Register to continue reading for free

Spain Retail: the future of footwear retail is clouded for the rest of the year

It’s not all bad news. The downward trend recorded by the TCF deflated retail sales index from April onwards remains above last year’s figures, and consumer confidence is about to reach a positive threshold. However, consumer footwear prices show yet no signs of slowing down, and, above all, imports in the category seem to be declining. These two factors could in fact be a warning of a further deterioration in footwear demand in Spain by the end of the year

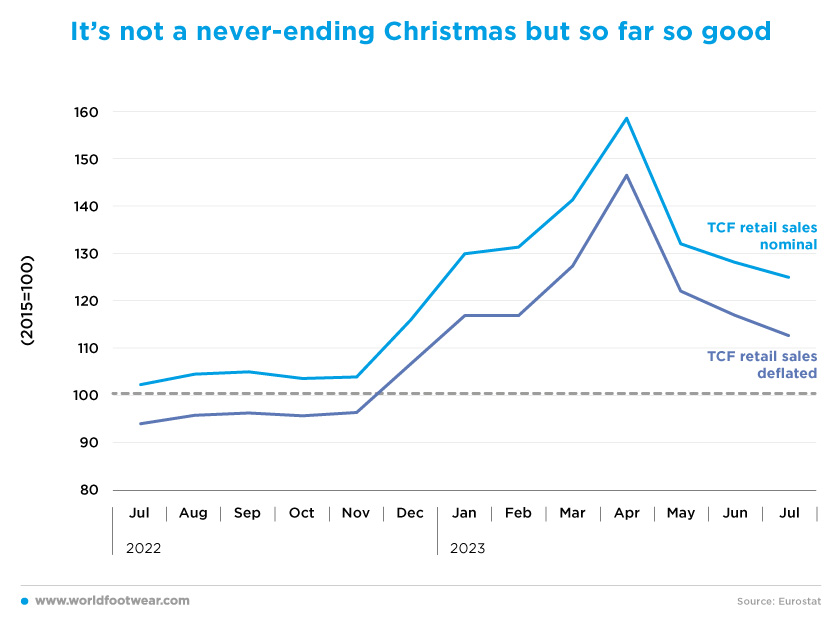

It’s not a never-ending Christmas but so far so good

There isn’t such a thing as never-ending Christmas. After growing continuously by 47 percentage points above the baseline during the five months to April 2023, the TCF (Textile, Clothing and Footwear) deflated Retail Sales Index (by Eurostats) lost 34 percentage points of its brightness in the following three months. However, the deflated value is still 13 percentage points above the 2015 nominal baseline and 19 percentage points above the same close in July last year.

This isn’t necessarily bad news if the TCF’s retail performance stabilizes at the July score, as it did last year, only to take-off again in November. Other indicators need to be considered in order to guess what might happen from now on.

If Mango, the European fashion group, speaks for the category, the outlook may actually be positive for retail, as the company plans “to extend its capillarity in Spain with more than fifteen store openings this year and the refurbishment of another fifteen stores”, which suggests that Spain made a convincing contribution to the “20% growth (YoY) of their overall turnover in the first half of 2023 and up to 30% more than the same period in 2019, surpassing pre-pandemic figures”.

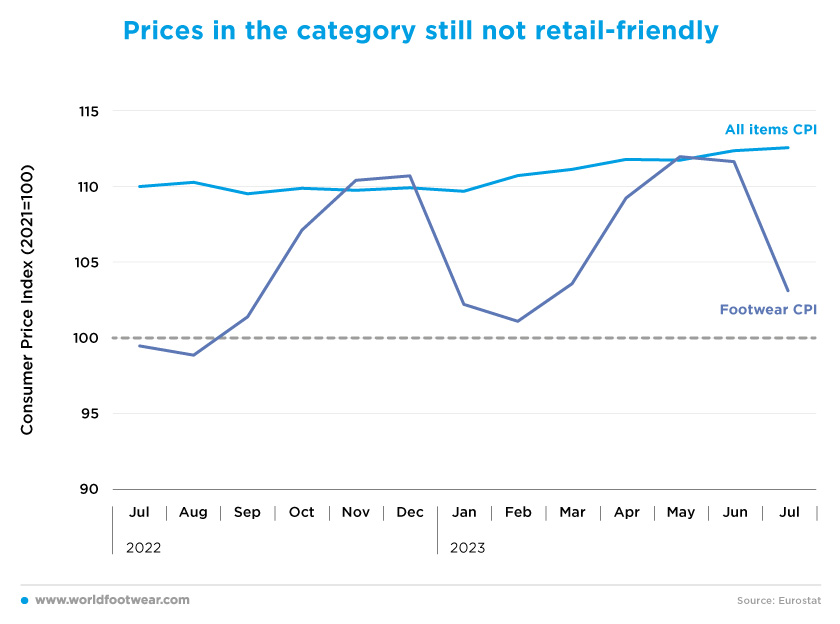

Prices in the category still not retail-friendly

The overall high inflation that followed the war in Ukraine has, in general, been a hard constraint for fashion retail due to the diversion of consumers’ disposable income to non-discretionary items such as food and energy. But the remarkable improvement in Spain of the TCF retail sales index from December 2022 through April seemed to indicate that consumption in the category hadn’t been caught in this trap.However, in the subsequent months, the Clothing and Footwear Retail Index began a downward trajectory. Consumer prices, in particular those of footwear, may help explain why.

