Register to continue reading for free

Germany Retail: after a surprising summer, retail might not be able to withhold the impacts of recession

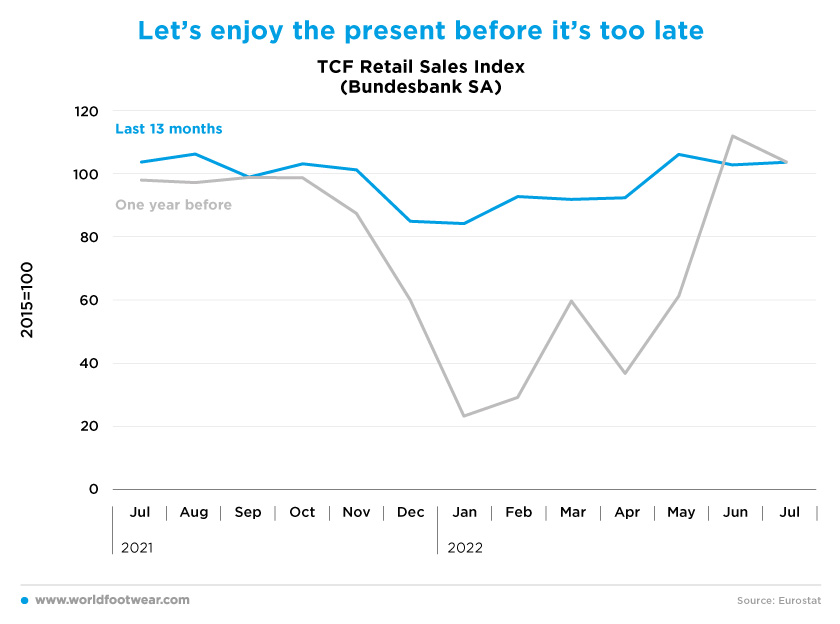

The analysis of both TCF (Textile, Clothing, & Footwear) Retail Index and footwear imports show that German consumers chose “to enjoy the present before it is too late”. In July, retail trade was still healthy enough to accommodate the price increases caused, first, by the impact of the pandemic on the global supply, and then, by the skyrocketing of energy prices following the Ukraine crisis, not to mention the high inflation. However, given the free fall of consumers’ and retailers’ confidence observed since March, additional uncertainties are expected to arise throughout Autumn. Furthermore, despite all gains observed in the recent past, the online seems to be losing some track, and the macroeconomic environment will not be an ally during the second half of 2022

Let’s enjoy the present before it’s too late

The seasonally adjusted TCF (Textile, Clothing, & Footwear) Retail Index (by Bundesbank) fell below the 2015 baseline in December last year. Surprisingly enough, the sequels of the pandemic at the turn of the year (15 percentage points under the line) were sharper than the impact of Russia’s invasion of Ukraine since February this year.The corrected category statistics for the period between February and April were better off (less than 10 pp (percentage points) under the line), and, from then through July, against what may be expected, they have returned to the upside.

It appears there is some misalignment between the statistical evidence and the readings about German consumer behaviour made in early August by the German Retail Association (HDE). “Retailers are feeling an unprecedented level of uncertainty among their customers, across all sectors”, says the HDE’s General Manager Stefan Genth. “The pandemic had already significantly changed consumer purchasing behaviour, but the energy crisis is increasing reluctance to buy. Customers were extremely cautious when it came to larger purchases (…) and reluctance also prevails when buying clothes” (einzelhandel.de). However, at least as of July, the leitmotif for consumers seemed to be “let’s enjoy the present before it’s too late”.

For footwear importers, retail still OK as of June

Concerning footwear imports, the acceleration has been visible through March (reaching more than 30 percentage points above the baseline), and after the overshooting correction in April, the trend was resumed up until June, much in line with the positive figures registered by the TCF retail.

Should expectations on footwear (and clothing) retail for the near future be dominated by an extremely cautious consumer, retailers would do well to adjust their supplies to the downside as soon as possible, with imports probably becoming flattered earlier.

On the contrary, a qualitative survey carried out later by the IFO Institute pointed to the fact that, on average, 77.5% of retailers complained about supply problems, up from 77.3% in July. Retailers of clothing were the least affected among the retailers surveyed, but still, 54.3% claimed to suffer from supply issues. “There is currently no sign that the problems will ease in the lead-up to Christmas”, said Klaus Wohlrabe, head of surveys at IFO (shoeintelligence.com).

