Register to continue reading for free

France Retail: inflation will yet impact retail, but there is a light at the end of the tunnel

Figures by the Banque de France suggest that retailers may have felt some relief in December 2022, but the weight of inflation in these results must not be overlooked, with turnover growing quite faster than the production itself. Moreover, the impact of inflation on footwear might yet be to be felt. French consumers tend to purchase the category during sales, but retailers may not be able to make the big discounts that would make consumers shop in a context of still significant inflation due to the need of preserving margins. However, there are signs of light at the end of the tunnel, as retailers’ and consumers’ confidence indicators show that there is room, at least, for the ceasing of confidence deterioration in 2023.

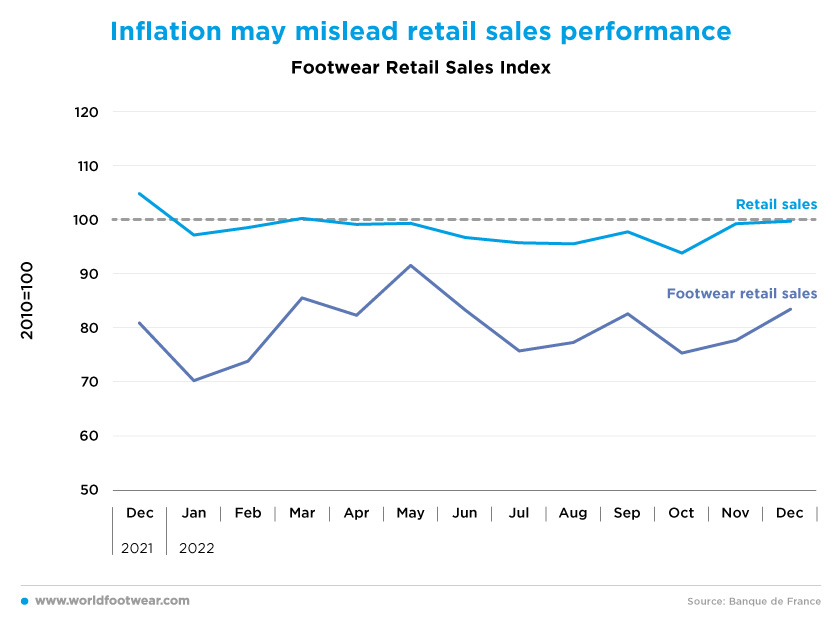

Inflation may mislead retail sales performance

According to the Banque de France data (seasonally adjusted), following the alarm raised by footwear retail from May through July 2022, retailers of the category felt some temporary relief until September. And, despite some loss in the first months of the last quarter, December closed 2 ½ percentage points up the score recorded one year before, which favorably contrasts the dynamics in overall retail.

October and November were “not very good” and “the Black Friday period was not exceptional either”, pointed out Yohann Petiot, general manager of the Alliance du Commerce, which brings together department stores and clothing and footwear brands. “However, December was good”, he added, with sales “11% higher than in 2021 in shops and 4% higher online”, according to a panel of some 40 retailers representing the clothing market carried out by the Retail Alliance with Retail Int. (fashionunited.fr).

Yet, make no mistakes about these numbers: just “in the first eight months of 2022, the turnover of French footwear manufacturing companies increased by 12% (against 5% for production). (…) The faster increase in turnover than in production in 2022 may be linked to an increase in prices due to inflation, but also to the distribution of production” (Dossier Economique 2022 in conseilnationalducuir.org).

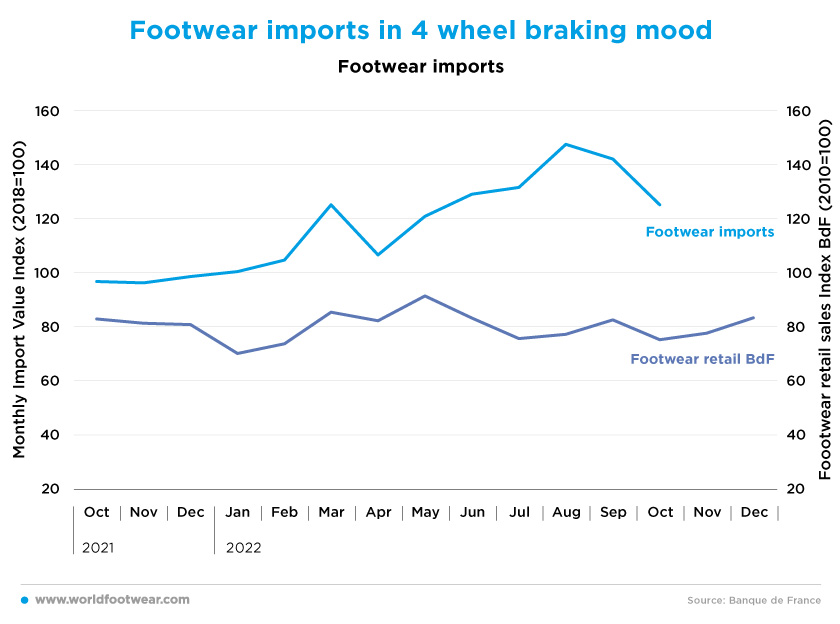

Footwear imports in 4-wheel braking mood

The numbers for footwear imports (not seasonally adjusted), however, didn’t follow those of retail. Despite the headwinds against retail, imports increased sharply until August, when importers apparently recognized their overshooting and the need to dramatically correct their supply.

