Register to continue reading for free

Spain Retail: concerns grow for retailers after an unexpected fall in sales

While 2024 began with consistent, albeit modest (around 1% monthly) growth, a concerning trend emerged in March, with retail sales falling sharply by 7.9% as compared to the previous month. However, a silver lining remains. Fashion is currently the retail sector experiencing the least inflation, and consumers still hold some optimism about the overall economy. This suggests that a period of resilience may be needed from retailers, but a potential rebound could be on the horizon

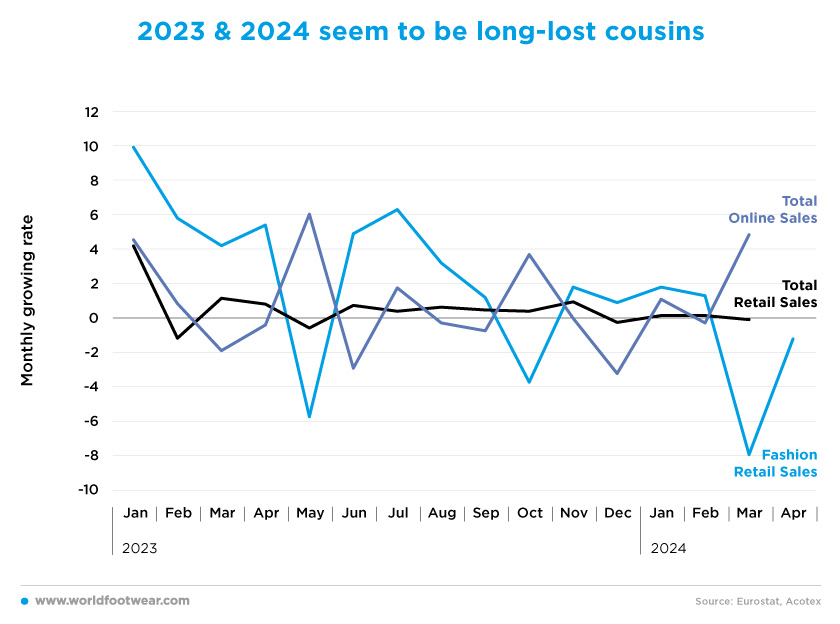

2023 & 2024 seem to be long-lost cousins

A quick analysis of the previous year shows that 2023 started with an increase in the monthly rate of fashion retail sales compared to the previous month, but it all went down in the second quarter of the year, with the month of May revealing a decline of 5.7%, mainly due to the high volume of sales registered in April (data from the National Association of Textile, Accessories and Leather Trade, Acotex).

After the downward trend in fashion retail sales between July and October, the data showed a better period with positive growth in November and December 2023, which was a positive consequence of the Black Friday and Christmas shopping strikes. The retail sales of the Spanish economy (Eurostat’s total retail sales index) have been stable through 2023, ending with an annual growth of 9.6% compared to the previous year.

But breaking a 15-month streak of year-on-year growth, retail sales in March 2024 fell by 1.6% compared to the same month in 2023 (according to the National Statistics Institute, INE). This drop represents a significant slowdown from the previous month’s decline (6.5 points lower). Although there was still a slight positive increase in retail sales (up by 0.6%), excluding seasonal variations, the overall trend suggests a cooling of the retail market, as retail sales fell by 0.5%, in contrast to the 0.5% increase recorded in the second month of the year (modaes.com).

“The data is worrying and confirms the difficulties facing the textile trade sector”, Acotex said. With the slump in March, the cumulative figure for the year is negative, a situation that continued in April, which was 1.4% lower than the same period last year (data from Acotex). The association reiterated that the level of disposable income and the slowdown in fashion consumption were among the main reasons for the decline, as well as the “adverse” weather in March and April, which “did not encourage shoppers to go out”, and an early Easter period that historically has an impact on sales (modaes.com).

The Total Online Sales Index (also by Eurostat) showed more volatility in 2023, but it seems to be growing slowly in the long run. Still, “the Icex report, which combines data from the National Statistics Institute (INE), Eurostat and the National Commission for Markets and Competition (CNMC), highlights the low penetration of e-commerce in the fashion, footwear, and accessories sector”, as consumers appear to prefer a face-to-face shopping experience.

