Register to continue reading for free

Germany Retail: After some successful months, retail took a massive hit by the end of 2020

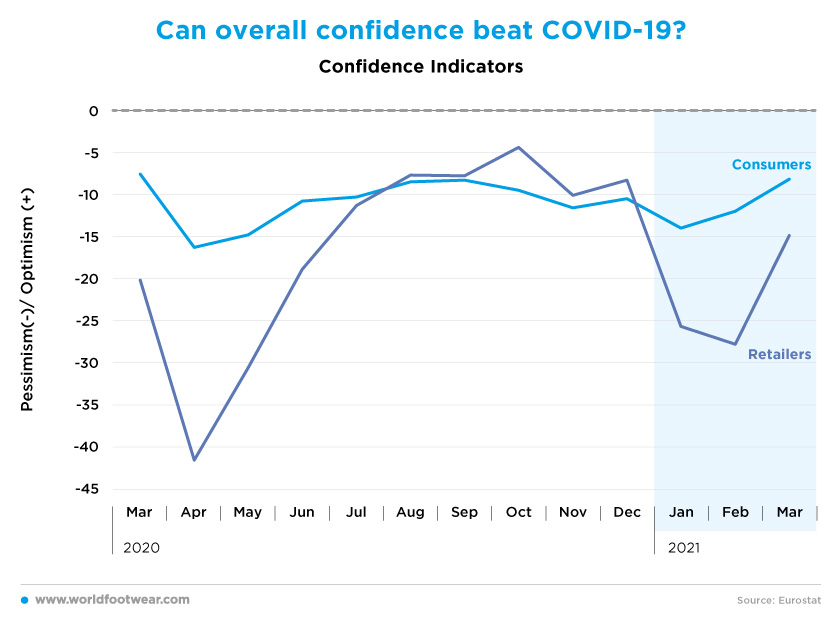

After the initial hit back in the first months of 2020, the impact of the pandemic in German retail sales seemed to be manageable for most of the year. However, in the last two months of 2020 the plot of the story changed, and with strength. As in other geographies, the bad news for the offline channels has been accompanied by good news for the online. Will this be enough? Most people believe it will not. The good news seems to come from the confidence indicators: consumer pessimism seems to be fading away. And retailers seem to follow. Will confidence beat COVID-19?

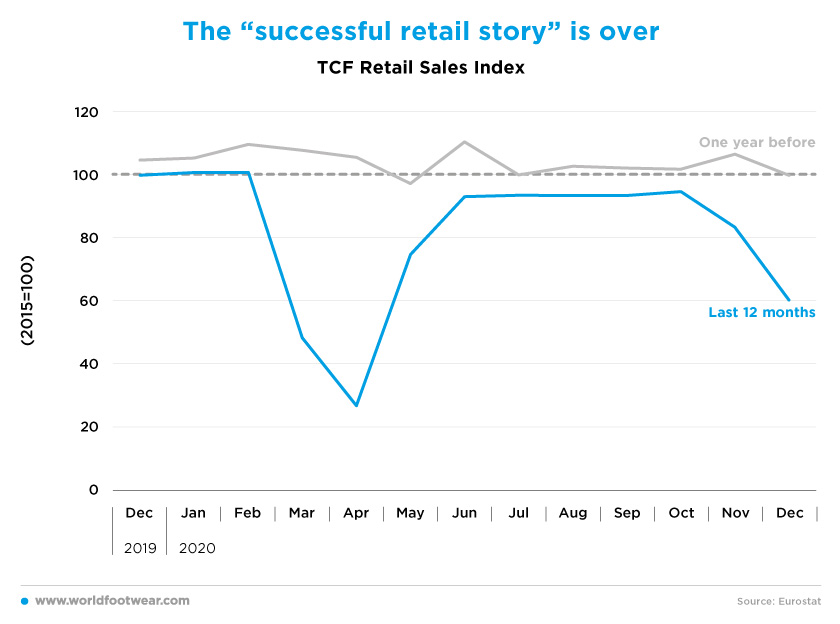

The "successful retail story" is over

After the so called “successful retail story in Germany”, which lasted until October 2020 and in which - far from other European countries - the COVID-19 impact on retail sales seemed quite manageable (standing at less than seven points beneath the 2015 retail baseline), the pandemic attacked with unexpected “violence” in Germany.

As a result, Retail Sales of Textile, Clothing and Footwear (TCF) entered into a free fall mode in the last two months of 2020. Further data from the Federal Statistical Office indicates that January could have closed with a retail loss of 55 points against the baseline.

And based on the ongoing COVID-19 related restrictions at the beginning of 2021, Rexor, the German buying group with a network of 509 companies, controlled by the retail cooperative ANWR, where many footwear and leather goods retailers are affiliated, expects a further decline in centralized revenues in 2021, on top of a 19% decrease in 2020, registered due to the impact of the CO¬VID-19 pandemic.

On the same direction, the Federal Association of the Shoe and Leather Goods Industry (HDS/L) reported that footwear industry domestic sales dropped by 8.6% from 2019, with fashion shoes manufacturers suffering the most with a 25% drop. While two thirds of German shoe and leather goods manufacturers expect sales and profit to further drop in 2021 expecting that half of the shoe, leather goods and fashion stores will not survive the crisis, due to extended lockdowns.

