Register to continue reading for free

Japan Retail: imported inflation troubles retail despite positive signs on consumer mood

Despite positive signs regarding the consumers’ mood, which is leading the BoJ to focus on boosting domestic demand, retailers are facing imported inflation unseen for decades. So, as the yen sinks, it is more accurate to wonder whether Japanese companies’ margins can resist for much longer to fully pass on rising costs to consumers. In addition, the sanctions imposed following Russia’s invasion of Ukraine will certainly take a toll on retail, alongside persistent supply chain disruptions caused by the pandemic, even as the country moves away from those times. Since expenses on energy and food cannot be readily cut, the slack demand for footwear already observed is far from being a surprise

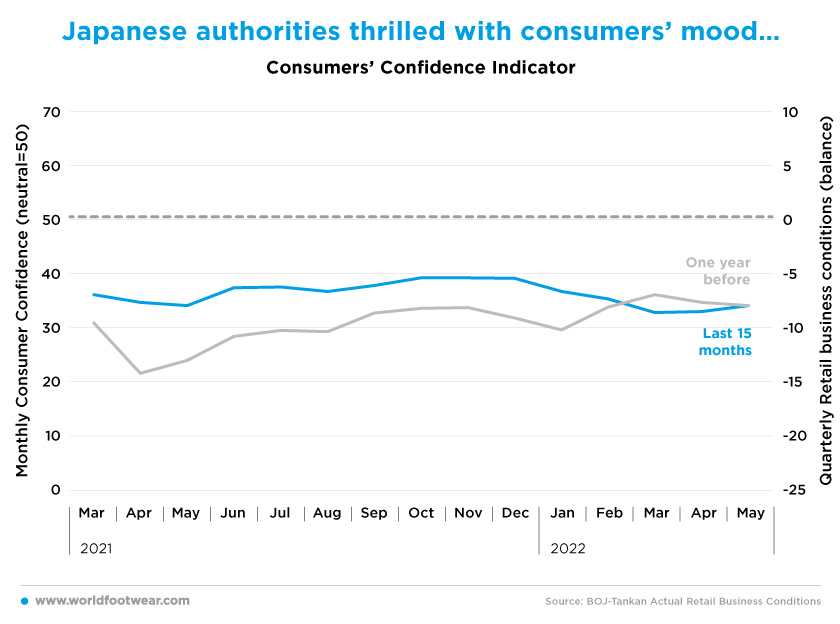

Japanese authorities thrilled with consumers’ mood…

Japanese authorities have shown to be quite enthusiastic about the consumer sentiment data for the last two months available, as it evolved from 32.8 to 33 percentage points (p.p.) in April and 34 p.p. in May. The Cabinet Office commented that the “consumer confidence index rose in May for a second straight month, as households enjoyed the first restriction-free spring holiday season since before the COVID-19 pandemic”. The government even upgraded its assessment of the sentiment index, saying the “decline has come to an end” (www.reuters.com).

Nonetheless, the stated above is in sharp contrast with the official survey conducted in late April that found that 93.7% of consumers are expecting prices of goods to rise in the next 12 months - the third straight month of record highs under comparable data dating back to April 2013, which leads to the conclusion that “the rising cost of living has fanned fears of a potential slowdown in consumer spending later this year” (www.reuters.com).

The official standpoint is that, in contrast to other Central Banks, the BoJ (Bank of Japan) will focus on boosting domestic demand, with its monetary policy remaining ultra-accommodative throughout 2022 (www.eiu.com), as it considers there is no pressure to demand in Japan. According to this, inflation is supposed to be transitory, with consumers being spared from the full impact of higher material costs, as companies are usually very cautious about raising prices and Japanese workers are used to refrain from demanding full compensatory wage increases (asia.nikkei.com).

