Register to continue reading for free

UK Retail: the second quarter might have been the lull before the storm

Despite a 6 percentage points gain in the TCF (Textile, Clothing, & Footwear) Retail Sales Index in the second quarter of 2022, over the prior one, and a positive trajectory in footwear imports, prospects do not look good for retail. Amidst skyrocketing inflation and the worst consumer sentiment since 1974, the footwear consumer can barely afford further price increases, making the retail volume tilted to the downside. With the threat of a recession from the fourth quarter on, the majority of retailers believe that the cost-of-living crisis will be almost twice as damaging as the COVID-19 pandemic

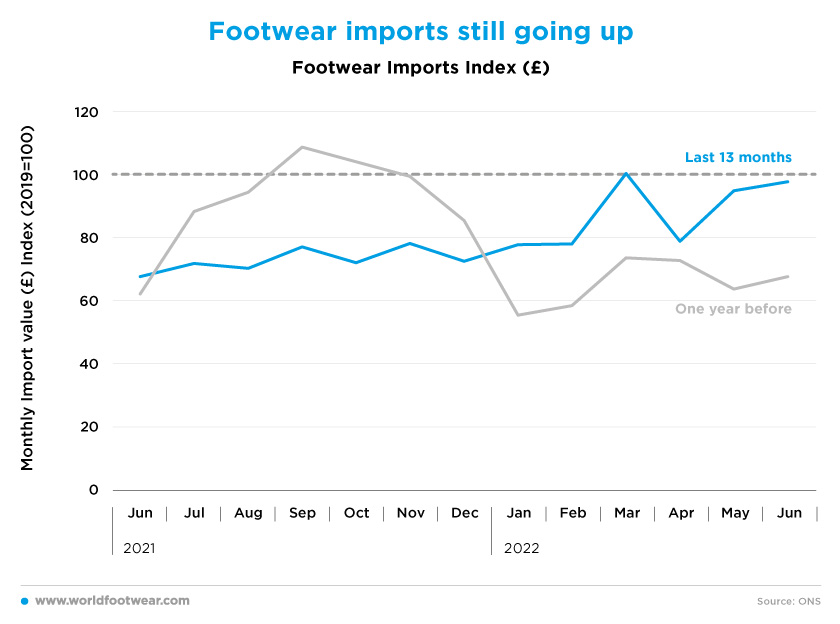

Footwear imports still going up

The latest data available for the UK footwear imports in the last twelve months, closing in June 2022, indicates a positive trending trajectory, while still below the 2019 baseline. As the UK is an intensive footwear importer, this could well help us anticipate positive prospects for footwear retail in the near future, given that the COVID-19 pandemic-related restrictions of the previous year are definitely far behind.

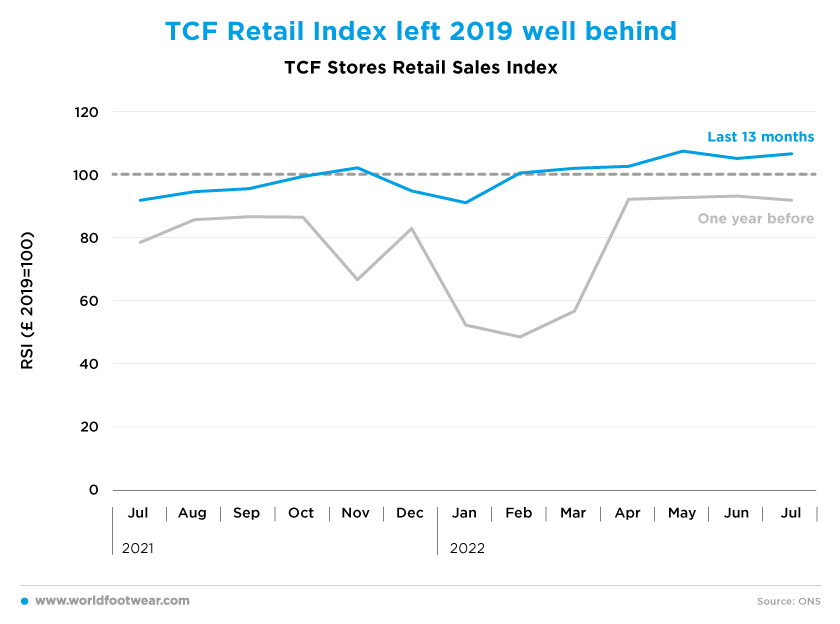

TCF Retail Index left 2019 well behind

The four months through July confirmed that the TCF (Textile, Clothing & Footwear) Retail Sales Index is now clearly above the 2019 pre-pandemic baseline, indicating average gains of about 6 percentage points over the performance recorded in the first quarter of 2022.

