Register to continue reading for free

France Retail: the retail boat is sitting on the water waiting for the wind to pick up

After a somewhat mixed performance over the summer, highly impacted by short-lived events such as the postponement of sales due to the riots or August’s heatwave, some signs suggest that retail in France could improve next year. Consumers seem to be less pessimistic about rising prices and their personal financial situation. But it all comes down to the trajectory of inflation, and whether food and energy prices will effectively ease until the end of the year

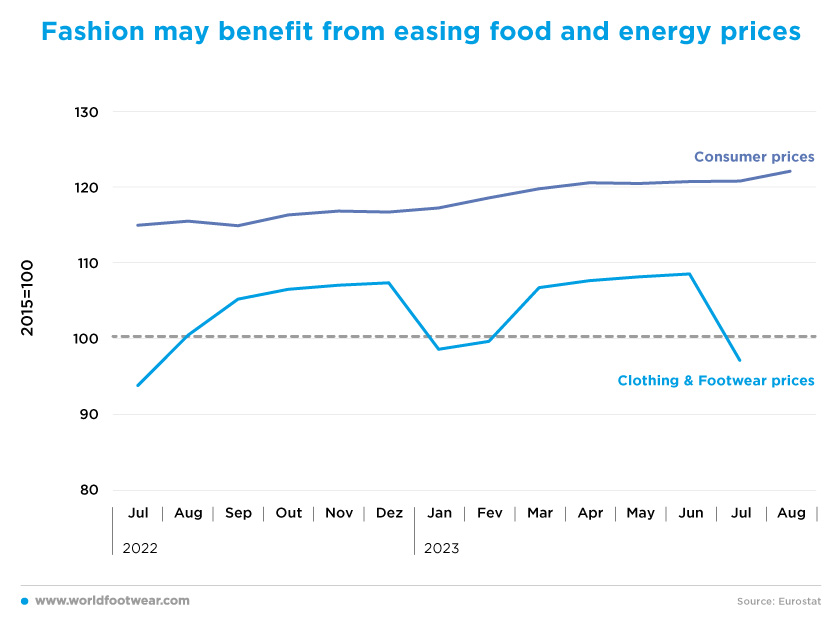

Fashion may benefit from easing food and energy prices

As noted in previous editions of the WF Retail Flash, the dynamics of footwear retail sales have been negatively affected by strong inflationary pressures since the second quarter of 2022, after Russia invaded Ukraine. France was not an exception.Essential goods such as energy and food triggered this process, capturing larger shares of consumers' disposable income, which has been detrimental to non-essential goods such as clothing and footwear – despite efforts to not fully pass on higher costs to the consumers. According to the Chambre de Commerce et Industries (CCI), “88% of retailers have seen a rise in prices from their suppliers this season, which they have passed on in full (22%) or in part (55%) in their selling prices”.

At the close of July, the consumer price index for footwear continued to increase by 3.5% year-over-year, while the all-items consumer price index (by Eurostats) rose by 5.1%.

But, so far, the outlook is not so positive because preliminary EU-harmonised official data shows that “French inflation accelerated more than expected in August (to 5.7%), as a new fall in food inflation was more than offset by higher energy prices” (reuteurs.com).

Expectations for clothing and footwear retail in 2023 therefore depend on the fact that “inflation in France should slow slightly more than expected between now and the end of the year, as pressure on food prices eases” indicates the French Institute INSEE.

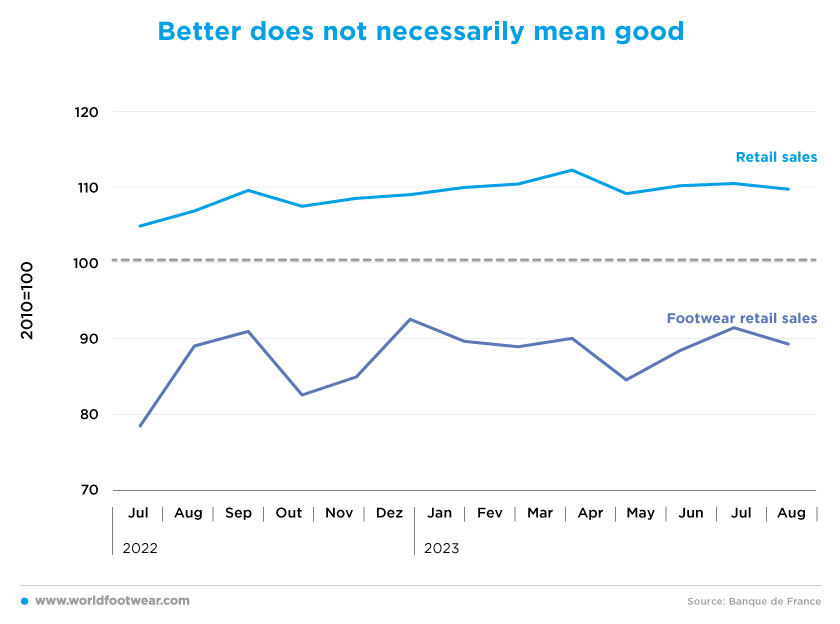

Better does not necessarily mean good

Although footwear retail sales (by BdF) have increased about 11 percentage points in a year at the end of July, the performance since the start of the year is fairly stable, 10 percentage points below the baseline. But, as the Federation of PROCOS Retailers points out, this growth is somewhat misleading: “Specialised retail sales in July were up by 9.4% on July 2022, but this figure should be put into perspective, as July 2022 was down sharply (by 6.5%) on July 2021”.

