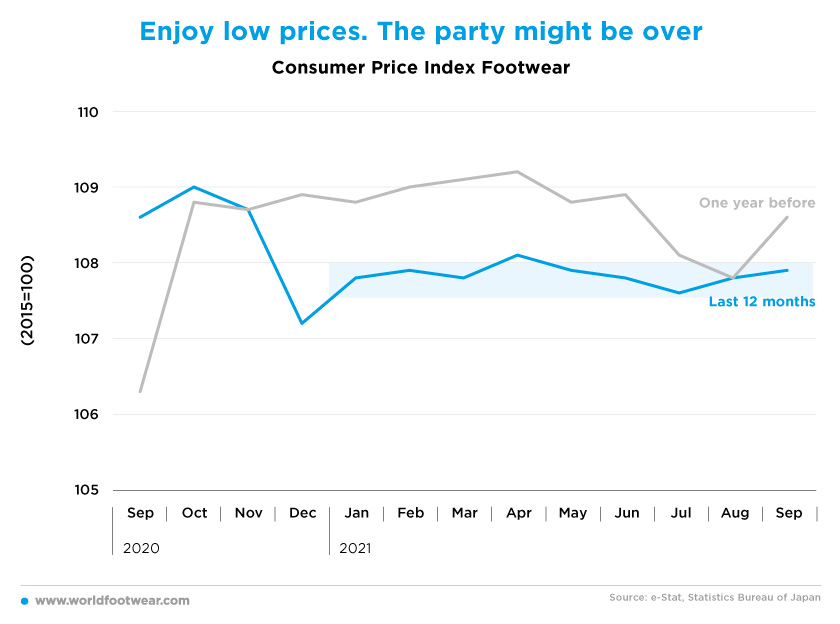

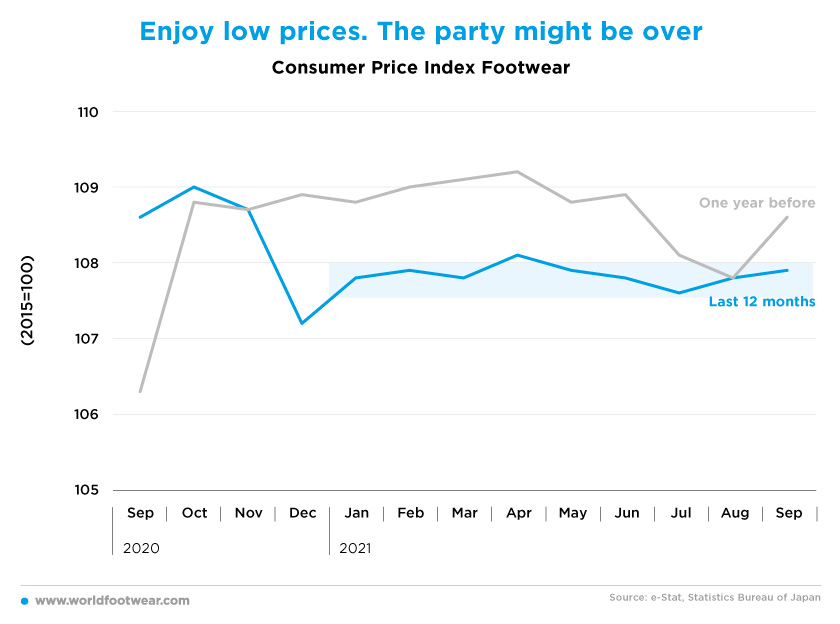

Enjoy low prices. The party might be over

Footwear consumer prices as far as we can see until the closing of September this year are less volatile than they were last year, fluctuating in a quite narrow range of one pp and almost always sharply below 2020.

Such a softening of footwear price pressures in 2021 is quite friendly for consumers after the hike effects of the Consumption Tax in October 2019. But things can turn differently soon, and negatively impact the good mood of consumers and further deteriorate the confidence of retailers.

According to Reuters (1st of October), “the Tankan's indices showed more companies seeing increases in both input and output prices, suggesting that rising raw material costs may gradually prop up consumer inflation ahead”.

As the Japan Times reported (22nd of October), according to a Bloomberg calculation “while the first rise in key consumer prices in 18 months was just 0.1% in September, once the impact of slashed mobile phone fees is removed, core inflation is closer to 1.4% - a price growth that would be the strongest in six and a half years”. And therefore “if hints of inflation end up discouraging Japan’s price-sensitive people from shopping, just as the country lifts virus restrictions, that could drag on the recovery”.