Register to continue reading for free

Japan Retail: fashion shows strength amid rising cost pressures

The Japanese fashion retail sector is enjoying a standout year, with apparel and footwear sales surging to record highs, despite early signs of cooling demand. Strong Chinese tourist spending has helped to boost results, although geopolitical tensions pose risks for the future. Meanwhile, e-commerce continues to grow much faster than physical retail. Inflation is now converging across categories, with footwear prices rising in line with general inflation. However, the weakening yen is pushing up import costs, leaving retailers reliant on steady consumer demand to absorb rising costs

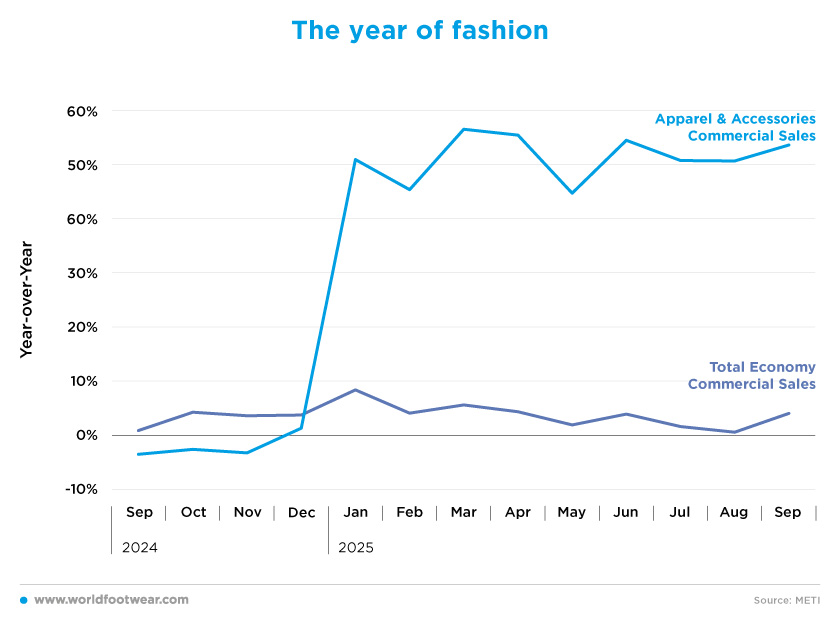

The year of fashion

2025 has been a record-breaking year for the Japanese apparel and accessories sector, including clothing and footwear. Since the beginning of the year, the fashion sector has registered year-on-year growth of over 44%. Compared to last year, fashion sales have increased by 51.5% in the first nine months of 2025. In real terms, sales of apparel and accessories grew from 3.169 billion yen to 4.802 billion yen. April was the best month, with sales reaching 628 billion yen.However, even though fashion retailers have been thriving, demand has slowed throughout the year. The third quarter of 2025 saw a 5.6% decrease compared to the previous quarter (Q2 2025).

The positive figures are indicative of a trend in commercial sales in the overall Japanese economy. Total commercial sales grew by 3.8% this year, increasing from 450.823 billion yen to 468.126 billion yen. While this is a positive increase in consumption, in this case most of the growth is tied to inflation. It is also important to note that every month this year has shown growth, with figures ranging from 8.4% in January to 0.6% in August.

In this context, it is worth examining the data relating to the influx of Chinese tourists. According to the Japan Tourism Agency, Chinese tourists accounted for 27.7% of foreign spending in Japan during the July–September period (590.1 billion yen), which was an increase on the 499.9 billion yen (26.1%) spent by visitors in the same period last year. The agency reports that high-priced items such as luxury brand bags, jewellery and cosmetics have long been popular with visitors to Japanese department stores.

However, Japanese companies are now preparing to address the potential consequences of deteriorating diplomatic relations between Beijing and Tokyo, primarily due to discussions about possible attacks on Taiwan. Toshihiro Nagahama, chief economist at the Dai-ichi Life Research Institute, said that a decline in visitors could have an impact. “Chinese tourist spending in Japan has exceeded 500 billion yen in each quarter this year, and if this trend had continued, it was expected to surpass 2 trillion yen”, he explained.

Nevertheless, he argues that “domestic consumption in Japan has been rebounding since the summer. Combined with economic stimulus measures, I believe it is possible to offset the decline in Chinese visitors to a certain extent” (asia.nikkei.com).

