Register to continue reading for free

US Retail: distressing times for footwear retail

In an environment of widespread destocking, footwear retail sales have been declining since the start of the year in the US, and despite good news such as a continuous moderation in price increases. The problem remains with the rising consumer price index for all categories, whose decreasing pace is not enough to generate an overall positive impact. Consumers are still attending to more pressing needs, and footwear is not on that list

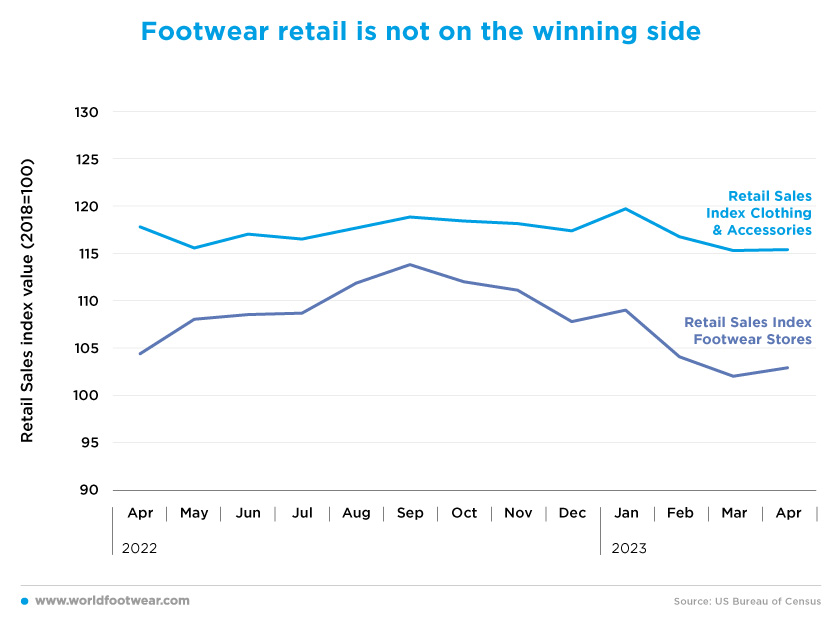

Footwear retail is not on the winning side

In the first four months of the year, Retail Sales of Shoe Stores (by the US Census Bureau) continued to decline, in a series of continuous losses since September last year (11 percentage points less), and much more sharply than that of the clothing and accessories category.

In contrast, National Retail Federation’s President and CEO Matthew Shay commented, “moderating price levels, continued labour market strength and wage gains have increased consumer’s spending ability”. NFR’s Chief Economist Jack Kleinhenz corroborated: “no sign of an abruptly slowing economy, despite what has happened with inflation and interest rate pressures”. Therefore, he said, “we continue to expect that spending will see modest gains through the course of the year” (fdra.org).

But footwear retail is by no means on the same winning side as the “core retail” indicator calculated by the NRF, which has recorded successive year-over-year gains from March to May.

As a result, “looking ahead, early reads on [the second quarter] show signs of continued softness, [and] so it will be important for [footwear] brands and retailers to focus their merchandising and messaging to promote value and versatility”, specified Beth Goldstein, Footwear & Accessories analyst at Circan, formerly the NPD Group (fdra.org).

Footwear pricing not guilty for poor retail

However, footwear retail pricing is far from being blamed for this underperformance of sales in the category. The growth of the Consumer Price Index for footwear (by US BLS) has scarcely moved up from the 145-index line during the last twelve months, closing May 0.2 percentage points up year-over-year. Definitely not enough to plead guilty.

According to a study recently published by Kearney Retail, footwear prices (…) rose at a decelerating rate in March, up by 0.3% from the same time last year. This marks the slowest growth in 24 months for the category (footwearnews.com).

Keen Footwear is a remarkable example of such a price policy. The brand announced to consumers and retailers that (…) “it is offering lowered prices on nearly every Keen shoe available through retail partners and their retail site. The brand (…) felt it was crucial to pass along savings to customers, [because] heavy inventories at retail and the resulting destocking effect felt by the majority of brands that have reported the first quarter have hurt brands and retailers”. (fdra.org)

The problem is not now in footwear prices, but in the All-items CPI instead. The fact that consumer prices rose by 4% in May compared to last year, [which] marks the smallest 12-month increase since the period ending March 2021 (finance.yahoo.com), isn’t still enough to positively impact lower- and middle-income communities, as well as accounting for the declines in the leisure and fashion categories in the first quarter (fdra.org). This reflects consumers’ decision to use their purchasing power on more pressing needs than footwear.

