Register to continue reading for free

Netherlands Retail: the footwear sector holds up amid volatility

The Dutch footwear retail sector has held up against volatility, achieving a 0.7% increase in sales in the first eight months of 2025, as compared to the same period of the previous year. This outpaces growth in the overall retail market. Despite highly variable monthly sales, ranging from a high of 11% to a low of 7.7%, this modest growth trajectory appears to be supported by a surge in retail confidence, which aligns with positive import data. Although still negative, consumer sentiment is slightly more optimistic

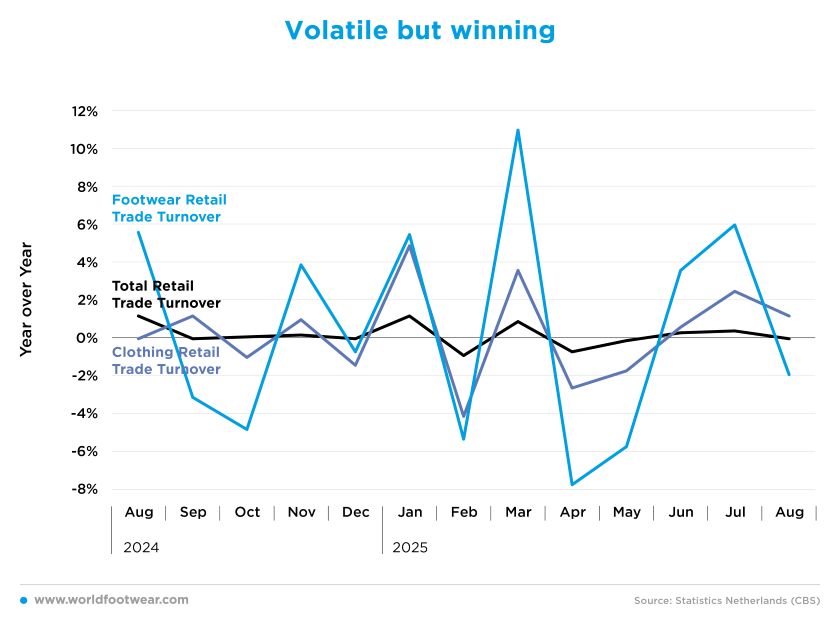

Volatile but winning

Retail revenue is expected to grow by 4% this year. Although this is higher than the 2% growth seen in 2024, it is not particularly impressive, especially considering the improved purchasing power this year. Unlike last year, when the food segment saw a slight contraction, all segments are contributing to revenue growth in 2025 (think.ing.com).However, despite all expectations, the reality is that retail sales in the Netherlands have barely improved so far in 2025.

The first eight months of the year saw a 0.1% increase compared to 2024. Although still small, the clothing and footwear retail sectors have shown growth compared to last year. After negative results in April and May, both sectors have now registered growth for three consecutive months. Overall, clothing retail sales increased by 0.6% and footwear sales by 0.7% from January to August, as compared to the same period a year earlier.

Footwear retail sales remain volatile, but are performing better than overall retail sales and other fashion sectors. In the Netherlands, year-on-year retail sales performance has ranged from 11% in March to minus 7.7% in April. After a promising start to the summer sales period in June and July, August delivered another negative result, with a reading of minus 1.9%.