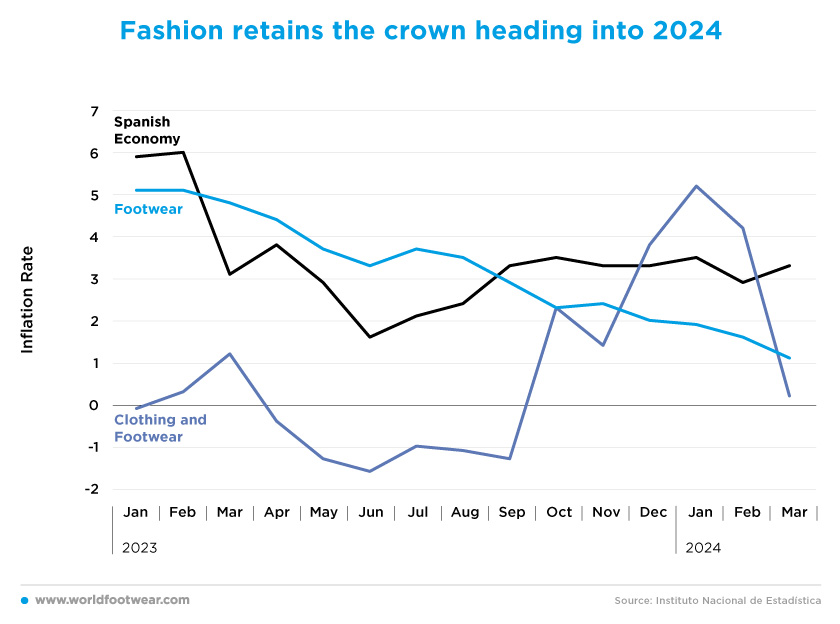

Fashion retains the crown heading into 2024

The overall Spanish economy showed a slowdown in inflation during the first half of 2023, but since June 2023 it looks like it’s going back up, with the all-items consumer price index (from INE Spain) up by 3.3% in March 2024 as compared to the same month in 2023. As for the Textile, Clothing, and Footwear (TCF) sectors, the inflation felt in these items has been lower than in the prices of general goods.Footwear inflation has been on a downward trend since the beginning of 2023 and has been below the inflation of the Spanish economy as a whole since September 2023; what’s more, it looks like it will be less and less inflationary until 2024. As for the clothing sector, there was a spike in inflation in the months leading up to Black Friday and the Christmas shopping spree, but since January the sector has regained its position as the sector with the lowest inflation.

“Footwear prices continue to normalize and seem to have put an end to the inflationary escalation of recent months. In February, according to data from the National Statistics Institute (INE), the consumer price index (CPI) for footwear sold in Spain rose by 1.6%. This rise is 0.3% lower than in January 2024 and 3.5% lower than a year ago” (revistadelcalzado.com). In March, according to the same source, the consumer price index (CPI) for footwear sold in Spain grew by 1.1%. This rise is 0.5 % lower than in February 2024 and 3.7 % lower than a year ago.

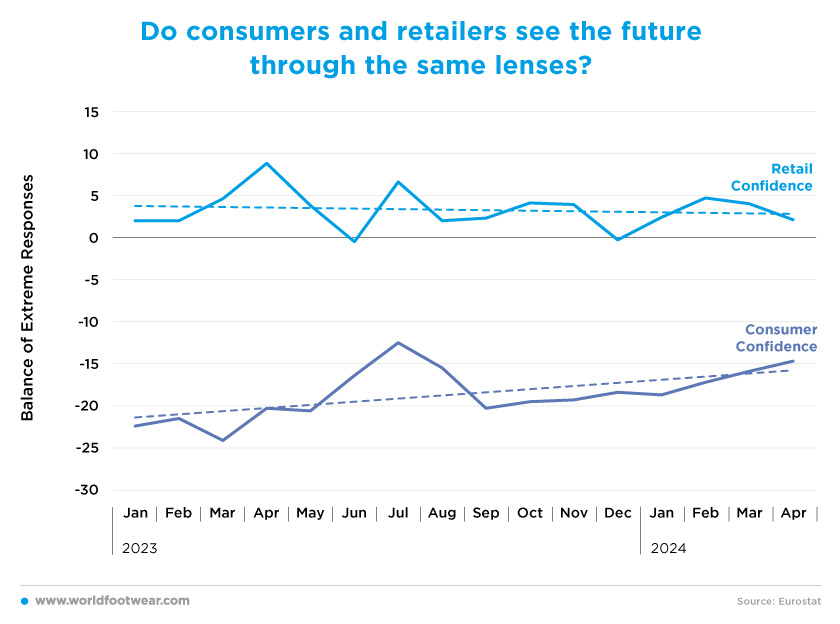

Do consumers and retailers see the future through the same lenses?

During the year 2023, the retailer’s confidence indicator stayed quite stable, despite some spikes due to sudden increases in sales like the one in April. As for 2024, since February, retailers seem to be getting on a pessimist trend even though “most retail sector indicators in Spain offer data that invite optimism. An example of this is the spending of tourists arriving in our country, which has shot up by 25.5% in recent months” (revistadelcalzado.com).As far as consumers are concerned, there was an upward trend throughout the year 2023, with a greater increase when the confidence indicator rose by 7.8 points (38%) between April and July. To date, in the first four months of the year, consumer confidence has risen from (-18.7) in January to (-14.7) in April, meaning that consumers are more hopeful about the Spanish economy in 2024.

