Register to continue reading for free

US Retail: footwear retail sales still below the 2018 average

No matter the seasonal hike in December, with flat retail sales of footwear since June 2020 and 20% lower than the 2018 average, the 1st quarter of 2021 will hardly beat this baseline. Even if one considers the hike in ecommerce, perspectives are not great. On top of that low consumer confidence and uncertainty regarding a full return of shoppers to the high street, add to the gloomy picture of retail in the US

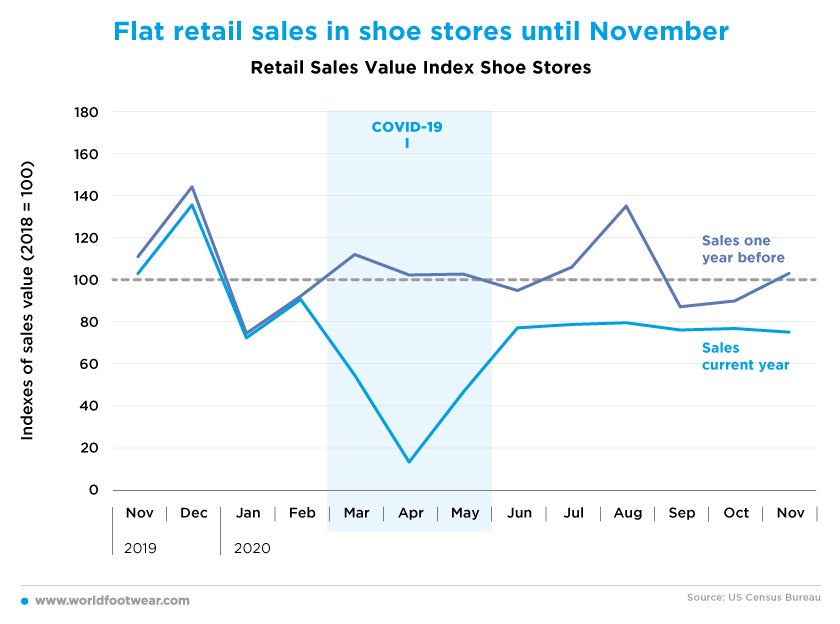

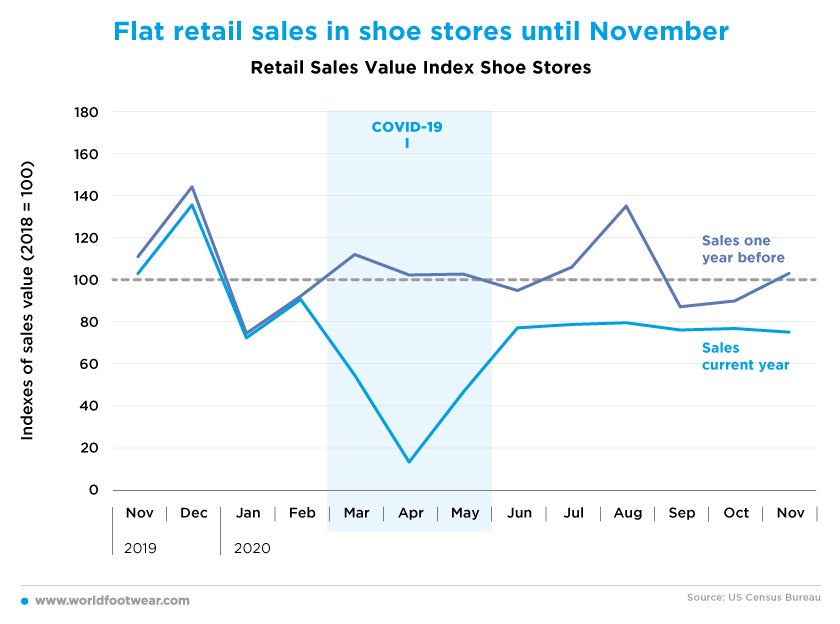

Flat retail sales in shoe stores until November

After the COVID-19 dip in March and April last year, retail sales of footwear have recovered until June. Then after, footwear sales became flat around 20 percentage points (pp) below the 2018 average.

