Register to continue reading for free

Netherlands Retail: mixed signs in the first half of the year

Despite a strong start to 2025, the Dutch retail sector has been experiencing some volatility. Sales in the footwear sector recorded significant fluctuations, reaching their lowest point in April with a decline of 7.5%, before recovering to a decline of 2.5% in May. Notably, the footwear sector experienced negative inflation in these months, meaning consumers paid less for footwear. However, imports to the Netherlands have increased in the first quarter, and Retail confidence remains above zero. Therefore, despite negative consumer confidence and a challenging macroeconomic backdrop, there may still be some hope for the rest of the year

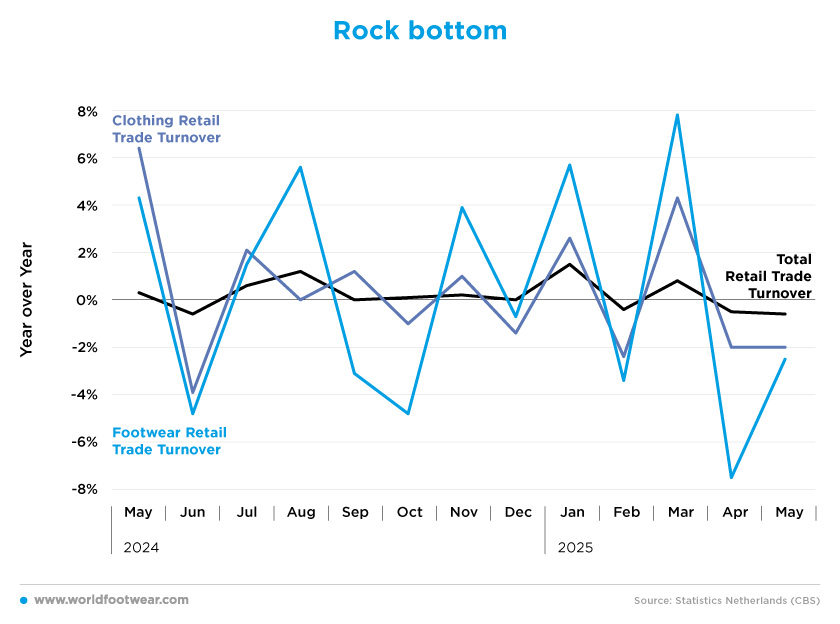

Rock Bottom

Despite a strong starting position, the Dutch bank ABN AMRO reports that the Netherlands’ economy is entering a period of financial uncertainty.In its recent retail sector forecast, the bank predicts modest volume growth of 1% in 2025, slowing to 0.5% in 2026. Domestic demand remains strong and household purchasing power is recovering thanks to rising wages. However, the bank warns that the retail sector could come under pressure due to low consumer confidence. According to ABN Amro, “uncertainty could lead to the postponement of non-essential expenses and consumers increasingly opting for private labels and discounters” (fashionunited.nl).

In terms of retail sales, after a strong start to 2025, there were two consecutive monthly decreases in April and May (0.5% and 0.6%, respectively). The fashion sector experienced a similar trend, albeit more intensely. Retail sales of clothing and footwear have exhibited similar behaviour, with the latter appearing to be hit harder on both the way up and down.

According to figures from Statistics Netherlands (CBS), clothing stores saw a 1.9% decline in May. Turnover in physical stores was lower for clothing companies than a year earlier, and online turnover was lower in May too (fashionunited.nl).

Footwear sales decreased by 7.5% in April, as compared to the same month last year, whereas clothing sales decreased by only 2%. This occurred right after a significant 7.8% increase in sales in March, which offset the previous month’s figures. After reaching rock bottom in April, footwear sales seem to be recovering, although they remain negative. The latest figures for May indicated a smaller decrease of 2.5%. So far this year, only two months have shown an increase in sales, painting a gloomy picture for 2025.