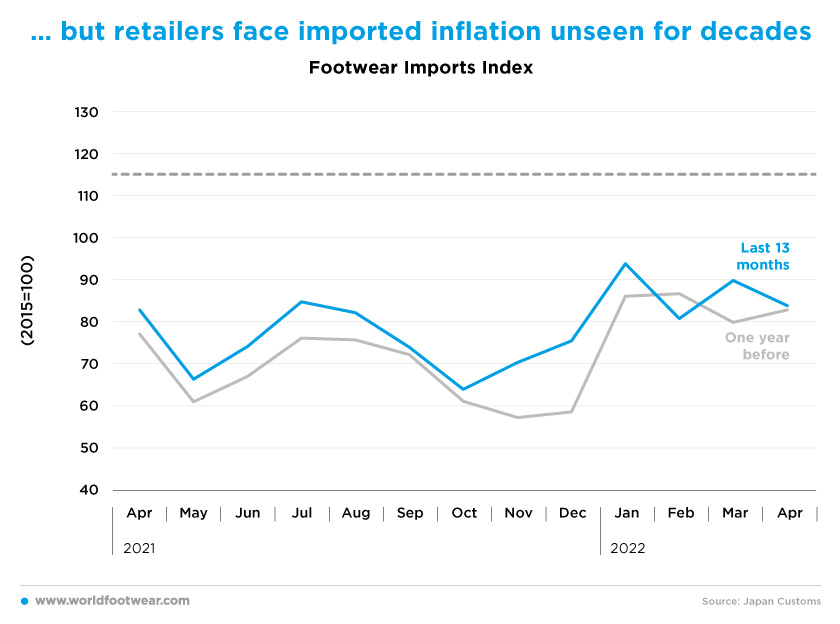

…but retailers face imported inflation unseen for decades

As of March, the Tankan Actual Business Conditions indicator for all Retail (by BoJ) was actually on a continuously improving trajectory. But the Retail Forecast indicator for June lost 5 percentage points to the pessimistic side, which means that retail waters are still troubled.

For the time being, footwear imports, which allow anticipating somehow the near future of retail, are evolving along a U shape. But with the Yen at a 20-year low and signs that it might sink further, import prices are also set to add to the pressure (www.japanconsuming.com), and one wonders if Japanese firms’ margins can resist for much time to fully pass on rising costs to consumers.

"Given the current economic situation in Japan, we think we cannot raise prices easily. Consumers are very sensitive to prices", said Tadeshi Yanai, Uniqlo’s Founder and President. But “it would be impossible to keep selling clothes at current prices if costs continue to rise”, he acknowledged (asia.nikkei.com).

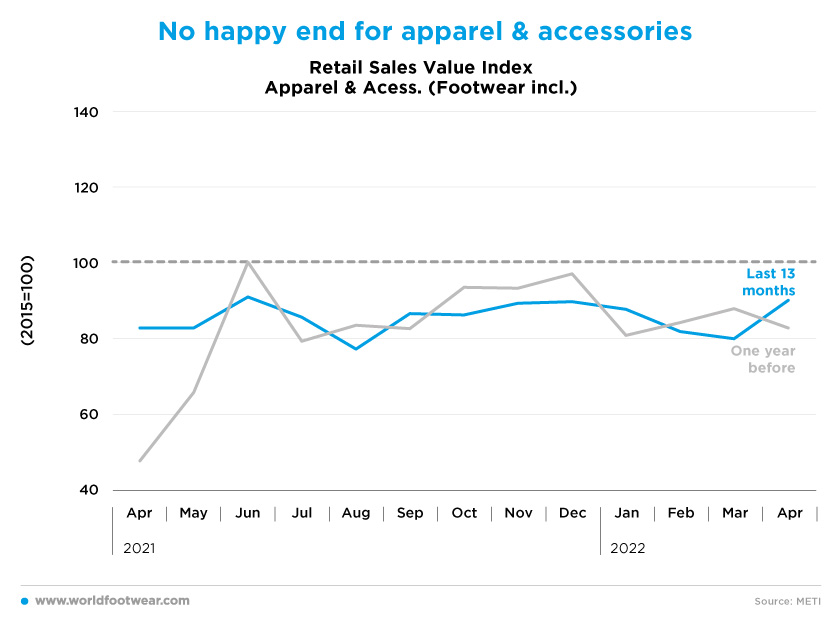

No happy end for apparel & accessories

It is plausible to assume that Japan is moving away from the pandemic period since March. As a matter of fact, the Apparel and Accessories (including Footwear) Retail index (seasonally adjusted) experienced a boost of about 10 p.p. in April. Still, it remains to be seen if this sign resumes the trend upward observed in retail before the Omicron hit in the first quarter of the year. But that reading barely reached the 90-percentage points’ resistance barrier that prevailed in the last thirteen months, and is far from the 103-p.p. score recorded just before the start of the pandemic.In our view, the chain of sanctions that followed Russia’s invasion of Ukraine is adding up to the supply chain disruptions already entailed by the pandemic. And both will take a toll on retail throughout the remaining 2022, at least.

On the same wavelength, and looking into the weakening of private consumption, Shigeto Nagai, head of Japan economics at Oxford Economics, commented that “consumption will be severely constrained by a sharp squeeze in real household income caused by a combination of higher inflation and stagnant wage growth” (www.aljazeera.com).

In any case, as “expenditures on energy and food cannot be readily cut, [so] spending on consumption such as leisure and clothing may be squeezed down the road”, concluded Hideo Kumano, chief economist at Dai-ichi Life Research Institute (asia.nikkei.com).

