Register to continue reading for free

Germany Retail: cautious forecasts reign amid uncertainty

Although the retail sector has shown modest year-on-year growth overall, the footwear segment continues to struggle. Meanwhile, online sales have recorded double-digit increases since September 2024. The truth is that despite signs of easing inflation and seasonal discount campaigns, both retailers and consumers remain cautious amid geopolitical tensions and economic uncertainty. The rebound seen earlier in the year has given way to cautious forecasts, particularly in light of the sharp downturn in footwear imports and the potential ramifications of shifting trade policies

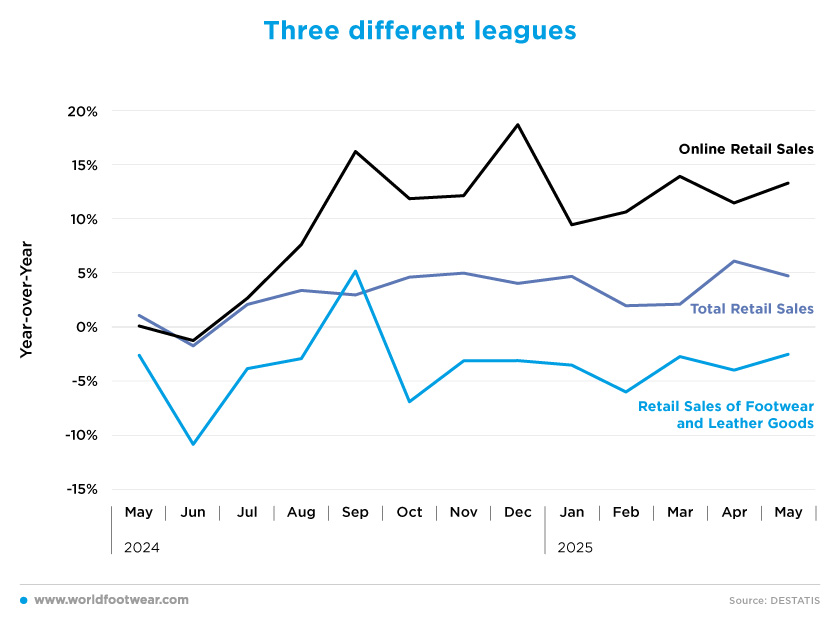

Three different leagues

Over the past few months, retail sales sectors in Germany have been playing in three different leagues.The footwear retail sector has been struggling for a while now. Since September 2024, sales have decreased every month compared to the same period the previous year.

Total retail sales in Germany have shown small but consistent year-on-year growth every month since July 2024, a trend that has continued into 2025. The average year-on-year growth is 3.9%, ranging from 1.9% in February to 6% in April. However, retail sales unexpectedly fell in May. Although there could be some recovery in June, Hauck Aufhäuser Lampe economist Alexander Krueger does not expect a large and sustained increase in consumption for the time being.

This could pose problems for economic growth in the second quarter, following unexpectedly robust growth in the first quarter, partly thanks to consumer spending. “The strong growth seen in the first quarter will not be repeated”, said VP Bank economist Thomas Gitzel (reuters.com).

On the other hand, online is in a league of its own. Since September 2024, growth rates have remained in double-digits (except in January 2025), with no signs of slowing down. Following stagnation during the first eight months of 2024, online sales have rebounded and are once again on an upward trajectory. Having started the year with a 9.4% increase in January, this figure has risen to 13.2% by May.

Online footwear sales grew by 5.8% in particular, recovering from a 6.3% decline in the weak Christmas quarter of 2024. Sales reached 918 million euros in the first quarter of 2025, up from 868 million euros in the same period last year. Online fashion sales also increased, rising by 3.9% to 3.449 billion euros, as compared to 3.318 billion euros in the first quarter of 2024. Compared to 2019, before the Coronavirus pandemic and the war in Ukraine, they have increased by 17.5%.

“The upward trend gives us hope, even if consumers remain unsettled in the short term by global political events”, commented BEVH’s Deputy General Manager, Martin Groß-Albenhausen. “Germans have a lot of money set aside - it will now be up to the new government to safeguard purchasing power despite the trade wars. Above all, companies must not be burdened even more” (shoeintelligence.com).

The growth level of retail and online retail sales is higher than last year’s, but June 2024 brought the only negative month of that year. Will it happen this time around?

