Register to continue reading for free

US Retail: fashion retail under pressure despite signs of recovery

Although overall retail sales increased in the first half of the year, fashion sales fell, weighed down by weak demand in the early months, inflationary pressures and new tariffs. In this context, the online channel remains a bright spot, as consumers increasingly seek convenience and discounts. At the same time, footwear imports in the first seven months of the year recorded higher values but lower volumes, as average prices climbed under tariff pressure. Despite glimpses of improvement, retailers face a challenging road ahead, with fragile consumer sentiment and uncertain trade policy

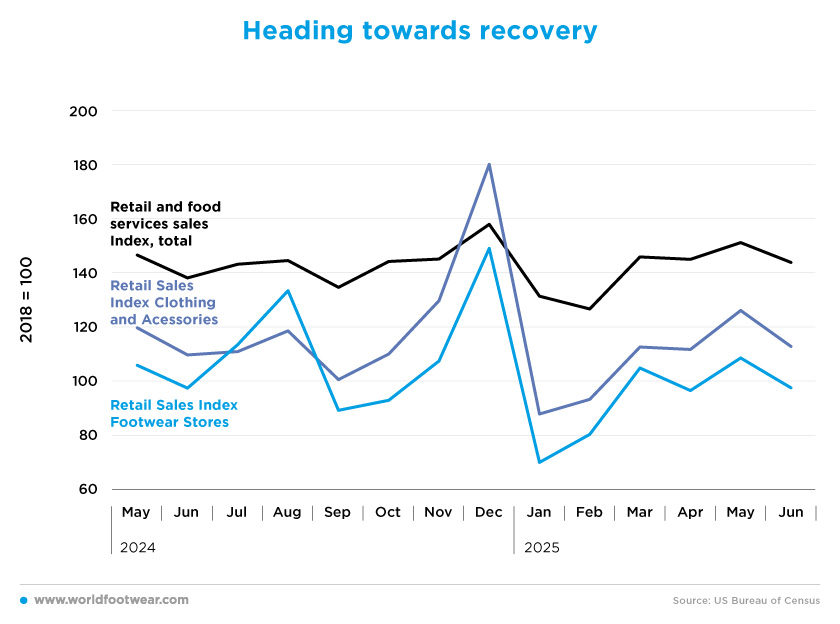

Heading towards recovery

Footwear sales in the US market have been slightly lower than last year. In the first six months of 2025, sales decreased in value by 1.6%, mainly due to weak sales in the first three months of the year. However, the second quarter of 2025 is on track for recovery. Meanwhile, clothing and accessories have shown an even greater decrease; sales are currently down by 10.3%, as compared to 2024.Overall retail sales in the US have increased by 3.7% year-on-year in the first half. This difference is a worrying sign for the fashion sector, suggesting that retailers are struggling more than other businesses. Nevertheless, there has been some improvement over the past three months, and things may be heading towards recovery.

“Our second quarter results were highlighted by a 280-basis point sequential improvement in comparable sales from the first quarter, underscoring the impact of our targeted operational initiatives”, stated Doug Howe, Chief Executive Officer of Designer Brands. “These initiatives supported a strong start to the back-to-school season within the US Retail segment as well as gradual improvements in traffic and a notable uptick in conversion”, he added (investors.designerbrands.com).