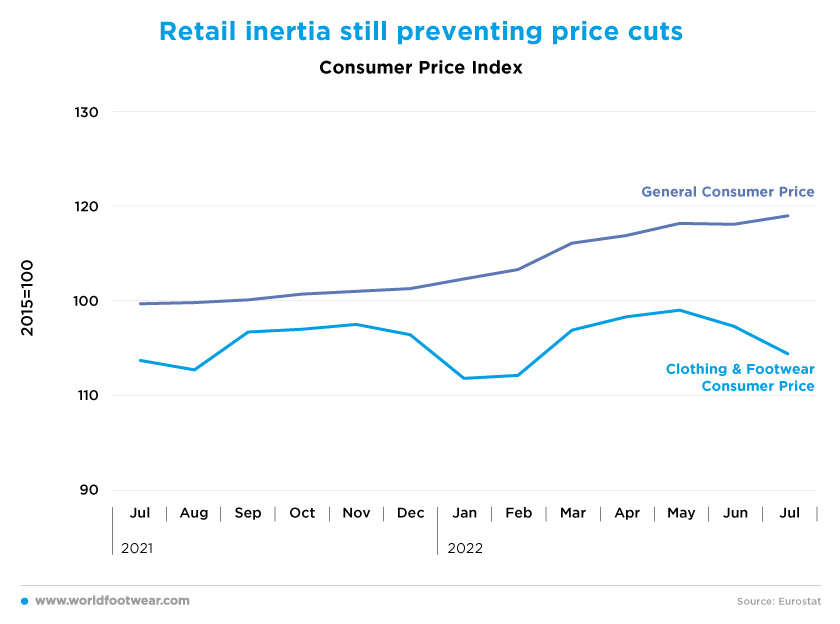

Retail inertia still preventing price cuts

The impact of the pandemic on the global supply chain, first, and the skyrocketing of energy prices following the Ukraine crisis, caused the general consumer price index to jump 9 pp in the year closing in July. Obviously, runway inflation is supposed to produce higher damages in the demand of non-food products, such as clothing and footwear.

The point is, however, that despite such inflation, underneath, the seasonal effects of the clothing & footwear consumer price index (Eurostat) continue to increase moderately, meaning that retail trade in July was still healthy enough to allow it. Some shock absorbers have been identified to explain such retail inertia.

“So far, energy suppliers have borne the brunt of the sharp increases in market prices for electricity and natural gas, passing on only a small proportion to their customers”, explained Timo Wollmershauser, head of forecasts at IFO (shoeintelligence.com). And, according to Reuters, the trade union-affiliated Macroeconomic Policy Institute (IMK) sees the latest government support measures preventing a drastic decline in consumer demand in the coming months. The measures could "at least significantly mitigate or possibly even prevent a recession that is now looming", stated the IMK director Sebastian Dullien.

