Register to continue reading for free

Spain Retail: good signs for retail in the first quarter of the year

Several indicators showed that consumer confidence is improving, reversing the downward trend seen after the invasion of Ukraine, but overall, consumer sentiment remains rather pessimistic. On the other hand, retailer confidence has been on the rise since January. In fact, the TCF (Textile, Clothing and Footwear) Retail Index (seasonally adjusted, by Eurostat), which had been recovering modestly from June to November 2022, soared thereafter as if Christmas were an uninterrupted season for the entire first quarter of 2023, and even the imports’ behaviour seems to have anticipated a sales boom. Meanwhile, expectations for online sales in 2023 are overall positive, but comparisons with the pandemic period might be misleading

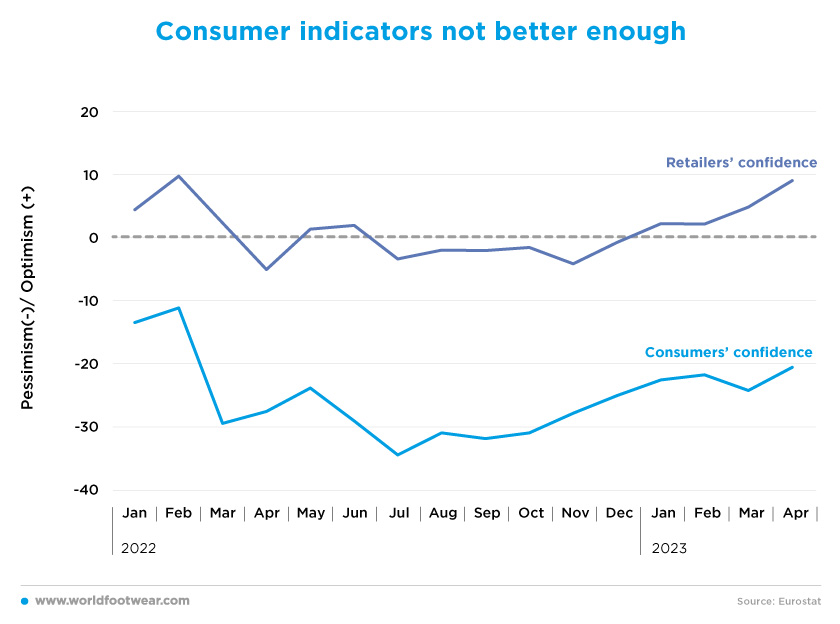

Consumer indicators not better enough

The Consumer Confidence Indicator (seasonally adjusted, by Eurostat) has been improving in Spain from September through April this year, thus reverting the downward trend recorded in the previous period following the invasion of Ukraine in February 2022. Still, the consumer mood remains rather pessimistic, with a negative balance of about 21 negative points, about 11 points worse than before the war.

Alternative confidence indicators confirm this improvement, but it’s still not good enough, especially when compared to the unfavourable pre-war scores. According to the National Statistics Institute indicator (by INE/CIS), despite the gains observed in April on consumers’ evaluation with regard to the present situation and expectations about the future, the score stands at only 73, well below 100, “the point at which starts the positive consumers’ perception” (efe.com).

The GfK EU Consumer Climate, which summarises in a single number overall consumer expectations for the upcoming month, pointed to a significant recovery in April in all its three climate components (country economic expectations, income expectations and propensity to buy). However, all three scores have been in negative territory for another month, particularly the last one (at -29), indicating a restriction on consumption (gfk.com).

Retailers’ confidence followed a similar recovery trend while taking off later, but has been posting an increasing optimist since January this year.