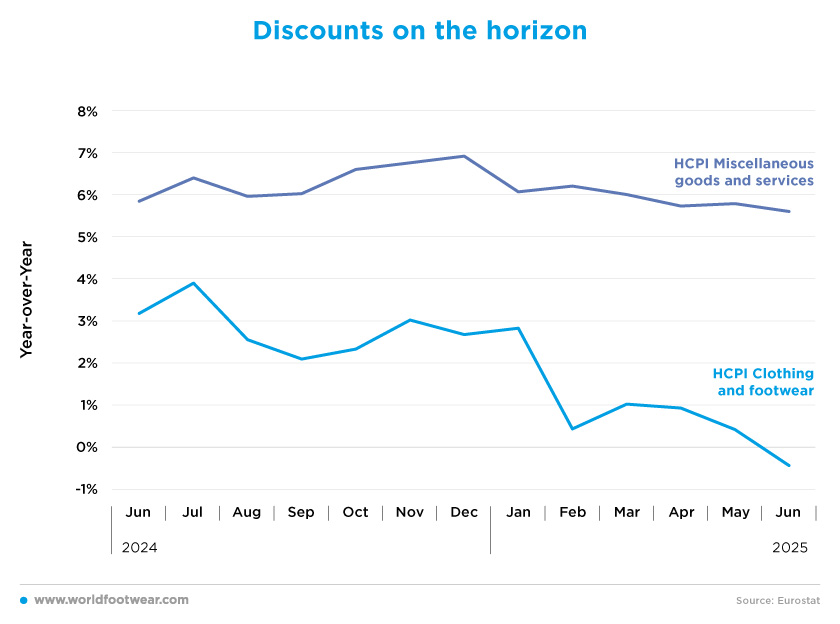

Discounts on the horizon

The usual target for inflation is an increase of around 2% per year in the prices of goods and services, but the German economy has experienced high inflation for some time. The all-items inflation rate over the past 12 months has averaged 6.2%, which is more than three times higher than the European Central Bank’s target.However, since February 2025, inflation appears to be easing, dropping from 6.2% in February to 5.6% in June. Elsewhere in Europe, June’s inflation figures showed a slight increase in France and Spain’s harmonised rate, but no change in Italy (cnbc.com).

Nevertheless, this trend is not evident across all sectors. Since the beginning of the year, clothing and footwear have experienced inflation of less than 1%, with the latest reading in June hitting minus 0.4%.

In any case, many companies in the textile, shoe, and leather goods industries will launch their summer sales over the next few days, recalls the German Trade Association of Textile, Shoes and Leathergoods (BTE). Traditionally, the summer sale, also known as the ‘final sale’, marks the end of the period when items are reduced in price. Discounted collections are often reduced in price again, while other items are offered at a discount for the first time.

“Many fashionable items from the spring and summer collections will be available at low prices in the coming weeks, making a shopping spree worthwhile again this year”, says Axel Augustin, Managing Director of BTE (bte.de).

Therefore, this downward trend doesn’t seem set to stop soon, meaning consumers can expect to see discounts on fashion goods soon.

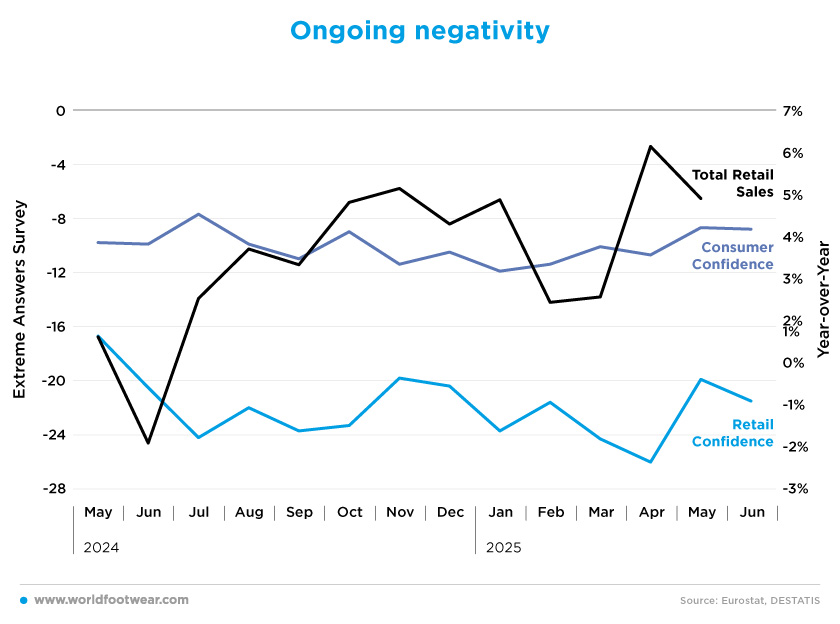

Ongoing negativity

Although total retail sales in Germany have shown small but consistent year-on-year increases, retailers remain pessimistic about the future. The last time retail confidence was positive was in November 2021 (3.9 EAS).Since then, there has been a persistent negative outlook on the future of the German economy and, consequently, future sales. April 2023 was the first time in two years that retail confidence went above minus 20, but it quickly fell again to minus 21.5 in June. On the bright side, retail confidence has improved by 9.3% since the beginning of the year.

