Register to continue reading for free

UK Retail: the first months of 2022 might be a cold shower for the expectations of retailers

Although the TCF sales index surpassed the 2018 baseline in November, the downwards trend of pessimism experienced among consumers since July last year is raising concerns. In fact, last month, the consumer confidence index dropped to its lowest level in 11 months. Retailers should be wary of consumers fears over surging inflation, rising fuel bills and the prospect of interest rises, while managing supply difficulties brought by the ongoing unwind of the Brexit process

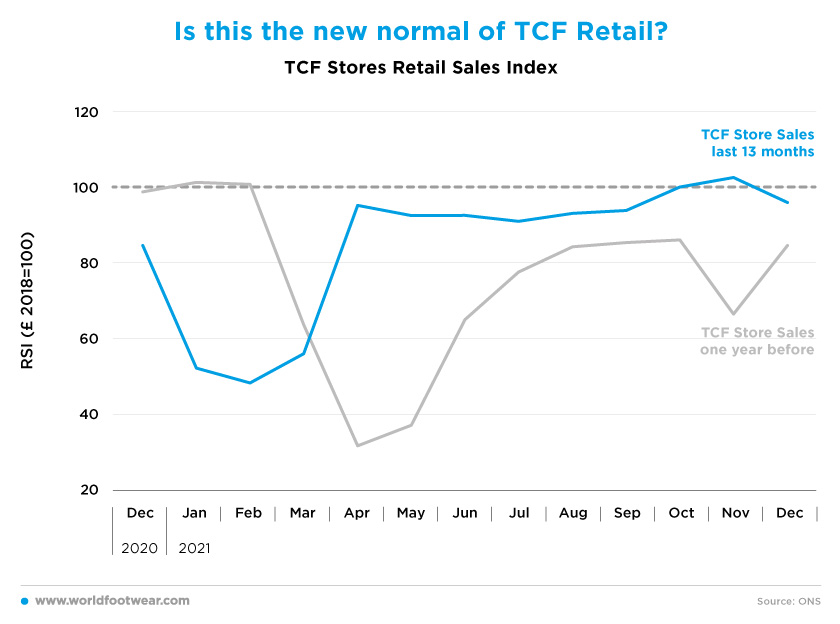

Is this the new normal of TCF Retail?

Following the quick absorption of much of the pent-up demand witnessed from March through April last year, the TCF (Textile, Clothing & Footwear) Sales Index seemed to return to ‘business as usual’, reaching 2.7 percentage points above the 2018 baseline in November. However, it dropped immediately to 3.9 below the baseline in the month of December.An explanation for the abrupt decline can be found in the next statement of Helen Dickinson, Chief Executive of the British Retail Consortium: “the spread of the Omicron (variant) may have slowed Christmas spending as many non-food categories that had seen growth in November fell into decline”. Even so, we must not rush to conclusions.

In a trading statement relating to the four months ending on the 31st of December 2021, the retailer ASOS stated that “whilst both demand and returns rate uncertainty related to the Omicron variant are expected to remain in the short term, the guidance for the year remains unchanged with revenue growth expected in the range of 10% to 15%”.

Looking at December 2019, before the breakout of the pandemic, it can be inferred that slightly negative TCF Index readings are not enough, on their own, to transform entirely the big picture. Are we perhaps entering into a new normalcy regarding the TCF retail?