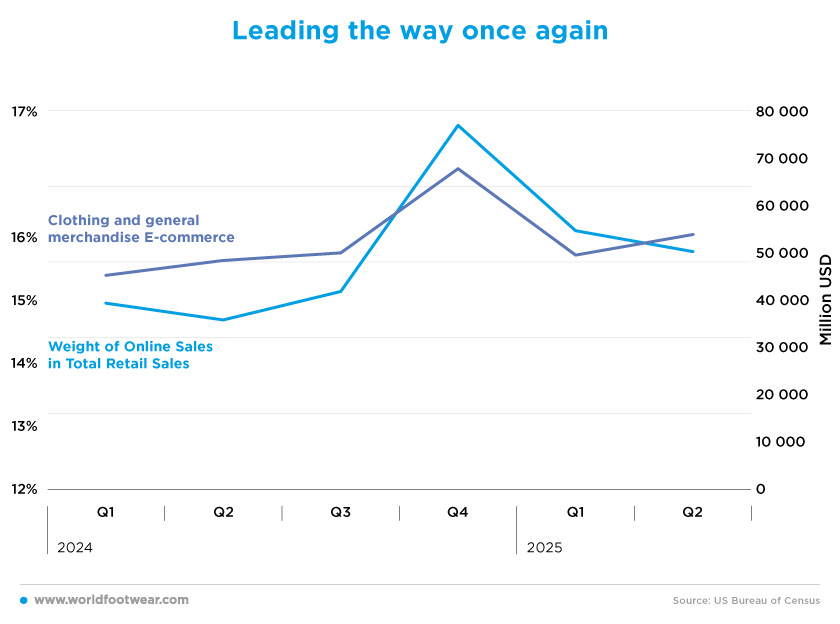

Leading the way once again

Although overall fashion retail sales have struggled this year, the picture is totally different for the online channel. In the first two quarters of 2025, fashion sales reached a total of 103.3 billion US dollars, marking a 10.4% increase compared to the same period last year.Not only that, but the weight of online sales in the total retail in the sector has been growing. The latest figures for the second quarter of the year show that online sales now represent 15.1% of total fashion retail sales – an increase of 0.9 percentage points compared to the same period last year.

According to Adobe Analytics, online spending soared to 24.1 billion US dollars across US retailers from the 8th to the 11th of July – a period dubbed ‘Black Friday in Summer’ – surpassing its previous forecast as shoppers rushed to take advantage of deep discounts on back-to-school essentials. In fact, retailers recorded online sales growth of 30.3% during events including Amazon Prime Day, compared with a projected 28.4% (reuters.com).

The truth is that consumers are increasingly prone to buying online because it is more convenient and discounts are more common. Therefore, US retailers not only have to contend with a tighter domestic market, but also with international sellers who sell through the main marketplaces.

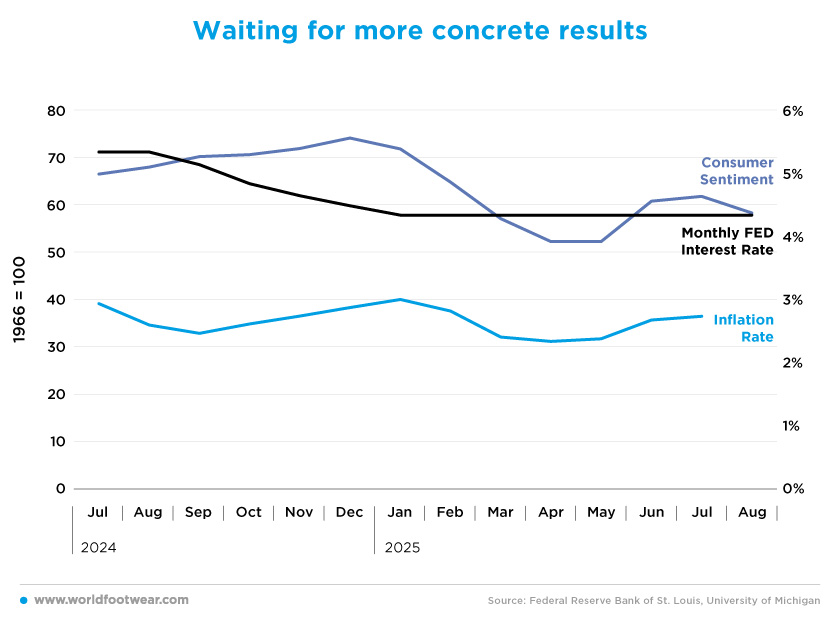

Waiting for more concrete results

The American economy as a whole is watching economic indicators very closely, as the tariffs and new budget may affect its behaviour.The US central bank has kept interest rates at 4.3% since January’s decrease, as it is waiting for concrete results on inflation and employment this year before making any changes. “Inflation remains hotter than hoped, but the Fed’s focus is jobs”, James Knightley, chief international economist at ING, wrote in a note, adding that the weekly increase in unemployment claims was the biggest in almost four years.

“On the face of it, this hints at a pick-up in the pace of layoffs in an environment of already weak hiring and will reaffirm expectations of a 25-bp (basis point) Fed rate cut next week”, he added (reuters.com). His expectation was shortly afterwards confirmed.

Consumer sentiment is trending lower than last year. According to the latest figures for August, consumer sentiment has fallen by 21.4% since December 2024 and by 14.3%, as compared to a year ago. This suggests that the recent political and trade instability in the US has taken a toll on consumers.

The worst months were April and May, when consumer confidence fell from 71.7 in January to 52.2. Coincidentally, these were the months during which tariff announcements were made and the first rounds of negotiations took place, suggesting that these events affected consumers’ outlook on the future.