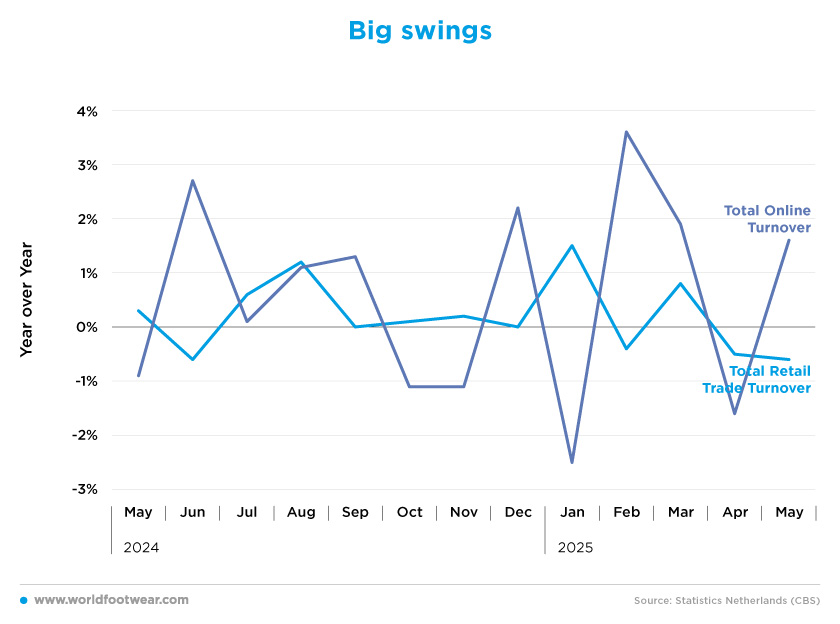

Big Swings

Over the past twelve months, monthly retail sales in the Netherlands have trended between 1.5% and minus 0.6% year-over-year, while online retail sales have fluctuated considerably, ranging from minus 2.5% to 3.6% (with both extremes occurring in consecutive months in 2025). E-commerce tends to be more volatile than physical retail, mainly due to significant discounts offered by online platforms and shops, as well as changes in weather conditions (rainy months tend to negatively impact physical retail).Compared to other European countries, the Netherlands has the highest proportion of online shoppers. In the last quarter of 2024, at least 86.7% of Dutch consumers bought something online. This equals to hundreds of thousands of people starting to shop online last year. These figures come from the latest report by Eurostat, the European Union’s statistics office (ecommercenews.eu).

The chart clearly shows the negative correlation between online and physical stores, highlighting the ongoing battle between the two. Most months, when physical retail improves, online retail suffers. For example, in January, online retail showed a year-over-year decrease of 2.5%, while physical retail increased by 1.5%. In February, the tables turned, with online retail increasing by 3.6%, while physical retail decreased by 0.4%.

The latest figures for May show e-commerce gaining strength once again with year-over-year growth of 1.6%, but looking at the recent past, it seems likely that this is just another big swing.

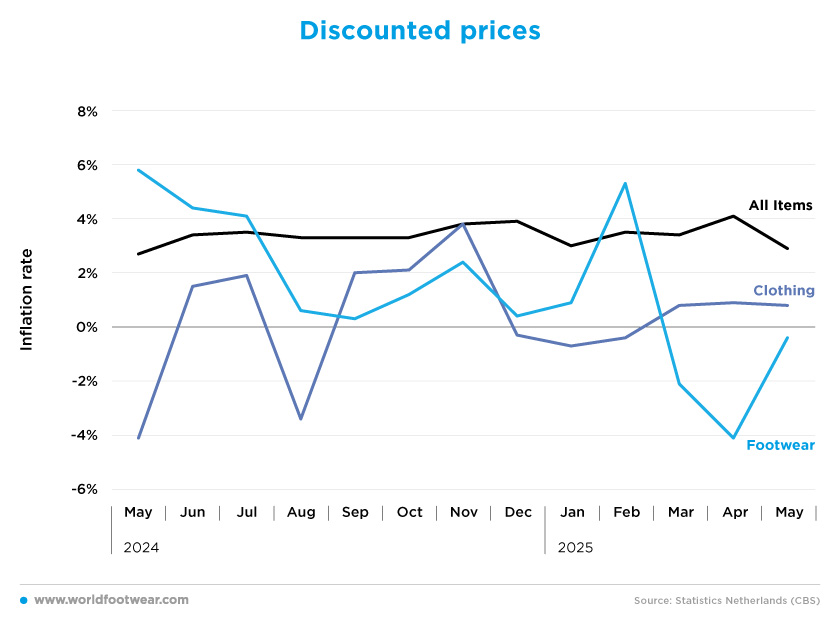

Discounted Prices

Inflation in the Netherlands remains higher than the European average. While energy and product prices have declined across much of the Eurozone, prices in the Netherlands have continued to rise.Although economists generally prefer to keep inflation near 2%, which they consider to be healthy growth, the Dutch economy has maintained a similar inflation level to last year. This means that it is still averaging above the European Central Bank’s 2% target. In the first five months of 2025, the monthly all-items inflation rate averaged 3.4%, with the biggest spike occurring in April at 4.1%. Although inflation dipped slightly in May, prices for groceries, energy and housing remained key drivers of higher costs.

