Register to continue reading for free

UK Retail: Christmas upsurge turns into big new dip at the beginning of 2021

As a new wave of COVID-19 struck the UK and a new confinement hit the country after the New Year, retail sales of footwear slowed down again. One interesting fact comes from the indicator of consumer confidence, which is now increasing for two succeeding months. If vaccination in the UK succeeds, footwear sales decline might not persist. The question is what the impact will be for brick and mortar, as this virus seems to have been fatal for many high street players

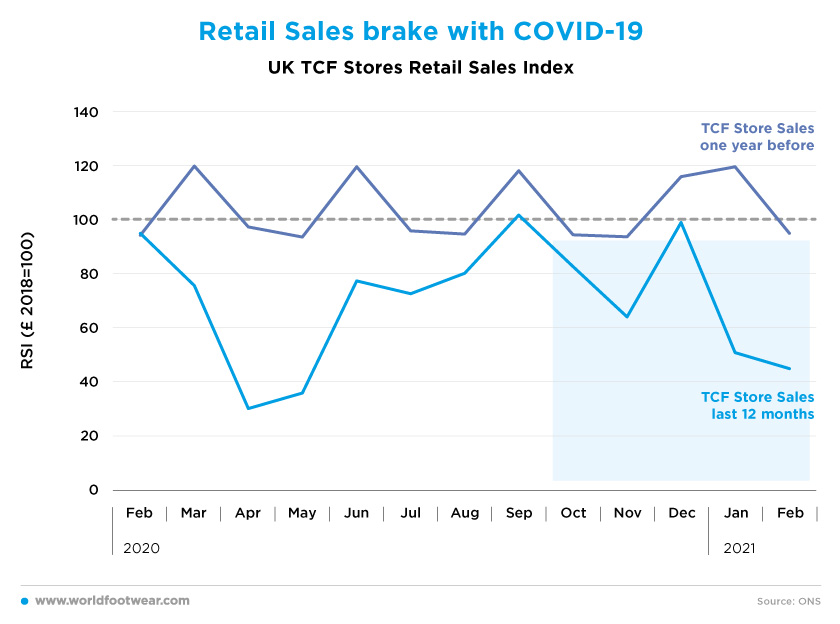

Retail Sales brake with COVID-19

After the TCF Retail Sales Index (Textile, Clothing & Footwear) reached the baseline in September 2020, COVID-19 took again its toll on retail sales through November. The brief Christmas upsurge turned immediately into a big new dip at the beginning of 2021, and February 2021 closed fifty points well below the same month last year, just before the hit of COVID-19.

The impacts of such a difficult 2020 is now marked on the companies’ history as they start to announce full year’s results: on the 8th of March 2021 Shoe Zone declared: “Revenue decreased by 24.3%” and the company swing to full year loss as the COVID-19 store closures bite the business. The UK-based footwear business also expressed its concern as “the financial pressure caused by COVID-19 has meant we now have debt on the balance sheet for the first time in over 15 years”.

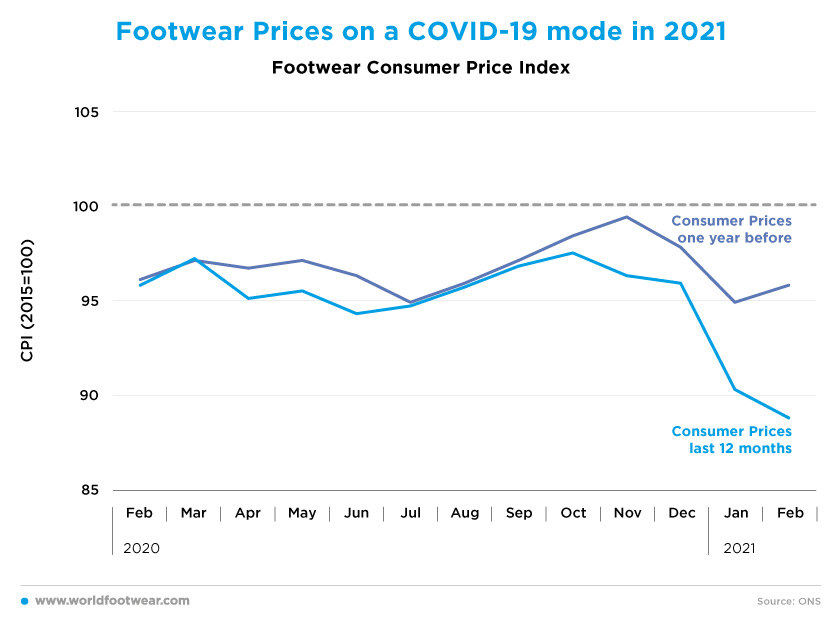

Footwear Prices on a COVID-19 mode in 2021

Consumer prices for footwear started to share the upward inflexion of retail since June 2020, on the “mistaken belief” that COVID-19 was a one-shot event. But since October, footwear prices also reverted to a crisis mode much beyond seasonality, loosing seven percentage points Year-on-Year (Y-o-Y).

