Register to continue reading for free

Japan Retail: apparel and footwear retail will hardly remain safe amidst such troubling waters

The further easing of COVID-19 border control measures brought tourists back to the stores, but the anticipated consumption-led recovery is being curbed by the high wholesale inflation, as the weak yen is inflating the costs of imports. On the other end, if the yen depreciation is fostering exports, the fear of a global economic slowdown is a bearer of bad news. Both the Apparel & Accessories Retail and the Consumer Confidence indicator are currently trending down, and not to increase prices is no longer an option. As for online commerce, now that the pandemic boosting effect is over, the competitiveness between this channel and physical retail is at stake, however, it is yet soon to claim a winner

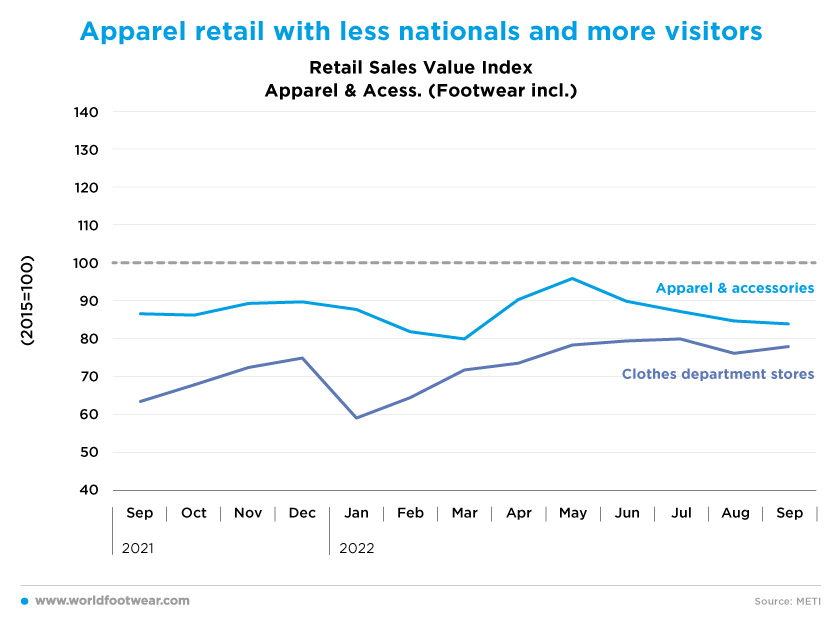

Apparel retail with less nationals and more visitors

Last April’s boost of the Apparel and Accessories (including Footwear) retail index (by METI, seasonally adjusted) has been short-lived. From May onwards, it returned to a descending trend through September. But it is one of a few exceptions to the improvement recorded in the overall retail index at this closing.

In fact, for the last two months reported, overall retail growth has been even higher than expected. And looking into the Clothes Department Stores retail index, the picture is a bit more satisfactory.

On the one hand, as explained by Uniqlo, “sales rose as the drop in temperature in the latter half of the month (of September) helped generate strong sales, (while) the weather again played along with high temperatures supporting summer clothing sales, (with) a total sales increase of 18.4% in August” (fashionnetwork.com).

On the other hand, with the yen depreciation at historical levels, “Japan is already seeing signs of recovery in consumption by inbound tourists, with department stores in the country enjoying jumps in duty-free sales by up to twenty-fold from year-before levels”, and the further easing of COVID-19 border control measures must be accounted for (japantimes.co.jp).

