Register to continue reading for free

UK Retail: fashion rebounds despite pressure on footwear spending

Since May, the UK’s textile, clothing, and footwear (TCF) sector has regained momentum, outperforming the total retail sector and benefiting from increased online demand. But this rebound masks underlying weaknesses in the footwear sector: consumer spending remains low amid persistent price deflation, and imports have fluctuated significantly as retailers adjust stock levels in response to volatile demand. With inflation still above the target rate and the Budget looming, the retail sector has entered the Golden Quarter with improved sales but constrained by economic uncertainty and cautious consumer behaviour

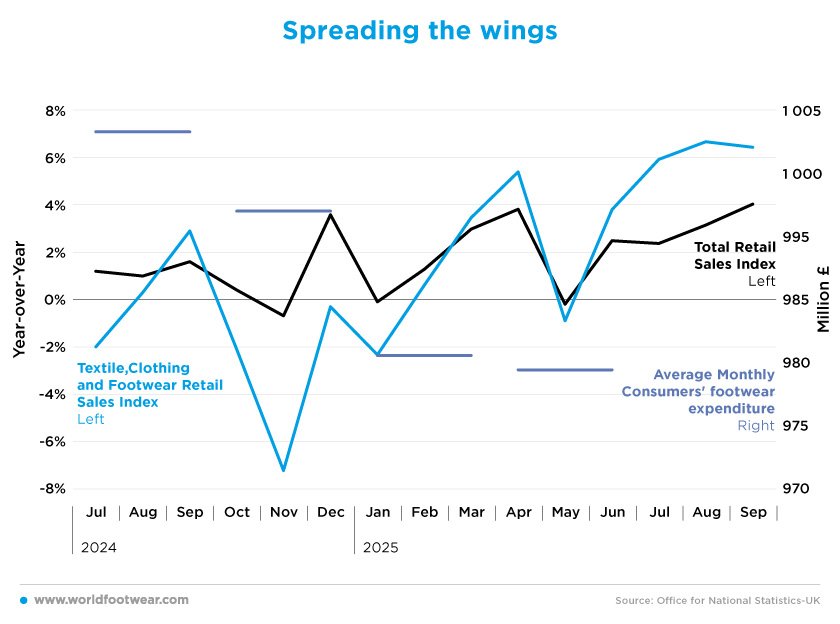

Spreading the wings

Textile, clothing, and footwear (TCF) sales took off after a negative sales growth in May (at minus 0.9%) and have now recovered. Apart from January and May, 2025 seems to be shaping up to be a good year for retailers in almost every sector in the UK.Although TCF sales show slightly less growth momentum in the latest available monthly data, slowing from 6.7% in August to 6.4% in September, September marked the fourth consecutive month of year-on-year increases in TCF sales. Even though total retail sales in the UK have also been increasing, TCF is performing even better.

The average year-on-year increase in TCF sales in the first nine months of 2025 is 3.2%, but if we look solely at the period between July and September, this figure rises to 5.7%. After the 2.2% decrease in sales last year, this suggests that fashion retail sales levels are definitely recovering.

In addition, the year-on-year increase in total retail sales in September was the biggest of the past 20 months, offering retailers a glimmer of hope. So far this year, total retail sales have increased by 2.2%, as compared to the same nine months of 2024.

“Overall sales grew in September (...). However, non-food sales are only growing by around 1.2% on average, indicating that spending continues to be very targeted as consumers remain cautious. As we enter the ‘golden’ quarter, retailers are planning product ranges and promotions to try and increase that rate of sales growth. They are also mindful that the Budget is beginning to move into view, with related detail about business rates reform and a general need for a boost to consumer confidence”, commented Linda Ellett, UK Head of Consumer, Retail & Leisure, KPMG (brc.org.uk).

Conversely, although sales are increasing, consumers’ expenditure on footwear appears to be decreasing. Average monthly consumer spending on footwear decreased from 982 million in the first quarter of 2025 to 981 million British pounds in the second quarter (at minus 0.1%). However, this decline has been ongoing since the second quarter of 2024, with an overall decrease of 2.2% in average monthly consumer spending on footwear.

These contradictory results from sales and consumer expenditure are mainly driven by the negative inflation footwear prices have experienced over the past 12 months (analysed later in this report).

