Register to continue reading for free

Germany Retail: footwear slumps as e-commerce and imports surge

The German retail sector is split in two: the footwear and leather goods market is experiencing one of its worst years, with sales falling by 4.2% year-on-year in the first eight months of the year, while overall retail is growing and e-commerce is booming, fuelled by Asian marketplaces. Complicating matters further, footwear imports have surged in value by 16.9%, defying the decline in domestic sales and raising questions about the country’s trade position. Despite current volatile business conditions and subdued consumer confidence, the industry is cautiously seeking signs of positive change

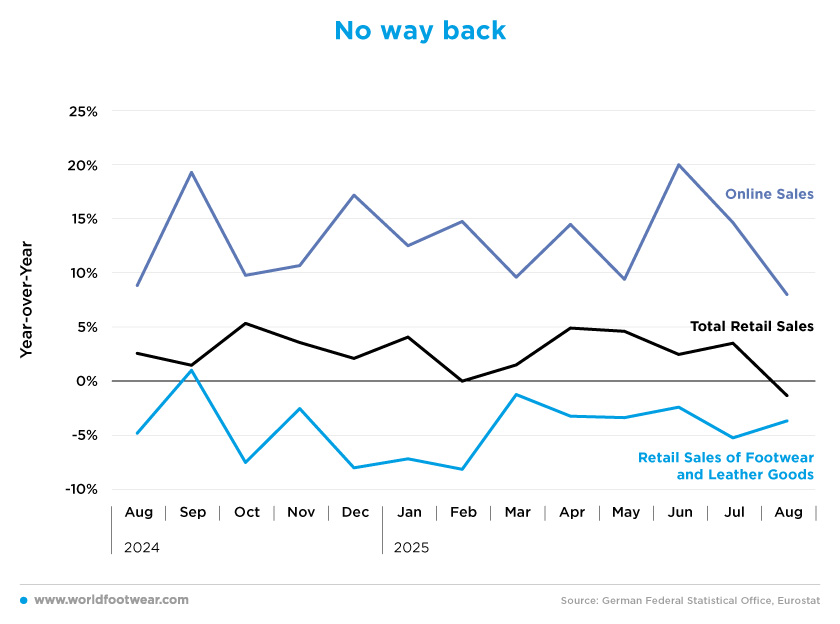

No way back

Sales revenue for footwear and leather goods is experiencing one of its worst years. In Germany, net turnover of retail sales of footwear and leather goods in the first eight months of the year was down by 4.2% as compared to the same period last year. Footwear sales have registered negative growth levels for 11 months straight.Although the decreases got smaller in March, making it look like the sun might be on the horizon, retailers’ hopes that things would turn positive were not realised, and not even the summer months were bright enough to stop the losses. “The buying mood was very cool in the middle of summer”, summed up Thomas Gitzel, chief economist at VP Bank (reuters.com).

The truth is that even if there are increases in sales in the last four months of 2024 due to the start of the school year in September, Halloween in October, Black Friday in November and Christmas in December, it seems unlikely that footwear sales will increase in 2025.

Footwear seems to be one of a kind because total retail sales in Germany this year have increased by 2.5% as compared to the same period last year. The only month to register losses was August 2025, with sales down by 1.5% compared to the same month last year – the first decrease in 14 months. April saw the highest growth in turnover, with an increase of 4.9%.

In this context, after several rounds of negotiations and intensive discussions, on the 13th of October 2025, the IGBCE union and the German Footwear and Leather Goods Industry Association (HDS/L) reached a collective bargaining agreement for the footwear and sporting goods industry in Frankfurt am Main. The negotiations covered pay grades and wages, fixing a growing fixed amount negotiated individually in line with the minimum wage increase.

“In these uncertain times, we have succeeded in creating a degree of reliability with this collective bargaining agreement. This gives our companies the necessary planning security to enable them to continue operating even in challenging environments”, emphasised Manfred Junkert, HDS/L's Managing Director (hdsl.eu).

As in most countries, online retail continues to experience double-digit monthly growth. Online retail turnover from sales has increased by 12.9% as compared to the first eight months of 2024. An interesting trend also observed in the Spanish e-commerce market was the increase in online shopping during the summer months, in contrast to physical retail.

Online shopping grew by 14.2% in June, July and August combined, which is 1.3 percentage points more than the eight-month average. Meanwhile, total retail rose by only 1.5% in the same period, which is 1 percentage point less than the eight-month average.

Nevertheless, it should be noted that retailers are experiencing the rebound unevenly. While marketplaces and direct-to-consumer platforms flourished, traditional online shops saw modest growth following weak performance in previous quarters.

Notably, Asian online marketplaces accounted for a third of the growth in German e-commerce. “The combined market share of major platforms such as Temu, Shein, and AliExpress increased from 5.5% in the second quarter of 2023 to 6.4% in the second quarter of 2024. In fashion, these platforms accounted for 14.1% of all orders” (shoeintelligence.com).