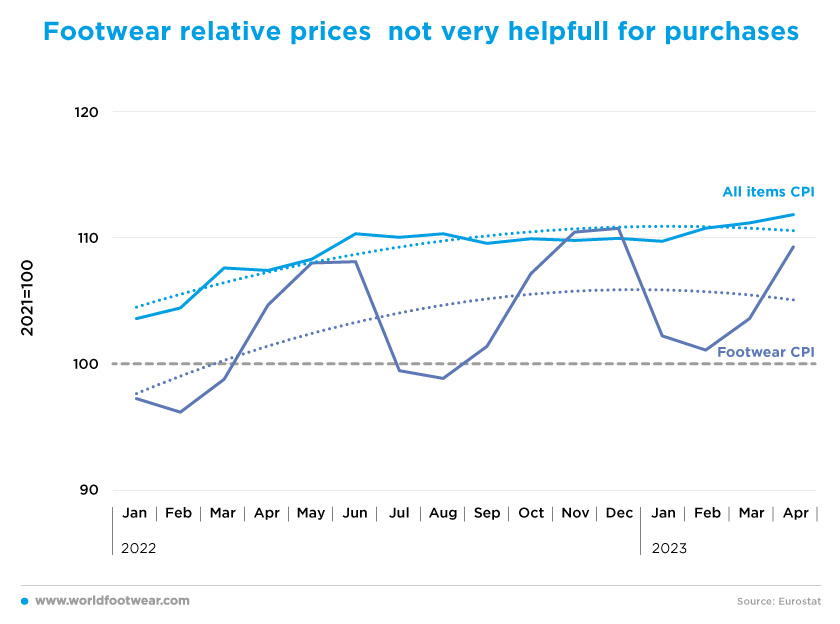

Footwear relative prices not very helpful for purchase

Although the consumer price indexes for all items and footwear followed an upward trend year-over-year, both have been softening since the beginning of 2023, which tends to help consumers’ propensity to buy and sell at retail.Nevertheless, footwear price increases are decelerating at a slower pace (from 4.9 percentage points in January to 4.6 percentage points in April), against more than 6 percentage points to 4.4 percentage points for overall prices (using the 2021 baseline). Footwear’s relative prices are now apparently less useful for footwear retail. This is most critical in Spain where “clothing and footwear continue to lose weight in the shopping basket (with) 3.7% in 2020, according to the Household Budget Survey (HBS) conducted by Eurostat, (…) the lowest figure recorded since the survey was conducted in 1988”(modaes.com).

According to data published by the National Statistics Institute (INE), “fashion is containing the rise in prices (with) the Consumer Price Index (CPI) for clothing and footwear recording a year-on-year increase of 2.2% in April, the lowest rise so far this year. Yet, footwear was the most inflationary category, having registered a 4.6% price increase in both men’s and women’s categories” (modaes.com).

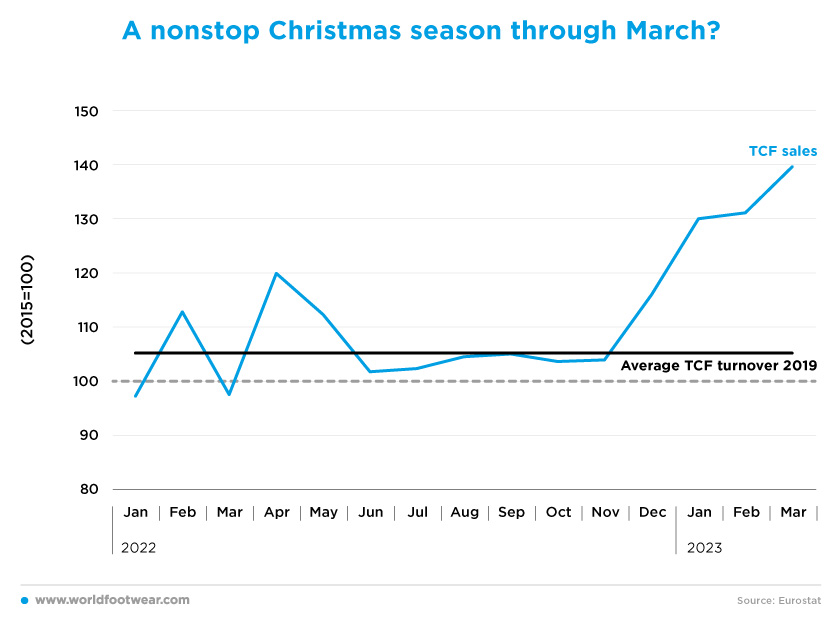

A nonstop Christmas season through March?

Notwithstanding the above, the TCF (Textile, Clothing and Footwear) Retail Index (seasonally adjusted, by Eurostat), which has been recovering modestly since June to November last year, soared thereafter, as if Christmas were an uninterrupted season for the entire first quarter of 2023. A gain of more than 34 percentage points in four months at the end of March is something that, if finally confirmed, neither the consumer confidence indicators nor the category price increases would have suggested. And if this is true, TCF retailers have definitely left the 2019 normality behind, which may be the reason for their recovered optimism.

However, the Acotex barometer from the National Association of Textile, Accessories and Leather trade suggests a much modest performance: “The sector is on an upward trend and continues to recover to pre-pandemic figures, (with) sales on April 5.4% higher than in 2022, leaving the annual cumulative figure at +6.4%” (www.acotex.org). But this data is not yet deflated.

Some companies’ fiscal yearly results go in the same direction. According to the analyst Marta Álvarez Guil concerning the internal data from El Corte Inglés, “consumption is beating forecasts, as shown by the fact that in the fiscal year closed on the 28th of February, the distribution group obtained an operating profit (more than 20%) higher than in 2019, the year before the pandemic”. These figures, pending final auditing, reflect the rise in consumer spending, especially in the fashion business, where it has the highest margin (elconfidencial.com).

At another scale, Hoff, a company specialising in sneakers that has fifteen shops in Spain, closed the year (period ending April) with sales of 46.5 million euros, slightly below the forecast of 48.5 million that the company set at the beginning of the year. This is the fifth consecutive year in which the company has doubled sales (modaes.com).