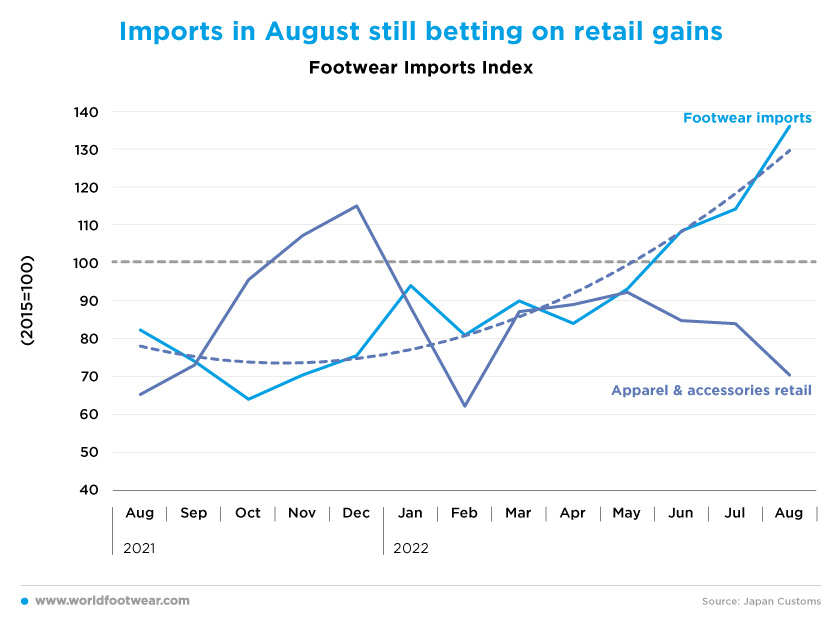

Imports in August still betting on retail gains

Despite the currency depreciation, as far as August, there is no clear evidence that the footwear import volume was negatively impacted. Last year’s import growth in volume (JPY) was up by 65%, while the increase in volume stood above 39%. This suggests that, as of August, the traction of retail was far from absent, even if some overstocking may be accounted for to mitigate further currency depreciation, plus footwear supply price increases at the origin.

However, commenting on the 9.7% year-on-year rise in the corporate goods price index, as of September, from the Bank of Japan’s data, Reuters (reuters.com) explained that “a weak yen, which inflates the cost of imports, has exacerbated already high wholesale inflation from a global surge in commodity prices”.

Ultimately, the footwear import volume will not escape such high wholesale inflation and retail will barely accommodate it. So, the odds are that Apparel & Accessories retail (seasonally adjusted) will continue trending down in the next quarters.

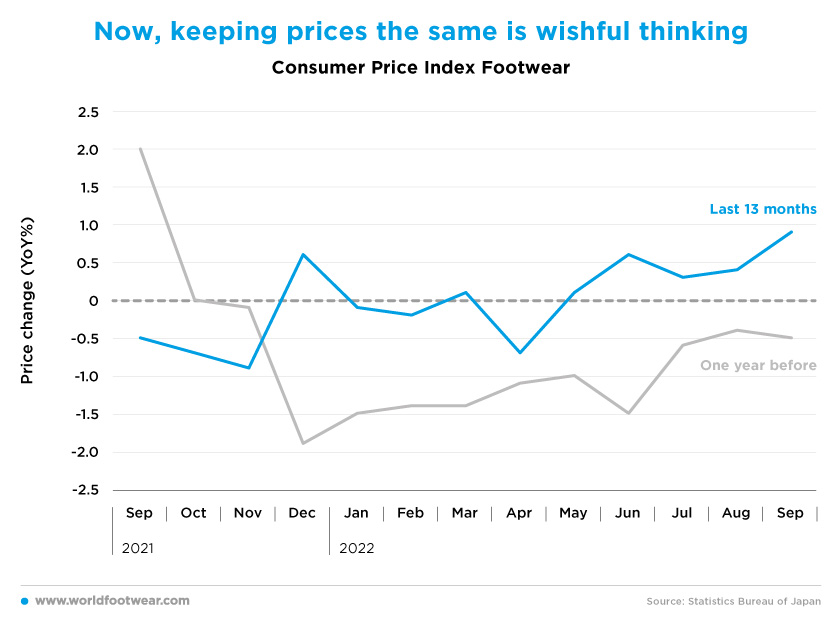

Now, keeping prices the same is wishful thinking

One thing is certain: the time for stable or trending down consumer prices is definitely over.

According to Japan News (japannews.yomiuri.co.jp), “Core consumer prices (…) rose by 2.8% in September from a year earlier, exceeding the central bank’s 2% target for a fourth straight month, (…) the biggest gain since 2014” (and) “reinforced expectations that nationwide core consumer inflation will approach 3% coming months”. Particularly from April through September, footwear price changes (year-over-year) became consistently positive touching the +1% rate, giving no hints of decelerating.

As summarized in a very straightforwardly way by Uniqlo’s Chief Executive Officer Tadashi Yanai: “I think that the lives of ordinary people are certainly getting worse (…). Everyone is talking about keeping prices the same, but the weak yen and high raw material prices are making that impossible” (reuters.com).

