Register to continue reading for free

Germany Retail: Better confidence with cautious retailers

The confidence background for retail in Germany is getting better, being the improvement noticeable for both consumers and retailers. Notwithstanding, the seasonally adjusted Textile, Clothing and Footwear (TCF) Retail Index has been rather volatile since December, with new decline registered in April, closing about the same 40 percentage points (pp) below the baseline as one year before. Online retail seems to be a winner, once again, and a recent study by McKinsey confirms that the online purchase during COVID-19 for footwear was 61% with a positive net intent of +26 pp to continue to do so after the pandemic

Better confidence with cautious retailers

The confidence background for retail in Germany is getting better, being the improvement noticeable since January for consumers and since February for retailers. However, this indicator is not yet on the positive side of the picture, even if both scores are now at or near their highest levels since COVID-19 entered the scene last year.

Interestingly enough, and differently from other European countries, retailers’ confidence is still below consumers’ sentiment, as if they are not yet completely convinced the storm is over.

In fact, back in March 2021, Manfred Junkert, Managing Director of the HDS/L - German Association of Footwear and Leather Goods stated that two thirds of its members considered the order book in the first quarter of the year as bad and the sales prospects for 2021 as very bad (as reported by shoeintelligence.com).

Similarly, German authorities, which all along the pandemic opted for a cautious approach, are once again, while facing the spread of the delta “turbo-variant” taking prudent stances, which may deter the “business as usual” mode.

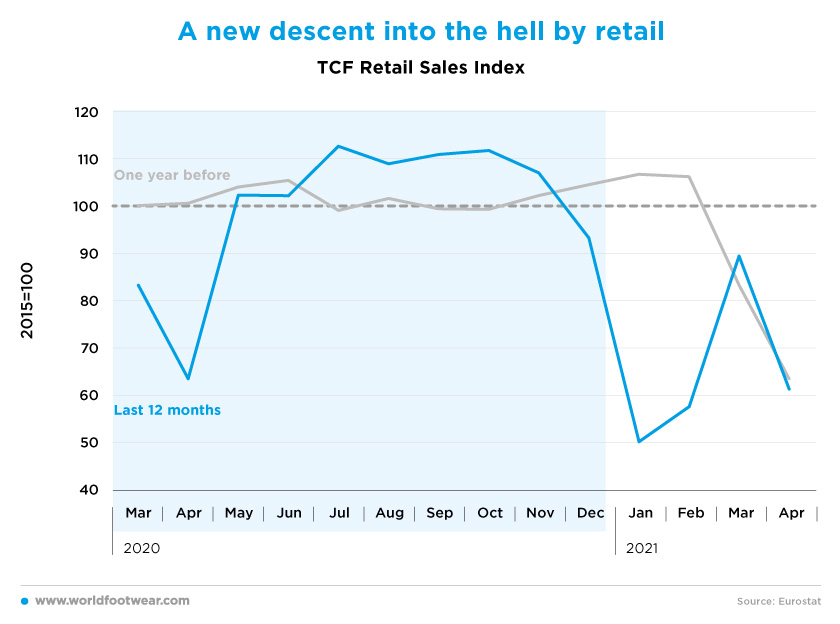

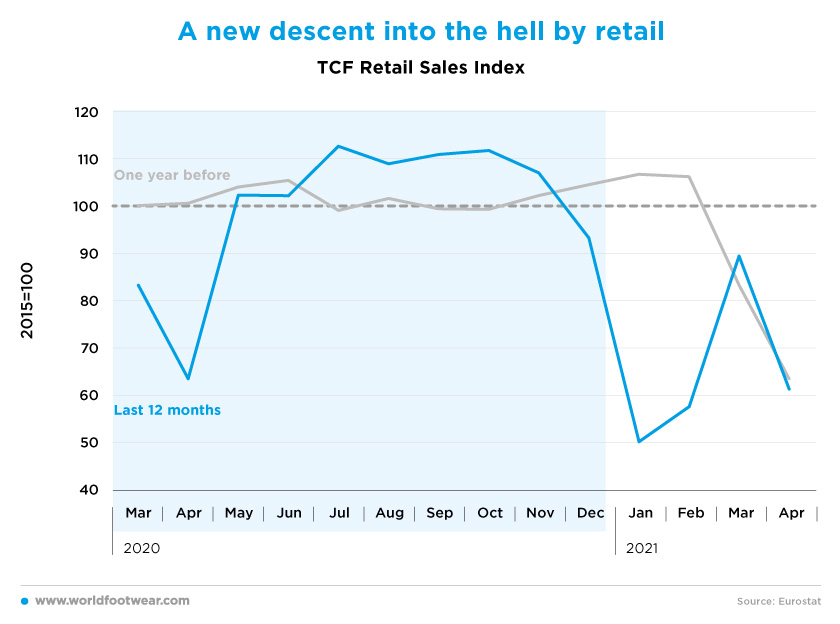

A new descent into the hell by retail

The recent story of the seasonally adjusted Textile, Clothing and Footwear (TCF) Retail Index, provided by the German Federal Statistical Office, has been rather volatile since December through April, closing about the same 40 percentage points (pp) below the baseline as one year before.

Perhaps there is some reason for caution, but recent evidence seems to show the other way round. According to an industry survey published on the 7th of June by the trade journal Textilwirtschaft, the sales of department stores, fashion retailers and brand shops in the first week of June were on average only 5% below the level of the same week in the pre-crisis year 2019 while in the last week of May, the minus had still been 32%, and in the last week of April even 80%.