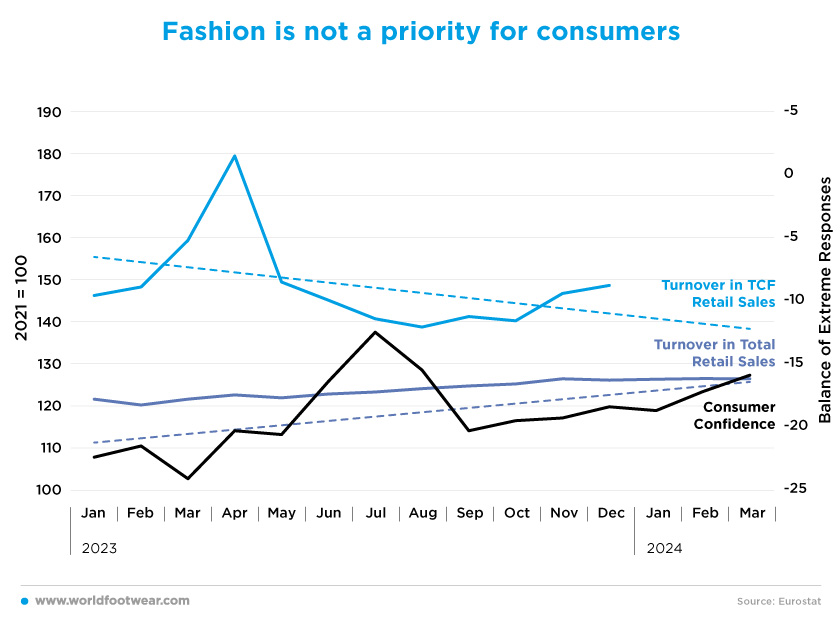

Fashion is not a priority for consumers

As seen through the confidence indicators, consumers seem to be more hopeful about the future, but retailers are not very hopeful about what the economy will look like in the near future, and this is particularly true for TCF retailers.Combining the evolution of turnover in Retail Sales of TCF and the Overall Retail Sales of the Spanish economy (both by Eurostat), these variables show different trajectories. The main reason for this is the change in people’s consumption habits. In recent months, with budgets shrinking, fashion seems to have fallen down the list of consumer priorities, with consumers preferring to spend their money on other goods and services, such as travel.

“Currently, less is being spent on clothing in Spain, although in 2023 the average expenditure will have increased by 4.89% as compared to 2022”, said Eduardo Zamácola, President of Acotex, in a statement. Enrique Bretos, co-founder and CEO of children’s footwear company Pisamonas, confirmed this, stressing that “last year was a year of decline for fashion at a global level, and even more so in the children’s sector”.

Even though the Eurostat TCF Retail Sales index hasn’t provided data for 2024 yet, “sales in the fashion trade in Spain fell in March for the first time this year, with a drop of 7.9%”. The figure contrasts with the rise in the sector in previous months, according to the Fashion Trade Indicator, compiled from provisional data from the Business Association of Textile, Accessories and Leather Trade (Acotex).

This is also the worst March for the sector in recent years, except for 2020 and 2021, when sales fell due to the pandemic. With the March decline, the cumulative figure for the year is also negative, with a drop of 1.6% compared to the first three months of last year.

When will sales pick up again?

The Spanish footwear industry is highly export-oriented, so imports are a better predictor of retailers’ expectations of future domestic market demand as compared to production indicators. Overall imports increased by 2.7% between 2023 and 2022, while TCF retail sales increased by 24% over the same period.After the first quarter of 2023, TCF retail sales adjusted sharply downwards between April and August, while the volume of imports tended to increase during the same period. The correlation between the two can be explained by the time lag between the retailer’s orders and the moment when these products arrive in the country. When retailers see their sales rising, they expect more demand and so place orders for future imports, which arrive a few months later. Thus, more than consumer demand, retailers’ hopes for future sales are the main driver of import growth.

“According to the latest Eurostat estimates, Spain’s economy is projected to grow by 1.7% in 2024 and 2% in 2025, surpassing the European Union’s average of 0.9% and 1.7%, respectively. Eurostat emphasized that consumption and investment will be the primary drivers of economic expansion this year, with private consumption buoyed by real income gains and the utilization of accumulated household savings, while investment growth will be supported by the broadening implementation of the Recovery and Resilience Plan” (Euronews).

This confirms consumers’ optimism about the future of the Spanish economy, although it may not be felt directly by the textile, clothing, and footwear retailers as sales momentum does not seem to be picking up any time soon.