Accordingly, the British Retail Consortium reported that “shop prices fell in February by 2.4%, below January’s decrease of 2.2%. This is the lowest deflation rate since May 2020. This is below the 12- and 6-month average price decreases of 1.7% and 1.8%, respectively”.

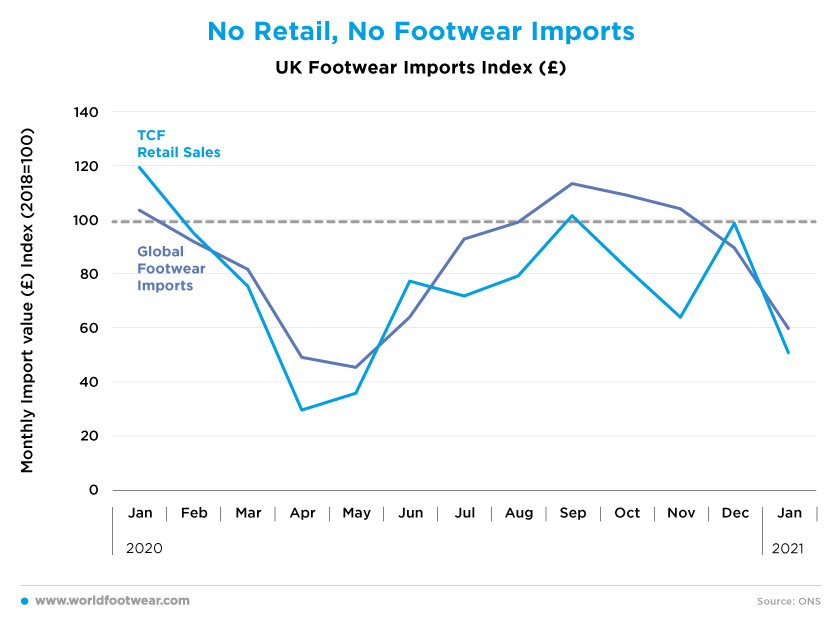

No Retail, no Footwear Imports

The UK footwear imports have increased over the summer and even overshot the TCF retailers’ recovery euphoria until September, when they started to decline month after month. And soon the brakes were also applied to imports, making no mistake about the “short-term fireworks over Christmas”.

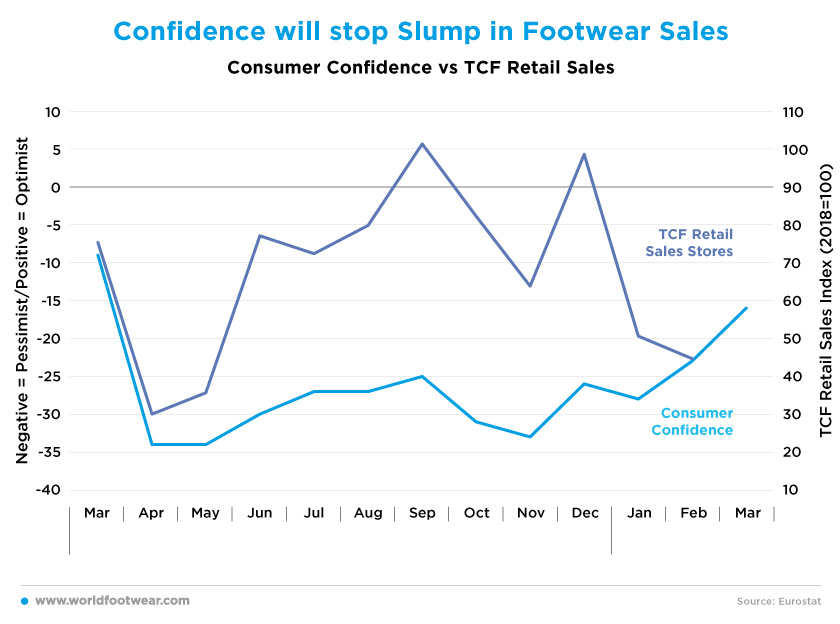

Confidence will stop Slump in Footwear Sales

Consumer confidence, according to the Gfk indicator, translated relatively well the COVID-induced pattern of TCF retail sales from March 2020 through January 2021. Even the Christmas upswing outlier of retail seems to be the result of increased consumer’s confidence.