Unfortunately, it would be unlikely to see this positive picture prevail for both Autumn and new Winter, if not further on. As Paul Martin, UK Head of Retail at KPMG, stated recently, “the summer could be the lull before the storm” (bloomberg.com, August 2022).

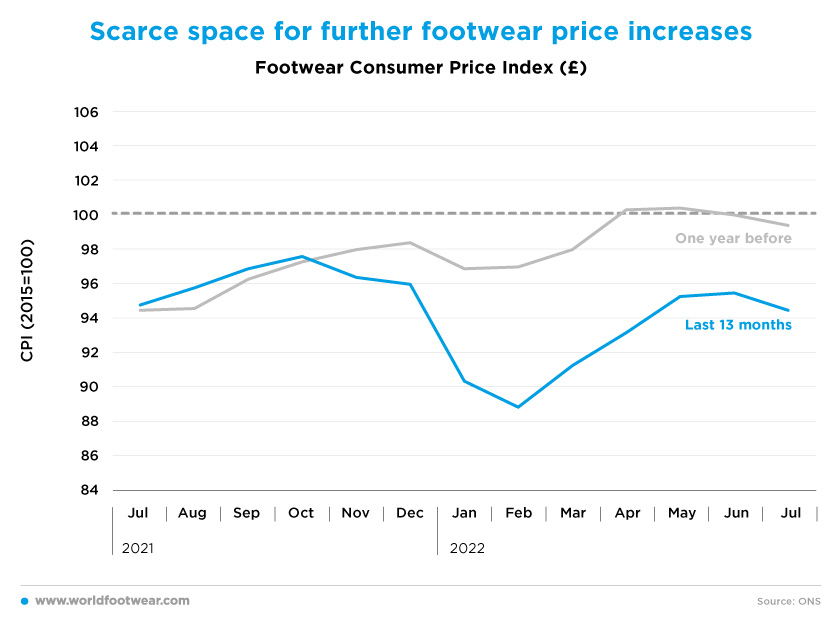

Scarce space for further footwear price increases

Footwear prices have ceased their upward trend since April, and appear to be resisting further improvements beyond the 2015 baseline. This means that the footwear consumer can barely afford further price increases, making the retail volume tilted to the downside. The fact is that inflation jumped to 9.4% in June, and then to 10.1% in the following month, leaving the Bank of England focused on bringing it back to its 2% target by increasing interest rates even at the cost of curbing growth.

According to the Ankorstore’s first Summer Retail Trend Report, supported by the British retail champion Mary Portas, “74 % of retailers believe that the cost-of-living crisis and current inflation hitting a 40-year high at 10.1% will be almost twice as damaging to the UK’s high street than the Covid-19 pandemic” (thetimes.co.uk, 22nd August 2022).

On the same point, Louise Delglise-Favre, GlobalData’s associate apparel analyst, said that the rise in interest rates “announced last week is really going to squeeze people’s budgets”, as consumers will have to pay more for their mortgage, which will “of course limit the amount of money that can be spent on non-essential items such as clothing, one of the categories that usually suffer when budgets are squeezed” (just-style.com, August 2022).

