Register to continue reading for free

Japan Retail: mixed signs for the footwear sector

Sales of apparel and footwear remain sluggish, with monthly declines compared to 2024. However, while clothing prices in Japan have outpaced general inflation (which is higher than usual for the country’s economy), footwear inflation has remained relatively stable, hovering just above the Bank of Japan’s 2% target. This suggests that, while households are reducing discretionary spending, footwear is less susceptible to price volatility. Nevertheless, rising import costs and exchange rate fluctuations could alter this situation

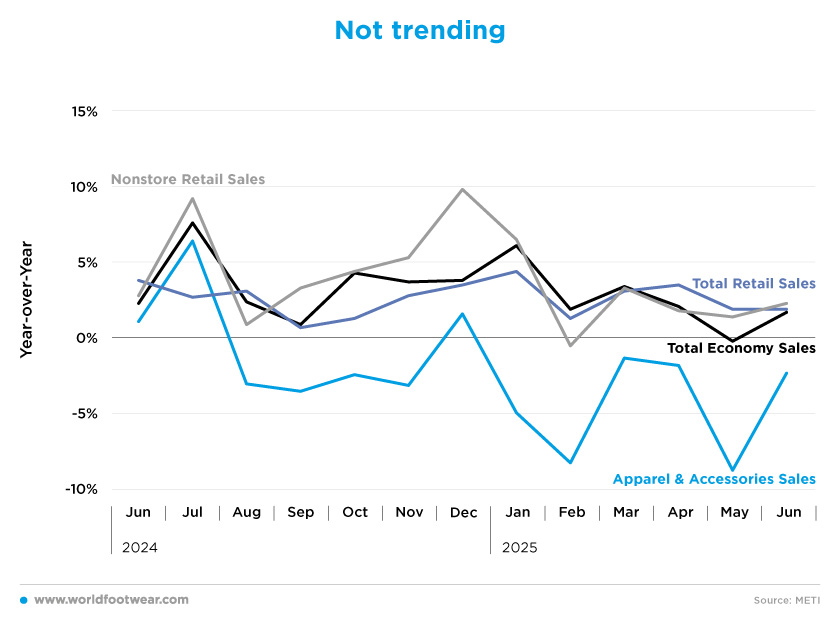

Not trending

Like the rest of the Apparel and Accessories sector, footwear does not appear to be trending right now. Since the beginning of the year, apparel and accessories sales reached 3.259 billion yen, but have decreased on a monthly basis, as compared to the same period last year. The worst months were February and May, with respective year-on-year decreases of 8.2% and 8.7%. The latest reading for June indicated a smaller decrease of 2.3%.

At a major company level, results are more positive. Uniqlo Japan reported significant growth in revenue and profits during the first nine months of the 2025 fiscal year (ending on the 31st of May). Revenue totalled 801.4 billion yen, marking an 11% increase year-on-year, while operating profit tolled 150.6 billion yen, marking a 17.8% year-on-year increase (fastretailing.com).

ASICS also reaffirmed its strategy: “We are on track to achieve our goal of becoming the No.1 brand in the run specialty store channel. Although monthly sales in July increased by only 0.3% YoY, this is due to the strategic reduction of unprofitable stores and a focused product lineup in EC” (assets.asics.com).

This scenario contrasts slightly with the overall picture of the Japanese retail sector, which is expanding, albeit at a slower pace than last year. Data from retail stores indicates that, contrary to global trends, physical retail is performing better than online this year. Retail sales rose by just 0.3% in July, as compared to the same month a year earlier, defying market expectations of a 1.8% increase and suggesting that the rising cost of living is affecting consumer spending.

Nevertheless, retail sales fell by 1.6% in July, as compared to the previous month, while factory output declined by more than expected, led by car production and machinery, according to the Ministry of Economy, Trade and Industry (reuters.com). “Production is somewhat weak as we are starting to see the impacts from Trump tariffs”, said Minami, but risks remain contained as the US economy is expected to avoid recession (japantimes.co.jp).

Although small, the Japanese economy is enjoying a net positive year in terms of sales, with only one negative month (May, minus 0.2%). However, persistent inflation has prevented sustained growth in consumer spending, as households dealing with higher costs for essential goods have reduced discretionary spending (japantimes.co.jp).

