Register to continue reading for free

France Retail: consumers confidence and footwear retail back to pre-pandemic levels

The increase in French footwear imports from May onwards reflects the reaction of importers following the COVID-19 wave earlier in the year. In the third quarter of the current year, consumers’ confidence and footwear retail figures have shown a return to the pre-pandemic levels. In this scenario, the expectation is that footwear sales could accelerate soon, even before the year ends

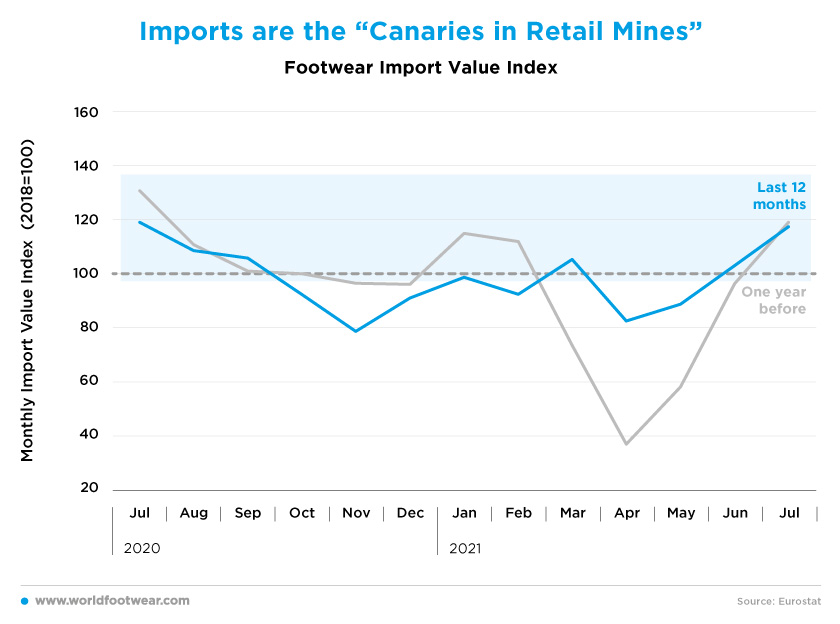

Imports are the "Canaries in Retail Mines"

The increase in French footwear imports from May onwards and closing twenty percentage points (pp) above the 2018 reference line in July reflects footwear importers promptly recouping their supply decisions after the COVID-19 shocks in March and April.

Assuming, as we did in the last France Retail Flash, that footwear imports are a good predictor of retail, such a leap of imports was supposed to have anticipated higher demand needs, in line with the pre-pandemic scenario.

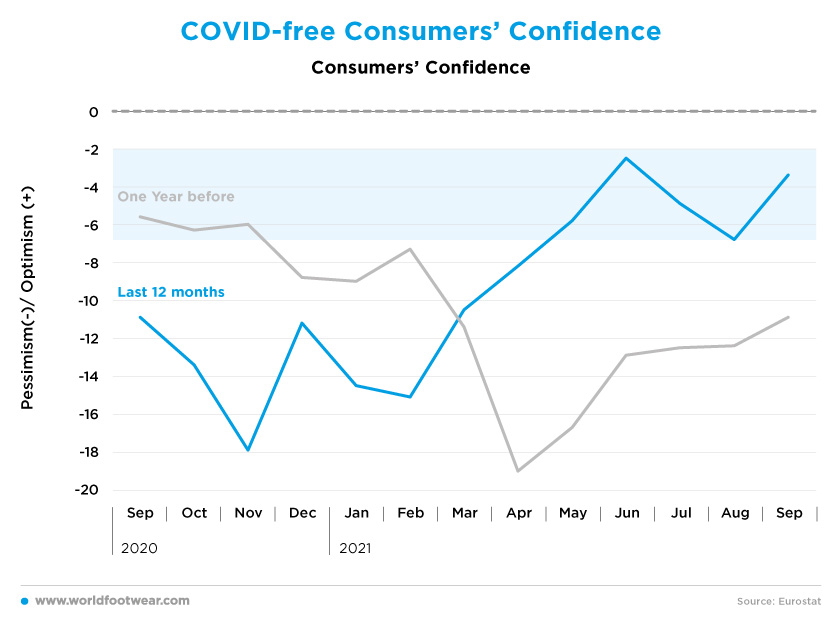

COVID-free Consumers' Confidence

In the third quarter of the current year, consumers’ confidence levels are now in the same range of 2019 (before the pandemic).

