Register to continue reading for free

US Retail: bleak prospects amid growing uncertainty

The footwear retail sector is definitely underperforming, especially compared with clothing and accessories. The current trade war between the US and its trading partners is not helping consumers recover from last year’s inflationary crisis. Consumer confidence has fallen by almost 30% in the first four months of the year as people believe that shoe prices may rise significantly again. Against this backdrop, importers are at a standstill, trying to guess the best course of action. Uncertainty is the word that best describes the current situation in the sector

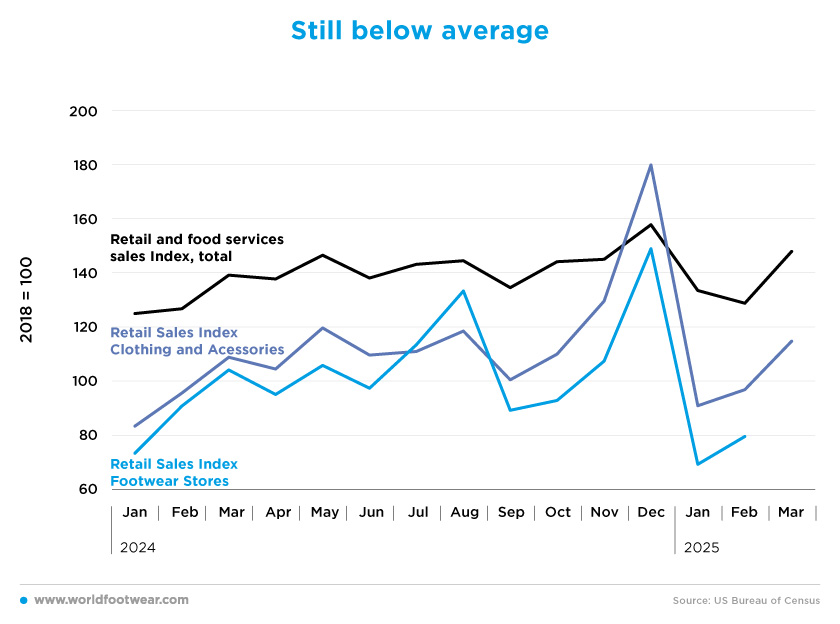

Still below average

Footwear retail sales have been below average for some time, performing even worse than the clothing and accessories sector.In 2024, footwear retail sales totalled 38.5 billion dollars, averaging 3.2 billion per month. But so far, the first two months of 2025 have been disappointing for the sector. Retailers were anticipating a decline in sales during the year's initial months due to a consistent trend observed in previous years; however, they weren’t anticipating results worse than last year.

Both January and February registered year-on-year decreases in sales (6% and 12%, respectively). These results put the footwear sector in a weaker position than other sectors. In fact, despite consumers continuing to worry about the impact of rising tariffs (according to Jack Kleinhenz, Chief Economist at the National Retail Federation), clothing and accessories retail sales grew by 5% in the first quarter of the year, in line with the overall growth of the American retail sector.

In general, “retail sales strengthened in March, supported by continued solid growth in income, lower energy costs and bigger-than-usual tax refunds that all helped support household budgets,” Kleinhenz said.

“However, there is no question that the consumer is not feeling great given the confusion of policy announcements from Washington. On-again, off-again rising tariffs and resulting turmoil in the stock market and world economy are clearly impacting consumer concerns about higher prices and future consumer spending growth”, concluded the Chief Economist of the National Retail Federation (nrf.com).

