Register to continue reading for free

Spain Retail: clouds are lifting for retail

Despite some concerns about inflation, retailers were optimistic about their prospects for the end of 2023, and data on imports at least confirmed a stabilisation in the footwear trade on favourable grounds. Looking at our previous Retail Flash, it’s now safe to say that the clouds are lifting over retail in Spain. On a different note, online fashion has clearly lost the momentum generated during the pandemic

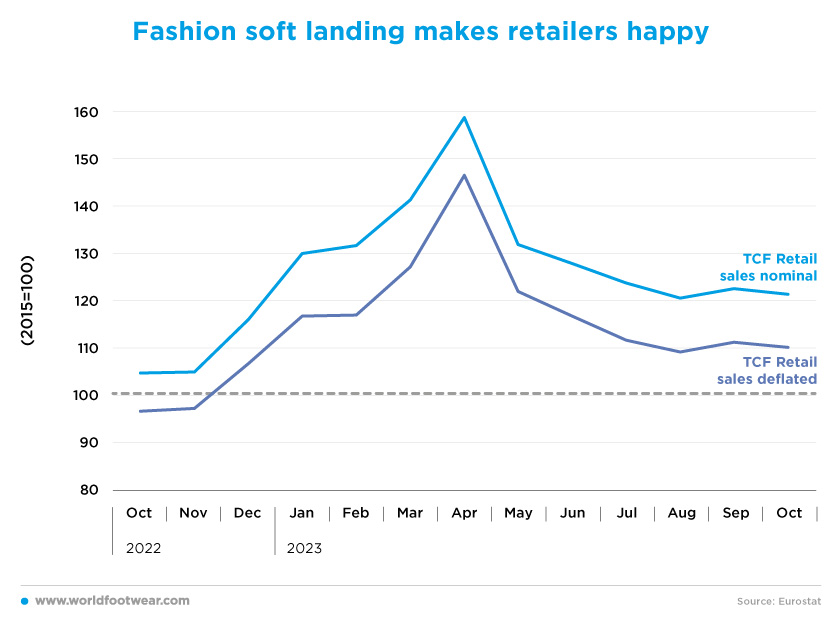

Fashion soft landing makes retailers happy

Data for retail sales of Textiles, Clothing & Footwear (TCF seasonally adjusted, by Eurostats) confirmed a stabilisation of the trend since August, one month later than anticipated in the previous WF Retail Flash edition. In October, it was more than 20 percentage points above the 2015 baseline (10 percentage points in deflated terms) and 16 percentage points higher year-over-year. Despite the sharp drop after the peak in April, such a soft landing of fashion retail in Spain is certainly a reasonable performance.

What’s more, retailers seem to be optimistic about the last part of the year. The Fashion Association Acotex estimated that sales would “grow by between 5% and 10% on Black Friday” and forecasted “less aggressive discounts” (…) at Christmas and sales (season)”, perhaps because stock levels were in a very healthy position when compared to 2022. Mastercard also predicted that spending on clothing in Spain would “increase by 13% in the Christmas campaign”.

Nevertheless, some caution prevails due to inflation. Mango, for example, said it had “not seen any impact - due to inflation - on consumers” (…) and expected an improvement “on last year’s sales by double digits” (…) “from Black Friday to the first week of January”. Many others were (more) cautious, “as the economic situation caused by inflation was expected to continue playing a leading role this Christmas” (expansion.com).