As for consumers, their confidence indicator has been doing better than the retail one for a while, but it is still negative. Over the past 12 months, consumer confidence has wavered between minus 7.7 and minus 11.9, but there seems to be some light at the end of the tunnel. Consumer confidence has increased by 26% from January to June this year, meaning that, even though it is still negative, consumers are becoming more hopeful.

According to Rolf Bürkl of NIM, the increase in the appetite for savings reflects a wider reluctance to commit to major purchases due to ongoing uncertainty and high prices. He emphasised that a durable improvement in sentiment will require clearer signs of stability to reduce uncertainty and unlock household demand (actionforex.com).

Still, it should be noted that economic expectations among consumers have reached their highest level since Russia’s full-scale invasion of Ukraine. The report noted that the improved outlook is due to the German government’s stimulus packages for defence and infrastructure, which are set to take effect later this year (wsj.com).

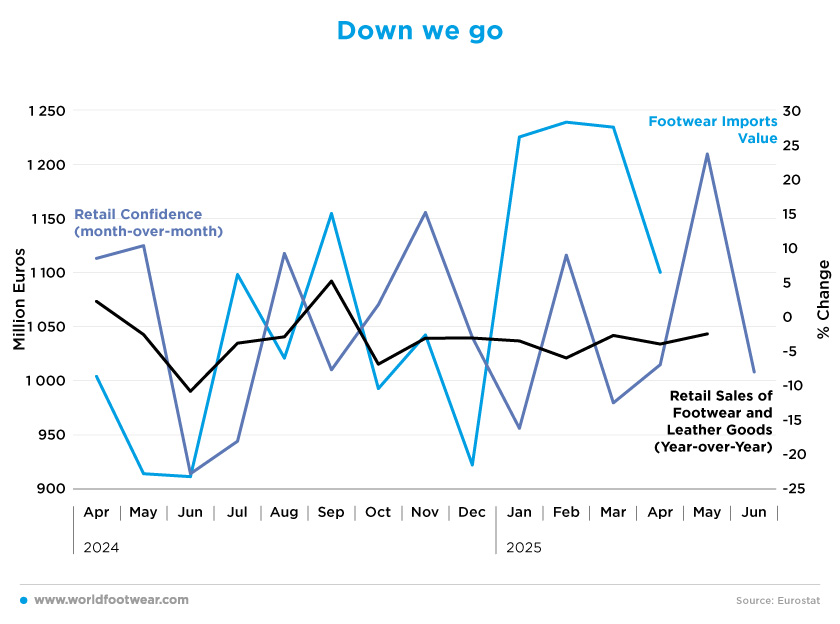

Down we go

In 2024, the value of footwear imports from Germany decreased by only 0.2%, but in 2025 they increased sharply. In January 2025, Germans imported over 18.5 million pairs of shoes more than in the same month of 2024 (an increase of 231.4 million euros), and this trend continued in February and March.However, data from April indicates a rapid decline. Taking into account the time lag between orders being placed and imports arriving, the 17.6% decrease in the number of pairs of shoes imported by German importers from March to April can be significantly correlated with the 12.5% decrease in retail confidence seen from February to March, which drove demand for stocks down.

“The level of consumer sentiment remains extremely low, and consumer uncertainty remains high”, explains Rolf Bürkl, a consumer expert at GfK. “The unpredictable customs and trade policy of the US government, turbulence on the stock markets, and fears of a third consecutive year of stagnation are all reasons why the consumer climate remains weak. In view of the general economic situation, people seem to think it advisable to save”.

This makes life unpredictable for importers, not only due to the impact on the import process, but also on sales forecasts for the coming months.

The truth is that the year was on track for good growth, but the huge shock of the new US trade policy, coupled with the recent 8% decline in retailer confidence and the decrease in footwear sales, means one can only expect imports to dive even deeper once the data is released.