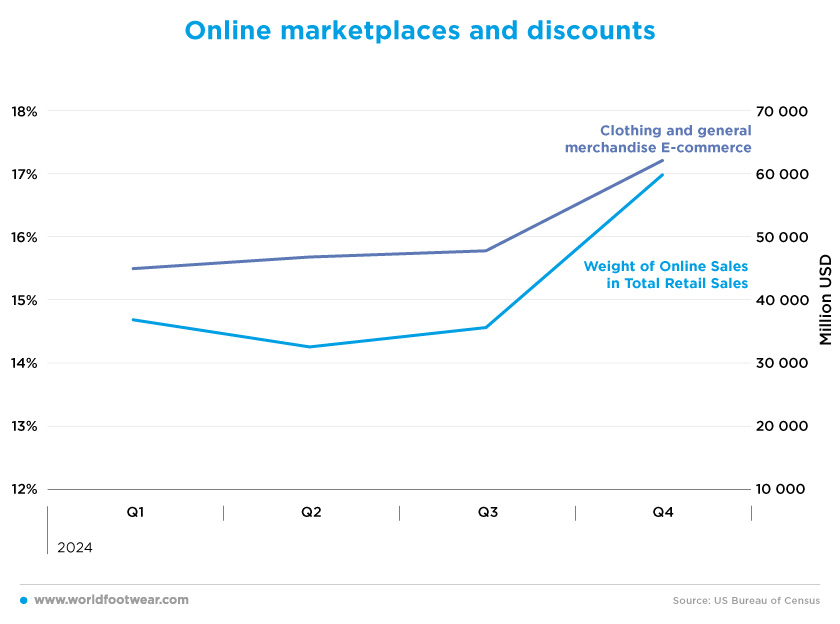

Online marketplaces and discounts

E-commerce saw two consecutive increases in the last two quarters of 2025. Even more impressive was the huge increase in online sales of clothing and general merchandise, which jumped from 504 billion US dollars to 69.5 billion US dollars. Although total retail sales showed increases, online sales have been gaining weight and becoming more popular.In the last quarter of 2024, online retail sales accounted for 17% of retail sales in the US economy, up by 2 percentage points from the previous quarter. This is mainly due to the significant discount campaigns that online marketplaces typically offer during this time of year. Events such as Prime Big Deal Days (Amazon), Black Friday, Cyber Monday, Green Monday, Free Shipping Day and Super Saturday all take place in the last quarter of the year and tend to boost online sales.

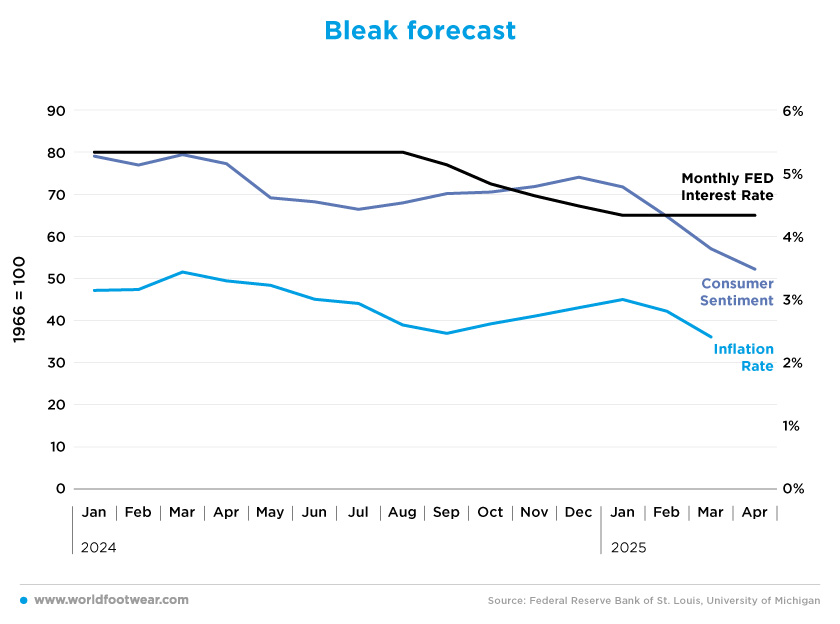

Bleak forecast

The latest available inflation reading for March (2.4% all items’ inflation) was the lowest in the US in the past 4 years. The inflationary crisis that occurred last year seemed to finally be over, but the latest trade war between the US and its trading partners has led consumers to expect a significant overall increase in prices.This is reflected in the downward trajectory of the consumer confidence indicator, which fell by 29% between December 2024 and April 2025. Even with FED interest rates going down (4.3% in April 2025), consumers do not seem to be more optimistic about the future. The outlook is bleak, and the prevailing perception is that consumers are fearful of the impact of tariffs on their budgets.

