Register to continue reading for free

Japan retail: unlocking consumer confidence is key for retail

The volume of footwear imports closed 2022 about 10 percentage points below the 2015 baseline, suggesting that the impact of the imported inflation on prices has been clouding the real performance of retail sales in the category. Both the government and some companies have offered inflation allowances or anti-inflation subsidies, but given the saving Japanese mindset, it can be expected that any additional disposable income will not necessarily be used for discretionary shopping, such as clothing and footwear. To boost consumption, it is therefore needed to unlock consumer confidence, which improved only marginally In February, and appears now to be flattening

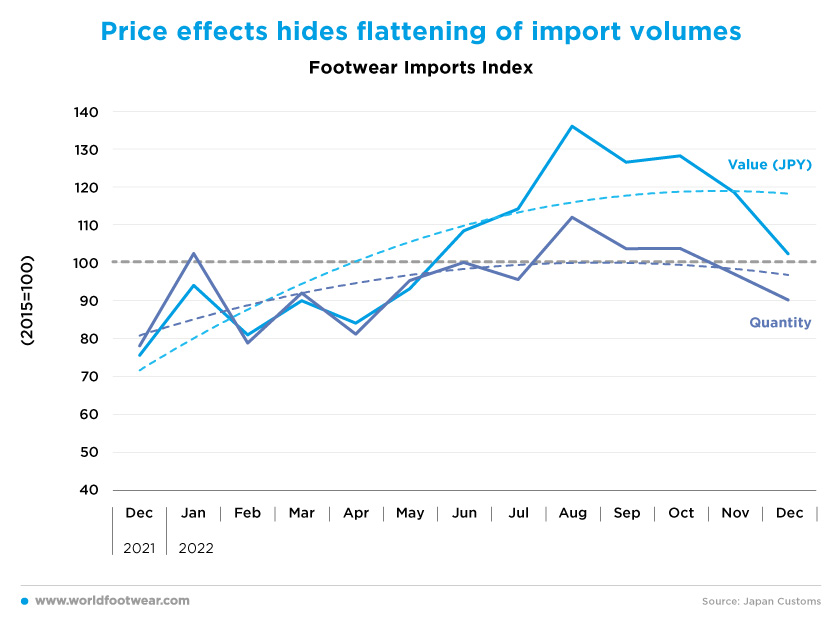

Price effects hide the flattening of import volumes

As Japanese footwear consumption (in pairs) is mainly imported (93%, according to the World Footwear 2022 Yearbook), the change in the volume of imports can be used as a proxy for the performance of footwear retail. After trending up through August, this volume indicator reversed its trajectory in the fourth quarter of 2022, closing the year about 10 percentage points below the 2015 baseline.

Everything considered, the recent performance of footwear retail sales may just reflect price effects. Firstly, and following Russia’s invasion of Ukraine, it reflects both the inflation in raw materials costs at the origin and the increase in shipping costs, all coupled with the depreciation of the JPY. Still, altogether, these effects are barely noticeable in the value of imports in December, just 2 percentage points up the baseline.

In fact, the yen-based import price index was clearly slowing due to some appreciation of the yen since November, thus easing the inflationary pressures from imports. According to Takeshi Minami, chief economist at Norinchukin Research Institute, “firms are still passing on rising input costs at home (…). But such price pressure will gradually weaken, with commodity inflation peaking out and major economies likely to stagnate in the first half of this year” (japantimes.co.jp).

