Register to continue reading for free

Inflation threw a curveball at sportswear spending in 2023

The sportswear segment has proven not to be immune to the effects of inflation, with most of global players seeing their sales slow in 2023. Caution seems to prevail in 2024, but there are signs that consumer spending could pick up later in the year

Consumers’ desire for comfortable clothing and the prioritisation of their health and fitness following the COVID-19 pandemic has helped to boost the global sportswear market, which accounted for 18.3% of total apparel spending in 2019 and 22.0% in 2022 (just-style.com). But 2023 appears to have interrupted this trajectory.

The ResearchAndMarkets’ Global Sportswear Market to 2027 report shows that the global sportswear market grew by 6.4% in 2022, but growth slowed to 4.6% in 2023, proving that this segment is not immune to the effects of inflation. This was particularly true in Europe and North America, where all major players faced headwinds. Let’s look at the numbers.

In the quarter to the end of November 2023, Nike’s sales increased by around 1%, with the sales from its brand and Converse declining mainly in the North American and EMEA regions. The company made headlines when it embarked on a restructuring plan that resulted in 2% of its workforce being made redundant. “This is a painful reality and not one that I take lightly. We are not currently performing at our best, and I ultimately hold myself and my leadership team accountable”, the company’s CEO said in February (cnbc.com). Sales figures have yet to improve significantly, as Nike ended its fiscal third quarter with a sales growth of 0.3% to 12.4 billion US dollars.

Nike’s traditional biggest rival, adidas, is not faring any better. The company closed 2023 with a revenue of 21.4 billion euros, down by 4.8% as reported and flat on a currency-neutral basis, as compared to the previous year. “Although by far not good enough, 2023 ended better than what I had expected at the beginning of the year”, adidas CEO Bjørn Gulden said, highlighting the improvement of its operational performance. “We expected to have a substantial negative operating result but achieved an operating profit of 268 million euros. With a very disciplined go-to-market and buying process, we reduced our inventories by almost 1.5 billion euros”.

In this context, the US region remains the most challenging for the company, “as this market was particularly affected by the negative Yeezy impact as well as the company’s conservative sell-in strategy to reduce high inventory levels”.

Even Puma, with its impressive growth over the past two years, could not escape the impact of the slowdown in consumer spending. Last year, the German sportswear giant reported sales growth of 1.6% year-on-year to 8.60 billion euros, down from 24.4% the previous year. “Going into 2024, we see that the market environment remains challenging. As we are working through this ongoing challenging trade environment together with our retail partners with a clear focus on sell-through and prudent sell-in especially in the US and Europe, we expect a softer first half of the year”, warned Arne Freundt, Chief Executive Officer of the company.

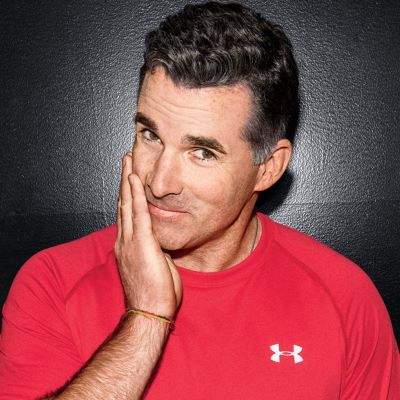

Under Armour continues to struggle. In the three months to the end of December, sales fell by 6.1% year-on-year to 1.49 billion US dollars, with sales in North America, its biggest market, declining by 12% year-on-year to 914 million US dollars. “Despite a mixed retail environment during the holiday season, our third quarter sales results were in line with our expectations”, said Stephanie Linnartz, the company's CEO at the time, highlighting “better than expected profitability”, which has been Under Amour’s focus for some time. But eyes are certainly on Under Armour, as a leadership change was announced shortly afterwards, with founder Kevin Plank returning to the helm just over a year after Linnartz’s appointment. We can only wonder what the future holds for Under Armour now.

In this context, the performance of Skechers offers a more positive outlook on the sportswear market. “For the full-year, we achieved a new annual sales record of 8.00 billion US dollars, reduced inventory levels by 16%, and continued to invest in our distribution facilities, including new locations in India, Canada and Latin America”, summed up David Weinberg, Chief Operating Officer of Skechers.

In fact, according to the Global Sportswear Market to 2027 report, “sportswear performance is expected to rebound in 2024 as easing inflation allows consumer confidence to improve”. Just last week, adidas reported better-than-expected first-quarter results and raised its full-year guidance. Is this an early sign of a better year ahead? Perhaps the next few weeks will help us get a better picture.

Image Credits: Clique Images on Unsplash