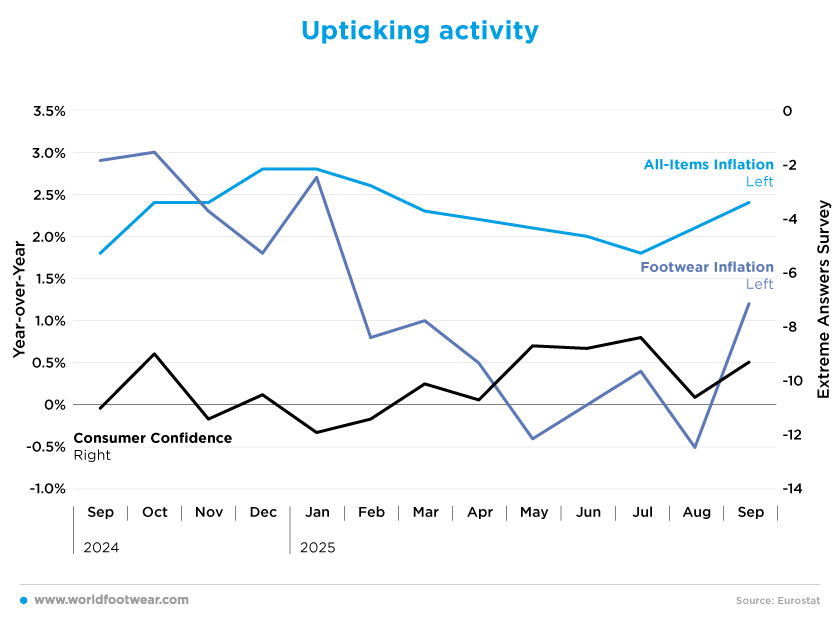

Upticking activity

Following a decline in consumer confidence at the end of 2024, consumers now feel more optimistic about the future. Nevertheless, the level of consumer confidence has risen by 21.8% since January, but remains negative due to slumping income expectations amid continued geopolitical uncertainty and higher inflation.“The ongoing tense geopolitical situation, increasing fears of inflation, and again growing concerns about jobs are destroying hopes for a short-term recovery”, Rolf Buerkl, head of consumer climate at NIM, said (wsj.com).

All-items inflation has averaged 2.3% this year, with the latest reading at 2.4% in September. While inflation in the German economy decreased every month from January to July, reaching 1.8% - the lowest level since September 2024 – it now appears to be rising again above the European Central Bank’s target. Despite a slight increase, the survey said that economic expectations among consumers pointed to no significant recovery in Germany in the coming months (wsj.com).

As for footwear prices, the decrease in sales this year has definitely affected pricing behaviour. Footwear inflation averaged 0.6% this year, with negative rates registered in May and August – essentially, discounted prices compared to last year. However, the outlook is improving. Footwear inflation reached 1.2% in September, marking the highest price growth since January. This may indicate that consumers have started shopping again and that the sector may slowly recover.

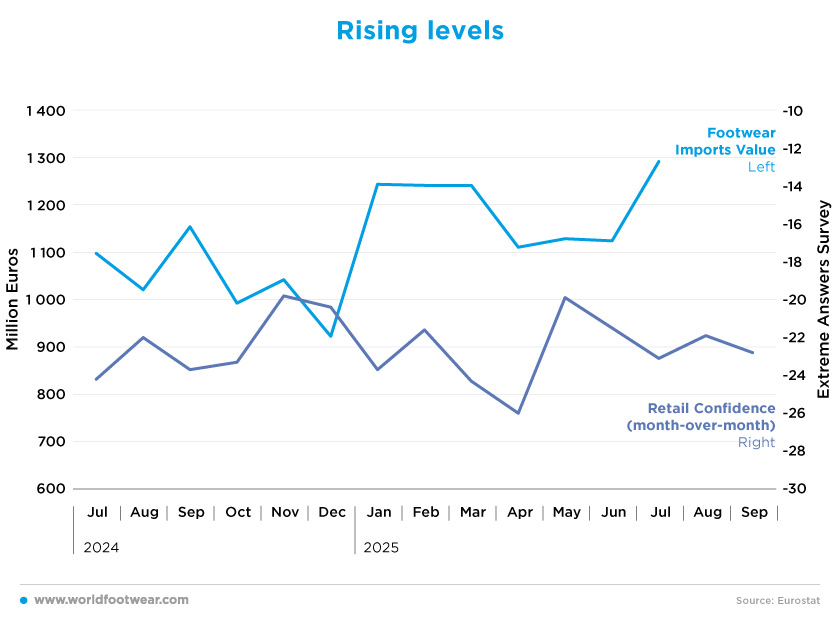

Rising levels

Germany’s footwear imports this year have taken everyone by surprise. Although footwear sales have fallen since last year, imports have increased in value by 16.9%, reaching 8.4 billion euros in the first seven months of the year – over 1.3 billion more than last year.Another unexpected development is the increase in the average import price. While footwear inflation in Germany is up by only 0.6%, import prices have increased by 1.2%. The average import price is now 18 euros per pair of shoes, an increase of 22 cents on last year.

But the rising levels of imports do not appear to be driven by retailers, even though retail confidence has increased by 3.8% since the beginning of the year, having reached its lowest point in April 2025. The contrasting trends in imports and sales, as well as import prices and inflation, have led economists to question the country’s position as a European hub for the footwear trade.

In the first five months of 2025, shipments from China increased by 13% to reach 138 million pairs. The Asian powerhouse accounted for over 40% of Germany’s imports, but lost ground to Vietnam and Indonesia, whose exports to Germany rose by 36.1% and 33.0%, respectively.

Despite the current volatile and uncertain business conditions and subdued consumer confidence in Germany, HDS/L sees “signs of positive change for the industry in the coming months” (shoeintelligence.com).