According to the previously mentioned Dossier 2022 produced by the Conseil National du Cuir, “the rise of the dollar, (…) in which many imports are made, is particularly unfavourable to the French market”, and for such reason the French Footwear Federation “expected inflation to intensify in the coming months in the order of +6 to +7% in the autumn-winter 22-23 collections”.

Although imports data lags too much in relation to retail, it seems quite unlikely that a satisfactory retail picture in December, if timely expected, might have been convincing enough to have reset the import drive before the end of the year, let alone “right at the start of the sales season, (when) retailers are particularly concerned about their economic model in 2023: the scissor effect between sharp increases in costs, crushing of margins and risks to consumption”, says preliminarily the French Federation of Specialized Retail (procos.org).

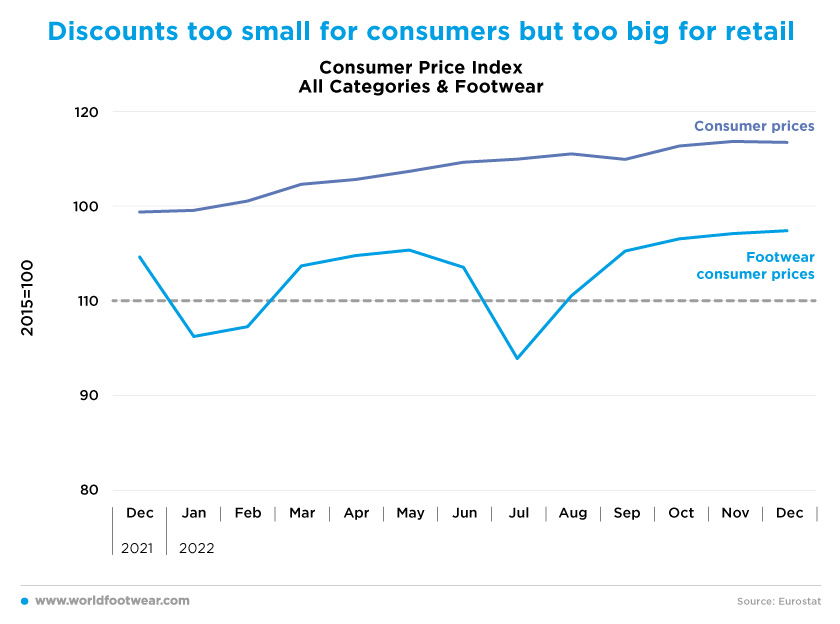

Discounts too small for consumers but too big for retail

Footwear consumer prices, differently from the general level of consumer prices, have a clearcut seasonal profile, corresponding to sales periods. But out of these, discount periods footwear prices (by Insee) grew in December just by 2.8 percentage points year-over-year, a modest figure when compared to the general price increase of 7.4 percentage points in the same closing (fr.fashionnetwork.com).

Looking forward, and with inflation hitting businesses, Yohann M Petiot, from the Alliance du Commerce, wonders if “retailers may be tempted to make smaller markdowns to preserve their margins as much as possible”, thus raising the question of whether “the French will have the purchasing power to enjoy the benefits from sales in a context of still significant inflation”. (fashionunited.fr).