This could mean consumers believe that their spending decisions are now COVID-free, no matter the fact the virus seems to be here to stay. While retailers’ confidence has suddenly deteriorated in September, somewhat below the pre-pandemic range, this is likely not related with some return to restrictions in the access to physical retail. Retailers have been systematically less pessimistic than consumers since April and could be in the process of correcting their expectations in September, after concluding the pent-up demand was over, or as a result of increased concerns about the wide spreading of supply bottlenecks.

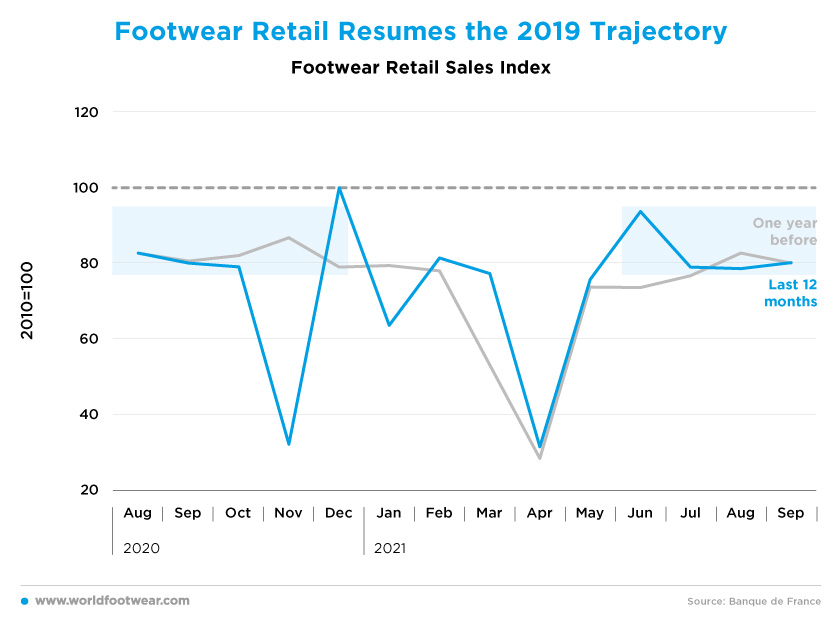

Footwear Retail Resumes the 2019 Trajectory

Footwear retail data for France, in the third quarter, shows a return to the pre-pandemic (2019) flow of footwear purchases, around 80 percentage points, 20 pp down the 2010 reference level. This seems to confirm the short-lived peak of June sales, not very far from the reference, was nothing but the expected pent-up demand effect, following the lifting of retail restrictions by the middle of May.

Also, as the COVID-19 incidence increased substantially in the country in July and August, the return of retail to normalcy means that with no retail access restrictions footwear consumption will not likely react to further pandemic fluctuations. As of this date, as COVID-19 cases are again climbing in France, both health experts and the local authorities consider this upsurge was expected and there are yet no reasons for alarm.

Supported by this expert's assumption, footwear sales are expected to return to the business-as-usual scenario (2019) accelerating at least through November.

