Register to continue reading for free

Spain Retail: footwear retail fears the end of the year on account of macroeconomic uncertainty

Looking exclusively into the available evidence from the comparison between the monthly behaviour of footwear imports and the TCF (Textile, Clothing, & Footwear) Retail Index in Spain, as well as the TCF Retail Indicator by Eurostat, there are not yet red lights on the retail side, so far. But, as more consumers struggle to make ends meet with high inflation and increases in gas and electricity, footwear retail is expected to soon be a victim of the need to divert from non-essentials. Meanwhile, online sales appear to have stabilized, so, with the COVID-19 influence out of the picture, it is up to retailers to continue investing in this channel, where there is much yet to be done

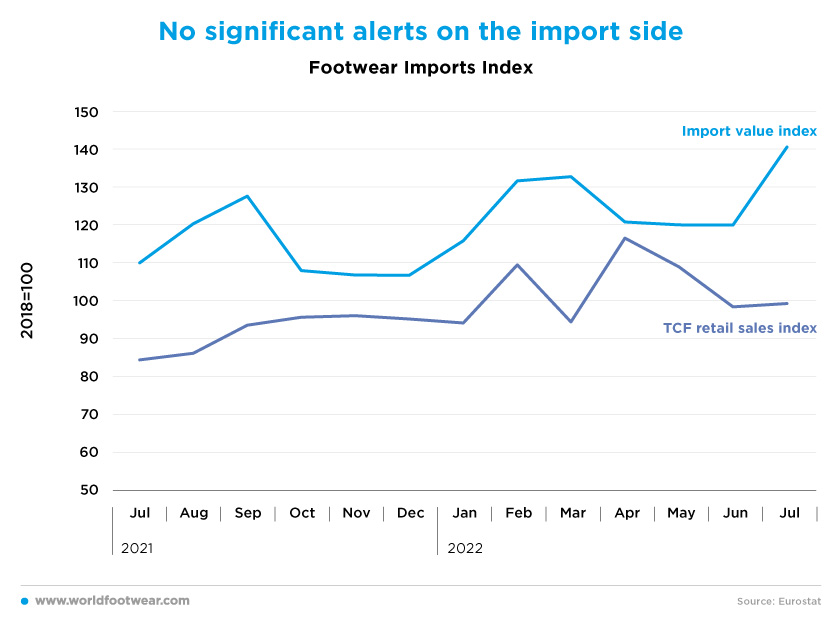

No significant alerts on the import side

Discounting for some difference in scope, the comparison between the monthly behaviour of footwear imports and the TCF (Textile, Clothing, & Footwear) Retail Index in Spain, in the last twelve months through July, shows that while retail appeared to be somewhat decelerating around the 2018 baseline, imports were still increasing in the same period.

Assuming that imports anticipate to some extent expectations about the footwear retail sales in the near future, perhaps importers (and retailers) were at the time not yet pessimistic regarding the prospects of retail for the second half of 2022.

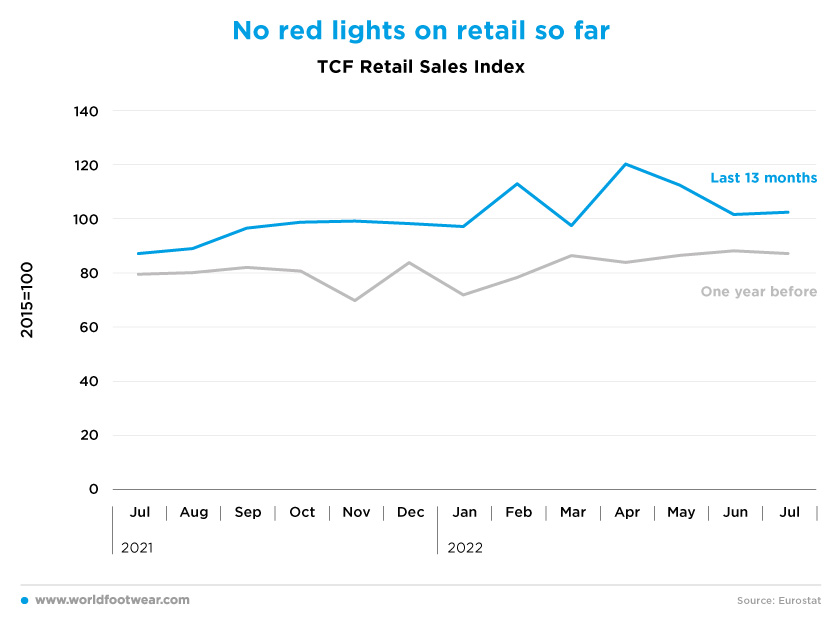

No red lights in retail so far

So far, evidence on the TCF Retail indicator (by Eurostat) is by no means negative. After finally converging to the 2018 baseline until October 2021, it was still there in June and July 2022. And, the two exceptions, were consumers’ aspirational peaks in February and April, promptly corrected after the understanding of the more lasting effects of Russia’s invasion of Ukraine.

