Register to continue reading for free

UK Retail: signs of a slowdown are emerging

After a promising start to the year, the UK retail sector is now showing signs of slowing down. Textile, clothing and footwear (TCF) sales, which had recorded consistent year-on-year growth in the first months of 2025, have now begun to decline, reflecting a general downturn in retail performance. Online sales have been highly volatile, with TCF categories being particularly sensitive to changes in consumer sentiment. Meanwhile, rising inflation and weakening consumer confidence are putting downward pressure on spending, and the decline in sales suggests that imports may follow this trend

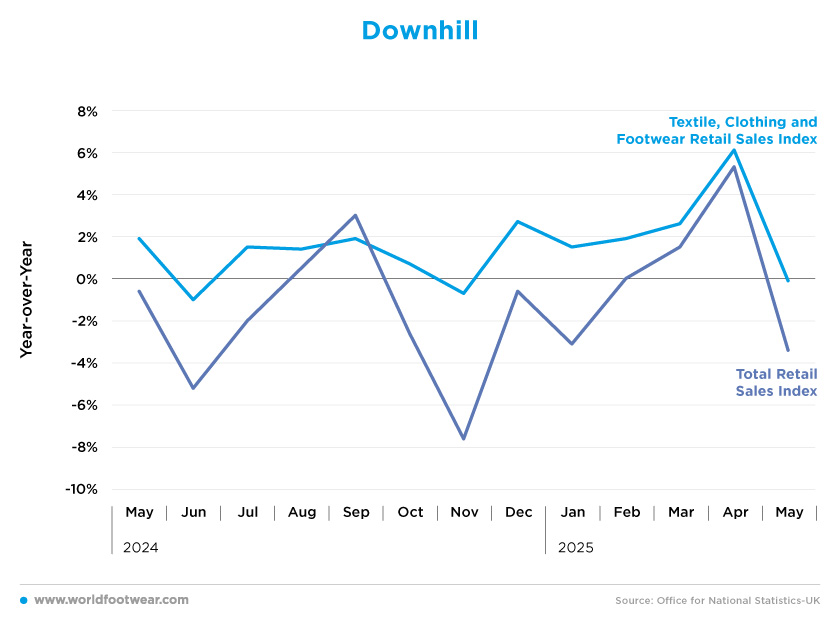

Downhill

Fashion sales in the UK got off to a strong start this year, with year-over-year growth recorded in every month. However, May saw a complete turnaround, with sales figures pointing downwards. After peaking at 6.1% in April, May saw a 0.1% decrease in textile, clothing and footwear sales, contradicting the 1.9% increase seen in the same month last year.

The reality is that the fashion sector is not alone in this. Total retail sales have behaved similarly so far in 2025. After turning positive in February, retail sales in the UK have gone back into the red, with a 3.4% decrease in May compared to last year.

In mid-July, Helen Dickinson, Chief Executive of the British Retail Consortium (BRC), said: “Retail sales heated up in June, with both food and non-food performing well. The soaring temperatures increased sales of electric fans while sports and leisure equipment was boosted by both the weather and the start of Wimbledon. Food sales remained strong, though this was in-part driven by food inflation (…).

However, “The outlook is not all bright and sunny: retailers are watching Government closely for details of the upcoming business rates reform”. “If the Government includes shops within its new higher rates threshold, then many retailers will be forced to rethink their investment plans. The closure of larger stores would harm the local communities they support, costing jobs and reducing footfall in the area they serve”, she warned (brc.org.uk).