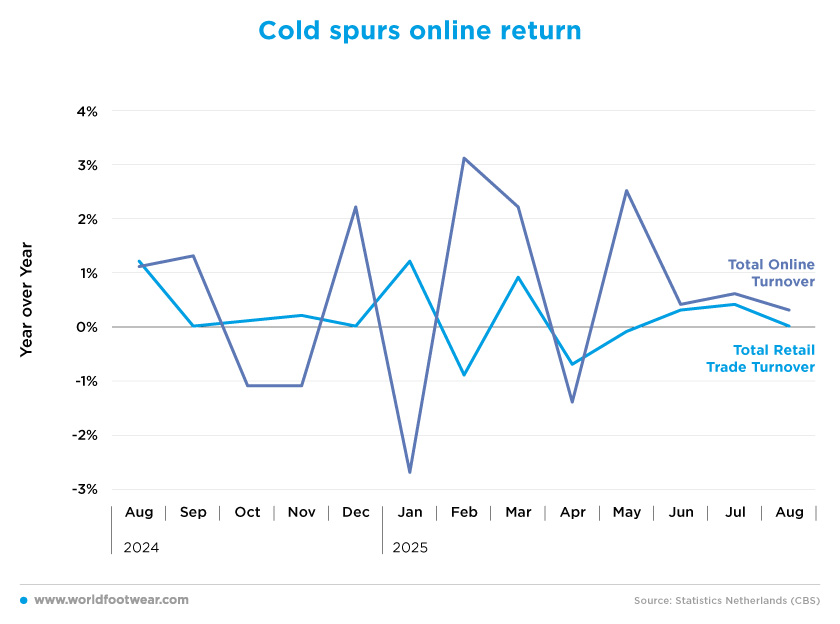

Cold spurs online return

As the winter months approach, retailers can expect consumers to start shopping online more frequently once again. While total retail sales increased by 0.1% in the first eight months of 2025, e-commerce has increased by 0.6%, with both registering three consecutive months of growth in the summer.Compared to the first five months of the year, growth in online sales has decreased from an average of 0.7% to 0.4%, due to shoppers spending more time outdoors in the summer. Retailers are aware of this seasonal trend and are preparing for the return of online shoppers when the colder weather sets in.

In general, economists from ING Think expect the online segment to grow by 9%. Online sales currently account for around 20% of total retail sales, up from 12% in 2019. A further shift from physical to online sales channels is anticipated in the coming years. This is due not only to the convenience of online shopping, but also to the wider range of products available online (think.ing.com).

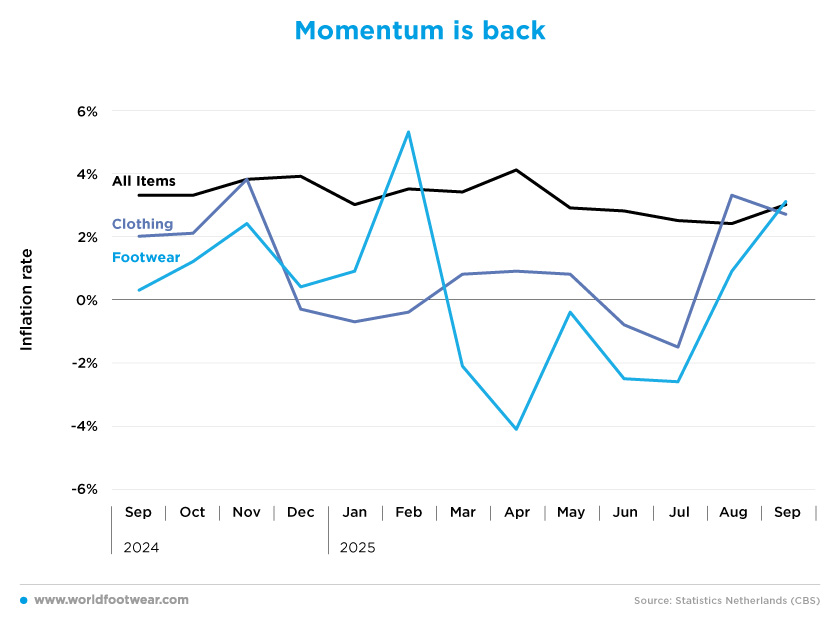

Momentum is back

The Dutch economy has been experiencing slightly higher inflation for some time, with the inflation rate reaching 4.1% in April before falling to 2.4% in August. According to the Harmonised Index of Consumer Prices (HICP), the cost of consumer goods and services in the Netherlands was 3% higher in September than a year earlier (fibre2fashion.com).This improvement in economic momentum is also evident in the fashion sector. While the clothing sector registered an average inflation rate of 0.1% in the first six months of the year, the last two readings in August and September indicated that stagnation was over, with clothing inflation reaching 3.3% and 2.7%, respectively.

