Register to continue reading for free

UK Retail: retail prospects for the next months lean to the downside

In the first quarter of 2022, TCF (Textile, Clothing & Footwear) Retail Sales Index returned to pre-pandemic levels, showing that it is no longer sensitive to COVID-19. However, its positive behaviour is somewhat puzzling: consumer pessimism continues to plunge, most likely due to the rising inflation, which hit a record 7% in March, placing pressure on manufacturers’ costs. In addition, it is yet early to quantify the impact of Russia’s invasion of Ukraine on European retail markets

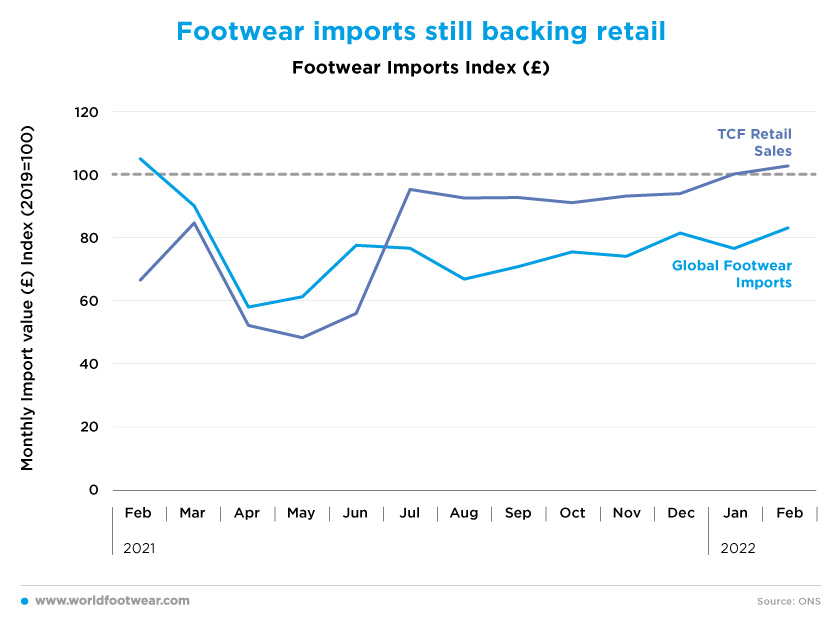

Footwear imports still backing retail

Taking footwear imports as an advanced indicator of retailers’ prospects in the near future for footwear sales, it is possible to infer from the available evidence on footwear imports through February that retail returned to “business as usual” in the first quarter of the year.

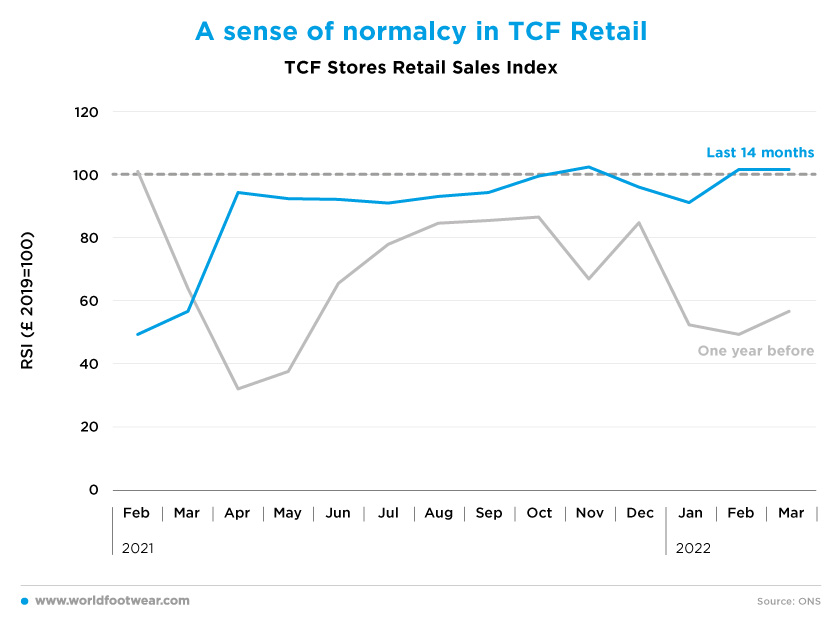

A sense of normalcy in TCF Retail

“March saw another gradual improvement to footfall levels across the UK. As the first full month without coronavirus restrictions in England and Northern Ireland, consumers were able to shop with a greater sense of normality, spurred on by some spring sunshine”, commented Helen Dickinson, the Chief Executive of British Retail Consortium (fashionunited.uk, April 2022).