With sales for the last three months of 2020 still unreported for some of the main US footwear retailers, one thing is certain, footwear sales still have room for improvement. With declining sales by 39% in the period April-June, Wolverine managed to recover in the following quarter and “only” reported a 14% decrease. DSW (-43% in May-July; -30% in August-October), Genesco (-20% May-July; -11% August -October) and Caleres (-33% May-July; -18% August-October) all followed the same pattern of declining sales in both the second and third quarter but with an improving performance in the summer months. Foot Locker, managed to go through the pandemic with better results, with net sales growing by 0.5% in May-July and up by 2.9% in the following quarter.

With sales for the last three months of 2020 still unreported for some of the main US footwear retailers, one thing is certain, footwear sales still have room for improvement. With declining sales by 39% in the period April-June, Wolverine managed to recover in the following quarter and “only” reported a 14% decrease. DSW (-43% in May-July; -30% in August-October), Genesco (-20% May-July; -11% August -October) and Caleres (-33% May-July; -18% August-October) all followed the same pattern of declining sales in both the second and third quarter but with an improving performance in the summer months. Foot Locker, managed to go through the pandemic with better results, with net sales growing by 0.5% in May-July and up by 2.9% in the following quarter.

Footwear imports, which in the US feed much of the consumption (in 2019, production of footwear in the US was only 25 million pairs, while consumption reached 2.4 billion pairs, according to the World Footwear Yearbook - available HERE) and anticipate in some sense the retail demand, were declining continuously since August, resulting in poor expectations for the future.

This is quite different from what happened with the general category of Clothing & Clothing Accessories where sales were still recovering in December clearly above the baseline (2018).

Specific footwear numbers for the last month of 2020 are not yet available, but it should not be surprising if sales were still dragging, perhaps showing some seasonal uplift, but far from the level registered in December 2019.

Behind the pressure on sales are for sure an increment in telework, closure of some services as well as the cancellation or avoidance of many social gatherings. Roger Rawlins, Chief Executive Officer at DSW commented on that: "fundamentally, our customers know Designer Brands as a dress and seasonal house. As they continue to work from home and avoid large social events, the balance of our assortment will remain challenged. We are pleased to see that a vaccine may be on the horizon, but widespread adoption will take time and our business will continue to feel pressure in the near-term."