The recent stats seem to indicate that the two indicators have “apparently divorced” in February 2021, with TCF sales going deeper and pessimism fading away for two succeeding months, closing in March 2021. Should the success of vaccination in the UK be more and more ingrained in the consumer expectations, footwear sales decline would not resist much more time.

As Dune Global Buying Director Debra Bloom said back in February 2021, “once we’re feeling the benefits of the vaccine and lockdown is over, we think everyone is going to want to go out to events and parties and get dressed up again. We have a range of occasion shoes going from April onwards. It is a smaller mix than normal, but we saw demand even through lockdown 2020 for special shoes. We want to get people excited to get dressed up again.”

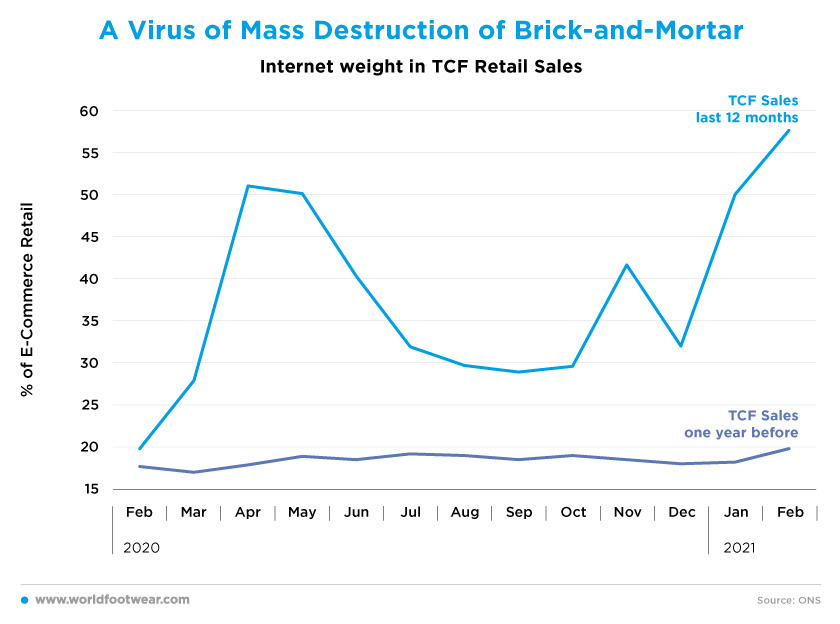

A Virus of Mass destruction of Brick-and-Mortar

Higher consumer confidence and vaccination success will come along with lockdown lifting. But shutdowns of physical retail will by no means prevent stronger consumer confidence from turning into higher total footwear demand, as online became a stronger player.

Luxury British footwear and accessories retailer Kurt Geiger warn that the financial year ending February 2021 meant revenue and profitability would be “materially impacted” by the pandemic, even though its digital platforms have continued to operate uninterrupted amidst lockdowns and other restrictions”.

And Hotter Shoes, one of the UK's biggest footwear maker, has reported (January 2021) “soaring online sales after it shut 59 physical shops in a drastic switch to digital [and] reported a 27% leap in year-on-year online sales in the six weeks to December 31.

While opening up of the economy helps bricks-and-mortar stores, internet sales seem to have seized any COVID-19-created opportunity, to not only increase its share of total TFC retail, but also, should confidence support, to substantially preserve it once the physical retail resumes.

Lucy Gibbs, Managing Consultant at Retail Insight (Capgemini) noted: ”February growth remains strong as we near a full year since the pandemic closed the high street for the first time. Online growth has been highest in this third national lockdown, however, as we approach the year-on-year comparisons against the swings of 2020 we are likely to see interesting metrics play out over the next few months”.

In a mature e-commerce market as the UK, the August-October online TFC retail participation serves as evidence of a sustainable share gain of some ten percentage points.

As Lucy Reece-Raybould, Chief Executive at the British Footwear Association, puts it: “With continued rapid distribution of vaccines, waning infections, and a new roadmap out of lockdown we expect consumer confidence to increase further in coming months, hinting at brighter days ahead for footwear demand. However, a cautious approach will be prudent as it may possibly take years for UK retail demand for footwear and leather goods to recover to pre-pandemic levels.”