“Fashion inflation (accelerated again) in August. The Consumer Price Index (CPI) for clothing and footwear recorded a year-on-year rise of 2.2%”. But “the consumer price index for footwear rose (in August) by 3.5%, one point up the (all items) consumer price index that remains contained at around 2.5%” (revistadelcalzado.com).

Even so, data on industrial production shows that fashion manufacturing continues to moderate the rise in prices, recording, as of July, the lowest growth rate this year. For footwear production, in particular, this price restraint is essential given the continuation of its “negative trend, which has been dragging on since the beginning of the year, falling 21.7% in July (YoY)”. This is true for both the export and domestic markets, which means that the outlook for footwear retail may be negative.

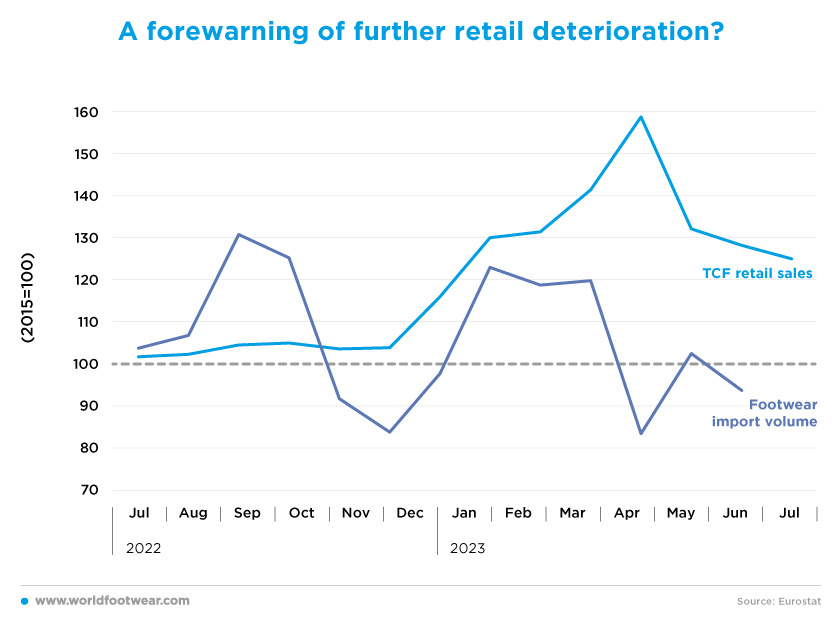

A forewarning of further retail deterioration?

Footwear imports may also help us to foresee what to expect for retail after July.“In the first five months of this year, footwear imports increased by 5.9%, as compared to the same period in 2022 in volume, (while they) fell by 2.5%, as compared to the figures from January to May 2019” (revistadelcalzado.com). However, after the peak in imports recorded in January, the trend is clearly negative, especially from the second quarter on, due to the April plunge.

While footwear retail remained unstoppable in April (both in nominal and deflated terms), the imports index had already predicted a significant fall in retail in the following months, confirmed by the retail figures from May through July.

Going ahead, imports lost 10 percentage points year-over-year at the end of June, which contrasts with last year’s upward trend. But remember that the increase in footwear imports last year proved to be a frustration for importers, since retail ended up being flat until November.

Therefore, the behaviour of footwear imports so far could be a forewarning of a further deterioration in demand for footwear in Spain.