However, Sophie Michael, BDO head of retail and wholesale, made clear in a statement that “there are also concerning signs that some of this spending is being supported by record levels of household borrowing, which has increased lately even as consumer confidence plummets” (fashionunited.uk, April 2022).

Footwear prices, a false friend for retail

While retail appears to have recovered some normalcy, footwear retail prices have followed an upward trend during the last year. The consumer price index (CPI) for footwear is again only 2 percentage points below the 2015 baseline – pretty much the same level recorded in March 2019, just as before the pandemic.

However, given that the pressure of demand recovery depicted by the TCF retail numbers has been, so far, very soft, the engine behind the footwear price increases must be placed on cost inflation, not upon demand.

This is perhaps better exemplified by the British brand Dr Martens, which said that “the cost of almost every aspect of its footwear had gone up – including the leather, metal eyelets, soles and shipping costs – because of demand for commodities and wage inflation”. Its Chief Executive, Kenny Wilson, added: “we have been holding off on price increases, but we will need to [change that] as of autumn/winter next year.” (www.theguardian.com, December 2021)

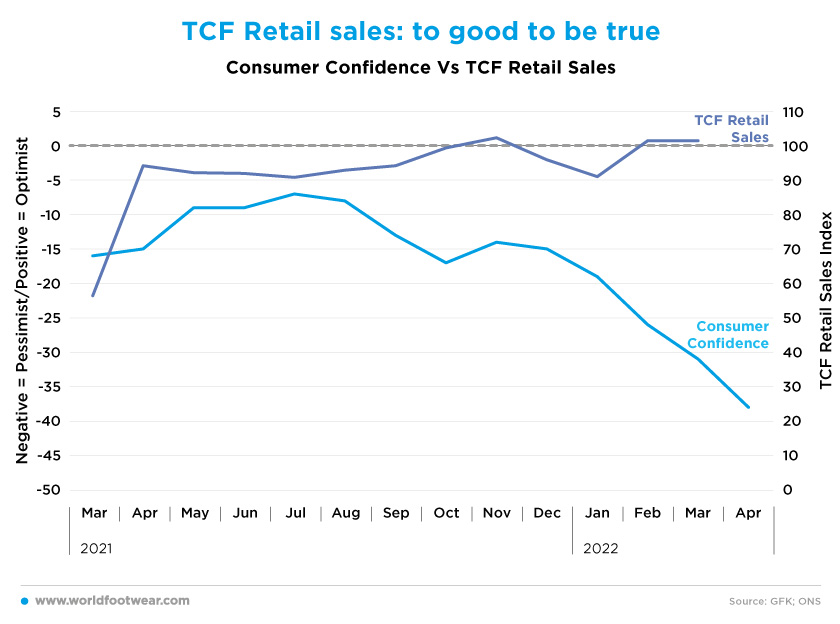

TCF Retail sales: too good to be true

So far, the main explanation for such poor consumer feeling relies on the fact that the UK’s annual inflation rate increased to 7% in March, the highest since the same month of 1992, due to higher fuel and petrol prices.

“The cost crunch is really hitting the pockets of UK consumers and the headline confidence score has dropped to a near-historic low”, commented Joe Staton, Client Strategy Director at GfK. “The personal finance score for the next year is also worse than the initial Covid shock in 2020. When rising inflation and interest rates meet low growth and declining incomes, consumers will understandably be extremely cautious about any spending. There’s clear evidence that Brits are thinking twice about shopping. With little prospect of any economic relief on the horizon, we can only forecast further falls in the index”, he added (fashionunited.uk, April 2022).

In addition, it is still too early to quantify the full shock waves on European retail markets following Russia’s invasion of Ukraine on the 24th of February. Nonetheless, prospects for the next months are strongly tilted to the downside.

