Register to continue reading for free

US Retail: a friendly atmosphere for retail

The consumer confidence momentum in the US is in good shape, resulting in the best results achieved in more than a year. Footwear consumer prices have increased significantly since February, and after a long year of deflation this is good news for retailers. As for ecommerce, the post-pandemic normalization is expected to brake the online impetus. However, the expectation is that the upwards online share trend will resume at least at the pre-pandemic ending point

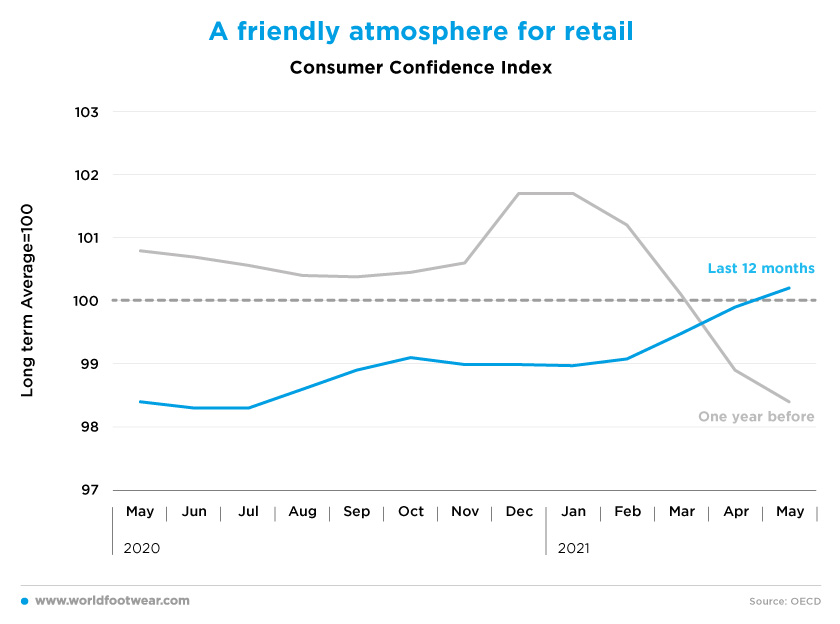

A friendly atmosphere for retail

The Consumer Confidence Index (OECD) has been improving in the US since February and in May it reached the long-term average, for the first time in the period of the last fourteen months.

The Consumer Sentiment (University of Michigan) was also better off, while still some points down the baseline.

“The early June gain was mainly among middle- and upper-income households and for future economic prospects rather than current conditions”, wrote Richard Curtin, Chief Economist of the University of Michigan’s survey, noting that respondents cited the rising market prices of homes and automobiles as top of mind among respondents. “Fortunately, in the emergence from the pandemic, consumers are temporarily less sensitive to prices due to pent-up demand and record savings as well as improved job and income prospects,” he added.

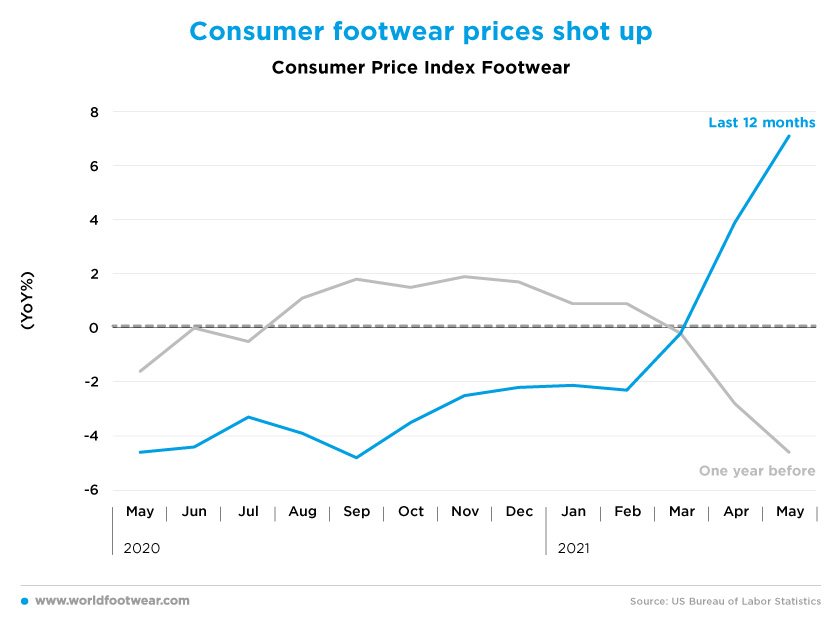

Consumer footwear prices shot up

Footwear consumer prices have shot up since February, and after a long year of deflation some price correction is good news for retailers to rebuild their margins.Although some price pressure is the unavoidable result of input cost pass- through by footwear manufacturers, overshooting (7% Year-on-Year (y-o-y) in May) should not kill the goose that lays the golden eggs.

