Register to continue reading for free

UK Retail: the sector appears to be holding its own

The UK retail sector appears to be holding its own despite fears of increased costs as a result of the new Employment Rights Bill. In particular, retail sales of Textile, Clothing and Footwear (TCF) have risen back-to-back in the first quarter of the year, and the improvement in footwear inflation from negative to neutral in March may suggest a boost to demand. Although consumers aren’t exactly optimistic about the future, especially with new rising bills and the ongoing US trade war, retailers still have reasons to restock

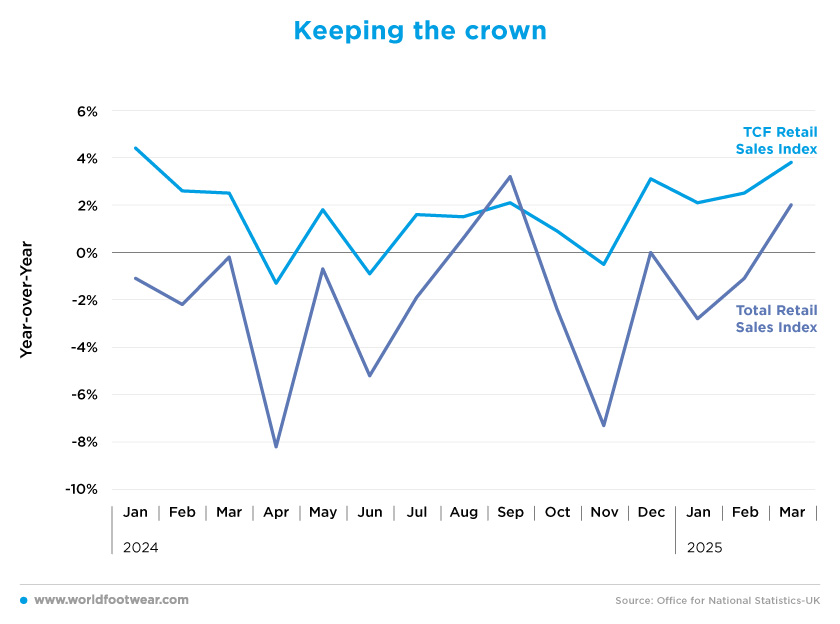

Keeping the crown

Textile, Clothing, and Footwear (TCF) retail sales have been growing year-over-year since December 2024, and the landscape seems to be looking better every month.After a bit of a rollercoaster year last year, TCF sales in the UK are returning to a steady growth trend. After 2024 ended with a positive month, the first three months of the year have given retailers even more hope with increases of 2.1%, 2.5%, and 3.8% in January, February, and March, respectively. This is an even better indicator when it is backed up by the increases seen in the same months last year, meaning that the rise in sales is not due to a recalibration, but to continued growth.

As for the overall state of the UK retail sector, after several months of declining sales, March finally brought some hope. This month saw an increase in sales of 2% compared to the same month of the previous year, but in 2024, the same month saw a decrease of 0.2%. Except for September 2024, it was a very difficult year for retailers, who saw a fall in the value of their sales compared to 2023.

Nevertheless, 2025 began with grey skies. According to Helen Dickinson, chief executive of the British Retail Consortium, the implementation of the Employment Rights Bill in its current form is not good news, especially when nearly 250 000 jobs have been lost in the retail sector over the past five years.

“Almost 250,000 jobs have been lost in retail over the last five years, and many major retailers have already announced further job cuts on the back of increased costs of employment, which kicked in April. Those in charge of retail hiring are clear – unless amended, the Bill will make it even harder to keep and create jobs and reduce the flexibility that defines many existing retail roles”, she warned, pinning her hopes on the amendments being debated by the Lords (brc.org.uk).