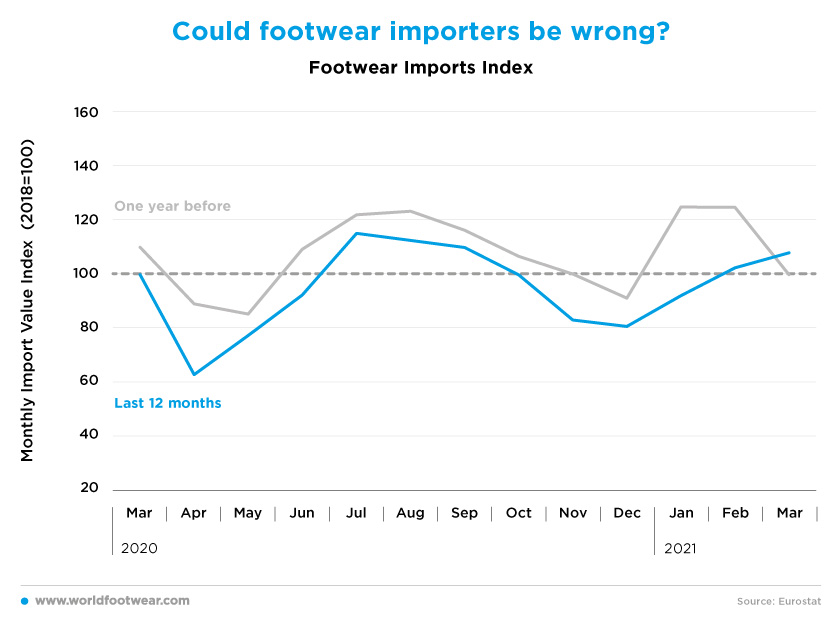

Could footwear importers be wrong?

Data on footwear imports, available for the first quarter 2021 only, seems to go exactly in the opposite direction.

Despite the poor performance of retail numbers in the quarter, importers have been increasing their supplies during the period, closing some 8 pp above the 2018 baseline, not far from the 2019 February-March numbers.

For sure imports have been higher and also on the upside from July through September 2020 before reverting. But that is seasonally usual. While the March 2021 import achievement is not so usual. Adding the vaccination coverage odds this might lead to a retail recovery from May onwards.

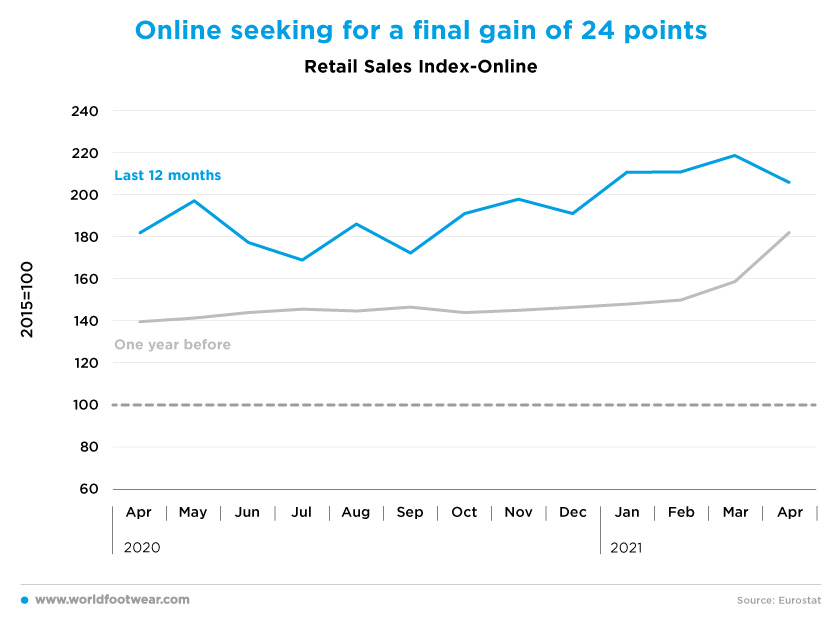

Online seeking for a final gain of 24 points

A lesson learned everywhere during the pandemic is that higher COVID-19 cases bring about store access restrictions to non-essential categories like footwear, while online retail makes a big step forward from the previous e-commerce performance.

According to ANWR Media (Shoeintelligence.com) its retail platform schuhe.de has seen a surge in demand for comfortable and functional shoes in the first quarter as more and more retailers have relied on it, while Click & Collect orders also increased in the first quarter of 2021 and were up by around 160% from the same period in the previous year. Still, Carl–August Seibel, the President of the footwear association HDS/L was cited to have said in March that online retail and click & collect have not been able to compensate for the expected fall of sales registered so far in 2021.

However, store access reversal does not mean a full return to the previous trend. All along the COVID-19 crisis the online sales index compared to the year before has always maintained at least a gain of about 24 pp. The same happened in April 2021, despite physical retail being equally hurt on both years.

And in a survey data collected in Germany from the 23rd to the 27th of February 2021 by McKinsey the online purchase during COVID-19 for footwear was 61% with a positive net intent to continue to do so after COVID-19 of +26 pp (63% intending to increase or maintain minus 37% intending to decrease or stop).