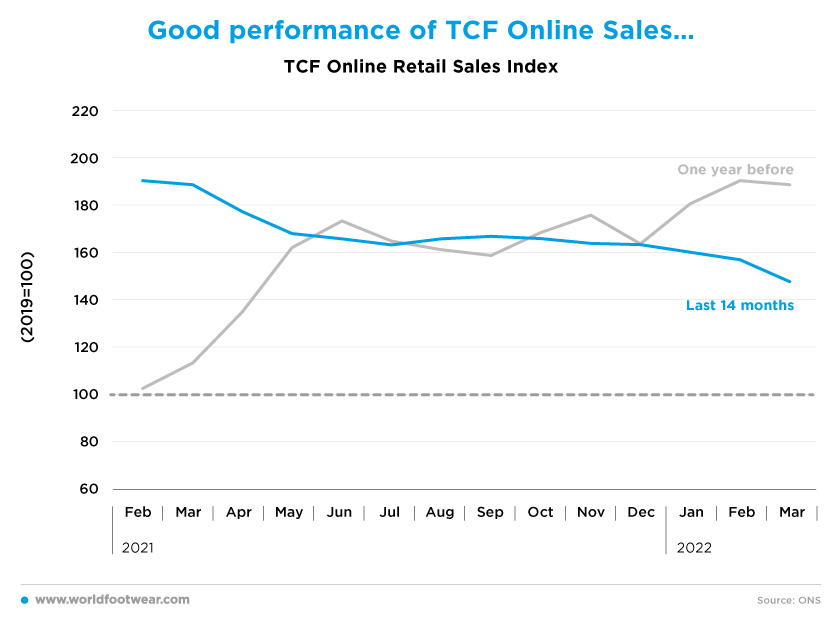

Good performance of TCF Online Sales…

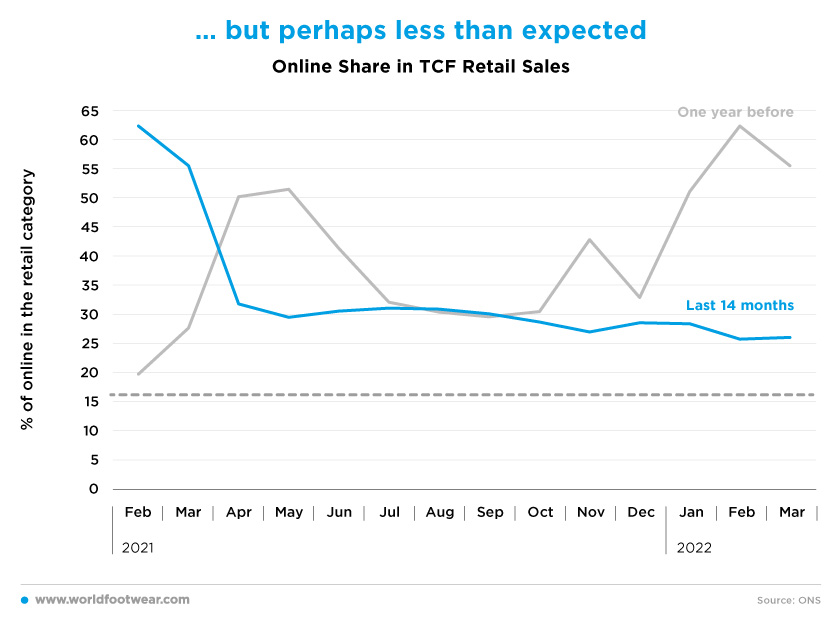

As seen in previous flashes, in March 2020, the COVID-19 impact took a dramatic toll on the overall TCF Retail Index (a loss of 37 percentage points), benefiting online retail instead. At the time, the internet of the TCF category increased by about 8 percentage points to 27.5% of the overall TCF retail in the month.

Now, in March 2022, the TCF Online Retail Sales Index showed an absolute gain of about 35 percentage points, as compared with February 2020. Apparently, this is good news…

… but perhaps less than expected

Against all expectations, the online share of TCF retail in March 2022 has barely exceeded a gain of 6 percentage points in the UK. If the numbers from the Office for National Statistics are accurate, the performance of the past two years was quite disappointing, as the same gain could have been achieved in a similar period in the absence of the pandemic. For instance, taking the two years before the pandemic, the online TCF retail share gain has been much higher, in the 9-percentage points range.

Lucy Reece Raybould of the British Footwear Association (BFA) says: “Our analysis of Q1 2022 footwear imports and associated retail data highlights a record start to the year, but this is all set to change with the rising cost of living, especially the rocketing cost of fuel, making discretionary purchases far harder. According to the Office for National Statistics, the value of footwear imports rose at a double-digit year-on-year rate for the third straight month in March, reaching a seventeen-month high of £457 million, the highest March on record. Largest-supplier China saw its footwear shipments to British shores sail 47.1% beyond the year-ago level to £134 million in March, the biggest month in four and a half years. Other suppliers also fared well, with shipments from the European Union jumping 34.0% while imports from the rest of the world climbed a comparable 31.3% from 12 months earlier. Sales of footwear and leather goods typically ebb and flow in step with consumer confidence. The sharp erosion in confidence noted over recent months strongly suggests these sales are likely to downshift, likely starting in the second quarter. To be clear, despite these impediments we continue to expect UK demand for footwear and leather goods will expand in 2022. But we caution that full-year sales are likely to slow sharply from the robust rate experienced at the start of the year. We expect a full recovery for UK footwear demand to the 2019 record is unlikely until 2023 at the earliest.”