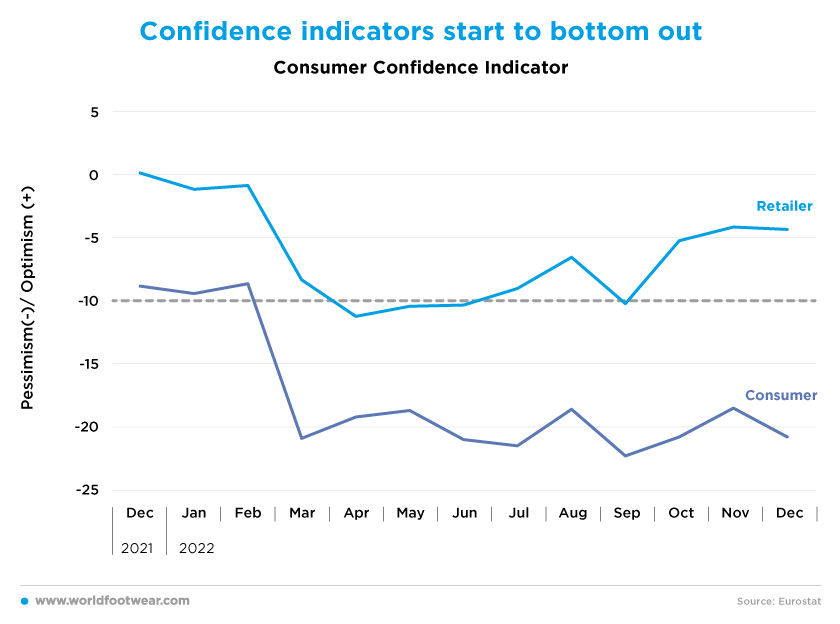

Confidence indicators start to bottom out

Some point to the fact that the INSEE household confidence indicator has been fluctuating since the Spring of 2022 around level 80, remaining far from the long-term average (1987-2022), and falling to 79 points on two occasions (July and September), a level not reached since June 2013 (lesechos.fr).

This weak French consumers’ mood isn’t, however, a surprise, given their sensitivity to abnormal losses of purchasing power as unleashed by the energy impacts of the invasion of Ukraine. Consumers had in fact already forgotten such losses. Anyhow, the confidence fluctuations have been only marginal, and no downward trend is visible so far; the same happens with the consumer confidence survey by Eurostat, herewith.

As for the retailers’ confidence survey (by EU), it also suffered a blow with the war between Ukraine and Russia, but the good news here is that the trend seems to be up, at least so far as December, with pessimism improving almost 7 points against the April’s bottom.

Forecasts for the future are still very risky at the time being. But, according to the economist Sylvain Bersinger from the consultancy Asteres, “in the short-term, energy prices are likely to add to inflation pressures in January as regulated gas and power prices rose by 15% at the start of the year. Nonetheless, the favourable moves in energy prices suggest there may be light at the end of the tunnel” (reuters.com). Should it be true, there is room, at best, for the ceasing of confidence deterioration in 2023, which may help somewhat clothing and footwear retail.

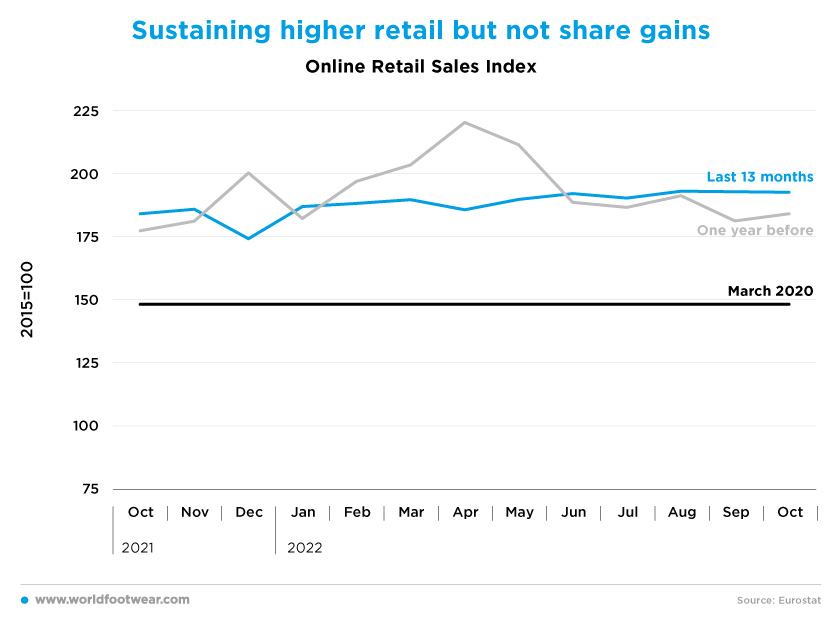

Sustaining higher retail but not share gains

Monthly retail online sales (by Eurostat) provide no detailed data by purchased category. Clothing and footwear appear to be very popular categories concerning the online channel. According to Dorval Ligonnière, head of research and marketing at the French Shoe Federation, “today, three-quarters of French consumers have already bought shoes online. And a third of the under 35s say they prefer to buy their shoes remotely, rather than in a shop” (Dossier Economique 2022 in conseilnationalducuir.org).

But all items’ online retail index isn’t a safe proxy for the category. It has slightly declined (by 2.3% on average year-over-year) in the first ten months of 2022, whilst in the same period “online clothing and textile sales were down by 15%, as compared to the previous year” and “at the same time, sales in physical shops were up by 16%. The difficult context did not spare online sales”. Nevertheless, it should be noted “that the weight of e-commerce in the market is now stabilizing at a level well above that of 2019”, said Gildas Minvielle, director of the economic observatory in IFM - Institut Français de la Mode (filieresport.com).