Register to continue reading for free

Spain Retail: After the hit of COVID-19, retail is still trying to recover

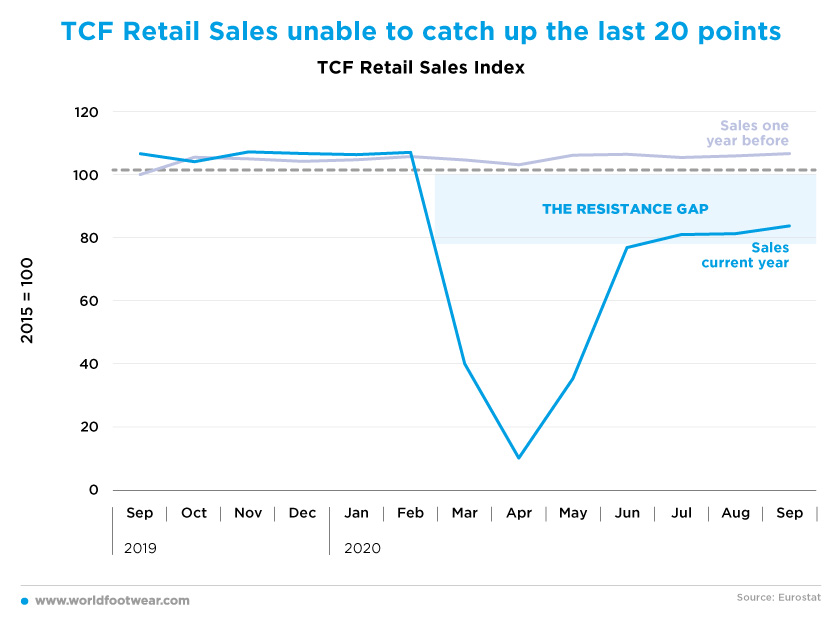

Similarly to what happened in other countries, the Textile, Clothing and Footwear (TCF) Retail Sales have lived dramatic moments with the first wave of COVID-19 hitting Spain, one of the European countries with most critical sanitary emergency. TCF sales almost disappeared in April and although the scenario improved from there, one cannot say that recovery materialised completely in the South Europe country

E-commerce is having a (expected) good performance, especially notable after the first wave confinement terminated. However, consumer and retail confidence indicators are not anticipating a good year end for retail in Spain. The recovery did not take off, despite the belief that things could be better. As read on the novel D. Quixote by Miguel de Cervantes, “Even faithful and simple Sancho is forced to deceive Don Quixote at certain points”.

TCF Retail Sales unable to catch up the last 20 points

In Spain, the reaction of Textile, Clothing and Footwear Retail Sales to the COVID-19 pandemic was not exactly the same as the one registered in other big European markets. Although similar in the dramatic diving in and out phases, from March through May due to lockdowns, TCF sales were unable to resurface so far and a resistance gap to reach the baseline is clearly noticeable and sticked at about 20 points from it.

Some businesses were unable to recover from the hit. In November, the closure of Spanish footwear retailer Rumbo was announced, after an agreement with its creditors have failed. During the summer Marypaz, maker and retailer of shoes and accessories for women, announced the layoff of part of its staff and the closure of stores across Spain. Even the giant Inditex Group felt the pains of the COVID-19 hit and consequent collapse in sales and recently announced it will go ahead with the closure of 250 stores in Spain.

