Register to continue reading for free

Germany Retail: hope rests on the ability of retailers to weather gloomy circumstances

In a landscape where e-commerce is in a league of its own, footwear retailers continue to struggle to regain sales growth, even against the backdrop of overall retail performance. And low inflation in the sector is actually indicative of low demand, not consumer confidence. Indeed, the data shows that consumers remain far more pessimistic than retailers, and a renewed rise in the propensity to save is clouding the overall picture. Given the volatile global trading environment, hope rests on the ability of retailers to weather these gloomy conditions

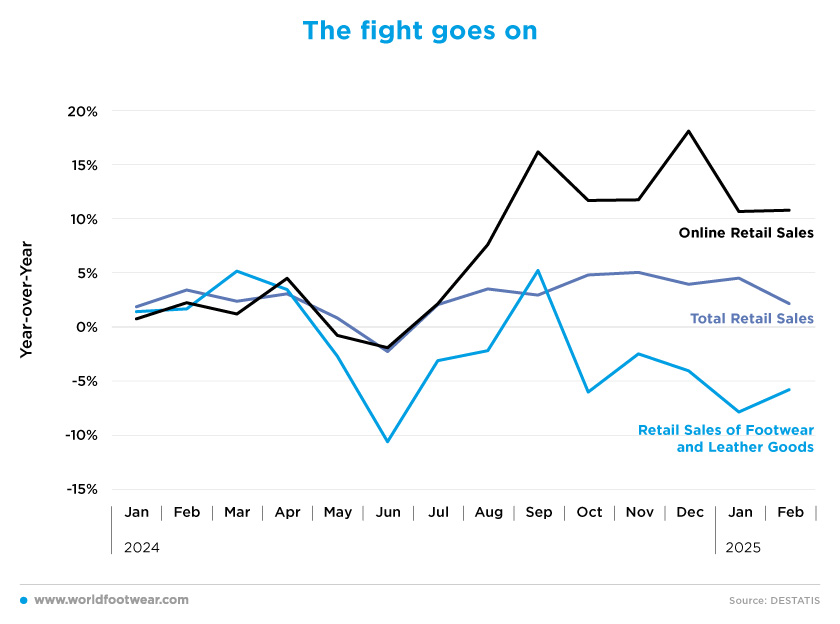

The fight goes on

Since the spring of last year, footwear retailers in Germany have been struggling to regain sales growth, but something seems to be going wrong. From May 2024, the average year-over-year change in footwear retail sales has been minus 4%, and the situation is worsening in 2025. In January and February 2025, sales decreased by 7.9% and 5.8%, respectively, a very different behaviour from last year, when they grew by 1.4% and 1.6%, respectively.The BTE trade association for textiles, shoes and leather goods recently announced that, according to its projections, revenue of shoes in Germany fell by 0.8% or 90 million euros to 11.62 billion euros (gross) last year (bte.de).

Pressure from e-commerce giants and unregulated competition from online marketplaces such as Temu and Shein are also taking their toll on the sector. Still, the pace of store closures has slowed in 2024 compared to 2023, according to BTE. There are now an estimated 8 700 shoe stores in Germany (shoeintelligence.com).

However, the picture for the German economy as a whole is different. Total retail sales have risen every month for the past eight months, ranging from 2% to 5% - although the latest reading for February suggests a possible slowdown in the sector, with sales up by just 2.1% year-on-year.

E-commerce has also been in a league of its own since June 2024. Before that, online sales seemed to describe retail sales in the economy as a whole to some extent, but since then they have grown exponentially, with double-digit increases in the last six months. Now, in 2025, it seems to be stabilising, with year-on-year increases of 10.6% and 10.7% in January and February respectively.

According to the German association of e-commerce and mail order trade (BEVH), total revenue from online sales of goods in the first quarter (not adjusted for inflation) rose by 3.2% year-on-year to 19.7 billion euros. After the rollercoaster ride of recent years - the peak during the coronavirus pandemic and the subsequent downturn with the outbreak of the war in Ukraine - sales are currently 17.5% higher than the comparable figure for 2019.

“The upward trend gives us hope, even if consumers were temporarily unsettled by global political events”, commented Martin Groß-Albenhausen, deputy chief executive of BEVH

In this sense, online shoe retail also stands out, recovering from a poor Christmas quarter in 2024 (6.5%) with sales up by 5.8% at the beginning of the year. (…) Fashion retailers, which are important for online retail, increased their sales by 3.9%. (…) (bevh.org).