Even more striking is the surge in footwear inflation. After five consecutive months of falling prices (from March to July, with an average inflation rate of minus 2.3%), the sector has now recorded two months of rising prices, with an inflation rate of 3.1% in September – 1.1% above the 2% target.

The CBS (Dutch Central Office of Statistics) said that inflation helped drive retail sales by 2% in August, even though sales volumes dropped by 6%. This month, the Dutch government announced plans to spend around 18 billion euros next year to help people pay their bills, as well as capping gas and electricity prices (reuters.com).

Overall, this can be interpreted in two ways: on the one hand, it suggests that economic activity is picking up again; on the other hand, consumers may start to notice the increase.

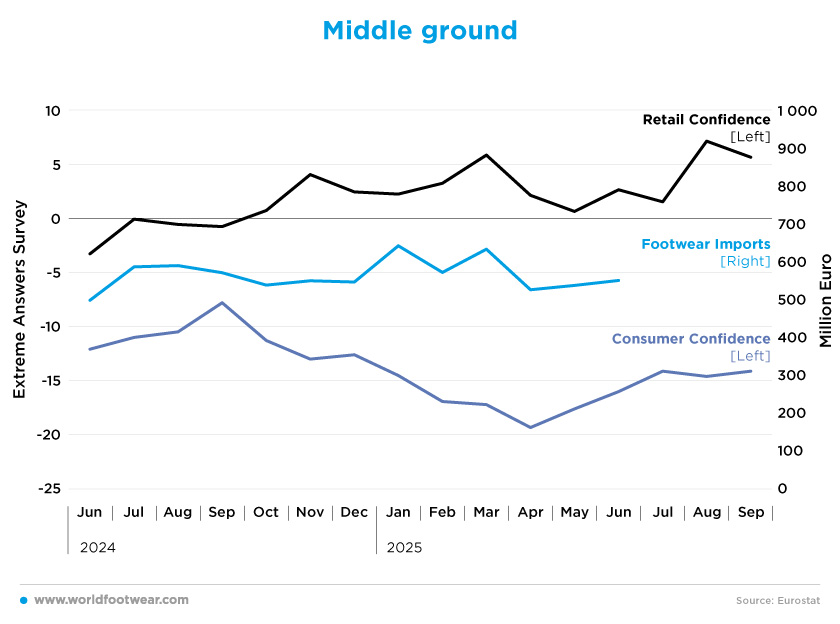

Middle ground

During the first half of 2025, the Netherlands imported 216.9 million pairs of shoes, worth 3.5 billion euros in total. This equated to an average price of 15.94 euros per pair. These figures represented a 17.9% increase in import volume and a 12% increase in value.These double-digit increases represent a middle ground between retail and consumer confidence. Following the slumps recorded in May, retail confidence surged by 833% (from 0.6 to 5.6 points on the EAS), while consumer confidence increased by 25% (from minus 17.6 to minus 14.1). Although consumer confidence remains negative, it is now back above the levels seen in January.

In September, the willingness-to-buy index was minus 18, up from minus 19 in August. Consumers were less negative about their personal financial situation over the next twelve months, but equally negative about their situation over the previous twelve months. Their attitude towards making large purchases in September was no different to that in August (cbs.nl).

The Dutch economy is starting to improve, and hopes are growing that imports will increase. It is important to note that the average import price decreased by 5%. While most speculate that this phenomenon is caused by an increase in imports from outside the EU, particularly from Asian producers, this has not been proven.

Overall, the eurozone’s fifth-largest economy expanded by 0.3% in the first three months of 2025, as compared with the previous quarter. The government policy adviser CPB said earlier this month that it is expected to grow by 1.7% over the whole of 2025, which is up from 1.1% last year but slower than previously expected (reuters.com).