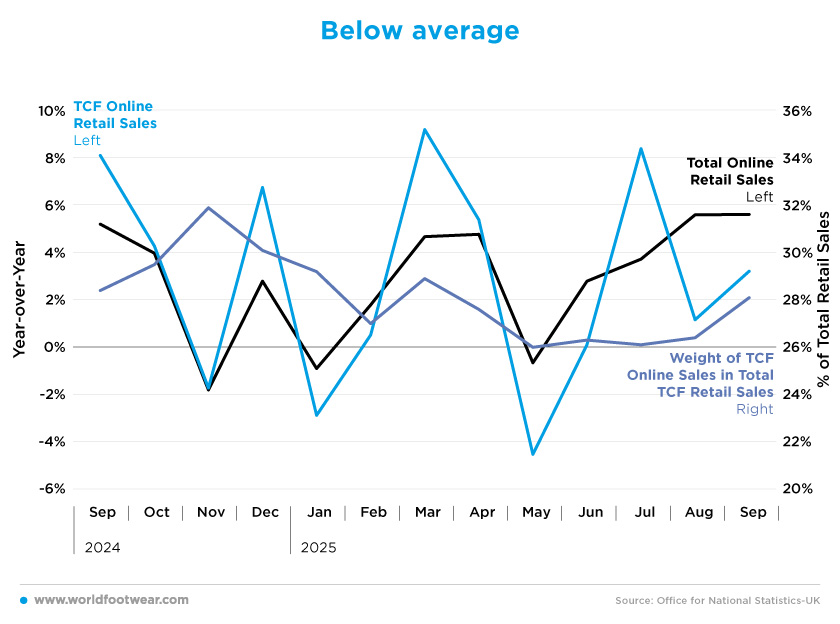

Below average

Online sales in the UK have exhibited similar behaviour to physical retail sales, albeit on a different scale. Total online sales also experienced negative growth in January (down 0.9%) and May (down 0.7%), which was felt more acutely in TCF goods (down 2.9% and 4.5%, respectively). Nevertheless, total online shopping has increased by 3.0% so far this year, and total fashion sales have increased by 2.3%, which is slightly below average.Although overall TCF sales are increasing every month, the reality is that this level of growth has been highly volatile for some time. Similar volatility patterns were seen last year, but this year the situation seems to have worsened, with year-on-year sales ranging from minus 4.5% to (positive) 9.2%, reaching their highest peaks in March (9.2%) and July (8.4%). The latest figures, from September, showed a year-on-year increase of 3.2%.

In terms of the proportion of TCF retail sales that are made online, it seems that consumers are shopping more in online stores than in physical ones this year. As previously mentioned, total TCF retail sales have grown by 3.2%, and the average monthly proportion of TCF online sales to total TCF retail sales in the first nine months of 2025 has increased by 0.5%. This suggests that online fashion sales are growing faster than physical sales. The latest figures, released in September, indicated that 28.1% of total TCF sales were made online.

“The autumnal weather certainly helped fashion sales, with clothing retailers continuing their run of outperformance and encouraging shoppers to refresh their wardrobes with the newest season trends”, said Kien Tan, Senior Retail Adviser at PwC UK. “However, autumn showers also discouraged shoppers from visiting physical stores, as high street footfall fell and the proportion of sales online increased to 28%, which is the highest penetration of online retail since the end of the pandemic”, he noted.