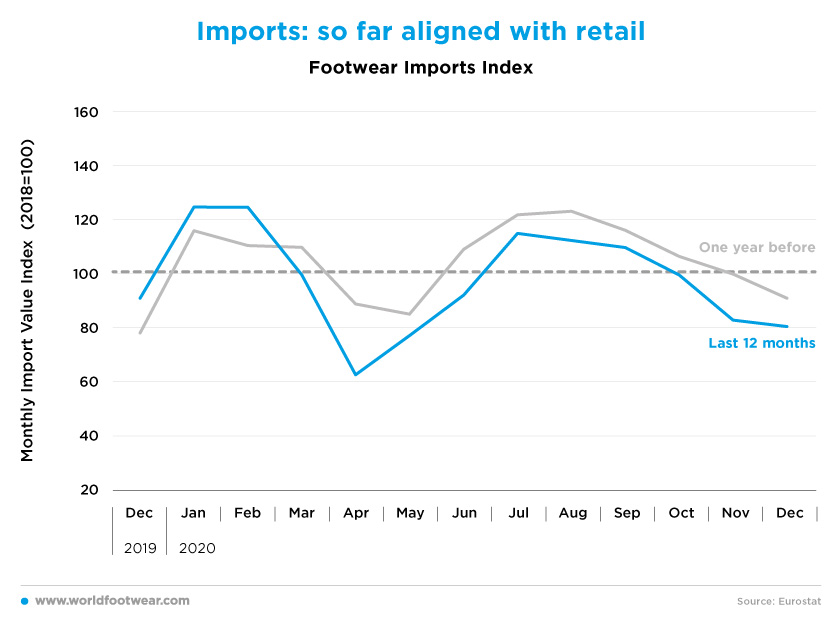

Imports: so far aligned with retail

In contrast with retail, before COVID-19 (December 2019-February 2020) footwear imports were moving above the previous year. The pandemic naturally reversed this gap since then, aligning both retail and imports on a downward trend. But the Y-o-Y (Year on Year) pattern of footwear imports remains more or less the same along the year, still highlighting the COVID-19 impact in April and November.

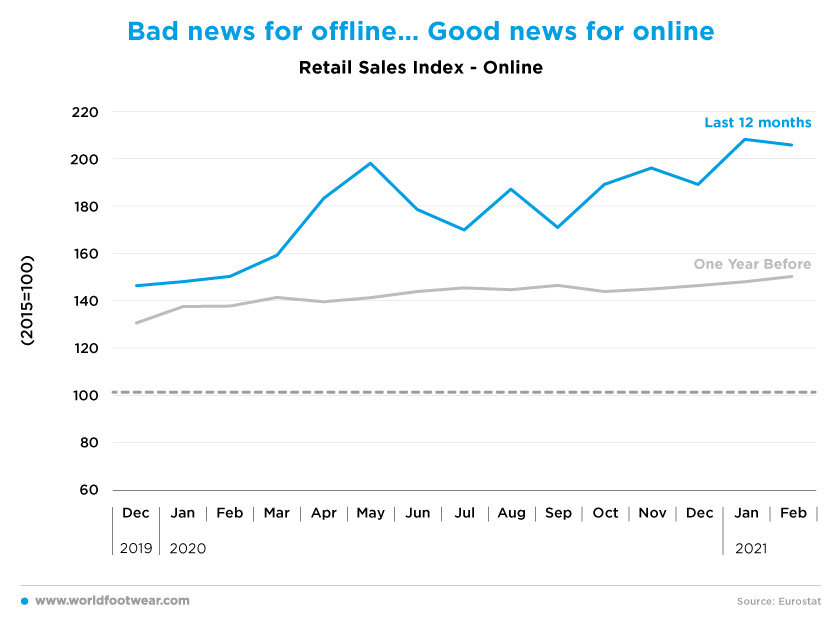

Bad news for offline ... Good news for online

Since October 2020 through February 2021, the online profile of retail sales translated the increasing barriers to physical trade. Christmas season and February outliers reflect only the ever-changing “yo-yo” lockdown rules being applied in the country.

Yet online and click & collect sales will likely fail to compensate for the expected drop in sales in physical stores, according to the Federal Association of the Shoe and Leather Goods Industry.

Can overall confidence beat COVID-19?

With the second COVID-19 wave losing power by February 2021 a light lockdown came into effect. This was short-lived, as a third wave in March called for a new brake. With no fresh data available yet, one could bet another retail tumble was around the corner. But German consumers don't seem convinced that the COVID-19 risks will prevail. Instead, consumer pessimism is fading away, as data for the two months ending in March 2021 shows.

And retailers’ lack of confidence, still resisting in February, quickly followed a favourable pace in March. The fact that footwear consumer prices are increasing and closed February above the previous year for the first time since March 2020 is probably feeding their expectations.

But the hope that the restrictions on retail trade would be relaxed across the board has not been fulfilled as by the end of March Germany remained in lockdown and public life is still to be largely shut down.

But the hope that the restrictions on retail trade would be relaxed across the board has not been fulfilled as by the end of March Germany remained in lockdown and public life is still to be largely shut down.

And Uli Rau, spokesman for the retailers cooperative SABU Schuh-Verbund eG, stated that “in the footwear sector in particular, a slow return to normal purchasing habits is expected and therefore additional financial liquidity is to be offered to its affiliates, bridging possible financial gaps between due invoices and a sluggish sale recovery”.

The question now is: Will confidence beat COVID-19 sooner than the vaccine?