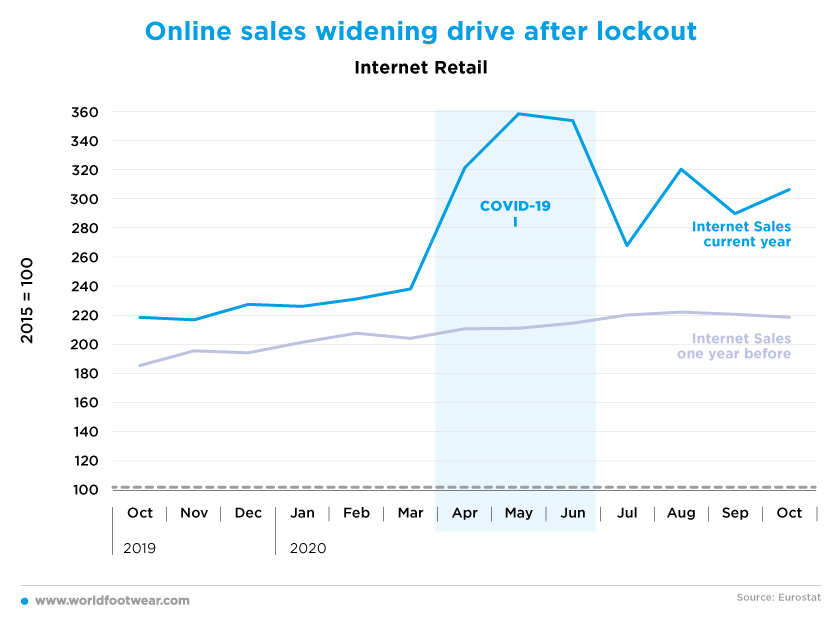

Online sales widening drive after lockout

One possible explanation for the resistance of retail sales towards a recovery could be a more persistent shift from brick-and-mortar retail to e-commerce. As countries came out from the lockdowns, online retail automatically shrank, and Spain seemed to follow such trend in July. But from then onwards, the Spanish consumer seems to be hooked up by e-tailing, as depicted by the broadening gap between the performance in 2020 and in the previous year.

Fashion retailer Tendam (formerly known as The Cortefiel Group) confirms the trend, as they are achieving better results in the digital channel after the lockdown than during it, both in sales and in increased traffic. The Spanish company is already close to a business volume of 50 million euros through its online platform and while in the first quarter Tendam achieved online revenues of 19 million euros, in the second quarter digital sales rose to 29.7 million euros (compares to 21.2 million euros in similar period in the previous year)

Saying this, one thing seems to be certain: the online gains will not compensate for the collapse in the high street. Pikolinos, the company owned by the Perán family, expects its business to decline by 30% in 2020, and underlines: "So far this year, the online channel is growing a lot, but it does not compensate for the drop in sales caused by the pandemic".

Department store El Cortes Inglés continues to strongly invest in increasing online sales, especially by strengthening its delivery capacity to meet customer’s demands, and is redesigning its logistics distribution network, with the transformation of 90 of its large stores into distribution centres. The company also wants to enhance the in-store collection service, with Click & Collect and Click & Car. An omnichannel strategy initiated during the first wave confinements, when El Cortes Inglés was managing almost 200 000 daily online orders at the time.

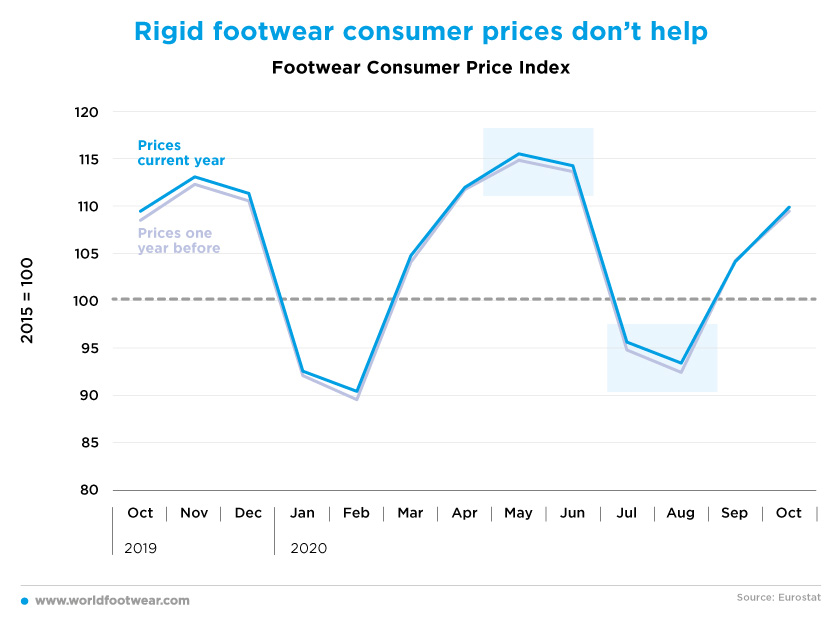

Rigid footwear prices don't help

A specific Spanish behaviour of consumer prices for footwear might also be responsible for the resistance. Comparing to the previous year it is difficult to note a depressing COVID-19 effect on footwear prices. Where a differential does exist, it is pushing prices up instead of bringing prices down, as one would naturally expect. And if consumer prices are not sensitive to the weakness of demand as it should, recovery will suffer.