“With so much uncertainty surrounding the economy in the past few months, I’m not sure anyone can predict the storm path of tariffs and their likely impact. The wide range of uncertainty has introduced a high level of unpredictability and has raised the probability of a significantly slower pace for the US economy. Hiring, unemployment, spending and inflation data continue in the right direction, but at a slower pace. Everyone is worried, and a lot of people have recession on their minds”, commented Kleinhenz (nrf.com).

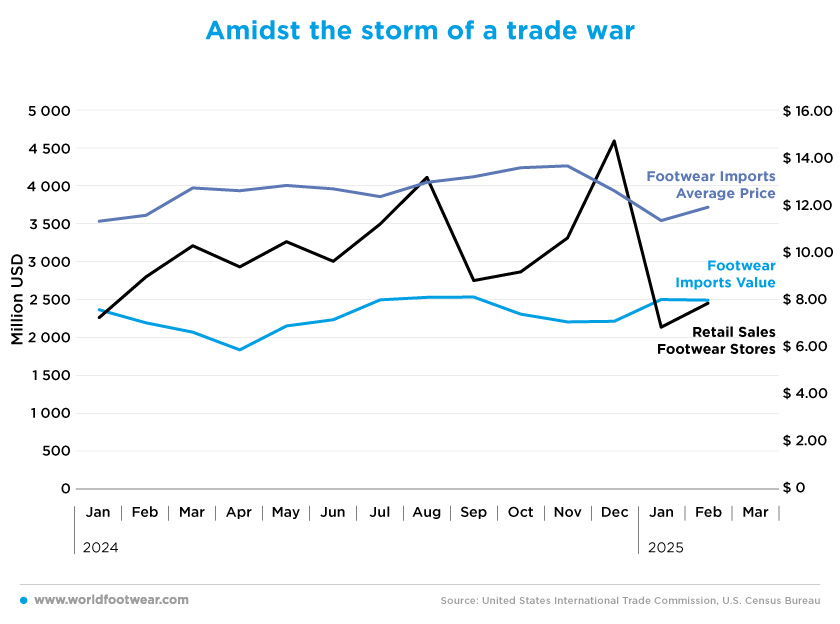

Amidst the storm of a trade war

In 2024, the US imported 27 billion dollars of footwear at an average price of 12.59 USD. Last year, however, footwear imports and retail sales diverged several times. Typically, imports only grow after an increase in sales due to the need to restock inventories. However, the current situation appears to be stagnant for importers, who are still uncertain about the potential outcome of a trade war.The US has been imposing tariffs left and right, putting pressure on importers’ margins. Import prices are expected to increase by at least 10%, with tariffs on Chinese goods potentially even rising by up to 145%. However, a 90-day pause was agreed with China last week, reducing the tariff on Chinese imports to 30%. A 90-day pause is also currently in place for all countries, with the US hoping to force countries to the negotiating table.

Nevertheless, according to American Apparel & Footwear Association president and CEO Steve Lamar, the “average tariff on clothes, shoes and accessories, necessities every American must buy, was already more than five times higher than on other US imports” before the new duties were announced.

Therefore, all this will affect the volume of imports to the US, and the footwear sector will be impacted too.

According to researchers, this reversal in consumer spending and sentiment is part of a broader reshaping of consumer behaviour in the US, “where imports account for around 99% of shoe sales and carried an average tariff of around 12% before the latest round of levies.”

For Bryan Eshelman, partner and managing director of AlixPartners, added, “The uncertainty is the problem. Consumers have been hit by inflation and supply-chain disruption in recent years, and now they’re worried about the price impacts of trade policy” (footwearnews.com).

Footwear sales are currently at a 12-month low. If prices increase, this will likely exacerbate the situation. Amidst the storm of a trade war, the so-called theoretical economic effects are certainly to be expected.