Register to continue reading for free

Netherlands Retail: The sector held its ground in 2025, but momentum is cooling

The retail sector in the Netherlands remained resilient in 2025, achieving moderate growth. However, the fashion retail sector, including the footwear sub-sector, was more volatile. While overall inflation eased, clothing and footwear saw subdued or negative price dynamics, potentially suggesting limited pricing power. Despite relatively stable retail sentiment, consumer confidence deteriorated towards the end of the year, which, together with a slowdown in footwear imports, points to a softer trade outlook

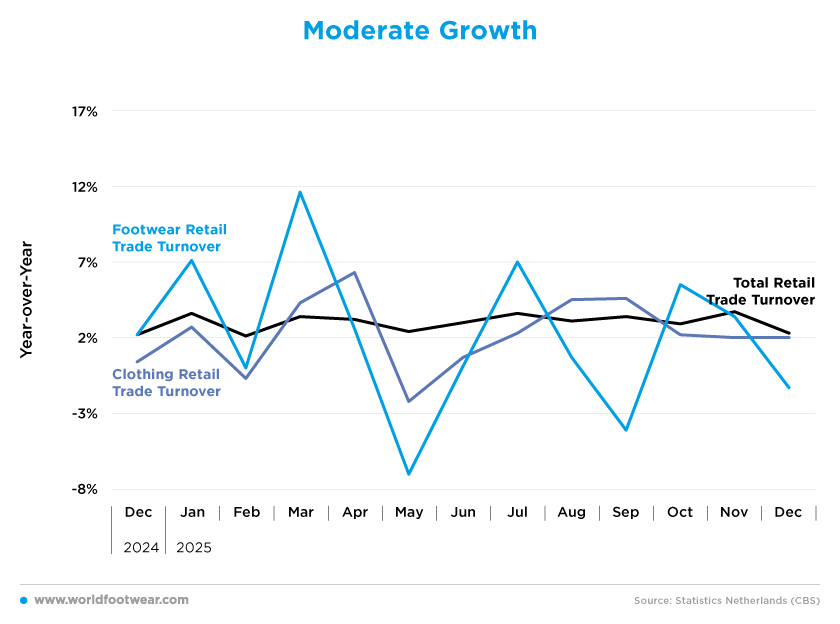

Moderate Growth

Total retail turnover* in the Netherlands experienced a slight slowdown in growth at the end of the year 2025, increasing by 2.3% in December – the lowest growth rate in the past ten months. This development may be due to more negative consumer expectations regarding future unemployment and by slower year-on-year growth in the employed labour force (cbs.nl).Nevertheless, despite relatively modest GDP growth of 1.8% in 2025, retail turnover growth remained stable throughout the year, consistently ranging between 2% and 4%, resulting in an annual average growth rate of 3.1%. Overall, this points to a consistent expansion in retail sales across the sector.

By contrast, the fashion retail sector (combining clothing and footwear) continues to exhibit considerably greater volatility in growth rates, while still showing overall expansion. Of the two subsectors, footwear is the most volatile: turnover grew by 11.6% in March, 7% in July, and 5.5% in October, but declined by 7% in May, 4.1% in September, and 1.3% in December. This results in an annual average growth of 2.1%, which is smaller than that of the retail sector in general, and is accompanied by a reduction in sales at the end of the year.