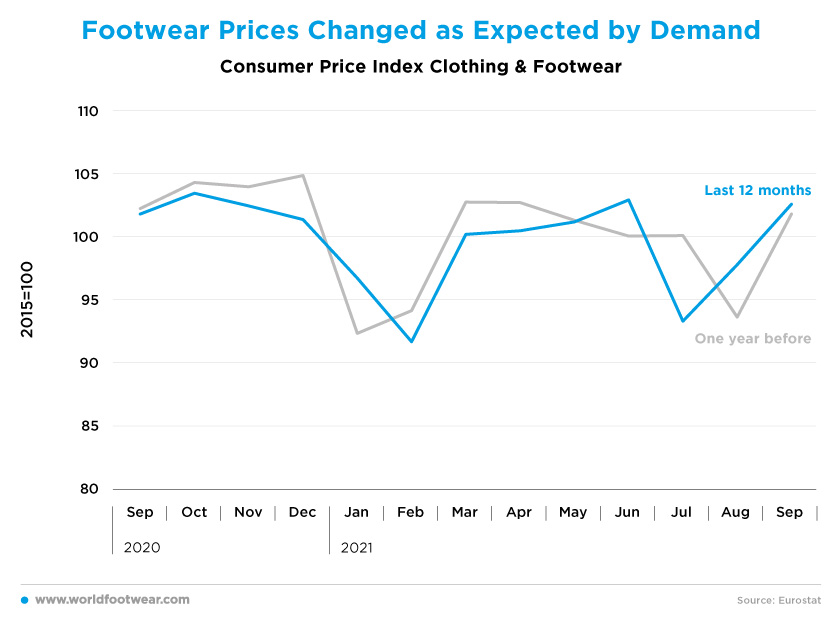

Footwear Prices Changed as Expected by Demand

The flat profile of the footwear retail index in contrast to consistent imports and confidence indicators is not striking because it matches the seasonal pattern. Clothing & Footwear price changes in the same quarter, with a sizeable correction both in August and September after a fall in July have been themselves the pattern in retailers’ behaviour in 2019. In normal times a flat retail is consistent with the usual average price practices.

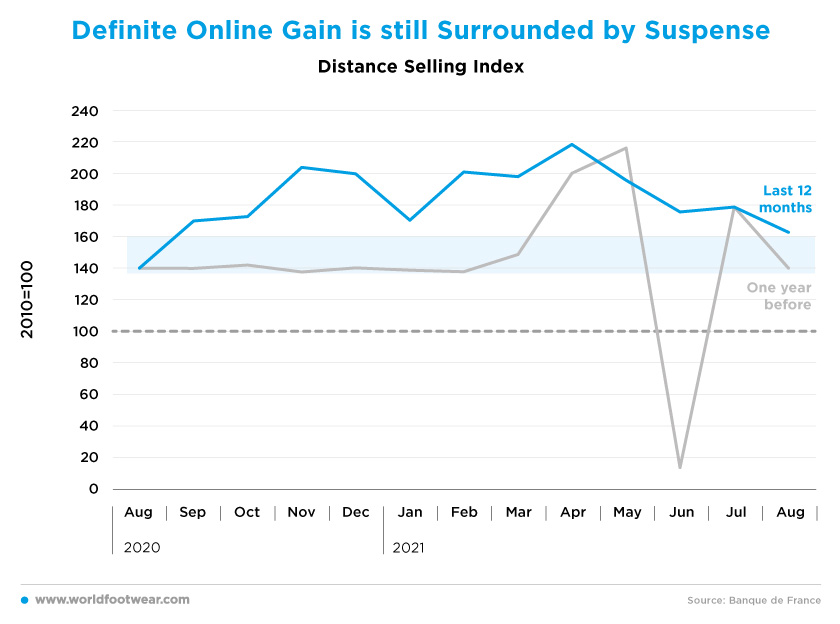

Definite Online Gain is still Surrounded by Suspense

As the restrictions to the physical retail have been practically lifted by mid-May, non-store sales of goods are losing their pandemic drive. However Boris Saragaglia, Chairman and CEO of Spartoo, the French footwear and fashion e-retailer highlighted that sales in the first semester 2021 exceeded expectations, while Spartoo’s business-to-business service “is experiencing significant growth, driven by the need to digitalize brands and independent shops. ” The B2C business was up 16% while sales in its physical stores were up by more than 40 percent year-over-year and have exceeded 2019 levels (shoeintelligence.com., October 2021).Most recent data, available at the end of August, while still 20 pp above the pre-pandemic level is not totally conclusive on the structural nature of the online retail gain in France, once physical retail is unrestrained.

Despite the fact that distance selling as a whole (and Clothing & Footwear, as one of the dominant product categories in it) has been almost always higher or much higher than before the COVID-19crisis, August 2020 has been a striking one-off exception. The rule of a definite online gain seems to stick, but until we get next monthly data we will be kept in suspense.