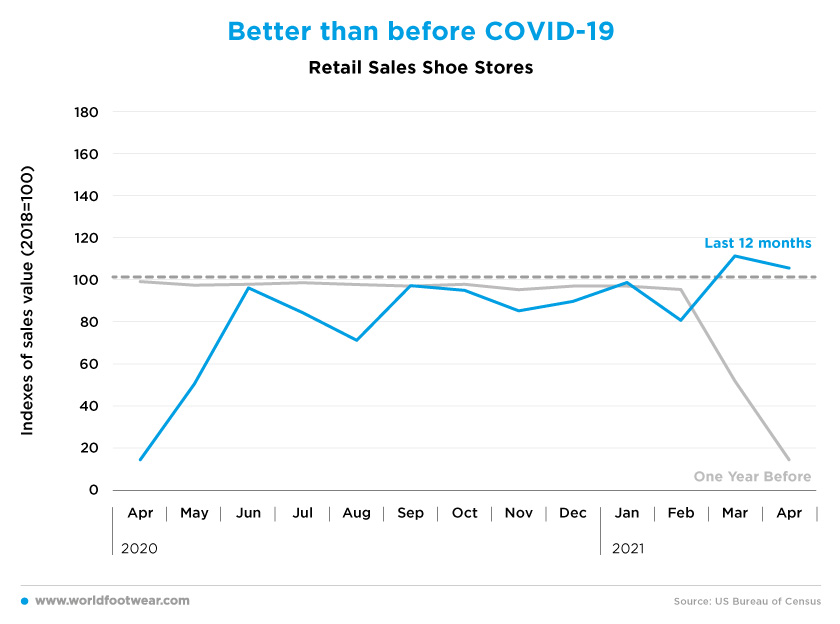

Better than before COVID

In March and April, when consumer confidence was still behind the red line frontier, retail sales in shoe stores were already clearly 6 to 11 percentage points (pp) up the line. Such positive footwear retail performance compares very well with its modest profile in 2019 before COVID -19 entered the picture.“Notably, Famous Footwear’s quarterly sales increased 13 % over the first quarter of 2019, benefitting from strong demand for the category, increased consumer confidence and improving in-store traffic trend”, commented Diane Sullivan, Caleres Chairman and Chief Executive Officer.

And David Weinberg, Chief Operating Officer of Skechers also stated “the momentum we experienced in the second half of 2020 continued into the first quarter as we achieved revenue growth of 15% over the same period in 2020 and an exceptional 12% increase over the first quarter of 2019.The positive results were due to a 20.2% increase in our international business and an 8.5% increase in domestic sales compared to 2020”.

For his part, John Donahoe, President & CEO, Nike reported North America delivered record revenues, up by 141% for the fourth quarter, up by 29% compared to the fourth quarter of 2019, including increased wholesale revenue due to delayed shipments from the previous quarter.

Thus, better confidence signs in the months ahead will add on brighter retail prospects for the next quarter as long as the pent up consumer demand accumulated during the pandemic does not dissipate.

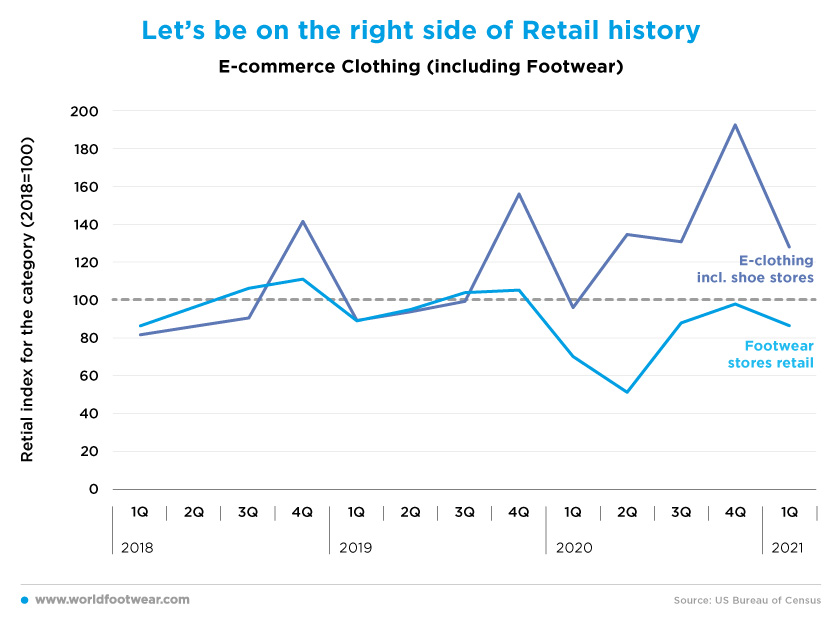

Let’s be on the right side of Retail history

Past online retail data for the extended “Clothing” category (including footwear) pointed to systematic quarterly increases from 8 to 14 pp y-o-y comparing 2019 to 2018, with peaks in the fourth quarter followed by a drop in the next. The COVID-19 barriers to brick-and- mortar retail obviously boosted both effects.Edward Rosenfeld, Steve Madden Chairman and Chief Executive Officer, commented: “we are off to a good start to 2021 that significantly exceeded our expectations. Our first quarter retail segment revenue increased 7% compared to pre-COVID-19 first quarter 2019, on the strength of exceptional growth in our digital business.”

And as for Nike, “North America Digital growth continued to be strong, increasing 54% versus prior year and 177% compared to the fourth quarter of 2019”, said John Donahoe, President & CEO.

The post- pandemic normalization is expected to brake somewhat the online impetus. But it is widely accepted that the upwards online share trend will resume, if not up, at least at the pre-pandemic ending point.

This means that despite physical retail may now go full steam ahead, footwear retailers cannot risk themselves to be on the wrong side of the retail history.