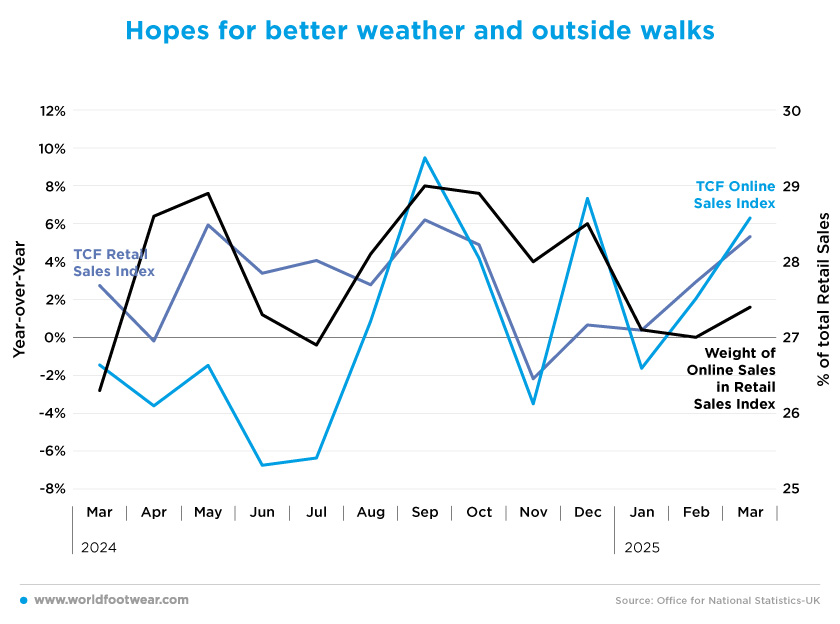

Hopes for better weather and outside walks

E-commerce has been the trend for TCF sales around the world, but recently it seems that consumers in the UK are going outdoors again.TCF sales via online channels have been on a rollercoaster ride for several months now, with strong increases in September and December 2024 (9.5% and 7.3% respectively) followed by a return to growth in March 2025 with an increase of 6.3%. The year-on-year trend in TCF’s online sales has closely followed the overall e-commerce behaviour of the UK retail sector as a whole, with just a little more volatility.

However, the reality is that in most sectors, increases in online sales are closely linked to periods of big discounts and promotions, making it a better option for consumers.

“As we have seen already this year, firms are increasingly scrutinising where best to be located and the implications of the likes of recently announced employment cost rises. Online shopping and the growth of social commerce has contributed to a lowering of demand for some physical retail stores and boardrooms will continue to keep a close eye on monthly footfall and sales data as 2025 progresses”, said Linda Ellett, UK Head of Consumer, Retail & Leisure at KPMG (brc.org.uk).

In any case, since peaking in September 2024, the weight of online retail sales in total retail has fallen significantly, from 29% to 27.4% (latest reading March 2025). As the spring figures come in, physical retailers are hoping that better weather will bring consumers back to the high street and reduce their reliance on e-commerce.

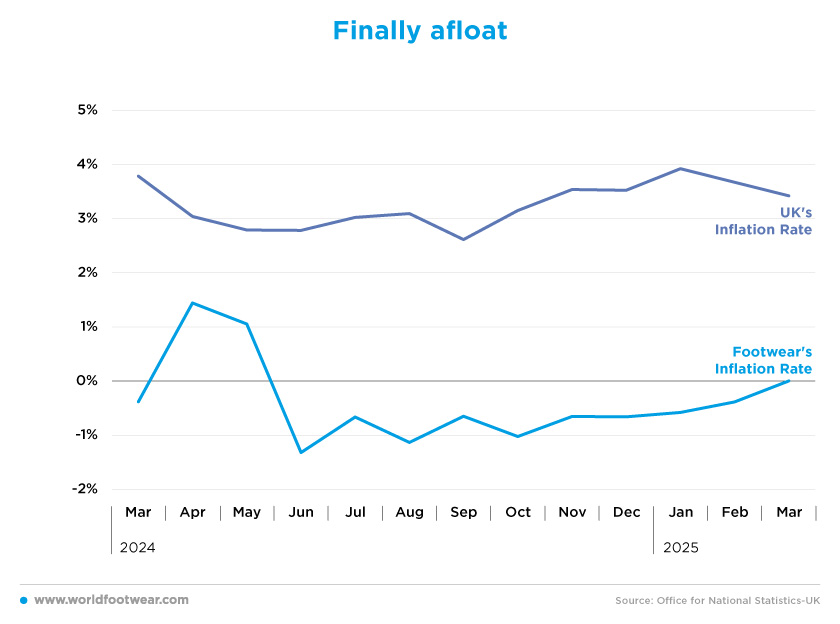

Finally afloat

Inflation in the UK economy has been somewhat contained over the past 12 months. Although it remains above the Bank of England’s target of 2%, there haven’t been any spikes in recent months, with inflation ranging from 2.6% to 3.9%. There has been some deflation since the beginning of the year, with the higher figure of 3.9% in January followed by a slight cooling to 3.4% in March. But as expected, inflation isn’t hitting all sectors equally. This is particularly true for footwear.From June 2024 to February 2025, the UK footwear sector experienced negative inflation rates, as low as minus 1.3%. This type of phenomenon is particularly dangerous, as it represents a fall in demand that causes prices to fall so much that products become even cheaper than they were in the past.