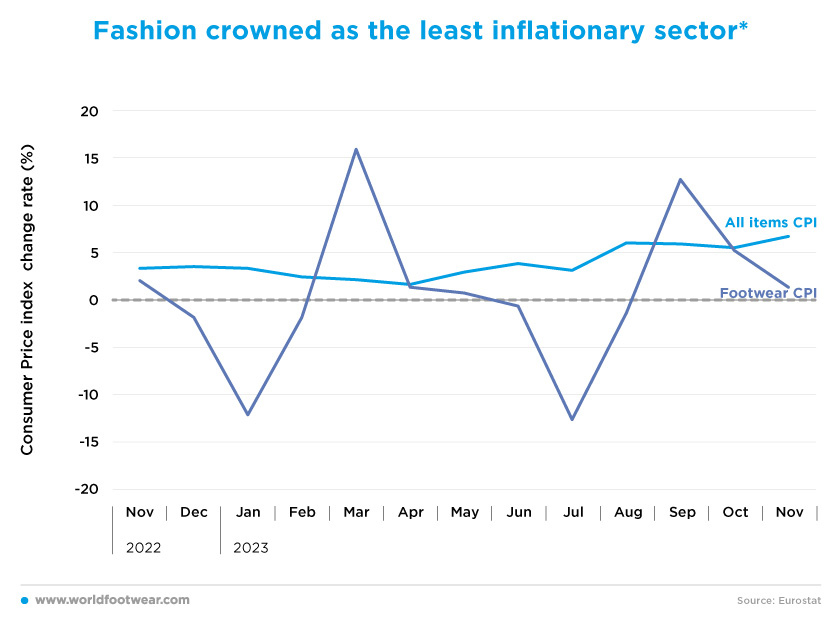

Fashion crowned as the least inflationary sector*

The All-Items Consumer Price Index (by INE) slowed down until April but has been accelerating since then, with the inflation rate in November being around 2 ½ percentage points, year-over-year. This situation is always a threat to the income available for discretionary items such as fashion ones.However, considering the whole category of Clothing & Footwear, “fashion continues to be crowned as the least inflationary sector in October” *. (modaes.com). Moreover, if the seasonal volatility of footwear inflation in March and October is disregarded, in all other months, footwear inflation has been lower than general prices and, in most cases, decelerating, if not negative. In November, it was even 0.7 percentage points below the 2% rate a year earlier, and such price moderation may explain the satisfactory sales situation so far.

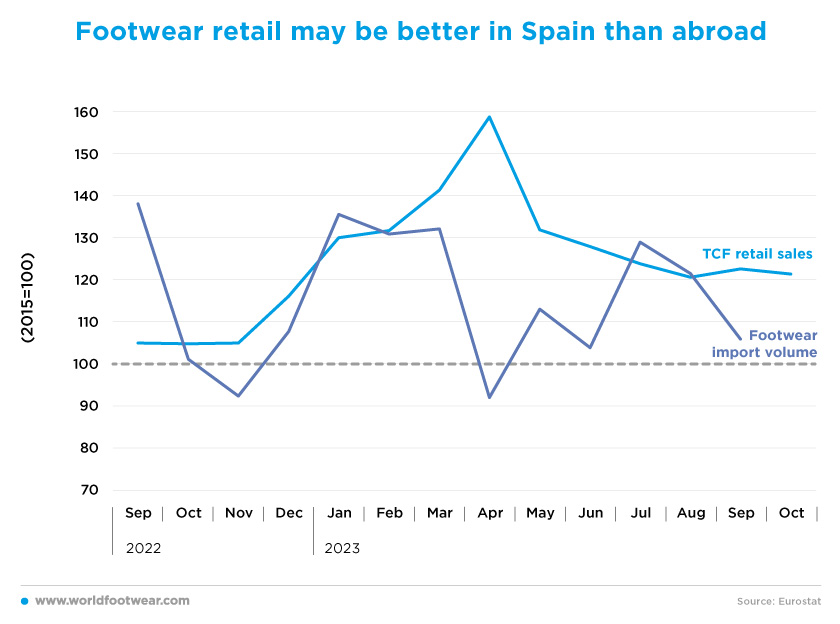

Footwear retail may be better in Spain than abroad

Looking upstream to footwear factories, the industry turnover “at the close of the spring-summer season had already reached 2019 levels”, even if, according to Rosana Perán, President of the Spanish Footwear Federation (FICE) and Pikolinos’ Vice President, “the second part of 2023 has been quite difficult”, (and) “the (Pikolinos’) order book for 2024 is still well below that of the previous two years” (elpais.com). But to be fair, Spanish footwear manufacturing is highly export-oriented, so this performance may reflect more on its business abroad rather than sales at home and is not necessarily a direct indicator of the state of domestic trade now and in the future.On the contrary, imports are a better predictor of the future. As seen before, footwear retail sales adjusted sharply downwards between April and August, while imports in volume terms tended to increase over the same period.

In September, the volume of imports was not so reassuring, closing 14 percentage points above the April minimum and 6 percentage points above the baseline. However, according to revistadelcalzado.com, cumulative import data for the first ten months of the year “increased by 3.4% (in nominal terms) compared to the same period in 2022 and by 33.5% compared to 2019”. When compared to October 2022, stronger imports seem more likely to maintain a stabilisation path for footwear retail on favourable grounds. This contrasts with the negative outlook in the previous edition of the WF Retail Flash.

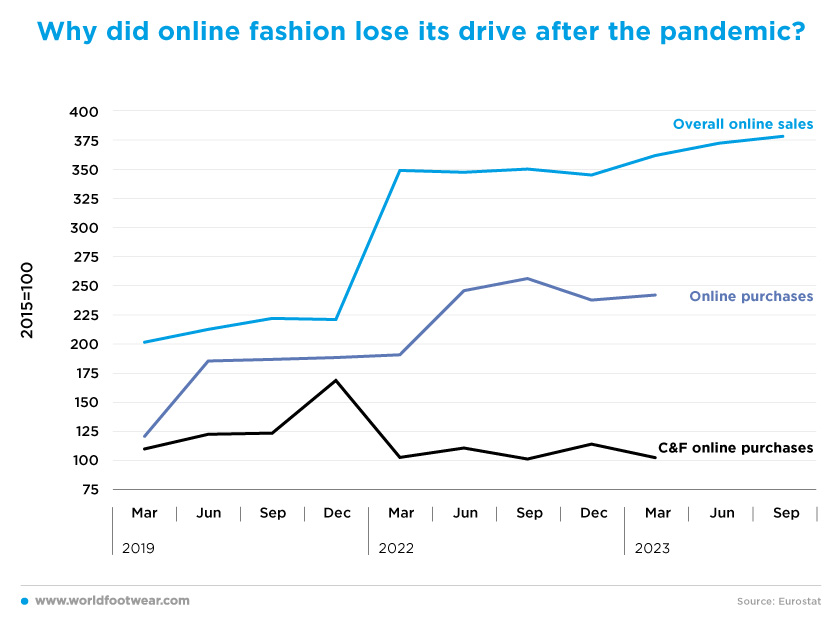

Why did online fashion lose its drive after the pandemic?