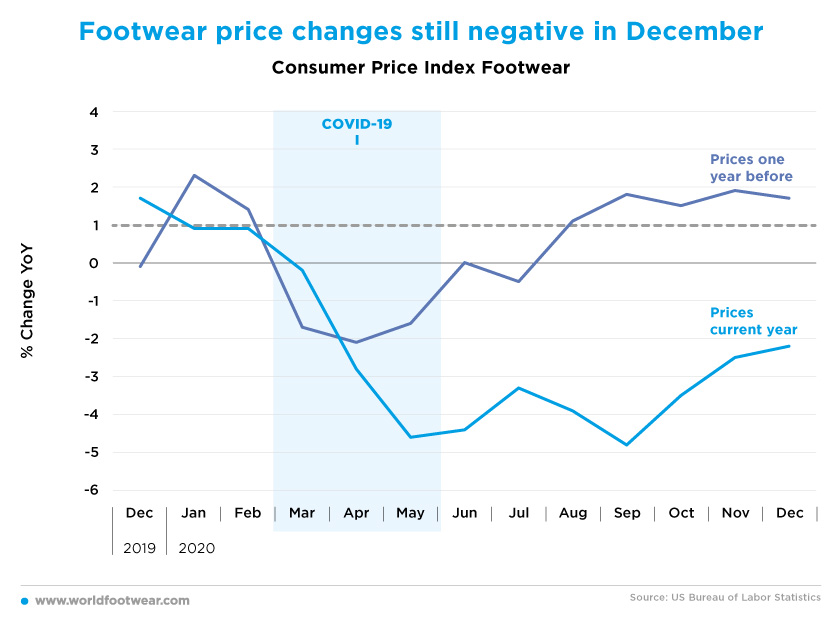

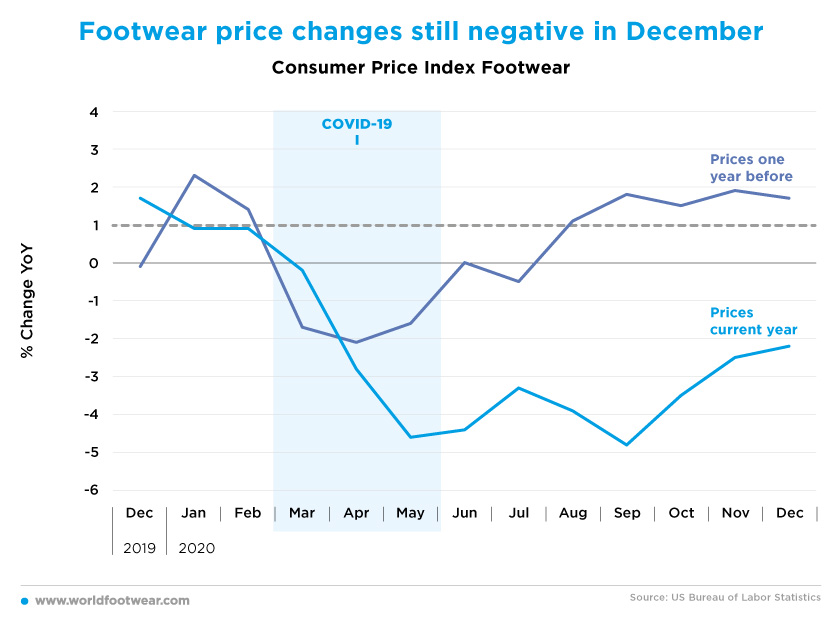

Footwear price changes still negative in December

Such a slight uplift is indirectly anticipated by the improvement of the Year-on-Year (YoY) change of the Consumer Price Index for footwear in December. But then prices were still decreasing 2.2%, while in 2019 they were 1.7% up as expectable in the Christmas season.

The distance between price changes in both years is an eloquent sign of the enduring COVID-19 impact in the footwear retail business.

The distance between price changes in both years is an eloquent sign of the enduring COVID-19 impact in the footwear retail business.

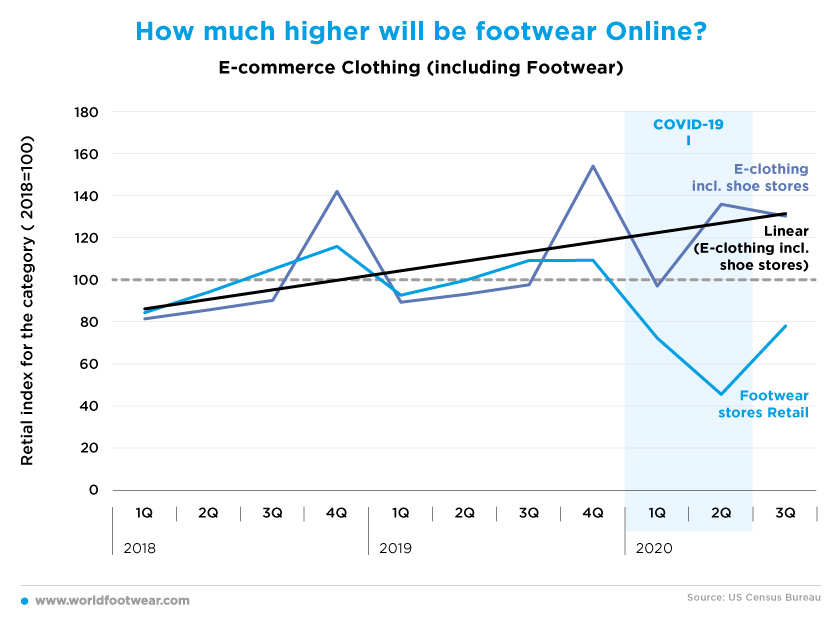

How much higher will be footwear online?