The footwear sector is facing similar problems. The latest data from the Footwear Distributors and Retailers of America (FDRA) shows that shoe prices increased in August in tandem with overall inflation. The FDRA noted that retail prices of footwear climbed by 1.4% in August, which is the fastest rate in 17 months and the second fastest in 33 months.

This comes as prices were generally higher across all target markets last month. Prices for women’s footwear increased by 2.8%, which is the fastest rise in 34 months, while prices for children’s shoes increased by 0.9%, which is the fastest rise so far this year. However, men’s footwear prices fell by 0.2% in August, although they have risen in fourteen of the last nineteen months (wwd.com).

Although consumers are starting to feel better, everyone is still waiting for more concrete results before making their move.

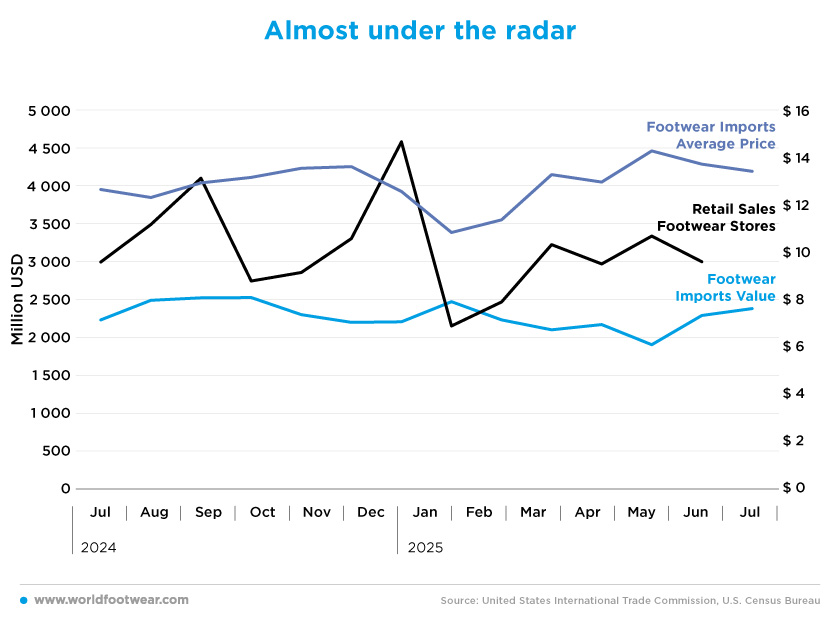

Almost under the radar

In the first seven months of 2025, American footwear imports reached a value of 15.5 billion USD and totalled 1.23 billion pairs. While value is up by 1.5%, as compared to last year, the number of pairs corresponding to that value has decreased by 2.1%. This is due to the average price of imported footwear increasing from 12.20 to 12.66 US dollars, representing a 3.7% increase, mainly due to the new tariffs introduced by the Trump administration.The reality is still blurry, and most people are unaware of this phenomenon of price increases, but economists are watching it closely as they know that stockpiled goods are being depleted and imports will have to adapt to the new trade situation.

On top of inflation, “these tariffs disproportionately impact the footwear market, given that more than 98% of footwear sold at retail is sourced abroad”, told Gary Raines, chief economist at FDRA, to Footwear News.

He continued: “In the latest month, duties paid on footwear imports soared a near-record 108.7% year-over-year to an unprecedented 635.8 million US dollars. Recall we’ve shown before the year-over-year changes in duties paid have moved in step with year-over-year retail footwear prices. The recent streak of surging duties paid on footwear imports strongly suggests retail footwear prices may climb even further” (wwd.com).

The American retail sector is fighting to improve its performance in the future. Following the federal appeals court ruling that struck down the Trump administration’s use of the International Emergency Economic Powers Act to impose increased tariffs, Jonathan Gold, the National Retail Federation’s Vice President of Supply Chain and Customs Policy, called for certainty.

“The retail industry is at the mercy of a tug-of-war between the courts, the administration and the congress when trying to plan and implement business operations and supply chain continuity. Tariffs have created significant disruption to the retail supply chain, resulting in increased costs for retailers large and small. The ongoing instability threatens economic growth and will ultimately, and most certainly, result in higher prices for goods and services to be paid by American consumers. Retailers need certainty, and we look forward to the case being settled by the Supreme Court”, he said (nrf.com).