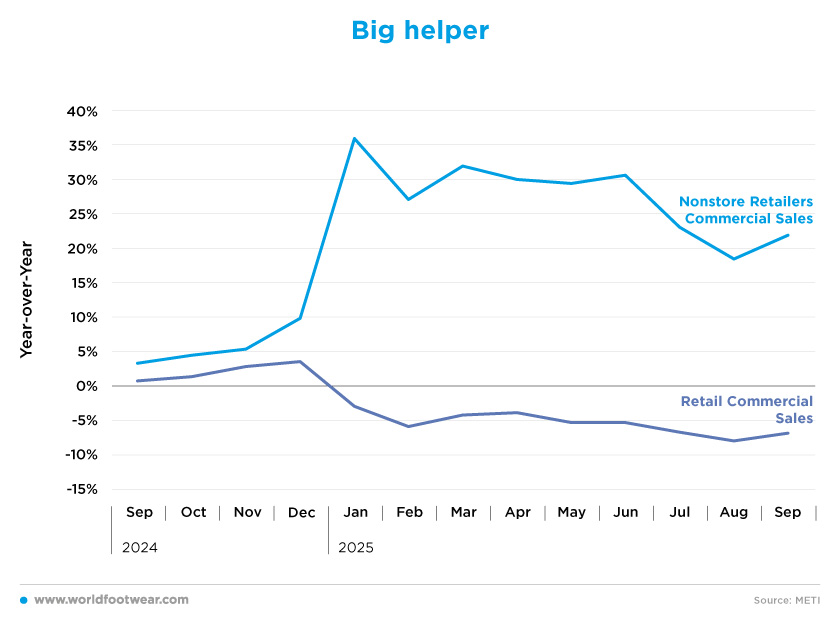

Big helper

As previously mentioned, commercial sales are increasing in the Japanese economy this year, but the distribution of these sales between online and physical stores differs significantly.Sales through non-store retailers, such as online stores and platforms, have increased by 27.3% compared to the same nine months of 2024, while physical retail sales have decreased by 5.5%. This makes e-commerce a significant contributor to the increase in total commercial sales in Japan. So far this year, physical retail sales have reached 116.282 billion yen, which is 6.738 billion yen less than last year. Meanwhile, online sales have reached 11.349 billion yen, which is 2.436 billion yen more.

It is clear that, as in many other economies worldwide, online sales are growing and becoming an increasingly important way for consumers to shop.

Even though sales are showing yearly growth, it is important to take note of the latest behaviour over a shorter timeframe. Sales decreased in both channels from the second to the third quarter, indicating some sluggishness: online shopping decreased by 4%, while physical retail decreased by 0.1%.

Perhaps the silver lining is that Japan's economy grew at an annualised pace of 0.1% in September compared to the previous month, despite uncertainties surrounding the economy stemming from US tariff policies easing, according to an estimate released by the Japan Centre for Economic Research (JCER).

The Nikkei-affiliated think tank said that consumer spending was affected by hotter-than-average temperatures earlier in the month, with people buying fewer clothing items. Domestic private demand added 0.1 percentage points to gross domestic product (asia.nikkei.com).

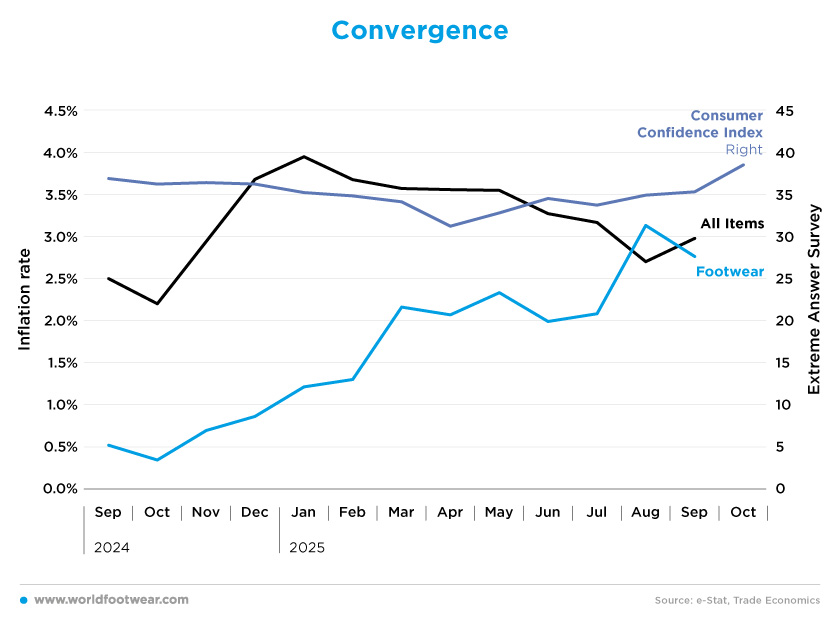

Convergence

The Japanese economy has been dealing with high inflation for a while, but the footwear sector hasn’t been affected until now. The latest figures for September show general inflation at 3% and footwear inflation at 2.8%, a difference of just 2 percentage points.Retailers in Japan are raising the prices of food and other everyday items, which is increasing their quarterly operating profits, but forcing consumers to tighten their budgets as wages are failing to keep up with inflation. However, Takuya Hoshino, an economist at Dai-ichi Life Research Institute, observed that “consumers have to buy essential goods, so it is structurally easier to raise prices” (asia.nikkei.com).