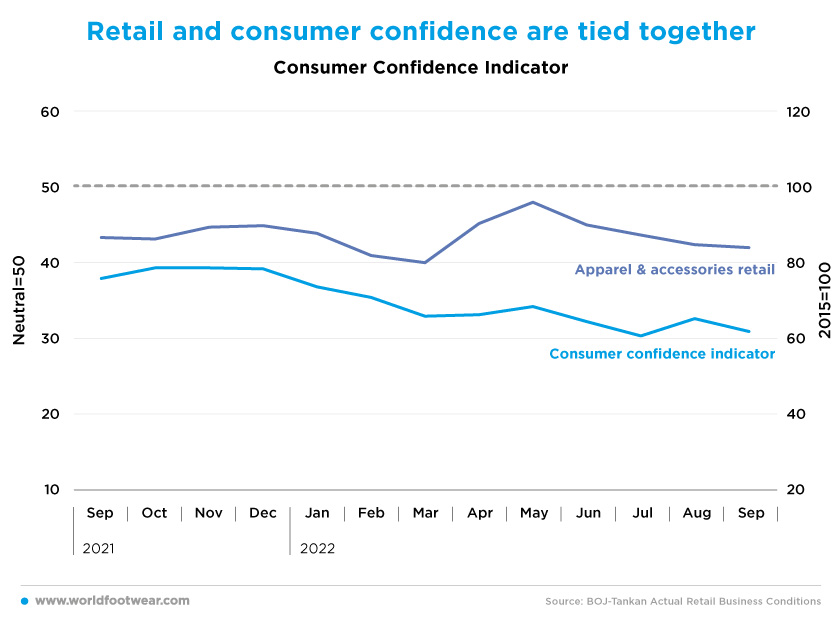

Retail and consumer confidence are tied together

In Japan, the Apparel & Accessories Retail index appears to be quite tied to the Consumer Confidence indicator. Especially since May, both have displayed a negative trajectory.

“The momentum of what could have been a consumption-led recovery is curtailed by the inflation”, said Takumi Tsunoda, Senior Economist at Shinkin Central Bank Research Institute, anticipating that “household sentiment may turn more thriftier in coming months” (reuters.com).

Simultaneously, the yen depreciation has been fostering exports, so, “fears of a global economic slowdown cloud the outlook for the export-reliant economy” (reuters.com). “If the global economy slows further, other sectors may also see sentiment worsen”, stated Takeshi Minami, Chief Economist at Norinchukin Research Institute. Considering this, it is difficult to anticipate that apparel and footwear retail will manage to remain safe amidst such troubling waters.

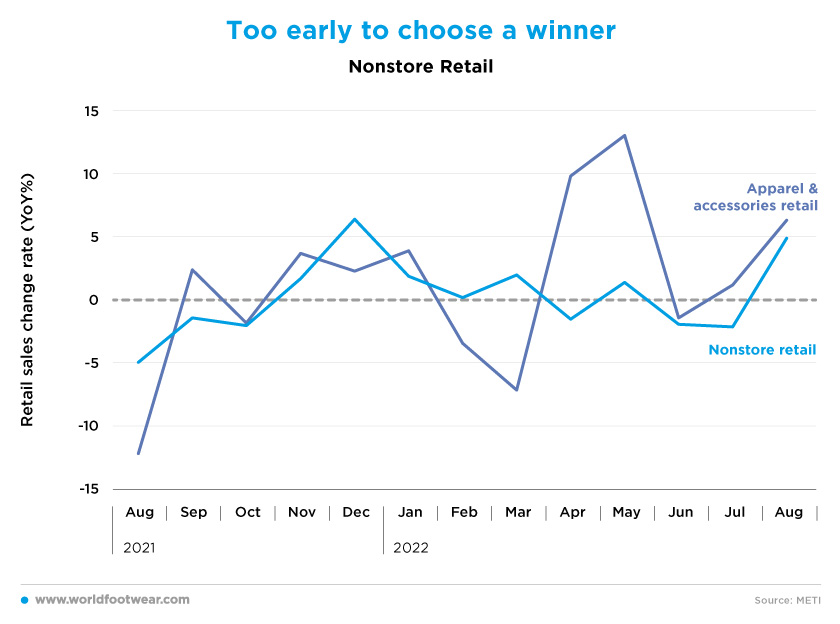

Too early to choose a winner

The most approximate index by METI capable of assessing the performance of online commerce is Nonstore Retail, yet not on a seasonally adjusted basis. The rate of change of the index had been decelerating since last December, and has turned negative in June and July. There was a reversal in August, but it is far from an outlier. Now, the actual competitiveness of this retail channel against overall (physical) retail is at stake, as the pandemic boosting effect is over. At least, the overall Apparel & Accessories retail change rate appears to be better off, but the underlying price change difference can be misleading.

According to the Financial Times (ft.com), based on another online commerce consumption index compiled by Nowcast, “online shopping is showing signs of slowing (…) by the end of June, after rising sharply through early 2021”, concluding that “many consumers are apparently growing tired of shopping on smartphones”.

But it is not yet crystal clear. GlobalData banking and payments lead analyst Ravi Sharma argued, in turn, that “the Japan online commerce market has registered sustainable growth over the last five years supported by high mobile and online penetration and high consumer preference for online transactions” (chargedretail.co.uk).

The cross-borderonline commerce segment should also be considered. According to Japan’s leading cross-border online commerce service provider Beenos, “the index of yen-based sales in the first six months of 2022 rose 80% from the same period in 2020 and increased 3.7 times from five years earlier, led by orders from Southeast Asia, Europe, and North America” (asia.nikkei.com).

In addition, the numbers reported by Rakuten at the end of the second quarter of the year – up by 13.5% year-on-year, including growth in domestic online commerce (global.rakuten.com) – suggest that it is yet early to choose a winner in Japan.