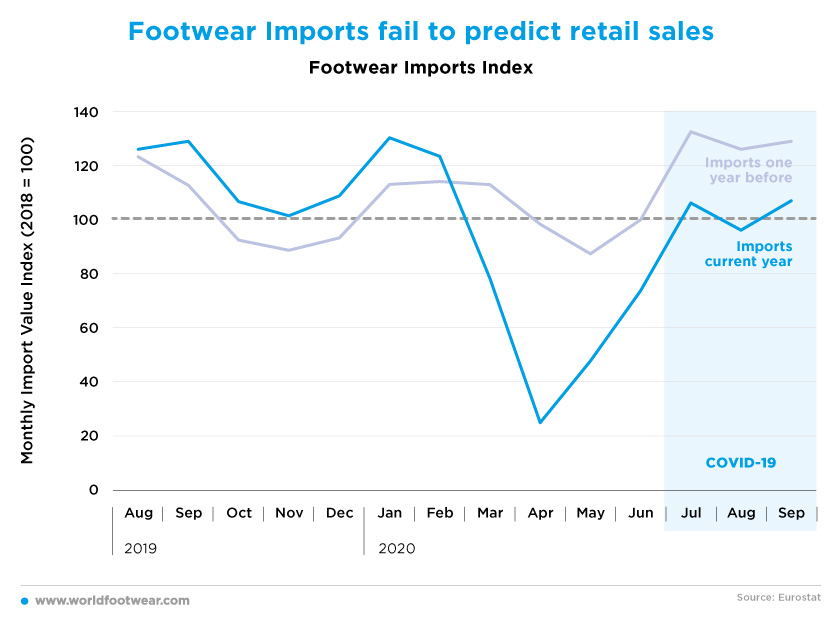

Footwear imports fail to predict retail sales

Differently from retail, footwear imports are apparently back to the upside albeit still far from last year’s performance. But in Spain this does not seamlessly translates into higher retail sales as imports weight here much less on footwear supply than in other European big markets. The higher the domestic footwear production, the worse are overall imports as a predictor of retail development in the market.

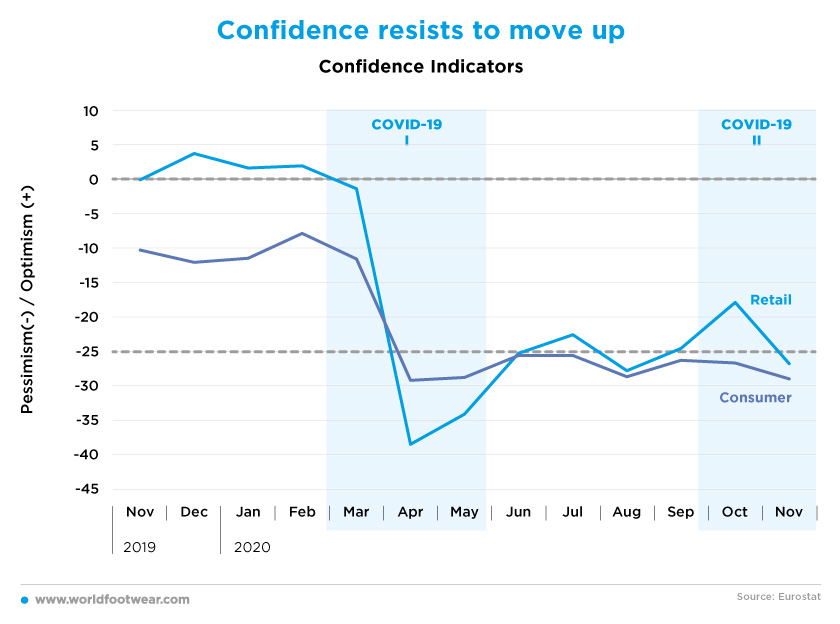

Confidence resists to move up

The retail resistance gap identified so far goes very well hand in hand with the consumers’ confidence indicator. Spanish consumers never recovered clearly from the COVID-19-induced pessimist mood of April and May, and so are giving no chance for retailers to sustain better expectations. November’s confidence scores are no good news for retail and one can doubt if it can take off again without a powerful doping. The COVID-19 vaccine deployment seems to be the next bet.

All this said, the perspectives are far from being encouraging. In its annual report, the National Association of Large Distribution Companies (ANGED), regretted that the confinement and restrictions "had a very virulent impact on Spanish trade, which subtracted 9.5 points from the Gross Domestic Product (GDP) of the country compared to the 8.8 average points of the member states of the Organization for Economic Cooperation and Development (OECD)”. In addition, ANGED warns that the fall may be even worse: "The loss of tourism spending .. would mean an additional 3.5% decrease in turnover for the retail trade". And if the impacts are not seen on the labour market yet, that is the result of the temporary employment regulation files (ERTE) applied since the Spring by many companies.