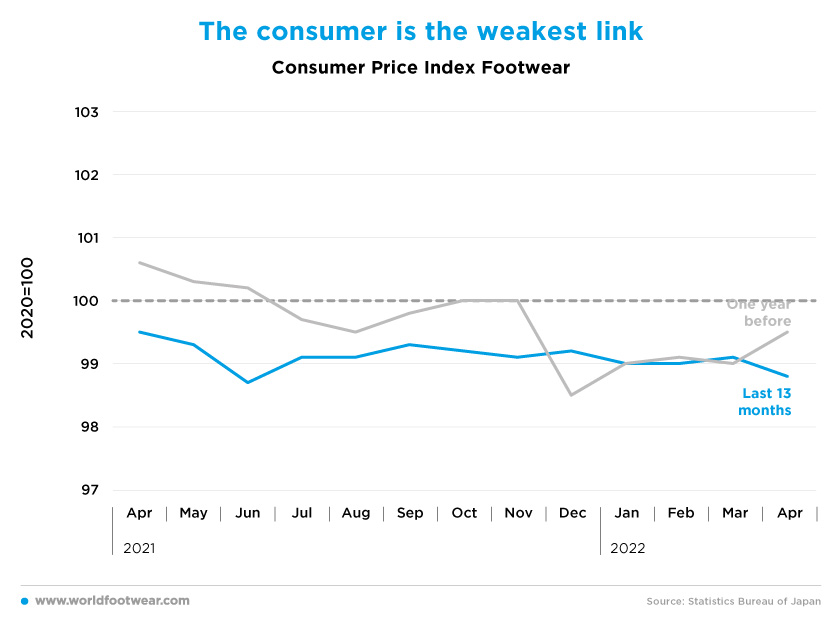

The consumer is the weakest link

Considering the last thirteen months through April, the trajectory followed by footwear consumer prices (now with the new 2020 base) is also trending down, closing at 98.8, which indicates a decline of 1% year-over-year.

At the same time, according to a survey of economists by Nikkei, consumer prices in Japan were on track to rise 2% in April for the first time in seven years, while Taro Saito of the NLI Research Institute is expecting the price growth to stay around 2% throughout 2022, going as high as 2.3% in October. “Higher costs from the weak yen will be passed on to consumers more broadly in areas like daily necessities and apparel”, he added (asia.nikkei.com).

Pondering such an inflationary environment of the Japanese economy, albeit modest in international terms, footwear consumer prices are quite consistent with slack demand for footwear despite any eventual positive signs regarding the consumer mood.

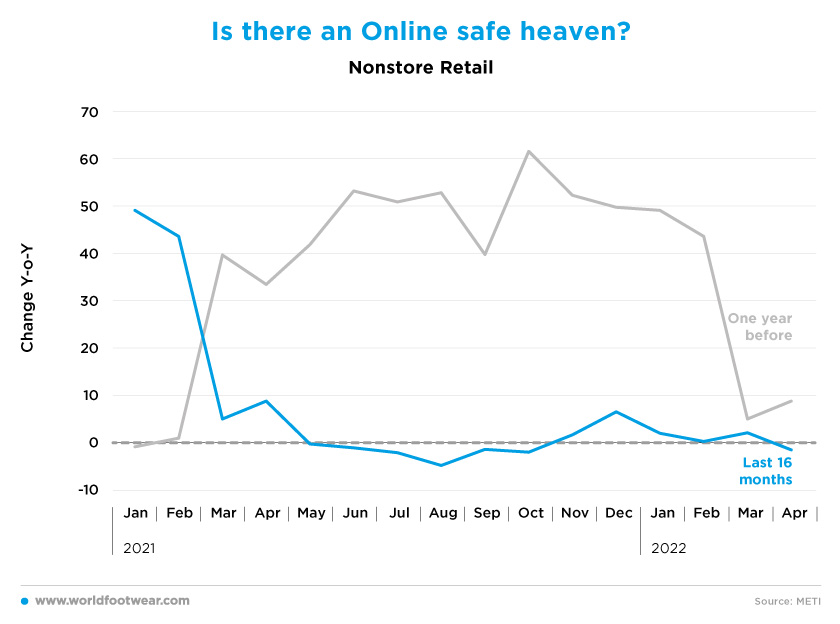

Is there an Online safe heaven?

While no specific monthly online retail data is available in Japan for the category, including footwear, since May 2021, the nonstore retail statistics (by METI) show clearly that the times for big growth rates year-over-year that characterized the first pandemic season are now over and trending flat.

Other sources, however, report that the growth in 2021 of the e-commerce retail market for physical goods has been more consistent than the overall online market [and] looks set to grow 6.6% in 2022, with fashion among the highest growth categories (www.japanconsuming.com).