Available data for e-commerce in the category to which footwear belongs has been in an upward trend since the beginning of 2018 with abnormal hikes in the Christmas quarters followed by seasonal drops in the next ones.

In 2020 the first quarter drop was much less pronounced than in the off-line retail and in the second quarter there is a clear transfer to the online due to COVID-19. In the 3rd quarter 2020 the offline re-emerged and e-commerce suffered a little while still riding an upward trend.

The increase in online sales is common to many US-based companies. Wolverine reported a hike in ecommerce of 96% between April and June and 56% in the following quarter. Nike underlined that their “return to growth is a testament to their digital strength”, when reporting second quarter results for fiscal 2021, marked by digital sales increasing by 84%, with triple-digit growth in North America and strong double-digit increases in EMEA, Greater China and APLA.

The increase in online sales is common to many US-based companies. Wolverine reported a hike in ecommerce of 96% between April and June and 56% in the following quarter. Nike underlined that their “return to growth is a testament to their digital strength”, when reporting second quarter results for fiscal 2021, marked by digital sales increasing by 84%, with triple-digit growth in North America and strong double-digit increases in EMEA, Greater China and APLA.

This shift into the online has consequences for brick and mortar. Caleres, which owns brands such as Famous Footwear, Naturalizer, Dr. Scholl’s Shoes, LifeStride or Sam Edelman, already announced changes in its brick and mortar panorama for Naturalizer. “Like the rest of the industry we have seen a structural shift in the shopping behaviour of the consumer – a change that has been further accelerated by the global health crisis. With a larger percentage of Naturalizer’s sales originating online, now is the opportune time to shed the legacy stores and evolve it to be more profitable”, commented CEO Dianne said Sullivan, back in November 2020 when announcing the closure of approximately 133 Naturalizer stores.

Return to the physical retail is expected to accelerate in the course of the first quarter 2021 but there is no reason to expect the online upward trend will be reverted. The question is whether the acceleration of the offline footwear will be higher (as in 2018 and 2019) or finally lower than the online trend.

Not all signs are pointing for des-investing in brick in mortar in the US. A few days ago, UK-established giant sports retailer JD Sports announced the acquisition of Baltimore-based sportswear company DTLR Villa in a 495 million US dollars deal, which will further consolidate their presence in the US market.