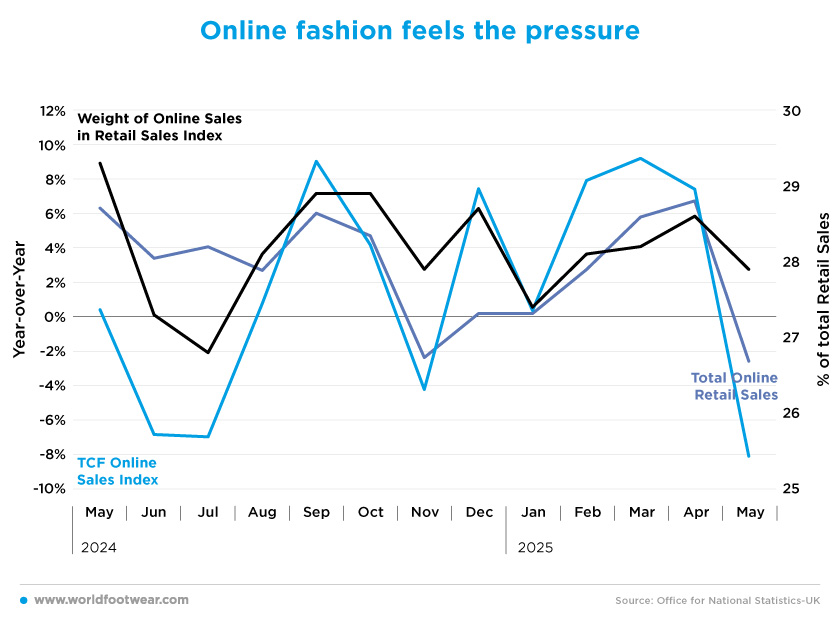

Online fashion feels the pressure

Online sales in the UK are the definition of a roller coaster, and 2025 is not escaping that either, with the sector experiencing significant fluctuations and unpredictable trends. The year started well, with online sales increasing by 6.7% year-over-year in April. However, this soon dropped to minus 2.6% in May.As textile, clothing and footwear sales have a significant and consistent impact on total online shopping (averaging 28.1% of total online sales over the past 12 months), it is expected that their growth rates will reflect the overall trend in online sales. After reaching a year-over-year growth rate of 9.2% in March, TCF online sales decreased by 8.1% in May, moving in the opposite direction.

Oliver Vernon-Harcourt, partner and head of retail at Deloitte, commented: “Overall, consumer spending has been more volatile in recent months, showing both positive and negative trends. Consumers remain cautious, no doubt due to the impact of persistent food inflation and higher energy prices. As demand for bigger ticket items such as appliances, electricals, and furniture remained slow in Q2, consumers also spent less on essentials as they prioritised saving and spending disposable income on holidays and eating out” (deloitte.com).

Fashion has always been popular when it comes to online shopping, so TCF sales are hit harder when the picture gets dark.

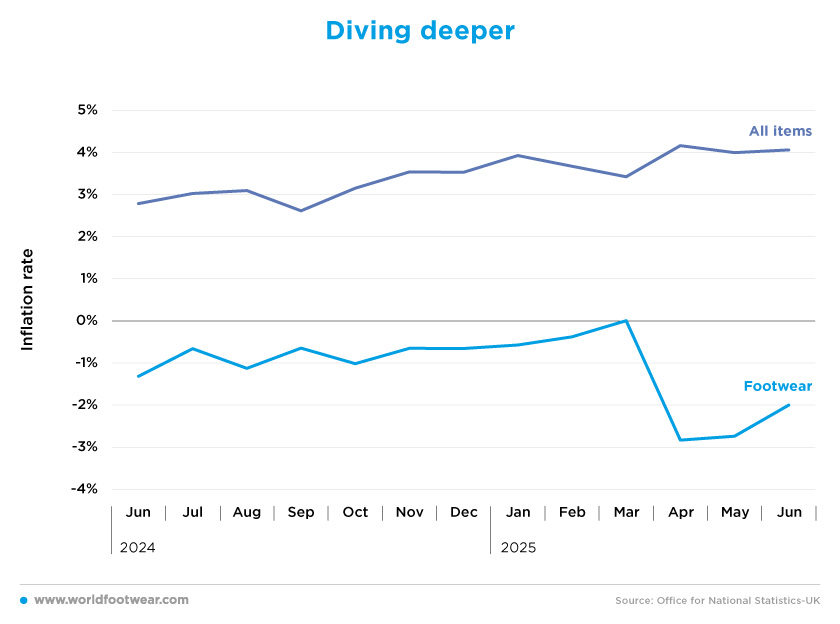

Diving deeper

Following a period of recovery that ended in September 2024, inflation in the British economy has been on the rise since then, and the first two quarters of 2025 are no exception. The year began with an inflation rate of 3.9% in January, but the latest reading in June indicates that this has increased to 4.1%, making it more difficult for consumers to predict their future spending.“Despite fierce competition between retailers, retail inflation has risen steadily over the last nine months as a result of the Chancellor’s last Budget, which significantly increased employment costs. Further tax rises hitting the retail industry at the next Budget would likely fan the flames of inflation as retailers are forced to increase prices”, warns Helen Dickinson, Chief Executive of the BRC (brc.org.uk).

