Global footwear trade: China loses ground, US imports rise in value

Year-to-date Chinese footwear exports are down, while Vietnam and Indonesia have grown. EU exports increased modestly, with Portugal performing better than Spain and Italy. US imports increased in value

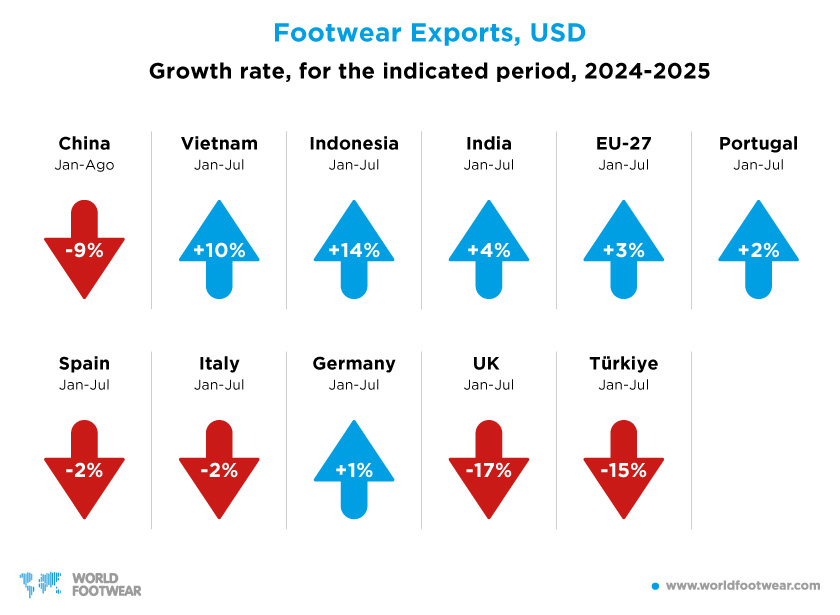

The latest data compiled by APICCAPS reveals that Chinese footwear exports have been on a downward trend, a trend exacerbated since 2024. Between January and August 2025, exports decreased by 2.0% in volume to 6.05 billion pairs and 8.8% in value to 28.9 billion US dollars, as compared to the same period last year.

This contrasts with the continued growth of other major Asian producers, such as Vietnam and Indonesia, and to a lesser extent, India. Between January and July, these countries experienced year-on-year value increases of 9.5% to 14.1 billion US dollars, 13.6% to 4.2 billion euros and 3.7% to 1.4 billion euros, respectively.

According to the World Footwear 2025 Yearbook (more information available HERE), this picture reflects both the evolving structure of China’s economy and ongoing trade tensions with the United States.

Some developments within the European Union are noteworthy. Even though the EU bloc as a whole recorded a 3.2% increase in export value to 29.3 billion euros in the first seven months of the year, as compared to the same period in 2024, some countries performed better than others.

While Portuguese footwear exports increased in value by 2.4% year-on-year to 1.0 billion euros in this period, competitors such as Spain and Italy recorded year-on-year decreases of 1.9% to 2.1 billion euros and 1.6% to 5.8 billion euros, respectively. Germany recorded a slight increase year-on-year of 1.4% to 5.7 billion euros.

During the same period, outside the EU, the UK continued to perform poorly, with a 16.7% year-on-year decrease to 387 million US dollars. Meanwhile, Türkiye recorded a 14.6% year-on-year decrease to 612 million US dollars, affected by the continued impact of lira devaluation.

Import Highlights

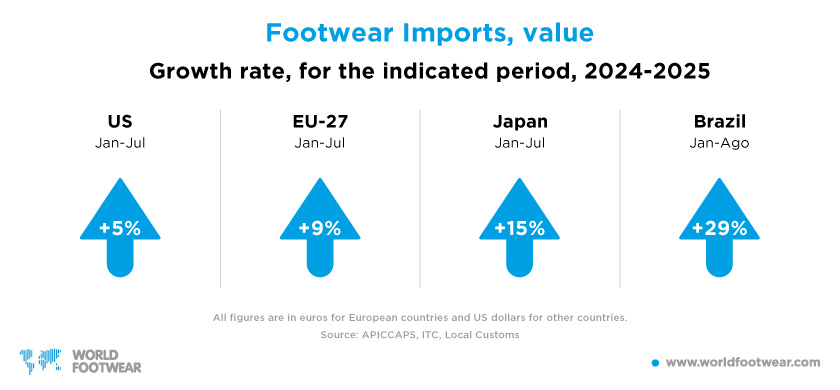

In terms of imports, the United States, the world’s largest footwear import market, imported 1.3 billion pairs of shoes worth 16.0 billion US dollars between January and July. This represents a slight increase of 0.4% in volume and 4.6% in value, as compared to the same period of 2024, suggesting that US consumers are purchasing pricier footwear.During the same period, the EU bloc imported 1.9 billion pairs of shoes for 32.6 billion euros, representing an increase of 11.2% and 9.0% respectively, as compared to the first seven months of last year.

Meanwhile, Japan imported 431 million pairs of shoes for 3.6 billion US dollars, representing a rise of 4.1% and 14.7%, respectively. As Japan is the world’s third-largest footwear import market by volume, but only eleventh by value, due to its focus on low-cost textile footwear, this data highlights the effect of higher-than-usual inflation in the country.

Finally, Brazil recorded a significant increase in imports of 28.8% between January and July, compared to the same period last year. According to the Brazilian Footwear Industries Association (Abicalçados), this aligns with the recent surge in competition from China, as a consequence of the ongoing trade war between the US and China.

Image Credits: Mathias Reding on Unsplash