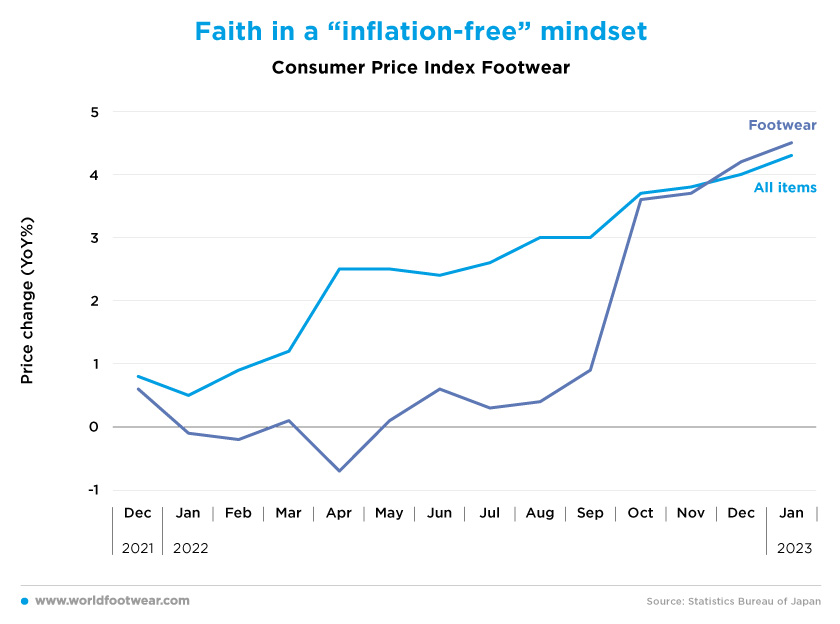

Faith in an “inflation-free” mindset

As a result of abnormal imported inflation, the all-items Consumer Price Index increased from 0.5% to 4.3% in the twelve months to January, a record score in more than 40 years. This is challenging the Japanese mindset of very low inflation if not entrenched deflation, making it difficult for economic operations to adapt and look ahead.

Footwear retailers, as usual, have resisted fully passing the import effect to customers, maintaining consumer prices under the 1% bar until September. By contrast, in October, footwear consumer prices radically jumped 3.6%, continuing then to rise through January, reaching 4.5%, year-over-year, exceeding the all-prices index itself.

Underscoring the prevailing inflation-free mindset, “most economists see the acceleration coming to a halt in February when the additional effects of Prime Minister Fumio Kishida’s stimulus package [including subsidies to utility bills for consumers, electricity and gas prices] are expected to materialize” (bloomberg.com).

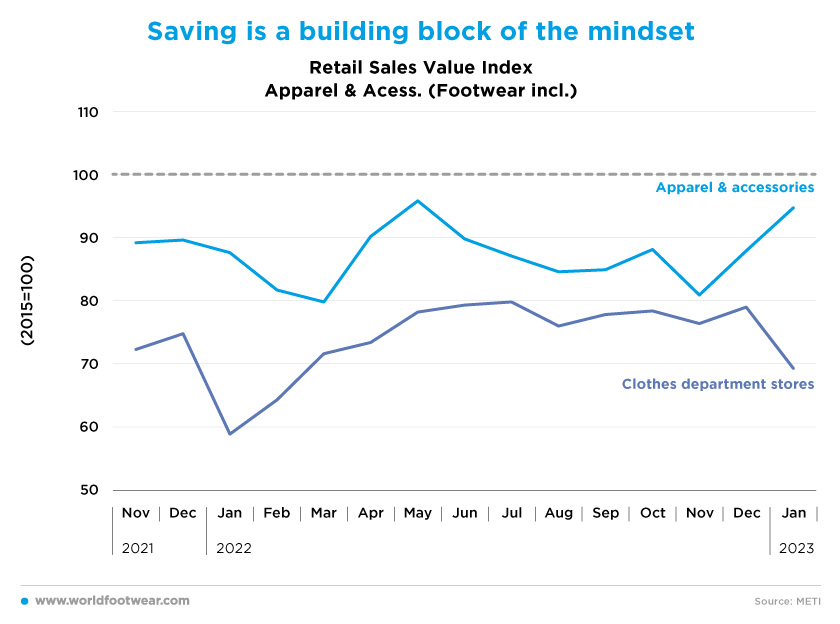

Saving is a building block of the mindset

Despite the price increases being “out-of-the-box”, both the indexes of Retail Sales for Apparel & Accessories (including Footwear) and Clothes department stores (seasonally adjusted by METI) show, on average, a very flat performance in the second half of 2022, clearly below the 2015 baseline for more than 10 to 20 percentage points. Evidence for January this year concerning the category of apparel & accessories appears to be mixed. Volume gains may be significant because inflation in the broad category is softening, as compared to footwear prices alone, as seen before.