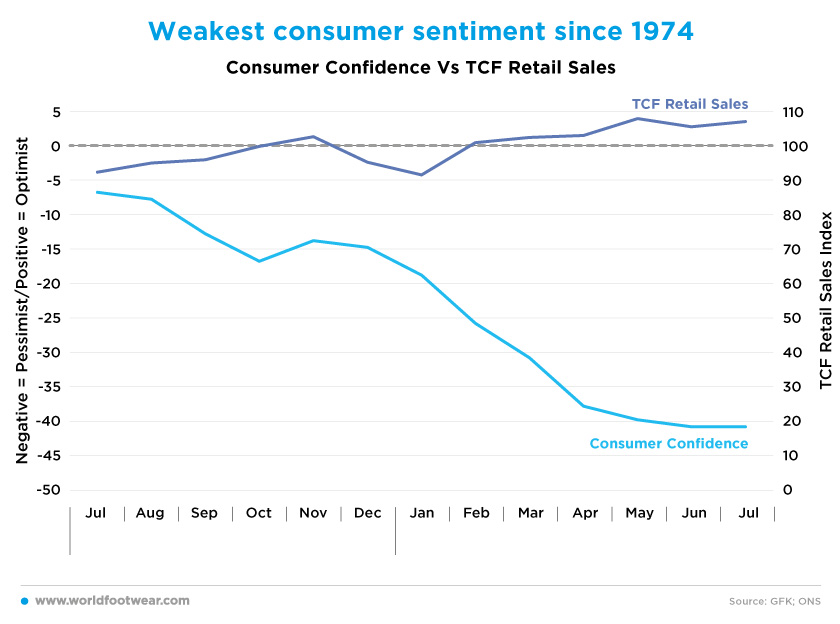

Weakest consumer sentiment since 1974

The indicator of Consumer Confidence in the UK (GfK) has been trending down since July 2021. As stressed by a GfK consumer survey, households are “exasperated” by the surging costs of living, and their sentiment is the weakest since the series began in 1974 (fashionnetwork.com, August 2022).

Should any doubts persist regarding the prospects for TCF retail, last but not the least, the Bank of England announced that “the United Kingdom is projected to enter recession from the fourth quarter of this year. Real household post-tax income is projected to fall sharply in 2022 and 2023, while consumption growth turns negative” (Monetary Police Report, August 2022).

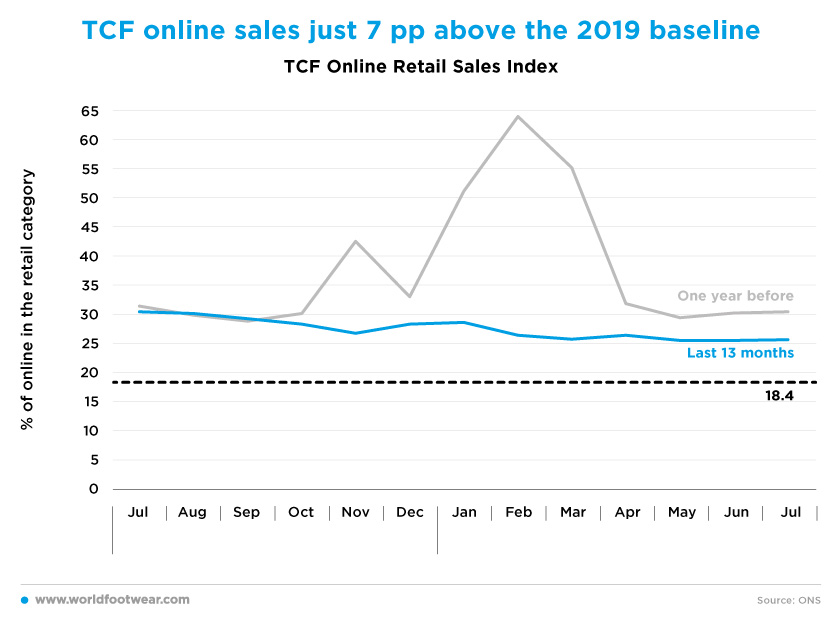

TCF Online Sales just 7 percentage points above the 2019 baseline

Most surprisingly is the penetration rate of TCF online retail of no more than 25.7% of the total TCF retail recorded in July 2022. This figure is only 7 percentage points above the ground-zero of the pandemic in February 2022, and it is lower than the 27.5% share registered in March of the same year, when the shift to online began to take place. The lasting glamour of online retail seems to be shining less than it was supposed to.

Quoting Andrew Goodacre, Bira’s CEO, while fashion online outperformed expectations in July “driven by the return of the wedding season following the two-year hiatus, which boosted formal wear sales considerably” it “has fallen more than store sales, probably as a result of much higher sales in the same period last year”. “Clothing & Footwear was the only segment to see prices fall within Non-Food, as retailers were enticing consumers back to stores with significant discounts” (bira.co.uk, August 2022).

Moreover, “the CBI figures suggest that online sales fell in August compared with the same month in 2021. The net balance for internet shopping was at -7%, up from -37% in July. Online sales are expected to stagnate next month. Retailers plan to cut back on investment in the next year amid concern that Britain is heading for a recession caused by the cost-of-living crisis” (thetimes.co.uk, 26th August 2022).