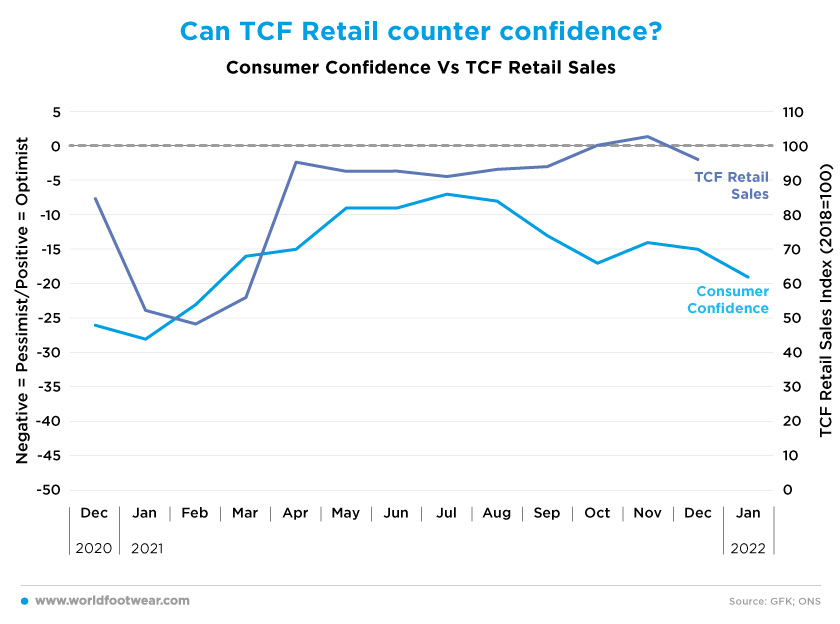

Can TCF retail counter confidence?

Such a possibility, however, collides with the figures of the GfK Consumers’ confidence in the UK. Pessimism has been following a clear downwards trend since July last year, safe the brief usual pause approaching the Christmas season. In fact, in January 2022 the indicator dropped to its lowest level (down by 19 pp) in 11 months.

“Despite some good news about the easing of Covid restrictions, consumers are clearly bracing themselves for surging inflation, rising fuel bills and the prospect of interest rate rises”, commented Joe Staton, client strategy director at GfK (tradingeconomics.com).

Considering this data, the TCF retail index might turn out to be a cold shower for retailers’ expectations, which can be exacerbated by the supply difficulties brought by the deploy of the Brexit process.

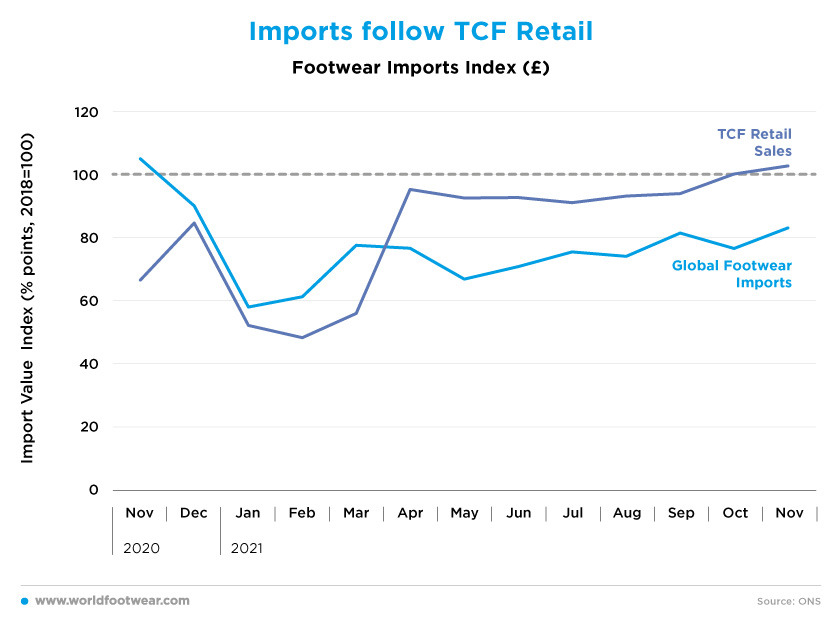

Imports follow TCF Retail

The delay on the disclosure of footwear imports statistics (both from the overall world and the European Union) does not allow us to take this indicator into account to anticipate the footwear retailers needs for the first months of 2022.

Discarding April as an outlier, footwear imports throughout 2021 have been almost covariant with TCF retail sales (seasonally adjusted). But without further data, it is difficult to forecast whether the downgrade of consumer confidence will curb footwear retail, or not.