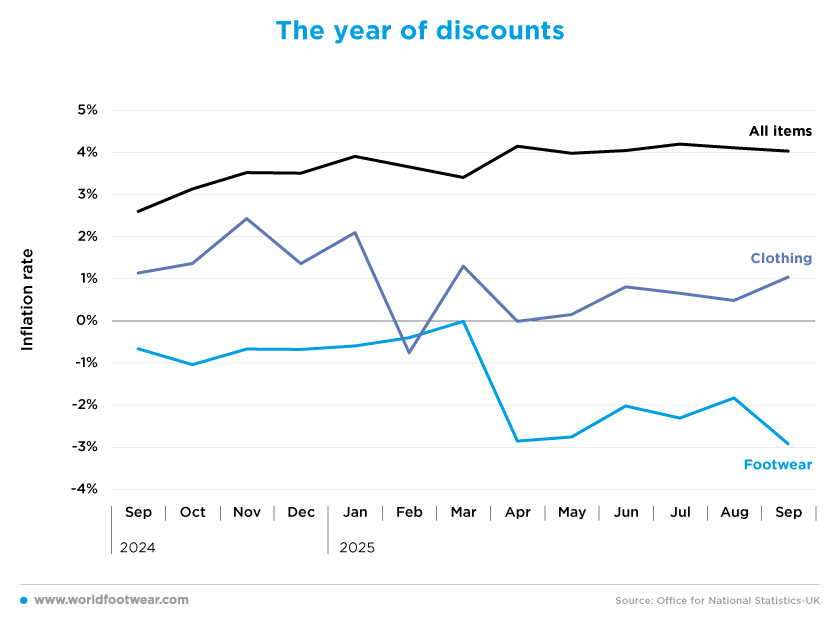

The year of discounts

Since July 2024, footwear prices have been on discount. Footwear inflation has been below zero every month this year (except in March, when the inflation rate was 0.0%), making it the most heavily discounted of the TCF sectors compared to last year. The average inflation rate for footwear this year is minus 1.7%, as compared to 0.7% for clothing. But both the main fashion sectors are experiencing a slowdown in prices, which contradicts the sales data.This tells us that consumers are buying more and that sales are increasing. However, it seems that this isn’t being reflected in price increases. The latest data, from September, showed the inflation rate for footwear at minus 2.9%, the lowest in the past six years, with no signs of an increase in the near future.

Matters are further complicated for the footwear by the fact that the overall inflation rate for the British economy is now above 4%. This means that inflation remains well above the Bank of England’s target of 2%.

Since August 2024, the UK’s central bank has cut interest rates five times, bringing them down to 4%. Inflation soared in 2022 due to increased demand for oil and gas following the pandemic, and energy prices surged again when Russia invaded Ukraine. It then remained well above the 2% target, partly due to higher food prices. Food prices continue to be a significant factor in current inflation figures (bbc.com).

The truth is that British consumers have been dealing with high inflation for a while now. However, since September last year, this economic variable has steadily increased, despite the actions of the central bank. Inflation decreased from 4.2% in July to 4% in September, so perhaps prices will start to slow down. However, this remains uncertain.

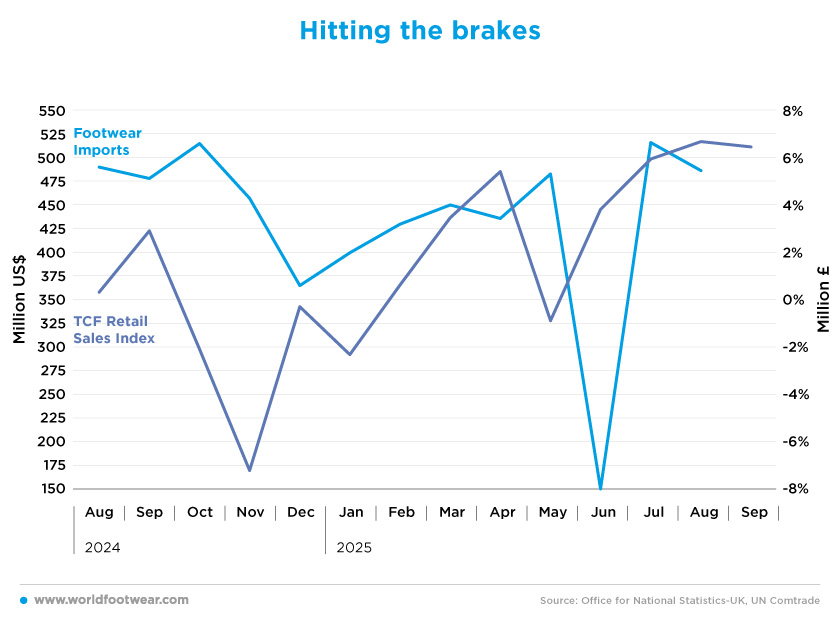

Hitting the brakes

In the first eight months of 2025, 3.3 billion pairs of footwear were imported, totalling 161 million dollars at an average price of 20.77 dollars per pair. This represents a 2.1% decrease in value and a 1.7% decrease in the number of pairs compared to 2024. However, the most striking figure emerges when analysing the month of June.As previously mentioned, May was the worst month for TCF sales this year, with a 0.9% year-on-year. This was reflected in the volume of orders placed by importers with suppliers the following month. While the average import value in the seven months of 2025 (excluding June) was 456 million US dollars, June registered just 150 million US dollars. This demonstrates how quickly retailers can react to their sales performance when restocking. Compared to the same month last year, June showed a 61.7% decrease in footwear imports.

Thankfully, imports climbed straight back up in July. After the positive sales figures in June, confidence returned and more than 516 million US dollars’ worth of footwear entered UK ports. This made July the biggest month for imports in the previous nine months.

Nevertheless, “rising inflation and a potentially taxing Budget is weighing on the minds of many households planning their Christmas spending. Retailers also face difficult decisions about investment and hiring over the Golden Quarter given uncertainty over business rates bills arriving in April”, emphasised Helen Dickinson, Chief Executive of the British Retail Consortium. Let’s wait and see what happens in the upcoming months.