Register to continue reading for free

How is COVID-19 impacting the footwear industry in different countries?

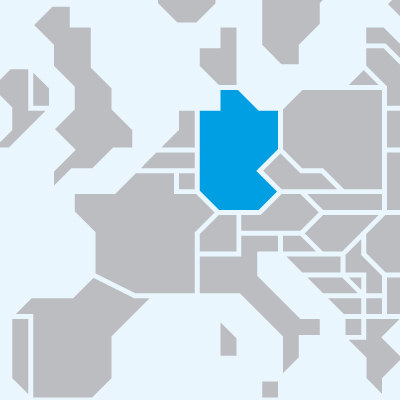

With the world fast approaching 100 million cases of infected people and with vaccination now in place in several countries, we did a round of conversations with footwear associations across the world to understand what the current situation of the footwear industry is in their countries, and to learn where and in what conditions are footwear stores open

We first started to hear about COVID-19 a year ago and it has been part of our conversations and lives since then. Pandemic, lockdown, sanitary measures, and restriction of movements became familiar words impacting our routines. Now, as we live the beginning of a new year, and as vaccination already started in many countries there is hope that this pandemic might be under control at some near future. However, for the time being the uncertainty is significative and most of the countries are still reporting strong impacts of the pandemic in their footwear industries.

Footwear retail is taking a massive hit. The lockdowns imposed by the governments in the first wave have led to hikes in unemployment, stores closing for good and stocks piled up in stores. In Europe, the summer months brought a new hope as the pandemic allowed some relaxation, and some holidays and social events took place. However, soon a second and a third waves stopped any recoveries and nowadays in many countries all over the world we have again reports of confinement, imposed curfew or early closures. In many places non-essential retail is once again closed, leaving footwear and leather goods stores in a difficult situation.

For the Shoe Manufacturers’ Association of Canada (SMAC) the big issue for the local footwear industry is the fact that retailers filling Chapter 11 are increasing significantly, leaving manufacturers in a tough situation with accumulated debt and with little new orders. “Last November there was a forecast saying that by the end of January a thousand stores would be closed for good in Canada”, Denis Falardeau, President of the SMAC told us in a recent interview available HERE.

Manfred Junkert, Managing Director at HDS/L (Federal Association of German Footwear and Leather Goods Industry), tells us that in Germany, footwear companies continue to “operate”, even though many are in “short-time work”. Retail remains closed until the 15th of February 2021, aggravating cash flow problems for bsuinesses. As the “Autumn / Winter 20/21 season was below expectations due to the lockdowns”, Manfred now asks for more “support for the industry”. (More details HERE)

In France, for now, footwear stores are open, although they have to close their doors by 6pm. The problem is the “drop in demand”. In fact, COVID-19 stimulated the adoption of distance working, with a decline in new acquisitions of smart clothes and shoes. Also, with many social gatherings non under severe restrictions the business of formal attire is in a tough situation. A new lockdown might be announced. (More information about France HERE)

Portugal is living in another State of Emergency, at least until the 30th of January. Manufacturing activities, as well as distribution, medical services and security were always considered vital and as such their doors were never closed. In this new lockdown the situation remains the same and the industry is operating as usual. Circulation of materials and products involved in the manufacturing process is allowed. APICCAPS, the Portuguese Footwear Association, considers this to be “vital” for the industry. At the same time, the association is concerned with the fact that “traditional high street retail is closed all over Europe”; but looks with good expectation to the online segment, where the business is growing, “either for companies with their own brand or working with customers who sell mainly online”. (Read more HERE)

The Federation of Spanish Footwear Industries (FICE) estimates a fall of 30% in production in 2020. The impact of the pandemic was also very strong in terms of foreign trade, with a drop in exports. In Spain, the industrial activity faces an “unprecedented lack of orders, driven by the international and domestic crisis, with thousands of sales outlets closed in across Europe”. On top of that, FICE estimates that “30% of the retail might at stake, and unfortunately, there is very little government support for the retail sector". (Read all about Spain HERE)

In Italy, the current situation is equally worrying. In the first nine months of 2020, 101 companies closed, 2 600 jobs were eliminated, and business fell by 33%. The President of Assocalzaturifici expresses "a strong concern for the coming months". “The sector's resilience is at risk”, and the situation is particularly serious for SMEs, the backbone of the Italian footwear industry, points out Siro Badon. He adds that "the first signs of recovery are in danger of being immediately postponed by a new pandemic wave". (More information HERE)

We got no better news from Malaysia, as the country is facing another wave of COVID-19 and is currently under Movement Control Order 2.0. This is planned to long until the 2nd of February, but might extend further. Under this new situation, footwear factories and retailers are not allowed to operate, except for those producing and trading essential products. As the Malaysian Footwear Manufacturers' Association told us in the country "production of footwear is depending on the festive season; Chinese New Year and Ramadan is coming soon, but we are not able to produce and sell”. (Available HERE)

A better picture was reported by China and Hong Kong. According to William Wong, Vice President of the Hong Kong Footwear Association, the situation in the territory “is very much under control”. Obviously, Hong Kong is feeling the impacts of the global pandemic, especially the retail business, which is heavily dependent on the touristic activity. In a recent interview, accessible HERE, William talks about a “bad hit” in the sector given the significant reduction in the tourist’s influx in the territory. The China Leather Industry Association reported HERE that “the whole industry is operating, although the overall business is much worse than the year before”. The main issue for footwear and leather goods companies is “short of orders”, which is reflected in a decline in exports as “footwear export dropped by 22.4% and 21.1% in volume and value, respectively. The sales revenue of companies above the annual sales revenue of 20 million renminbi dropped by 13.4% in the first 11 months”. A “great loss”, according to CLIA.