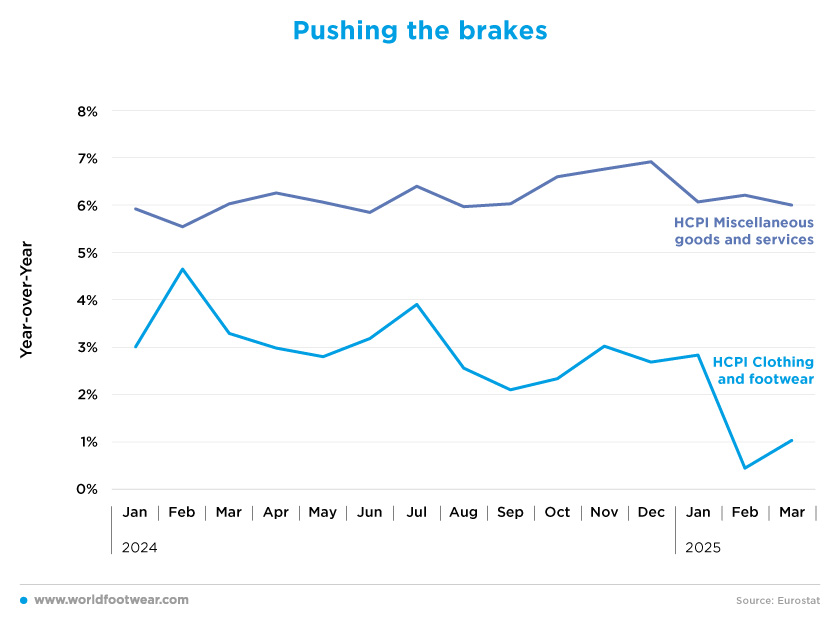

Pushing the brakes

The German economy, like many European countries, has had to contend with an inflation problem in recent years, but the picture remains bleak.The average All-items inflation rate in 2024 was 6.2%, well above the European Central Bank’s target and the latest readings for 2025 show an inflation rate of 6.2% in February and 6% in March, with the same pace of price increases.

This is mainly due to rising import prices as a result of the new trade barriers and the price of footwear components, but the result can be very negative for consumers. As a result, consumers delay purchases and lose confidence in the market, making life more difficult for retailers.

Still, it’s worth highlighting that Core inflation, which excludes volatile food and energy prices, fell to 2.5% in March from 2.7% in the previous month (reuters.com).

In the case of footwear, sluggish sales have put the brakes on price increases. After peaking at 4.7% in February, footwear inflation has been steadily declining, with the latest reading for March showing an inflation rate of just 1%. This usually means that consumers feel more comfortable and confident with their budgets as they know what to expect. But the reality is that this kind of low inflation is a result of a lack of consumer demand.