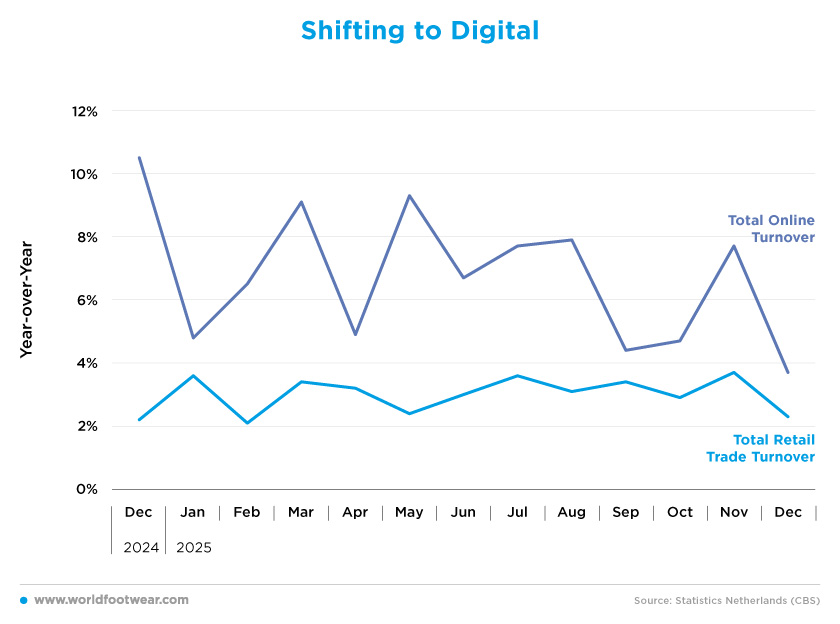

Shifting to Digital

When comparing online retail turnover with total retail turnover, it is clear that online sales grew at a faster pace than the retail sector overall. In 2025, online retail growth rates were relatively volatile, ranging from 9.3% in May to 3.7% in December, with an annual average growth rate of 6.5% being reached. By comparison, total retail turnover grew by an annual average of 3.1%, meaning online retail expanded by 3.4 percentage points more over the year.

While total retail turnover displayed relatively stable growth dynamics, online retail growth showed signs of a slight downward trend in 2025. In the first half of the year, online retail recorded an average growth rate of 6.9%, which declined to 6.0% in the second half. Seasonal patterns also differed from typical expectations, as the summer months recorded stronger average growth than the winter months (7.4% versus 5.0%, respectively).

According to Thuiswinkel.org, which commissioned NielsenIQ and GfK to conduct the study, the total number of online purchases increased by 3% in the third quarter, reaching 86 million euros. Dutch consumers also increasingly turned to foreign webshops, particularly Chinese retailers. Purchases from Chinese online stores were driven mainly by higher demand for home-and-garden products and toys. In contrast, American webshops lost market share, declining by 2%.

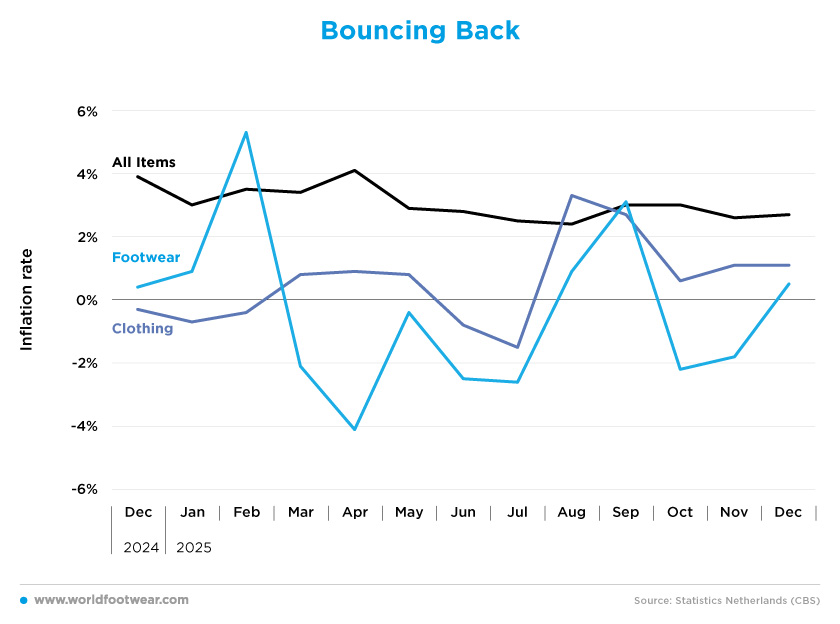

Bouncing Back

Headline inflation (all items) stood at 2.7% in December 2025, down from 3.9% in the same month of 2024. This confirms a slow but steady convergence towards the 2% target, despite some fluctuations throughout the year. The annual average inflation rate stood at 3.0% in 2025, down from 3.2% in 2024. However, services remained the main contributor to above-target inflation (think.ing.com), recording an average annual inflation rate of 3.9% in 2025, compared with 2.2% for goods.As expected, the clothing and footwear sectors displayed greater volatility but lower average inflation rates. Clothing prices ranged from -1.5% in July to 3.3% in August, resulting in an annual average inflation rate of 0.7% in 2025.

Footwear prices were even more volatile, peaking at 5.3% in February before falling to -4.1% in April, producing an average inflation rate of -0.4% (i.e. mild deflation). Two particularly sharp downward corrections were observed during the year: in March, inflation fell to -2.1% from 5.3% in the previous month, and in October it dropped to -2.2% from 3.1% in September.

More recently, price developments suggest the beginning of a rebound, with inflation rising to 0.5% in December from -1.8% in November, in line with broader expectations.

According to the European Commission’s January business survey, selling price expectations among Dutch firms have increased recently, reaching their highest level in twelve months. At the same time, indirect effects of trade tensions – particularly the redirection of Chinese exports from the United States to European markets – could exert stronger downward pressure on prices than currently anticipated (think.ing.com).