According to the barometer of the Business Association of Textile, Accessories, and Leather Trade (Acotex), in July, fashion products’ sales increased by 9.6%, as compared to the same month of last year and grew in August by 12.3%. Consequently, the cumulative figure so far this year is +16.8%. Moreover, sales in July were not “as good as expected due to the lack of stock in stores and less aggressive discounts than in previous editions” (revistadelcalzado.com).

On the same page, the Mastercard Spending Pulse, describing the back-to-school period from the 15th of August to the 16th of September (“one of the key spending seasons for retailers and a critical bellwether of the fortitude of the consumer”) registered a 21.9% increase in clothing, as compared to the same period of 2021 and a 13.9% in overall retail (www.mastercard.com).But the big question is how sustainable this picture is for the remaining 2022.

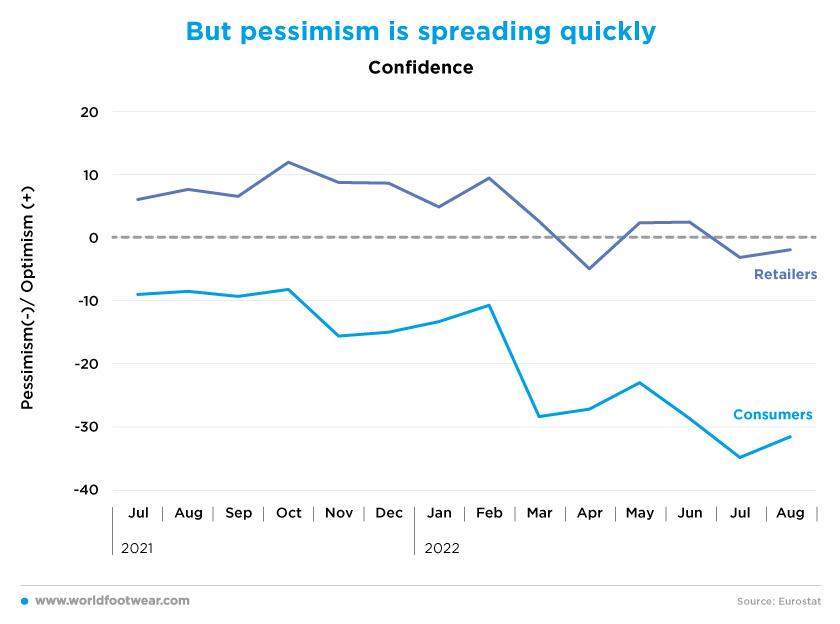

But pessimism is spreading quickly

Confidence indicators in Spain (Eurostat) from both consumers and retailers are clearly at the heart of the issue. Through February this year, both surveys suggested mixed feelings about the pandemic prospects and its lasting effects on the global supply chain. But after Russia’s invasion of Ukraine, uncertainty is spreading quickly among consumers and retailers. “In Spain, whose economy has benefited from a post-lockdown rebound in tourism, elevated prices are already hampering job creation and hurting consumer confidence” (www.bloomberg.com).

Furthermore, according to a study carried out by the online price comparator Idealo, 52% of Spanish cannot make it to the end of the month. To try to do so, they have begun reducing their expenses, mainly on products such as clothing and footwear (revistadelcalzado.com).

The already quoted Acotex business trade association also reported being pessimistic about the end of the year: “we expect that the last quarter of the year will be complicated and with a lot of uncertainty, since all the economic organizations point out that consumption is going to retract due to the increase in gas and electricity prices, the shopping basket, etc. In short, with inflation above 10%, families have less disposable income and therefore reduced consumption” (revistadelcalzado.com).