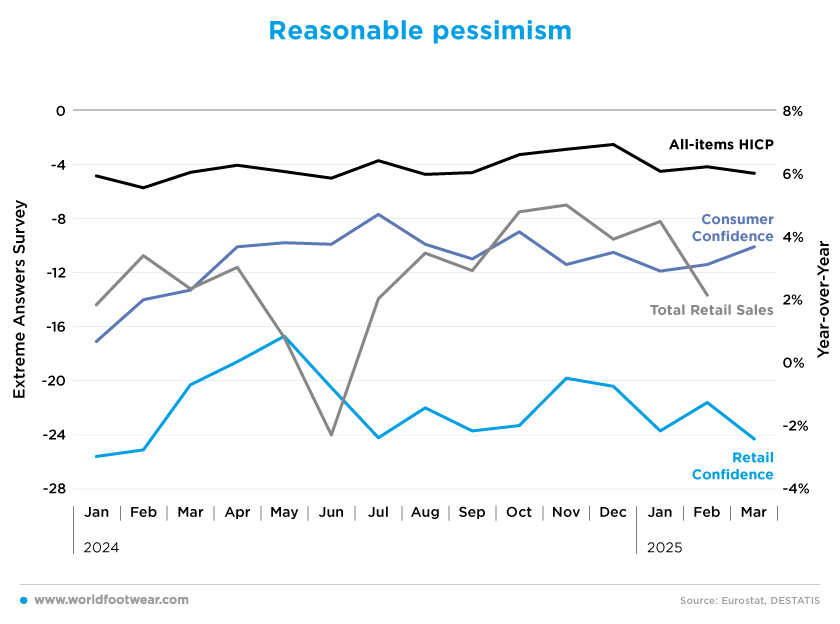

Reasonable pessimism

Retailers and consumers are under a dark cloud of confidence in the German economy. Despite both showing negative confidence indicators over the past 12 months, retailer confidence rose by 24% while consumer confidence fell by 20%.This divergence in behaviour is mainly due to two economic indicators. Retail sentiment is mainly correlated with sales, which have been rising steadily year-on-year for the past eight months, while consumer sentiment is deteriorating, economic activity and wages are stagnating, and inflation remains high, resembling a recession cloud.

“Apparently, the elections and the prospect of a new government have lessened pessimism among a number of consumers. However, the renewed rise in the willingness to save is clouding the overall picture. It prevents a stronger improvement in the Consumer Climate,” explains Rolf Bürkl, consumer expert at the NIM (nielseniq.com).

Manufacturers are also feeling the squeeze. Carl Semler, for example, has decided to move most of its production to Hungary in order to remain competitive, according to the insolvent German shoe manufacturer. The production site in Pirmasens will be retained, albeit with a reduced workforce. The general economic situation, particularly in the footwear sector, has deteriorated considerably due to the recession, market changes and increased costs, the company said at the time (shoeintelligence.com).

Overall, this means that most consumers and retailers expect the economic situation to worsen in the coming months, although consumers are slightly more pessimistic.

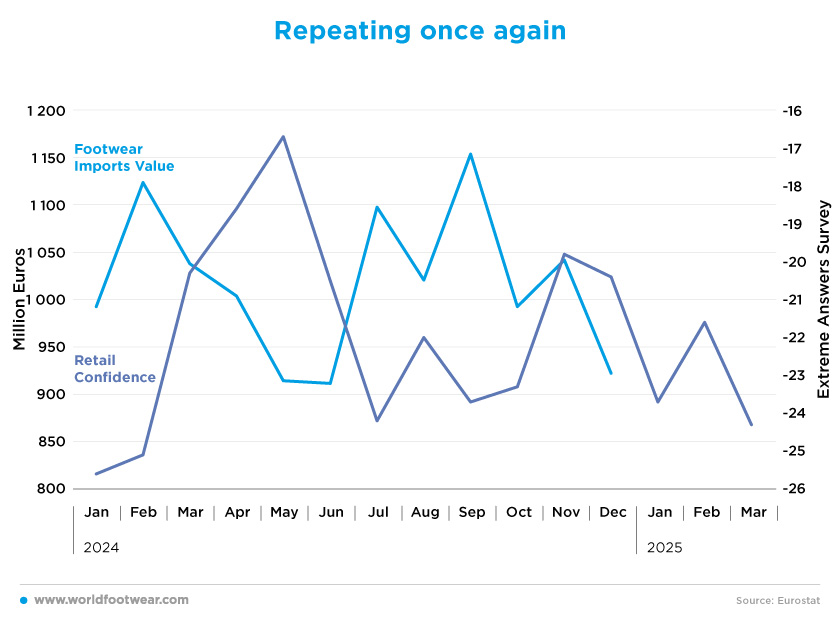

Repeating once again

The usual correlation between retail confidence and imports tends to show some delays. When retail confidence rises, this usually means that imports will rise in the following months due to the lag between orders and arrivals.

Last year, Germany imported a total of 663 million pairs of shoes, worth a total of 12.2 billion euros. This represents a decrease of 0.2% in value but an increase of 6.1% in volume compared with 2023 (more 38 million pairs imported in 2024). In 2024, that correlation was also observed.

Now, in 2025, one must believe history will likely repeat itself once again. Imports data for the first months of 2025 aren’t available yet, but one can speculate that with retail confidence having a little bit of a roller coaster trend since October 2024, the same may have happened to imports. For the months to come, the latest decrease in confidence may indicate less demand for imports.

The future is uncertain. The economy contracted in the final quarter of last year, reigniting fears of a recession, defined as two consecutive quarters of contraction (reuters.com). In addition, “the looming escalation of trade tensions and possible European retaliation to US tariffs could add to inflationary pressures in the short run”, said Carsten Brzeski, global head of macro at ING.

Germany’s retail sector is being shot from several angles, and the only hope is that retailers can persevere through this dark period.