While all-items inflation has fallen by 0.9 percentage points (from 3.9% in January), footwear inflation has increased by 1.6 percentage points (from 1.2% in January). This is mainly due to increased demand, as was seen when analysing commercial sales of apparel and accessories. Footwear inflation peaked in August at 3.1%, while all-items inflation hit its lowest value in eight months at 2.7%.

The governor of the central bank said recently he had informed the prime minister that the BOJ was gradually adjusting the degree of monetary easing to guide inflation smoothly towards its 2% target. “We had candid, good talks on the economy, prices, financial developments, as well as monetary policy”, Ueda said (asia.nikkei.com).

Although overall inflation remains well above the central bank’s target, consumers do not seem very concerned about it. The consumer confidence indicator is at its best level since March 2024, with consumers expressing more optimism about the future of the Japanese economy each month since July. Since reaching a 32-month low in April 2025, consumer confidence has increased by 23.4% by October 2025.

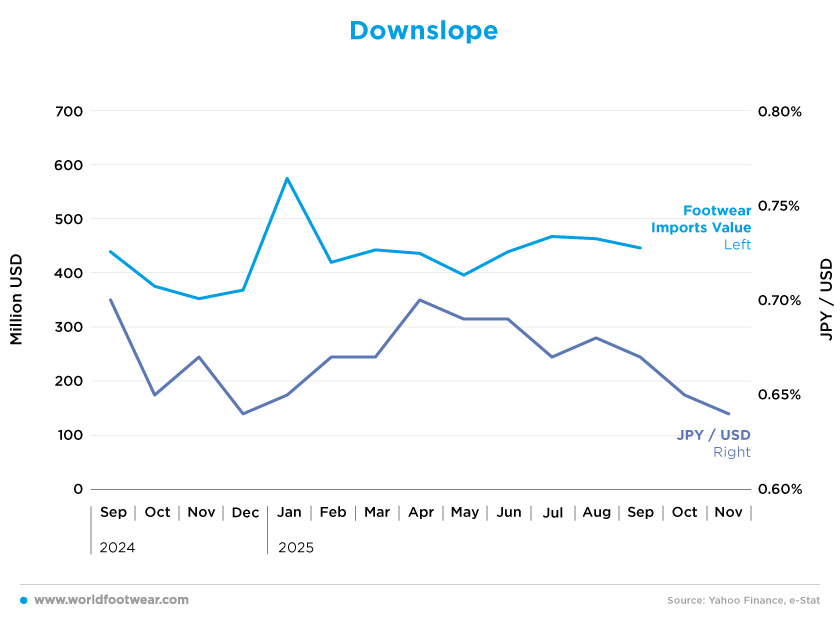

Downslope

Between January and September this year, 486 million pairs of shoes were imported at an average price of 8.41 USD per pair. This meant that imports increased by 4.4% in volume, but by a much greater amount in value, as the average price increased by 8.8% (69 cents). More than 4 billion US dollars’ worth of footwear was imported to Japan this year, representing a 13.6% increase in value, but some of this growth was driven by the appreciation of the yen in the first half of the year.If we analyse the variation in total imports in yen, however, we see that they have only increased by 11.3%, which is a difference of 2.3 percentage points. Nevertheless, imports seem to be heading downwards. From January to April, the yen gained 7.7% in value against the US dollar, but it has already lost 8.6% since then, making it weaker in November than at the beginning of the year.

On the 19th of November, Japan’s currency weakened to 156 against the dollar for the first time in nearly 10 months, as Prime Minister Sanae Takaichi pursues a loose fiscal policy and prepares to draw up a major economic stimulus package (asia.nikkei.com).

At that time, Kazuo Ueda (governor of the Bank of Japan), Satsuki Katayama (finance minister) and Minoru Kiuchi (economic revitalisation minister) held talks. According to Katayama, they agreed to monitor market developments with a “strong sense of urgency”, but the apparent verbal intervention failed to stop the yen’s slide (asia.nikkei.com).

With lower purchasing power, retailers can only hope that demand will increase to offset higher costs.