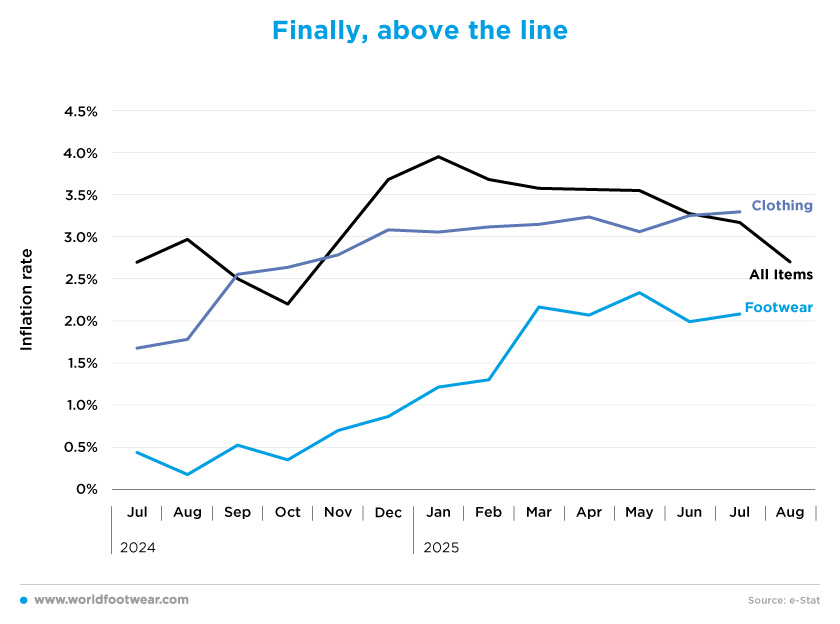

Finally, above the line

Even though inflation in Japan has been higher than usual for its economy, this hasn’t been the case for all sectors. So far in 2025, the all-items inflation rate has remained above 3%, peaking at 3.9% in January before slowly decreasing to 2.7% in August.At the sector level, clothing prices have risen faster every month for the past 12 months and are now higher than the general inflation rate, reaching 3.3% in July 2025, the highest rate in recent years. While the likelihood is that inflation will accelerate, footwear inflation, by contrast, only surpassed the 2% target by a maximum of 0.3 percentage points in March. Its latest reading showed it hovering at around 2.1% in July, slightly above the 2% line.

Core inflation, which strips away volatile food and fuel costs and is closely monitored by the Bank of Japan (BOJ) for underlying price trends, rose by 3.3% in August compared with a year earlier, down from a 3.4% increase in July.

Although consumer inflation has exceeded the BOJ’s 2% target for over three years, Governor Kazuo Ueda has emphasised the need for caution in further rate hikes due to uncertainty over the impact of US tariffs on Japan’s economy. Still, according to forecasts made in July, the BOJ expects the current price pressures, driven by rising rice and import costs, to dissipate and be replaced by more sustained price increases, backed by solid consumption and wage growth (asia.nikkei.com).

So far this year, the average monthly all-items inflation is 3.4%, with clothing inflation at 3.2% and footwear inflation at 1.9%.

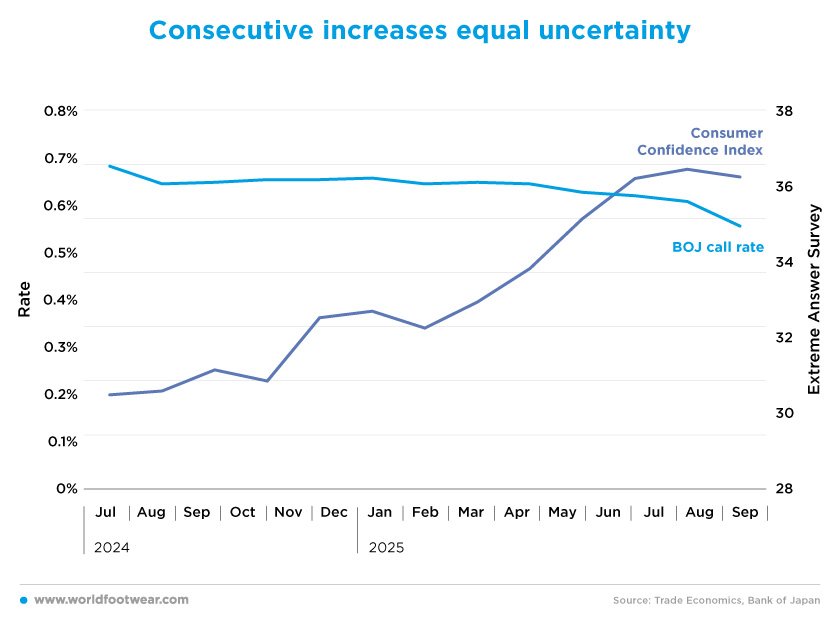

Consecutive increases equal uncertainty

Since the Bank of Japan started increasing its interest rates last year, the Japanese yen has attracted a lot more attention in monetary markets. While the exchange rate between the Japanese yen and the US dollar has remained relatively stable, the BOJ interest rate has increased. From January to July, the BOJ’s main interest rate increased by 0.15 percentage points, from 0.24% to 0.39% (a roughly 62.5% increase).Following a two-day board meeting, the BOJ announced that it would leave its benchmark interest rate on hold, as had been widely expected. While the institution’s main scenario remains the same as at its last board meeting in July – that Japan’s economic growth rate will moderate but rise thereafter – Ueda said: “Uncertainty remains high, and I would like to see more data. My assessment is that it is still a little below 2% but we are in the process of approaching that target” (asia.nikkei.com).