Around one-third of the overall price increase was attributed to housing-related expenses, such as energy and water bills. CBS noted that this trend is striking given that more households are generating their own electricity. Households with solar panels, heat pumps or improved insulation were likely to have faced smaller increases. In contrast, households without such measures are paying substantially more than average. The price of groceries also continued to rise. Products such as coffee and chocolate have been more expensive for a considerable amount of time (nltimes.nl).

However, the reality of the fashion sector appears to be quite different, with the footwear sector being a particularly stunning example.

Although footwear inflation eased in 2024, it seems to have been on a roller coaster in 2025. In February, footwear inflation hit 5.3% (1.8 percentage points above the inflation rate for all items), but it quickly changed trajectory, decreasing to minus 4.1% in April. The latest reading in May still showed a negative footwear inflation rate of minus 0.4%, resulting in an average inflation rate of minus 0.1% in the first five months of 2025. This means that, on average, consumers are paying less for footwear than last year.

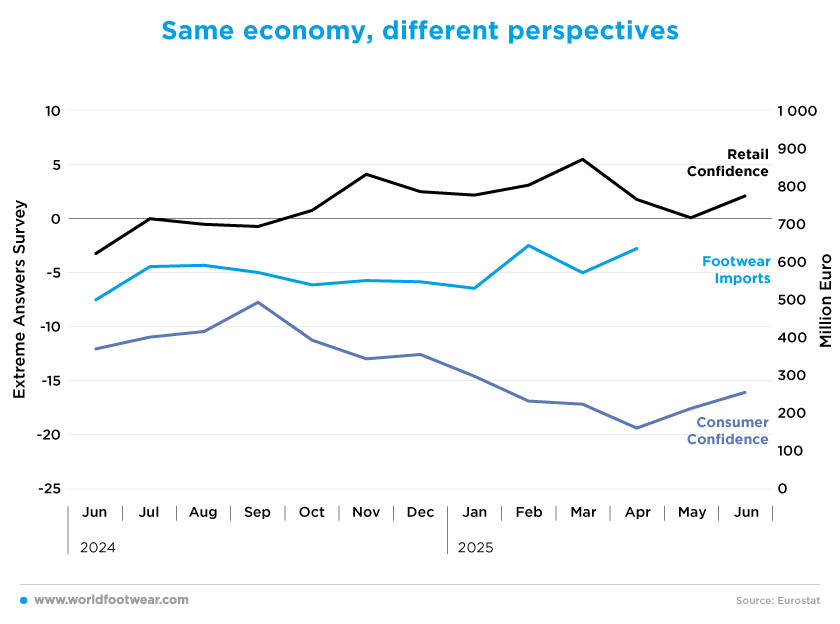

Same Economy, Different Perspectives

Despite the uncertainty surrounding trade tariffs, footwear imports to the Netherlands are finally starting to increase at a good pace once again. In the first quarter of 2025, footwear imports totalled 2.4 billion euros, representing a 12.4% increase, as compared to last year (262.4 million euros). February saw the highest value, at 641 million euros. This import value corresponded to 147 million pairs, at an average price of 16.06 euros per pair.One of the best indicators for predicting future import behaviour is the Retail Confidence Indicator, as it reflects the expectations of retailers regarding future sales. So far in 2025, this indicator has remained above zero for nine months (since October 2024), averaging 2.4. The latest reading in June showed a 2-point increase (rising from 0 in May to 2 in June).

On the other hand, consumers are viewing the economy more negatively, even though wages in the Netherlands rose by an average of 3.9% in June. This takes the increase over the first half of the year to 4.1%, according to new figures from employers’ organisation AWVN (dutchnews.nl).

Consumer confidence in the EU as a whole has been negative for some time, and the outlook for 2025 is similarly bleak. After ending the year with a score of minus 12.6, Dutch consumers had bad feelings about the state of the economy, with the score dropping to minus 19.4 in April before stabilising at minus 16.1 in June.

In June, consumer willingness to buy remained unchanged at minus 21. Consumers were slightly less negative about their financial situation over the next twelve months, but their view of the past twelve months remained equally pessimistic (fashionunited.nl).

“Never before have consumers found the time so unfavourable for making major purchases than in April 2022”, the CBS highlighted (reuters.com).

Despite everything, both retailers and consumers are showing increased confidence. The hope is now that the trend continues, despite several issues worrying the sector, such as competition from products originating in Asia that often fail to comply with European regulations, and the trade war initiated by US President Donald Trump.