Footwear retail is taking a massive hit. The lockdowns imposed by the governments in the first wave have led to hikes in unemployment, stores closing for good and stocks piled up in stores. In Europe, the summer months brought a new hope as the pandemic allowed some relaxation, and some holidays and social events took place. However, soon a second and a third waves stopped any recoveries and nowadays in many countries all over the world we have again reports of confinement, imposed curfew or early closures. In many places non-essential retail is once again closed, leaving footwear and leather goods stores in a difficult situation.

For the Shoe Manufacturers’ Association of Canada (SMAC) the big issue for the local footwear industry is the fact that retailers filling Chapter 11 are increasing significantly, leaving manufacturers in a tough situation with accumulated debt and with little new orders. “Last November there was a forecast saying that by the end of January a thousand stores would be closed for good in Canada”, Denis Falardeau, President of the SMAC told us in a recent interview available HERE.

Manfred Junkert, Managing Director at HDS/L (Federal Association of German Footwear and Leather Goods Industry), tells us that in Germany, footwear companies continue to “operate”, even though many are in “short-time work”. Retail remains closed until the 15th of February 2021, aggravating cash flow problems for bsuinesses. As the “Autumn / Winter 20/21 season was below expectations due to the lockdowns”, Manfred now asks for more “support for the industry”. (More details HERE)

In France, for now, footwear stores are open, although they have to close their doors by 6pm. The problem is the “drop in demand”. In fact, COVID-19 stimulated the adoption of distance working, with a decline in new acquisitions of smart clothes and shoes. Also, with many social gatherings non under severe restrictions the business of formal attire is in a tough situation. A new lockdown might be announced. (More information about France HERE)

Portugal is living in another State of Emergency, at least until the 30th of January. Manufacturing activities, as well as distribution, medical services and security were always considered vital and as such their doors were never closed. In this new lockdown the situation remains the same and the industry is operating as usual. Circulation of materials and products involved in the manufacturing process is allowed. APICCAPS, the Portuguese Footwear Association, considers this to be “vital” for the industry. At the same time, the association is concerned with the fact that “traditional high street retail is closed all over Europe”; but looks with good expectation to the online segment, where the business is growing, “either for companies with their own brand or working with customers who sell mainly online”. (Read more HERE)

The Federation of Spanish Footwear Industries (FICE) estimates a fall of 30% in production in 2020. The impact of the pandemic was also very strong in terms of foreign trade, with a drop in exports. In Spain, the industrial activity faces an “unprecedented lack of orders, driven by the international and domestic crisis, with thousands of sales outlets closed in across Europe”. On top of that, FICE estimates that “30% of the retail might at stake, and unfortunately, there is very little government support for the retail sector". (Read all about Spain HERE)

In Italy, the current situation is equally worrying. In the first nine months of 2020, 101 companies closed, 2 600 jobs were eliminated, and business fell by 33%. The President of Assocalzaturifici expresses "a strong concern for the coming months". “The sector's resilience is at risk”, and the situation is particularly serious for SMEs, the backbone of the Italian footwear industry, points out Siro Badon. He adds that "the first signs of recovery are in danger of being immediately postponed by a new pandemic wave". (More information HERE)

We got no better news from Malaysia, as the country is facing another wave of COVID-19 and is currently under Movement Control Order 2.0. This is planned to long until the 2nd of February, but might extend further. Under this new situation, footwear factories and retailers are not allowed to operate, except for those producing and trading essential products. As the Malaysian Footwear Manufacturers' Association told us in the country "production of footwear is depending on the festive season; Chinese New Year and Ramadan is coming soon, but we are not able to produce and sell”. (Available HERE)

A better picture was reported by China and Hong Kong. According to William Wong, Vice President of the Hong Kong Footwear Association, the situation in the territory “is very much under control”. Obviously, Hong Kong is feeling the impacts of the global pandemic, especially the retail business, which is heavily dependent on the touristic activity. In a recent interview, accessible HERE, William talks about a “bad hit” in the sector given the significant reduction in the tourist’s influx in the territory. The China Leather Industry Association reported HERE that “the whole industry is operating, although the overall business is much worse than the year before”. The main issue for footwear and leather goods companies is “short of orders”, which is reflected in a decline in exports as “footwear export dropped by 22.4% and 21.1% in volume and value, respectively. The sales revenue of companies above the annual sales revenue of 20 million renminbi dropped by 13.4% in the first 11 months”. A “great loss”, according to CLIA.

Also, with a brighter perspective is the Vietnam Leather, Footwear and Handbag Association (Lefaso), which tells us that: “the pandemic is well controlled in Vietnam. The country felt an impact last year, as according to Lefaso, total 2020 footwear exports reduced by 10% from 2019, and stand at the same level of 2018. Lefaso has good perspectives for the current year: “The industry is also favoured by moving production from China. We anticipate a recovery and increase of Vietnam's footwear export in 2021, with vaccination starting in the US and EU”. (Read more HERE)

Detailed articles for each of the mentioned countries are available in our website, just follow the links provided.

We will continue to report about the situation in other countries in the coming days.