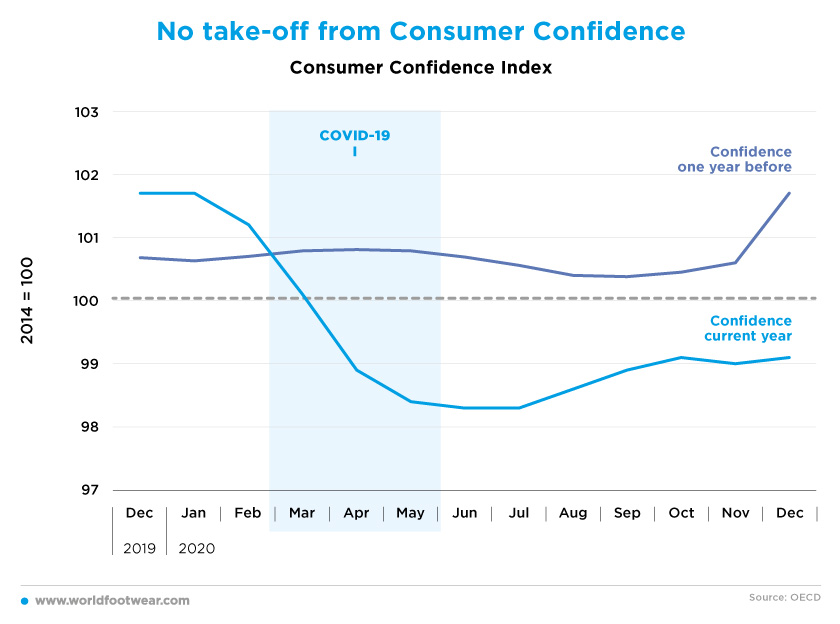

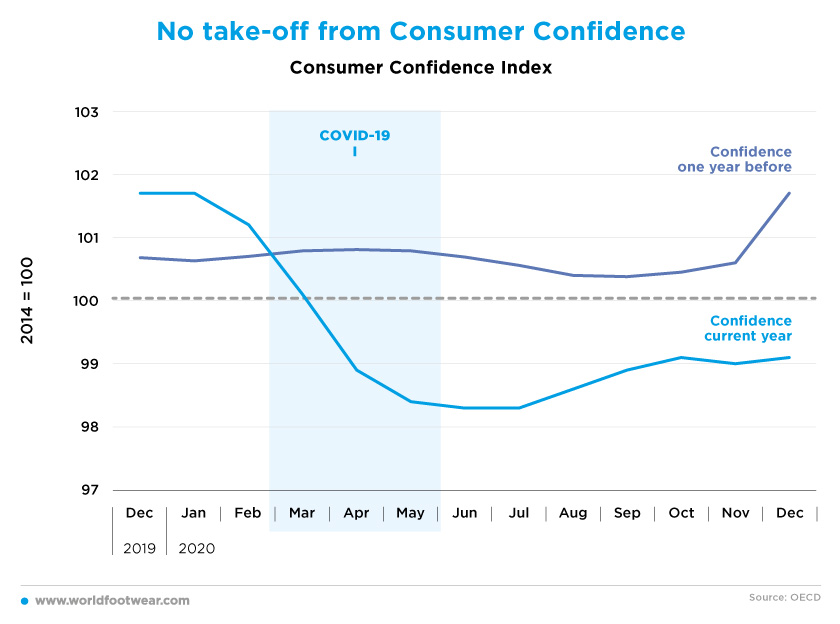

No take-off from Consumer Confidence

The negative long-lasting effect of COVID-19 in overall US retail as well as in the footwear business can also be derived from the Consumer Confidence Index, after adjusting for the seasonal factor (OECD). In December 2020 it was still flat and under (99.1 points) the baseline while in 2019 it was well in the upside.

And the distance between the levels of consumer confidence comparing January 2021 to 2020, advanced by the University of Michigan indicator is widening, besides the effect of a new administration.

On top of that, once should consider when will consumers feel comfortable to get back to the stores. Even with vaccination rolling out across the country, the scenario is not great for retail. According to a recent study by US-based First Insight “40% of consumers said they will shop for apparel in-store either less or the same amount after being vaccinated, a theme that is reflected across in-store visits for footwear (44%), accessories (43%), beauty products (45%), luxury items (41%) and electronics (43%). Further, the majority of consumers (61%) said they would cut back on spending if a national lockdown were enforced”. According to the same source, in December, 60% of the enquiry’s respondents said they feel unsafe trying on shoes compared to 51% in November (an 18% increase).

On top of that, once should consider when will consumers feel comfortable to get back to the stores. Even with vaccination rolling out across the country, the scenario is not great for retail. According to a recent study by US-based First Insight “40% of consumers said they will shop for apparel in-store either less or the same amount after being vaccinated, a theme that is reflected across in-store visits for footwear (44%), accessories (43%), beauty products (45%), luxury items (41%) and electronics (43%). Further, the majority of consumers (61%) said they would cut back on spending if a national lockdown were enforced”. According to the same source, in December, 60% of the enquiry’s respondents said they feel unsafe trying on shoes compared to 51% in November (an 18% increase).