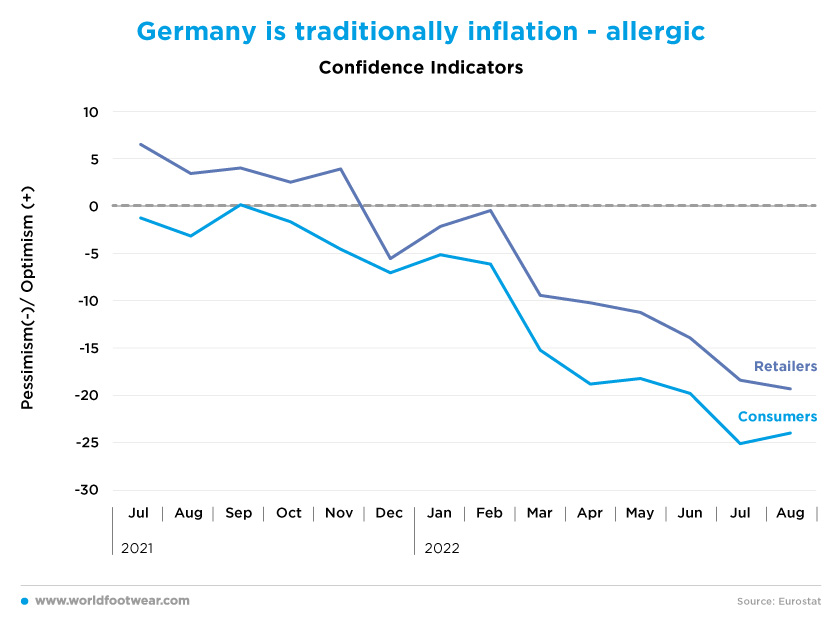

Germany is traditionally inflation-allergic

The TCF retail and imports figures came as much of a surprise as both the consumers’ and retailers’ confidence (Eurostat) entered a free fall movement from March through August. But it is not yet the end of the story.According to the consumption barometer of the German Retail Association (HDE), after hitting an all-time low in August, the index is now [in September] falling to a new all-time low. A trend reversal is not in sight, so the next few months are likely to be characterized by consumer restraint (einzelhandel.de).

The quick deterioration of the consumers’ confidence is not a striking feature in Germany, a country known for historical reasons for being highly inflation allergic. Nonetheless, “additional uncertainties could arise in autumn with a view to the energy supply and the pandemic. A noticeable improvement in consumer sentiment will therefore probably not become apparent before spring next year” reported the German Retail Association, in the same cited source.

Furthermore, retail cannot escape the “coming recession, fueled primarily by consumption” as noted by chief economist Alexander Krueger from Hauck Aufhaeuser Lampe (reuters.com).

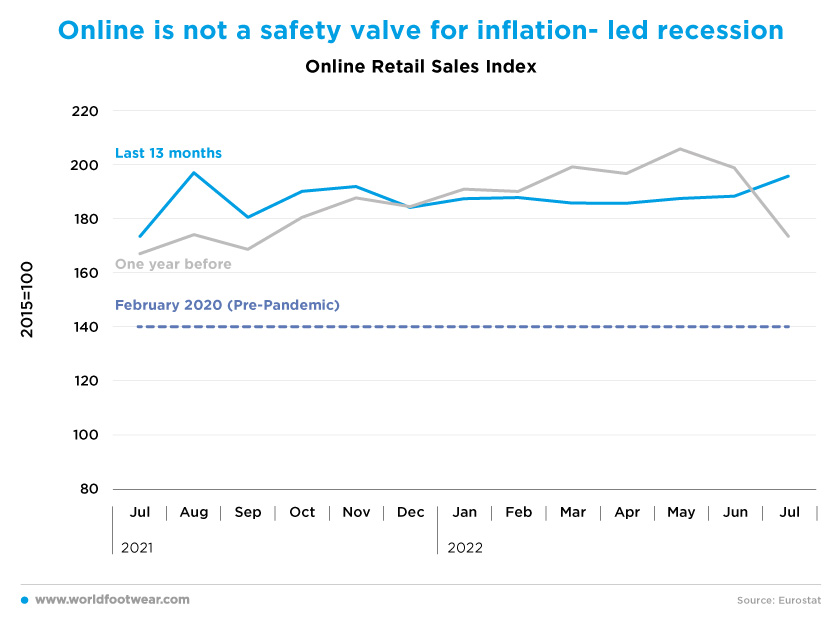

Online is not a safety valve for inflation-led recession

Monthly online retail sales statistics for Germany are released (by Bundesbank) only for all categories together. In the last twelve months through July, the online index was pretty much stable in the 180-200 range, that is, an average of 50 percentage points above pre-pandemic levels, two and half years ago. These figures mean that the penetration speed of online retail more than doubled in this period, as internet retail sales took 5 years from the baseline in 2015 to cover the 40 percentage points of the pandemic outburst. COVID-19 pandemic-related circumstances certainly can take much of the credit for this acceleration effect.

Due to a lack of available information, it is not sure if the same gains hold true for the clothing & footwear category in terms of internet retail. As the pandemic fades away, the category remains Top in capturing e-consumers, albeit having lost some drive in the previous year: from 40 to 39 million e-consumers, and from 68% to 63% of those that made purchases online (Postnord, 2021 vs. 2020). However, according to Federal Statistical Office, the online share in this category’s sales is only 20.5% which means “it ranks only 19th among the groups of goods” (destatis.de).

If Zalando’s performance can be taken as representative of online retail (as well as for the category), the company’s gross merchandise volume in the second quarter of 2022 has shown a “flat development, compared to an extraordinarily strong second quarter 2021, amid a challenging macroeconomic environment, with revenue falling 4%” (corporate.zalando.com). Considering the deterioration of the macroeconomic situation in Germany and Europe in general, these results do not anticipate good prospects for online retail in the second half of the year.