But perhaps the most striking point about clothing and footwear retail in Spain is that according to the Index of Purchases via the Internet (inside Spain plus outbound cross border only, by The National Commission for Markets and Competition CNMC), the category hasn’t been able to substantially maintain the online gains achieved during the COVID-19 pandemic in 2020-21. The index appears to be flattening out between the 2015 baseline and a maximum increase of 15 percentage points, albeit lower than the last three scores in 2019.

The CNMC data available so far (the series in our previous WF Retail Flash has been corrected) shows that the boost to digital sales in the category has clearly faded. This is in contrast with retail via the internet in general (reported either by Eurostat or CNMC), which never returned to the 2019 threshold, despite the moderation of its progress forward. The reasons for this unexpected divergence remain to be explained. Perhaps Spanish brands with an industrial base are prioritising opening their stores in Spain (and even abroad).

The Alicante-based footwear company Hoff, for example, plans to open between nine and thirteen stores in the next five years in order to “become an international brand of relevance”, according to Francisco Marchena, the company’s CEO. As a result, the company intends “to increasingly reduce the weight of the online market, as well as increase its presence in the multi-brand channel by between 50% and 45%” (modaes.com).

Wonders, which generates only 25% of its sales in Spain, is planning to open two more stores in Spain and Portugal. The company’s president Rubén Carbonell says that “it’s very important to have a large B2B platform, to have your own e-commerce, (but) it is not the time yet because we still have a large presence in (multi-brand stores) in Spain and Europe” (expansion.com).

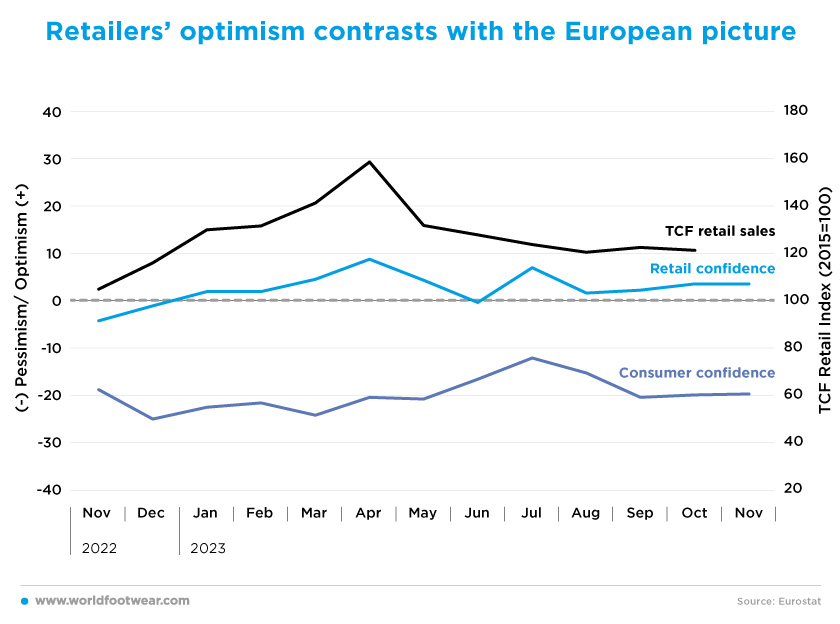

Retailers’ optimism contrasts with the European picture

With the resurgence of inflation since April, both the Retail Confidence Indicator and the TCF retail index (Eurostat) have been on a downward trend since their peaks. After August, however, both indicators seemed to stabilise at positive levels and better than a year earlier.TCF retailers are therefore cautiously optimistic about the development of retail sales (a balance of better and worse opinions ranging from +1.7 to +3.6 percentage points). And in November, retail confidence in Spain was higher than in the main European markets and the EU-27 zone.

“We view the season with cautious optimism and our estimates for the end of the year are positive,” said the Tendam fashion group of the final countdown of 2023, which boasts a "very healthy position in terms of stock levels” (expansion.com).

The consumer confidence indicator (by Eurostats) has followed a similar pattern over time, albeit with a delay in the turning points and no year-over-year increase in confidence in November. However, the CSI/INE Synthetic Consumer Confidence Index improved in the same month by 6.2 percentage points against October, driven by both a better opinion of the present situation (+4.8 percentage points) and consumer expectations (+7.5 percentage points). Inflation concerns dropped by 12 points and expectations of a hike in interest rates decreased by 16 ½ points, favouring consumption easing and fashion retail.