Retail risks tipped to the downside

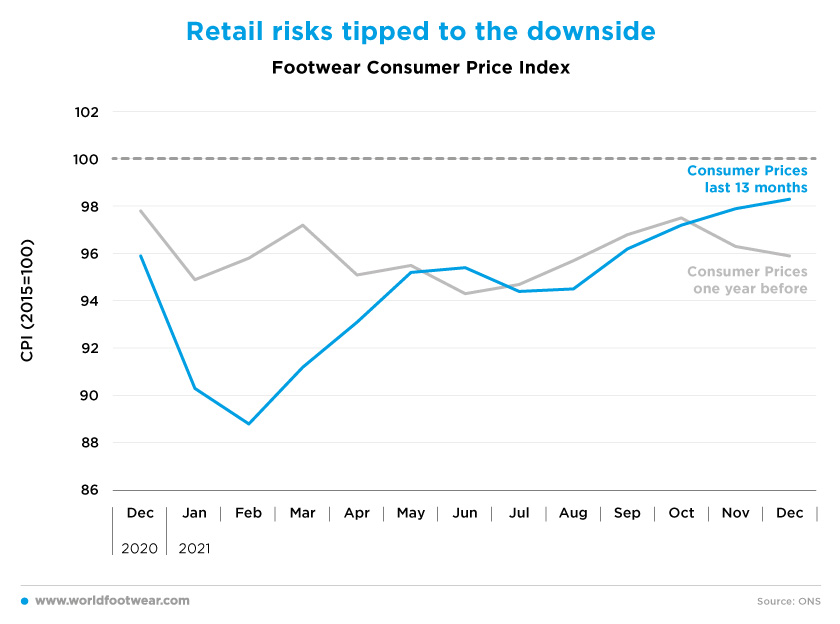

Footwear consumer prices have been increasing since February last year, safe a standstill in July and August. We have previously admitted this to be a sign of consumers’ faltering purchasing power due to inflation, but we must now consider that the weak Summer demand might have played a role in this outcome.The fact is that footwear price increases resumed afterwards at a higher rate, closing December only less than 2 percentage points under the 2015 baseline and more than 2 percentage points above the previous year. What does this information mean to retail?

The increase in footwear prices, which is coming from the supply side, combined with the widespread inflation, has tipped the retail risks towards the downside in the first months of 2022.

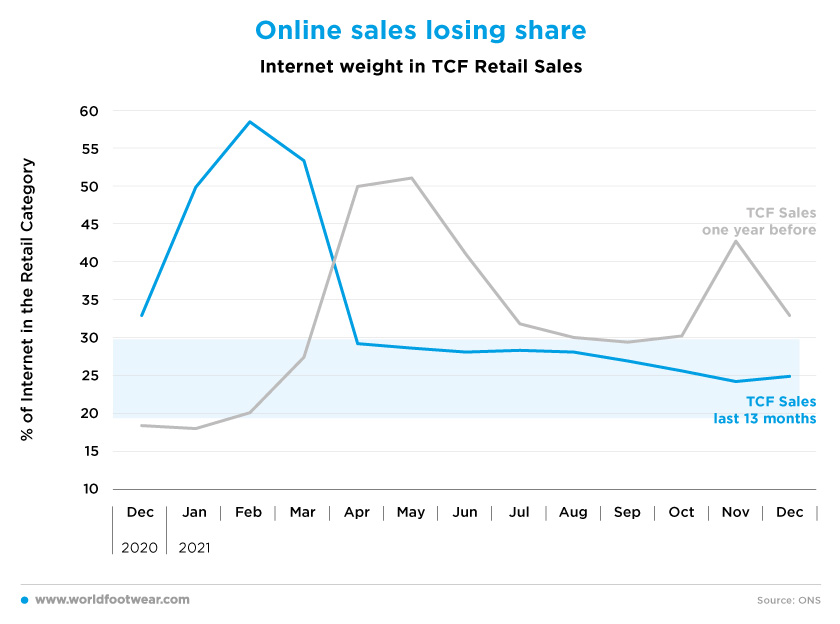

Online sales are losing share

Almost two years of the COVID-19 pandemic experience have shown us a new balance between offline and online footwear retail, with the last gaining substantial share, especially when the access to physical retail was limited.

“Our ecommerce revenue performance remained strong, with revenue growth of 16% against a tough comparative given the significant restrictions and closures within the store network in Q3 FY21 and up 85% LY-1. In the quarter, ecommerce revenue mix improved by 2pts to 39%", said Kenny Wilson, Dr. Martens’ Chief Executive Officer.

Still, the true question lies on whether this gain is sustainable as pandemic related restrictions fade away in the UK, which is the top online market in Europe. In the previous World Footwear retail flash, we ventured to guess that a 10 percentage points share gain would be expectable, on a comparable basis to 2019. However, as of December 2021, the TCF retail index was approaching again the normal baseline and the online share was shrinking, with the gain reduced to solely 5 percentage points.

Doubts are beggining to arise about the online retail behaviour, especially coupled with the uncertainty related to the trajectory of overall TCF retail in the first quarter of 2022, now for reasons not necessarily related to the COVID-19 pandemic.