Initially, the sharp increase in interest rates caused a decline in consumer confidence, falling from 35 points in January (according to the Extreme Answer Survey) to 31 points in April. However, since then, rates have remained relatively stable, resulting in a return to January’s levels (35 points in August). Consumers are easily affected by uncertainty. When they see their buying power decrease, they naturally become less confident about the future, but the picture gets darker when they can’t predict their financial situation.

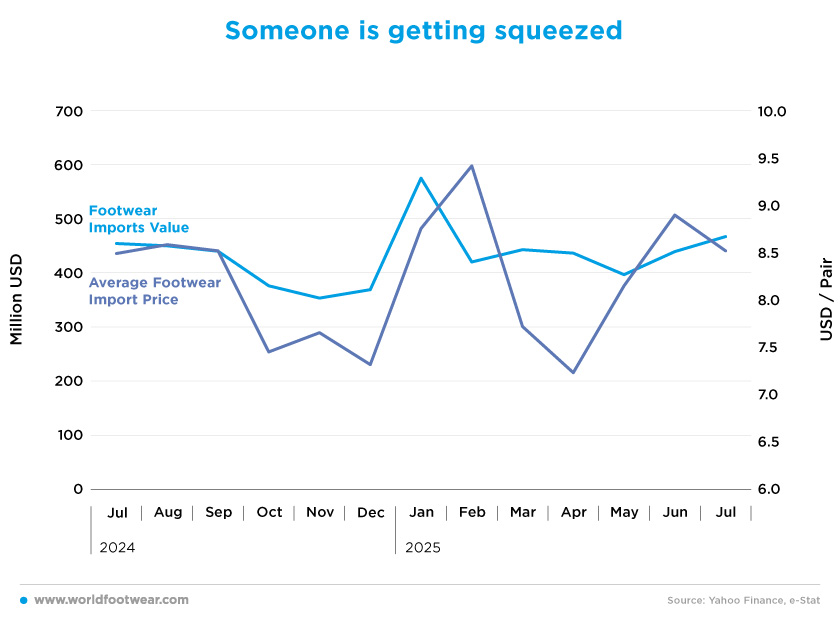

Someone is getting squeezed

In the first seven months of 2025, Japan imported a total of 381 million pairs of shoes, showing an increase of 5.4% year-on-year. Footwear imports in US dollars increased by 17.3%, which is more than three times the increase in volume. However, this isn’t the whole story.While imports in US dollars increased from 2.7 billion in the same period in 2024 to 3.2 billion in 2025 (up by 17.3%), imports in yen only increased from 414 billion in 2024 to 470 billion in 2025 (up by13.4%). Depending on which currency is chosen to analyse the trend, this represents a difference of 3.9 percentage points, mainly due to the recent devaluation of the US dollar.

In the wider context of international trade, exports have so far avoided significant damage from US tariffs, as Japanese car manufacturers, the country's largest exporters, have largely offset the additional tariff costs by reducing prices in an attempt to maintain production at domestic plants.

However, “the April-June data masked the real effect of Trump’s tariffs”, said Takumi Tsunoda, senior economist at Shinkin Central Bank Research Institute. “Exports were strong thanks to solid car shipment volumes and last-minute demand from Asian tech manufacturers ahead of some sectoral tariffs. But these aren't sustainable at all”.

“It's possible the economy could slip into decline in the July-September quarter as exports slow," warns Shinichiro Kobayashi, principal economist at Mitsubishi UFJ Research and Consulting (reuters.com).

In any case, the average price of footwear has increased in both currencies, reaching an average of 8.34 dollars (1,243.91 Japanese yen) so far. This represents an increase of 11.4% in USD and 7.7% in Japanese yen, which is far above the 2.1% footwear inflation rate published by e-Stat in July. The question now is who is absorbing these price hikes: the consumer or the retailer?

Brands like ASICS are so far holding up to these effects, “Wholesale sales, including run specialty stores, show strong growth. Regarding tariffs, although we had initially expected a maximum impact of 5 billion yen, measures such as early shipments worked well, and we now estimate the annual impact to be around 3 billion yen”. But what about other smaller Japanese companies? The consequences may start to appear latter this year.