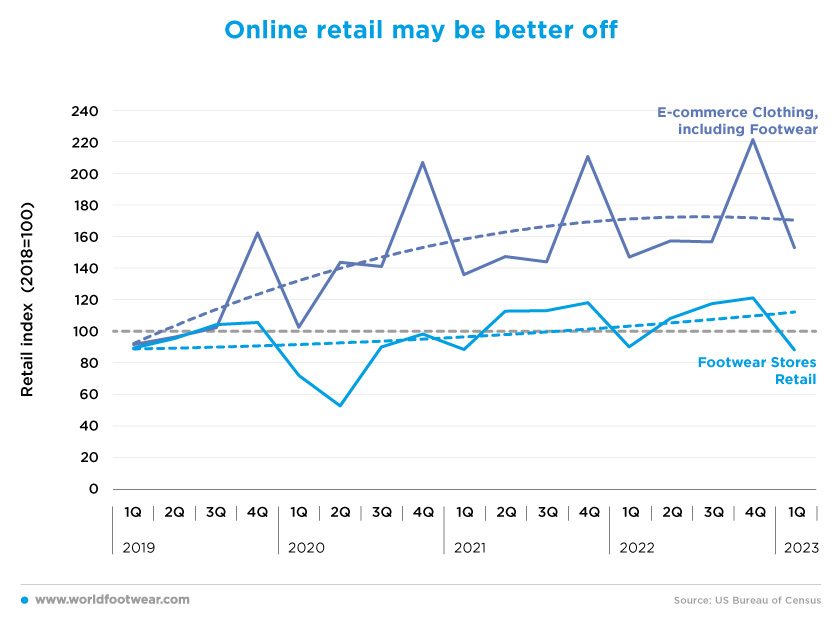

Online retail may be better off

Despite showing a decelerating growth year-over-year in the first quarter, the quarterly data on clothing (including footwear) e-commerce (by US Census Bureau, not seasonally adjusted) still indicates an interesting performance, with a 17 percentage points gain against the same period one year ago.However, converting the monthly shoe store retail data (not seasonally adjusted) into quarterly averages to make it more comparable, the performance is substantially worse and even slightly negative (a loss of 2 percentage points). The difference is even more striking as, according to Adobe, online apparel prices rose by 6.38% year-over-year in May, (wwd.com), while shoe store retail sales barely moved year-over-year in the same month, as reported before.

Piecemeal data provides additional insights into the issue. For example, Steve Madden, announcing the first quarter of 2023 results (investor.stevemadden.com), reported an 8.1% decrease (in) direct-to-consumer revenue (…) compared to the first quarter of 2022 driven by declines in both the brick-and-mortar and e-commerce businesses. At the same time, the President and CEO of Simon Property Group David Simon said that even with the economic uncertainty, [they] are running ahead of [their] internal plan [because] “tenant demand is excellent, and brick-and-mortar stores are where shoppers want to be”, [with] foot traffic at malls up 105.5% in March 2023 over March 2022 (footwearnews.com).

Scant retail, widespread destocking, import restraint

The yearly volume performance of US footwear imports, neutralising price and currency effects, leaves little doubt as to importers’ and retailers’ expectations of the negative trajectory of footwear retail in the near future (the indicator is not seasonally adjusted).

The destocking of many brands since last year is evident after footwear retailers' expectations were dashed. But the question is if a new frustration is on the way again, following the abnormal boost of imports in December and January. The fact that footwear retail trade (seasonally adjusted) has been declining since January may explain why imports are also adjusting down so quickly.

Yet, logistic variables impacting import decisions must also be considered. “The West Coast ports are a critical artery for retailers”, said NFR’s President and CEO Matthew Shay in a statement. And the Retail Industry Leaders Association (RILA) added that “with a tentative agreement [on a long-term contract for labour operations] in place, retailers can keep their supply chains moving with more certainty, [and] consumers can rest assured their items will arrive on time” (fdra.org).

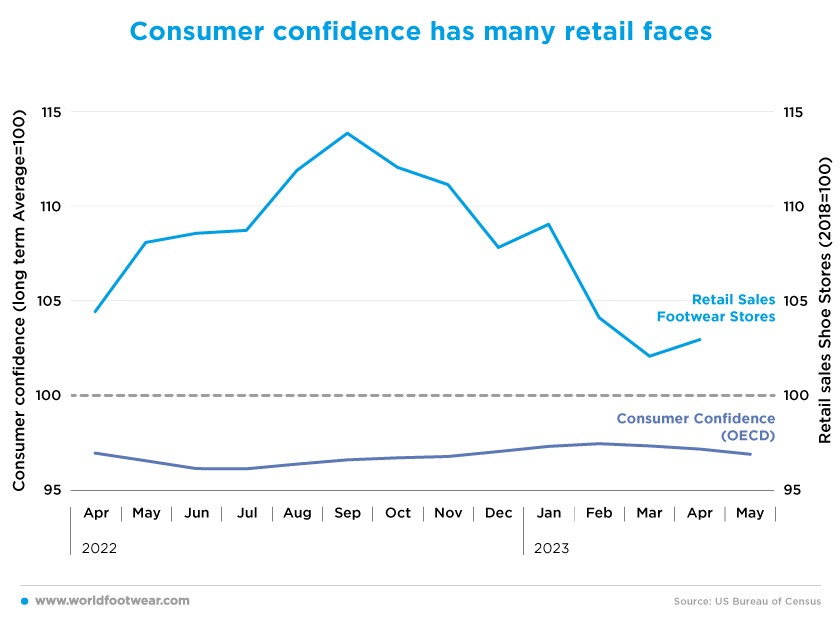

Consumer confidence has many retail faces

The consumers’ confidence indicator (by OECD), which increased from July last year through February, is now dwindling, closing still 0.4 percentage points up year-over-year in May.

The Conference Board combined index also reflects a weakening of confidence in May, but due only to the Expectations index alone, which has been [almost always] below 80 since 2022 - a level associated with a recession in the next year. By contrast, the Present Situation index also fell, but remains on optimistic grounds, meaning consumers are feeling good for now (footwearnews.com).

Joanne Hsu, University of Michigan’s Surveys of Consumers Director, in turn, said about their figures, “consumer sentiment is [in June] 28% above the historic low from a year ago and may be resuming its upward trajectory since then”.

Essentially, the relationship between retail sales and consumer confidence is not straightforward, except for big-ticket items. Footwear is not on the list.