On the other hand, footwear has been dealing with the opposite phenomenon, deflation. Footwear has been showing cheaper year-over-year prices since June 2024, but the trajectory seemed to be heading to positive inflation until it hit 0% in March 2025. But since April, things seem to be diving deeper. That month registered an inflation rate of minus 2.8% for footwear, the lowest of the past 2 years, which means that prices registered an all-time low of the past two years. Even though smaller, the latest reading of June still showed a 2% inflation rate.

In addition, consumer confidence fell by 2.6 percentage points in the second quarter of 2025, representing the first marked decline in confidence since October 2022, when inflation peaked at its highest rate in 40 years, and the lowest confidence level since the first quarter of 2024.

Céline Fenech, consumer insight lead at Deloitte, said: “This drop in confidence signals a weakening of consumers’ resilience, as concerns of a slowing labour market have left consumers worried about job security and income growth prospects, while persistent inflation and a high cost of living have negatively impacted sentiment towards personal debt”. However, “if an uptick in both economic growth and business sentiment reduces pressures on the job market and on earnings, a return to positive confidence could still be on the cards” (deloitte.com).

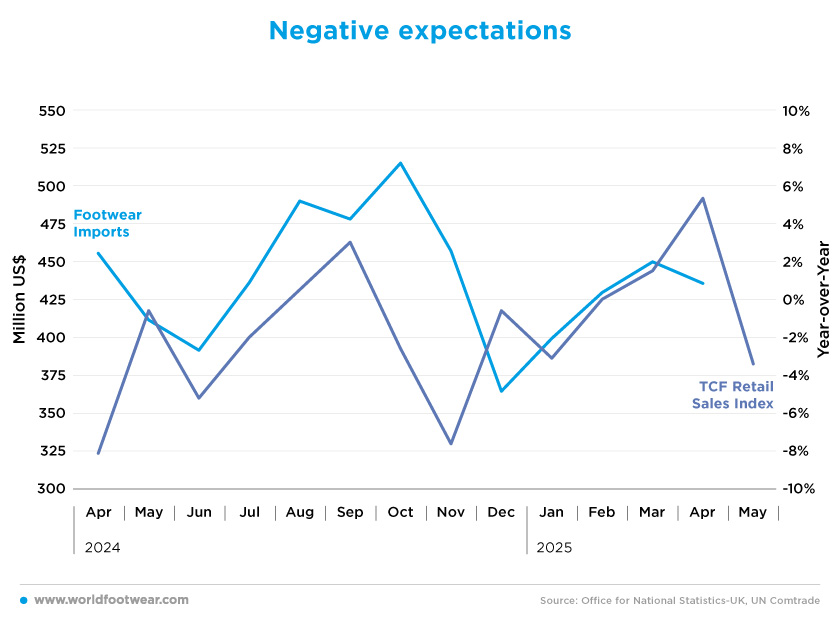

Negative expectations

There was a significant decline in footwear imports to the UK in the last two months of 2024, but things started to pick up at the beginning of 2025, with increases seen in the first three months of the year.So far this year, the British economy has imported a total of 70.8 million pairs of footwear, worth 1.7 billion dollars. Currently, the value of imports has fallen by 9.9% this year, but the quantity has increased by 1.3%, resulting in a lower average import price per pair. This could help to explain the significant deflation in footwear prices this year. While TCF sales were increasing, imports were flowing back in; however, now that retail sales of these goods are declining, expectations for import growth are negative.

Thomas Pugh, chief economist at tax consultancy RSM UK, commented: “Looking ahead, the second quarter will look substantially worse than the first quarter as there is some payback from activity brought forward to avoid taxes and tariffs. The big question now is whether the recent string of weak data in retail sales and employment is a one-off, due to the initial shock of tax increases and tariffs, or whether it’s the start of a new trend” (independent.co.uk).