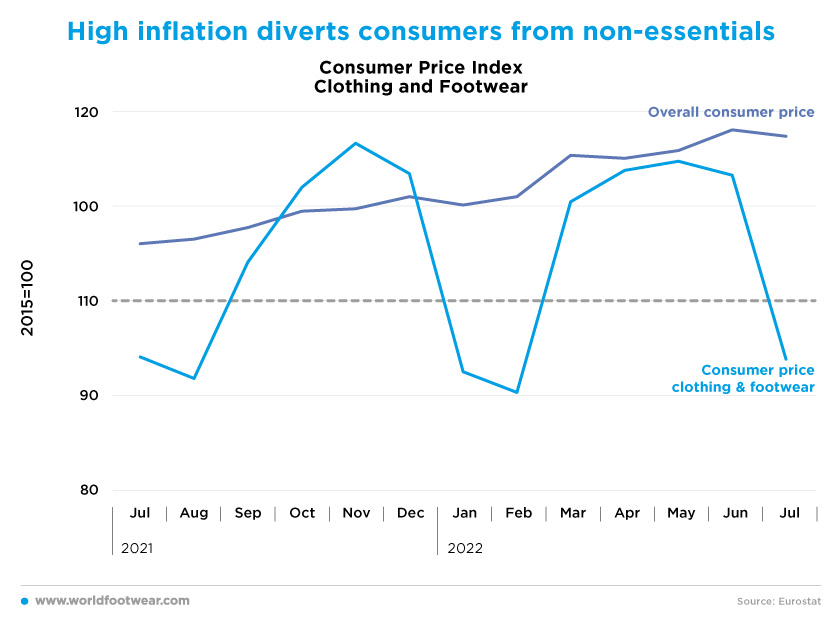

High inflation diverts consumers from non-essentials

The overall Consumer Price Index (Eurostat) increased in the last twelve months increased by more than 10 percentage points, as compared to the 2015 baseline, while the Clothing & Footwear component, despite its traditional seasonal pattern, is curbing downwards since February. However, the specific seasonal profile of the Consumer Price Index for footwear alone (by the Spanish Statistical Institute) is not coincident with the combined category C&F, beginning to trend down much before the combined one.

Commenting on the fact, the specialized magazine Revista del Calzado reported on its website that “shoe prices last July reached levels not seen in the last twenty years. Since 2002, the year in which the consumer product index (CPI) for shoes in Spain recorded percentages above 6%, footwear prices in our country have never been so high. Even so, the CPI for shoes is still practically half that of the general index, which, dragged down by the runaway inflation of fuels, electricity and fresh food, registered a growth of 10.8% in July” (revistadelcalzado.com)

So, summing it up, we share Mckinsey’s conclusion that as “spending for groceries and gasoline soared, consumers have reduced money directed to savings and spent less on non-essentials” (www.mckinsey.com), which means footwear retail is soon expected to be a natural victim.

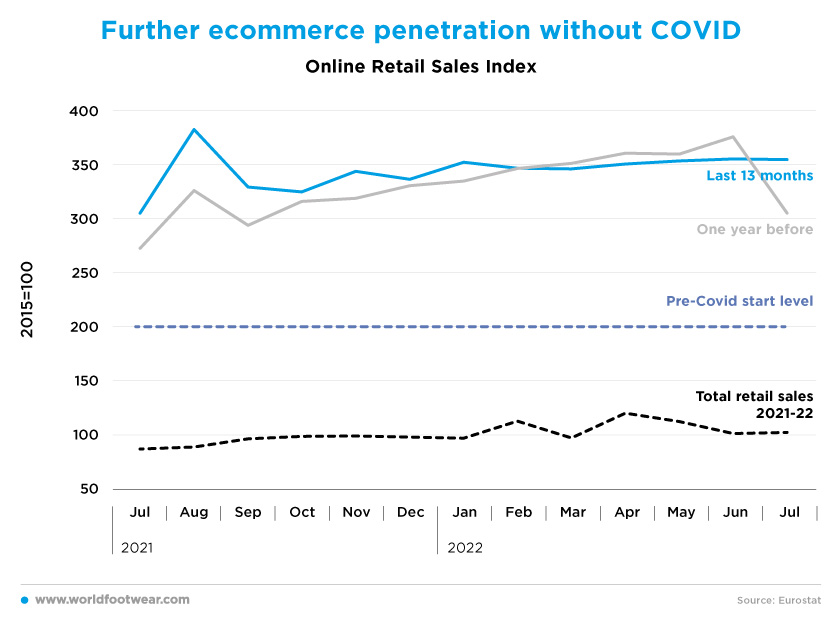

Further ecommerce penetration withouth COVID

After being strongly fed by two years of COVID-19-related restrictions, online retail sales appear to have stabilized, yet about 150 percentage points above pre-pandemic levels.

This stability is recognizable in overall retail sales until July, while the Mastercard Spending Pulse, previously referred to, pointed in Spain as recently as mid-September to the fact that in-store retail is growing at a much higher rate (+13.9%), as compared to online (+1.5%).

For lack of monthly data, we cannot assess if the same dynamics hold for clothing and footwear demand, concretely, in both channels. The COVID-19 accelerator on the online demand of the category seems, nonetheless, to have lost some drive: the increase in the number of consumers (from 20 to 21 million) and the percentage of e-commerce consumers that purchased this top category in Spain (from 63% to 64%) has moderated.

Thus, with the COVID-19 influence exiting the picture, the power for continued online penetration will be more dependent on the supply side, that is, on retailers’ efforts to push further this channel in Spain. Reading the recent news from Camper, Pikolinos, El Naturalista, Misako, and the achievements of Zara in this field, among others, we understand that much is yet to be done regarding online.