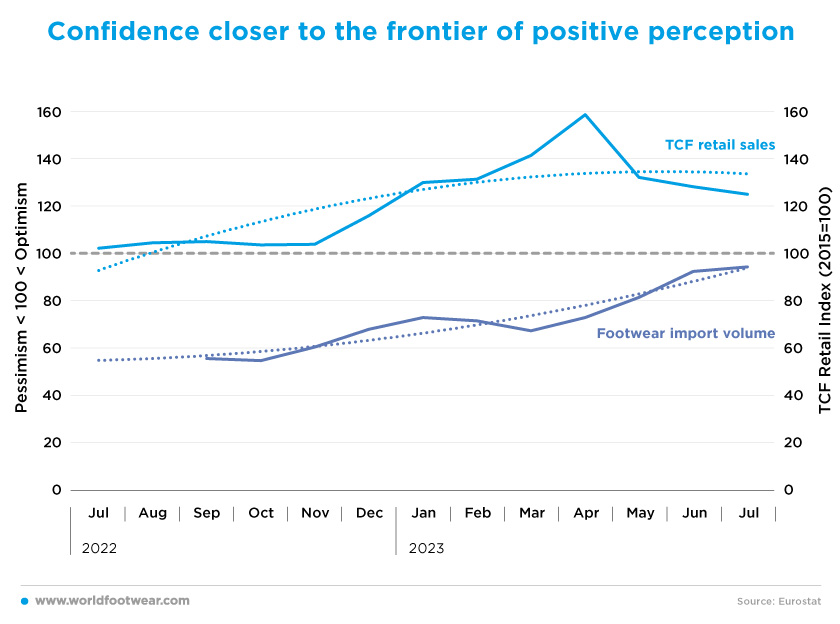

Confidence closer to the frontier of positive perception

The Consumer Confidence Index (by the Sociological Research Centre CSI/INE), improved in Spain almost to 95 percentage points, the highest level since October 2021, 34 points percentage points above the close of July, year-over-year. This translates into an acceleration toward the frontier, where Spanish consumers’ perception becomes positive (score 100). But it’s a broad macroeconomic indicator that scarcely allows us to anticipate the dynamics of micro-retail segments.

That’s why it’s not surprising that TCF retail sales, which translate the demand for TCF from increasingly confident consumers, although not yet displaying a clear downward, are, at best, losing momentum.

Among the components of the synthetic confidence index, some of them are pushing down the TCF index in July. “Expectations of the future remained virtually unchanged from June” (expansion.com) and, for instance, expectations of an increase in consumption were minor, while fears of inflation intensified in July.

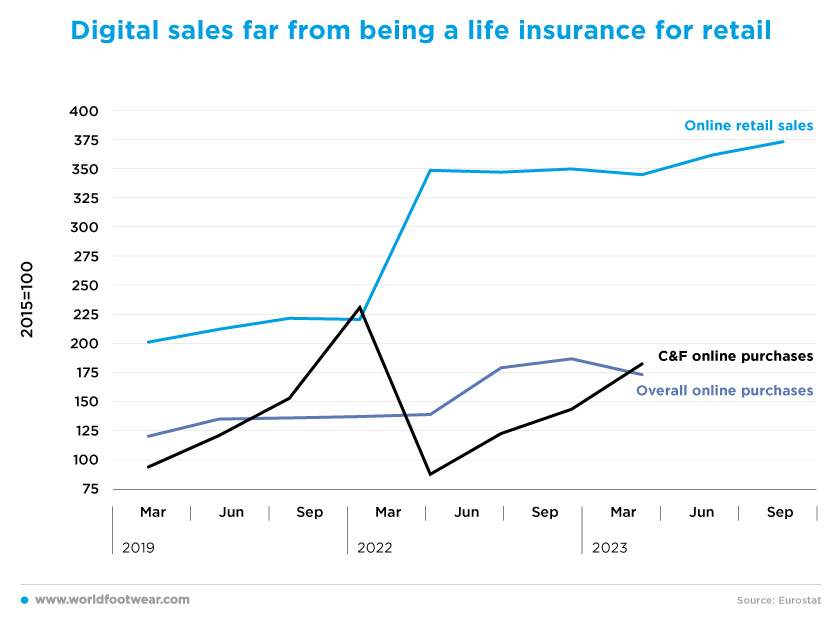

Digital sales far from being a life insurance for retail

Once again, the upward trend in online retail sales cannot be used as a reliable indicator of Internet sales for Clothing and Footwear, regardless of the category’s known importance in Internet traffic.“We have to compensate for the fall of the multi-brand channel with the online, not only for sales but also for brand awareness. The aim is to go from 10% of total sales - 70% generated in Spain - to between 25 and 30% in three years”, said Luis Chico de Guzmán, CEO of Hispanitas, the manufacturer of women's footwear and handbags.

While the TCF retail sales index seems to be losing momentum as of April, we have no up-to-date evidence on clothing and footwear internet purchases (within Spain and outbound cross border) to compare with. So far, the best source by The National Commission for Markets and Competition (CNMC) is only available up to the last quarter of 2022.

The graph herewith discarded the years (2020 and 2021) in which the pandemic distorted e-commerce use. Despite the same baseline (2015) and some content differences, both online indices for global transactions have a similar performance pattern: both 2019 and 2022 show a slow upward movement, albeit with different thresholds.

In contrast, the digital fall for the category was huge (mainly for clothing) and the recovery of 2019 levels in 2022 was slower. We see no reason why it should be any better in 2023.