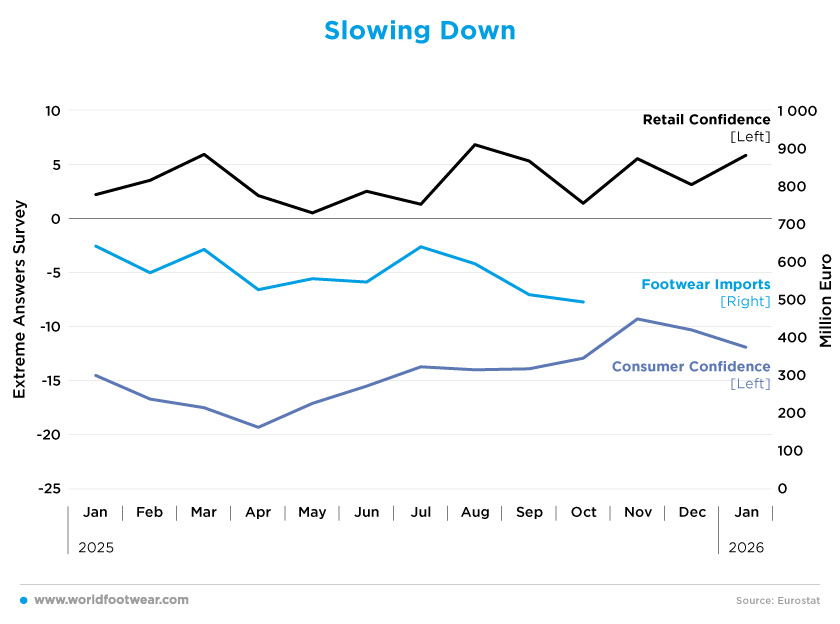

Slowing Down

The European Commission conducts monthly retail and consumer confidence surveys. These measure the balance between positive and negative responses, expressed in percentage points (pp) of total responses. This information is used as the basis for the following analysis.Consumer confidence in the Netherlands has remained in negative territory since at least late 2023. The lowest level was recorded in April 2025, at minus 19.3 pp. Since then, sentiment gradually improved, showing a clear upward trend and reaching minus 9.3 pp in November, although still below zero. The following two months, however, registered a decline in confidence, which fell to minus 11.9 pp in January 2026.

According to Statistics Netherlands (CBS), which conducts its own consumer confidence survey, this deterioration reflects more negative expectations regarding the economic outlook for the next twelve months, as well as weaker expectations about households’ personal financial situation.

The picture for retail confidence is contrasting. After a prolonged period of pessimism during most of 2024, the sector maintained a positive confidence balance throughout 2025. Although no clear trend is visible – reflecting relatively high volatility – the indicator reached a low of 0.5 pp in May and a high of 6.8 pp in August. In January 2026, retail confidence increased again, further diverging from consumer sentiment.

Against this backdrop, the outlook for footwear imports (in value terms) appears less favourable. Year-on-year growth shows a clear downward trend despite typical monthly volatility. Following a strong growth in late 2024 – 26% in October and a peak of 34% in December – import growth slowed steadily throughout 2025, turning negative in September (minus 10%) and October (minus 8%). As a result, the average growth rate from January to October stands at 7%, compared with 14% for the whole of 2024.

According to Statistics Netherlands (CBS), which conducts its own consumer confidence survey, this deterioration reflects more negative expectations regarding the economic outlook for the next twelve months, as well as weaker expectations about households’ personal financial situation.

The picture for retail confidence is contrasting. After a prolonged period of pessimism during most of 2024, the sector maintained a positive confidence balance throughout 2025. Although no clear trend is visible – reflecting relatively high volatility – the indicator reached a low of 0.5 pp in May and a high of 6.8 pp in August. In January 2026, retail confidence increased again, further diverging from consumer sentiment.

Against this backdrop, the outlook for footwear imports (in value terms) appears less favourable. Year-on-year growth shows a clear downward trend despite typical monthly volatility. Following a strong growth in late 2024 – 26% in October and a peak of 34% in December – import growth slowed steadily throughout 2025, turning negative in September (minus 10%) and October (minus 8%). As a result, the average growth rate from January to October stands at 7%, compared with 14% for the whole of 2024.

Overall, the outlook for 2026 remains uncertain. Consumer confidence improved during most of 2025 but weakened again at the turn of the year, while retail confidence remained positive, highlighting a contrast between household sentiment and business expectations. At the same time, although footwear import growth has followed a downward trend, the absence of data for November, December, and January means that recent developments may still alter the overall picture.

*Due to a revision of the Statistics Netherlands (CBS) retail turnover series, the data presented in this edition of the Retail Flash Netherlands may differ from those in the previous editions.