In fact, the performance in the Summer was mixed. Whereas clothing chains in the Int. The retail panel for the Retail Alliance recorded an increase in in-store sales of 15.7%, as compared to July 2022 (…), mainly due to the postponement and extension of the summer sales up to and including the 1st of August, caused by the riots that affected many retailers (…) there was a (6.4%) drop, mainly in the second half of August, due in particular to the heatwave, which impacted negatively store footfall and the launch of the new autumn-winter collection.

In addition, the National Apparel Federation (FNH) warned that “after two weeks of summer sales, independent multi-brand and single-brand retailers were not enjoying the same momentum as department stores”.

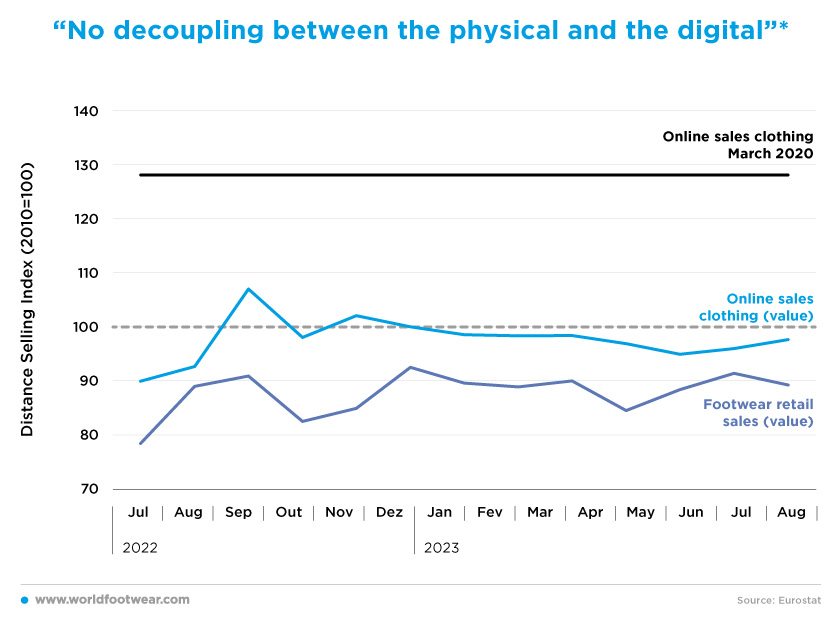

“No decoupling between the physical and the digital”*

According to the Distance Selling Index (by BdF), the dynamics of online clothing retail since the start of 2023 are no better than the offline's. In June and July, the index appears to point to a slight recovery, as “the first weekend of the sales (was) heavily impacted by vandalism at points of sale resulting in stores (shopping centres, town centres, etc.) being closed”.August figures, in which online sales increased by 17% year-over-year, are consistent with the idea that “the heatwave did not encourage people to go to the stores” (alliancecommerce.org).

Since these growth factors are short-lived, the downward trend observed from November 2022 may as well prevail. Gildas Minvielle, Director of the economic observatory at IFM (French Institute for Fashion) corroborates this conclusion, stating that “at the moment (…) there is no decoupling between the physical and the digital*”, therefore estimating that “digital sales will not be dynamic in 2023”.

On the contrary, FEVAD (the E-commerce and Distance Selling Federation) believes that “e-commerce today appears to be a solution for French families in the face of current economic difficulties: rising inflation, pressure on raw material prices, and declining household purchasing power”.

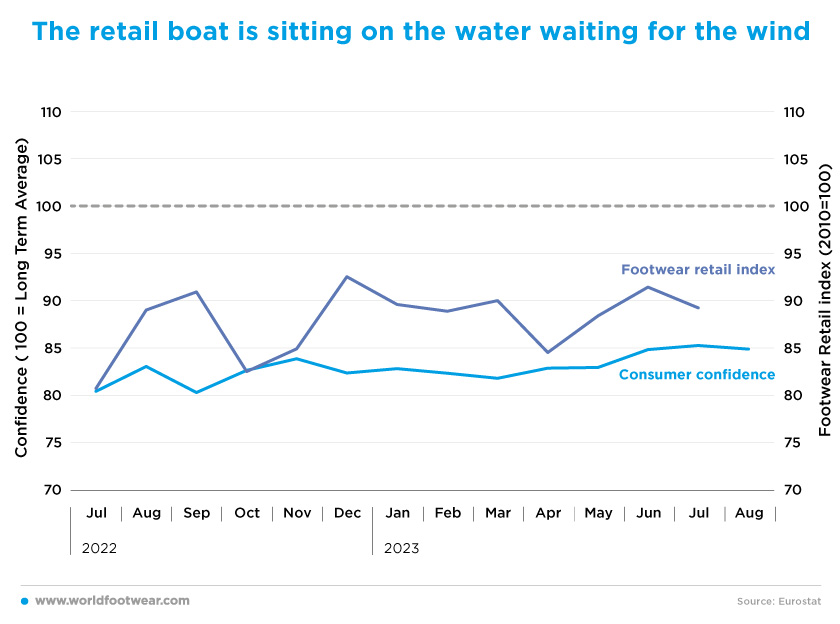

The retail boat is sitting on the water waiting for the wind

The Synthetic Consumer Confidence indicator (by INSEE) for the year at the close of August shows a slight upward trend, which favours general growth in the retail trade over the next 12 months, mainly due to less pessimism about rising prices and an improvement in the personal financial situation.

However, as seen above, the footwear retail index (seasonally adjusted) has been flattening since the start of 2023, so small improvements in confidence do not automatically translate into gains in retail, let alone gains in small ticket purchases such as footwear.

Altogether, for the time being, it seems that the retail boat is sitting on the water waiting for the wind to pick up. This makes it difficult to endorse an “outlook for business activity at the end of 2023, which suggests the start of an improvement that will undoubtedly bear fruit in 2024” (procos.org).