Nevertheless, there are signs of a recovery in activity: after the negative inflation rate in March 2024 (0.4%), the footwear sector registered a neutral rate this time (0% inflation in March 2025). There is little light at the end of the tunnel, but hopes are that increased demand for footwear will bring prices back up.

Not that either, but again, the new Employment Rights Bill may make the fight against inflation more difficult as costs rise.

According to Mike Watkins, Head of Retailer and Business Insight, NielsenIQ, “Shoppers continue to benefit from lower shop price inflation than a year ago, but prices are slowly rising across supply chains, so retailers will be looking at ways to mitigate this as far as possible. And whilst we expect consumers to remain cautious on discretionary spend, the late Easter will have helped to stimulate sales” (brc.org.uk).

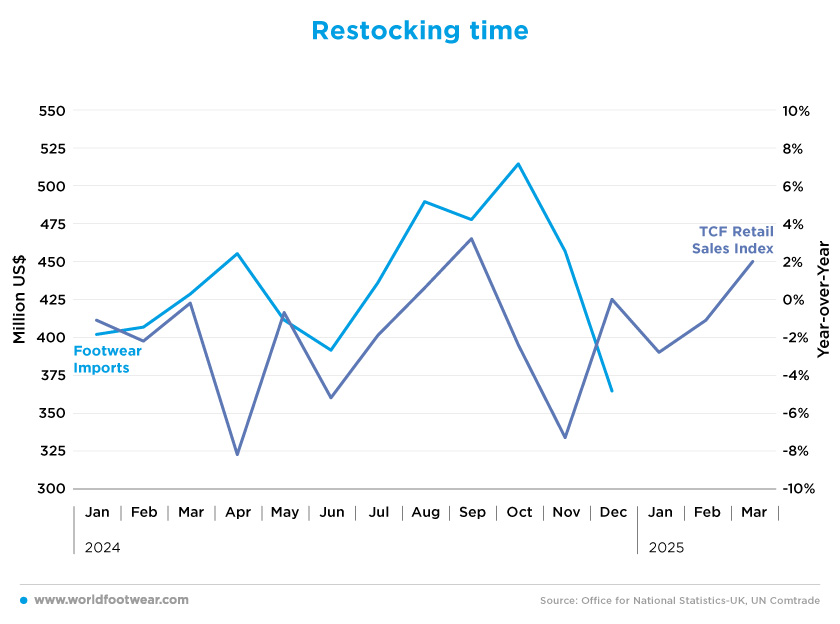

Restocking time

In 2024, UK importers imported a total of 5.2 billion US dollars worth of footwear (an increase of 0.6% on 2023), representing a total of 258 million pairs of shoes, at an average import price of 20.26 US dollars per pair. However, these high figures hide the monthly behaviour of imports. After the big spike in imports in October, when they reached 514 million dollars, the trend reversed, and in the last month of the year, only 365 million dollars were imported.This fall in imports in the last two months of last year, combined with the latest reading of an increase in TCF sales in March, may indicate that retailers have time to replenish their stocks for future demand. So far, there hasn’t been any published data on footwear imports in 2025, but it is expected that as footwear inflation rises and sales increase, retailers will increase their external orders and drive-up imports again.

Nevertheless, UK consumer confidence fell to its lowest level since November 2023 in April, as people became more pessimistic about the outlook for the economy, particularly due to new rising bills and the ongoing US trade war. Neil Bellamy, consumer insights director at market research firm Gfk, said consumer confidence could slide further if inflation picks up rapidly this year.

“Consumers have not only been grappling with multiple April cost increases in the form of utilities, council tax, stamp duty, and road tax, but they are also hearing dire warnings of renewed high inflation on the back of Trump's tariffs”, he said (reuters.com). Retailers will be hoping that this doesn’t derail the sector’s recovery.