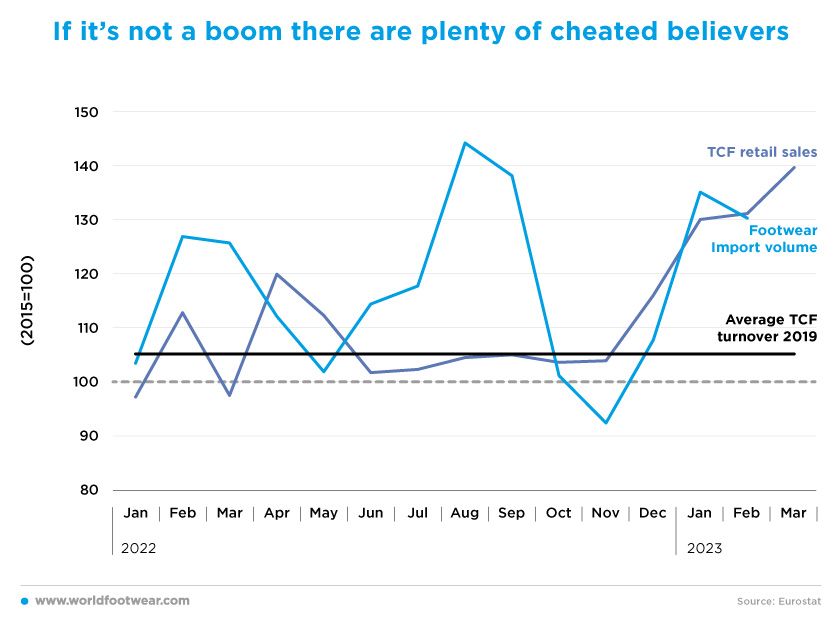

If it’s not a boom, there are plenty of cheated believers

Interestingly, the behaviour of Spanish footwear imports in volume (to discount the very high annual imported inflation in the category) also seems to have anticipated since November a boom of sales on the horizon: almost 38 percentage points of volume increase between November and February (discarding the still higher score in January). This contrasts sharply with the apparent import overshoot from June through September with no proportional supporting retail evidence, calling for a radical correction in the coming months.

Domestic footwear production may have also reacted to the big new opportunity for sales for the first quarter, but apparently, disappointment came sooner. According to the National Statistics Institute (INE), the industrial production index (seasonally adjusted) of the footwear industry in February 2023 fell by 9.8 % (20.7 % less than in January 2023, which has been a remarkable increase in footwear production). And, in March 2023, it fell again by 12.5% (revistadelcalzado.com).

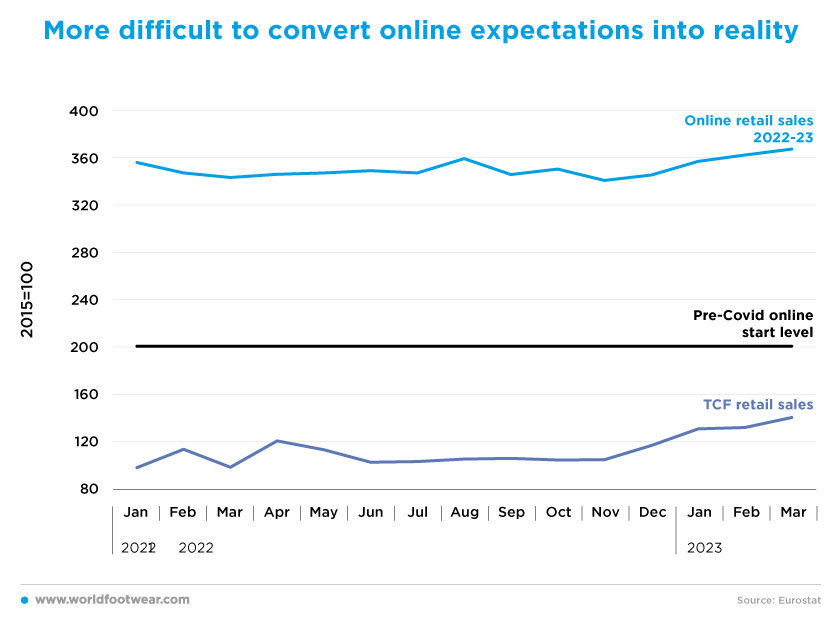

More difficult to convert online expectations into reality

The online sales performance also seems to be improving since November and, in the absence of specific data, there is no reason to think that the TCF category is not following the same path. However, the upward trend in overall retail TCF figures is more robust considering the same starting point in January 2022 (40 percentage points versus 11 percentage points).

Expectations for online sales in 2023 are overall positive, but the future annual growth of the channel compared to the terrific performance during the period 2020-2022 (up around 140 percentage points) may mislead the expectations.

The footwear company Mimao, which distributes its products in more than 150 multi-brand shops in the country, expects to grow by 30% in wholesale sales throughout 2023 driven by the boom in online and multi-brand sales, as Aaron Vilas, co-founder and marketing director of the company, explained to Modaes magazine. The online channel accounts for 90% of Mimao’s total turnover, but this includes other European countries besides Spain.

Other companies place high stakes in the e-commerce channel. For instance, 70% of Yuccs’ 10 million euros footwear sales are generated primarily online, but the company expects to reduce the share to 60% by 2023. And Castañer, which operates through its e-commerce and marketplaces such as Amazon has seen a 35% growth, although it represents (only) 10% of its total 24 million euros sales. But Castañer explained, “we have noticed a slowdown in recent months in e-commerce sales traffic” (modaes.com).