Meanwhile, “a quarter of Japanese firms have offered inflation allowances or plan to do so”, informed the corporate credit research firm Teikoku Databank. Yet “there is a possibility that the trend of passing on the increased cost of electricity and other expenses to customers will continue after summer” an official with the credit research company added (japantimes.co.jp).

However, discrete “bonuses or inflation allowances would have only a limited impact on easing the pain of cost-push inflation, as consumers tend to save one-off pay-outs rather than spend”, said Takahide Kiuchi, an executive economist at the Nomura Research Institute and former member of the BoJ (japantimes.co.jp).

The same may happen to the new anti-inflation subsidies offered by the government; demand for subsidized categories can be better sustained, but additional disposable income, if any, is likely to be saved instead of used for discretionary shopping categories, such as clothing and footwear. After all, the preference for saving is also a building block of the Japanese-specific mindset.

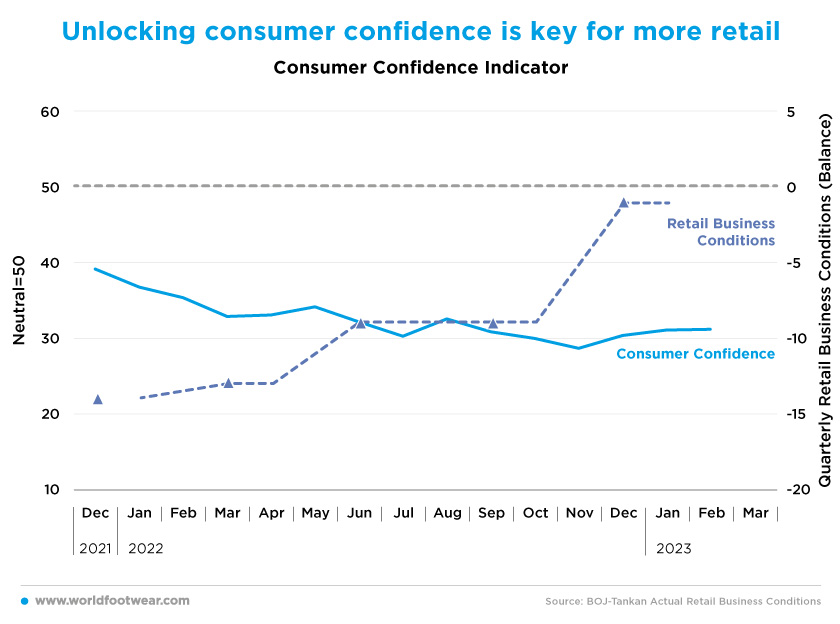

Unlocking consumer confidence is key for more retail

The Consumer Confidence indicator (source the Cabinet Office of Japan) improved marginally in February, but it seems to be now flattening. However, as of February, the indicator is still some 20 percentage points down the neutral frontier, mainly because it continues to exhibit the Japanese consumers’ allergy to inflation. “The percentage of households anticipating price expectations in the year ahead to "go up" at 94.3% - up 0.5% from January” (forexlive.com), and such negative item almost overwhelmed the positive items of both income growth (up 0.6 points from January to 36.2) and employment (up 0.8 points to 38.0).

Within the same time frame, retailers' perception of actual business conditions (quarterly Tankan indicator by BoJ) is trending up and almost kicking the zero-balance point. Despite retailers’ optimism, consumers’ mindset on inflation is paramount to translating confidence into a better retail outlook.

In a recent document, the Cabinet Office said “extra savings have been increasing, albeit at a slower pace than before. Even in the current phase of rising prices, it cannot be observed that (people) have been dipping into their savings”, concluding, therefore, that “any boost to consumption is not clear at this point” (japantimes.co.jp).

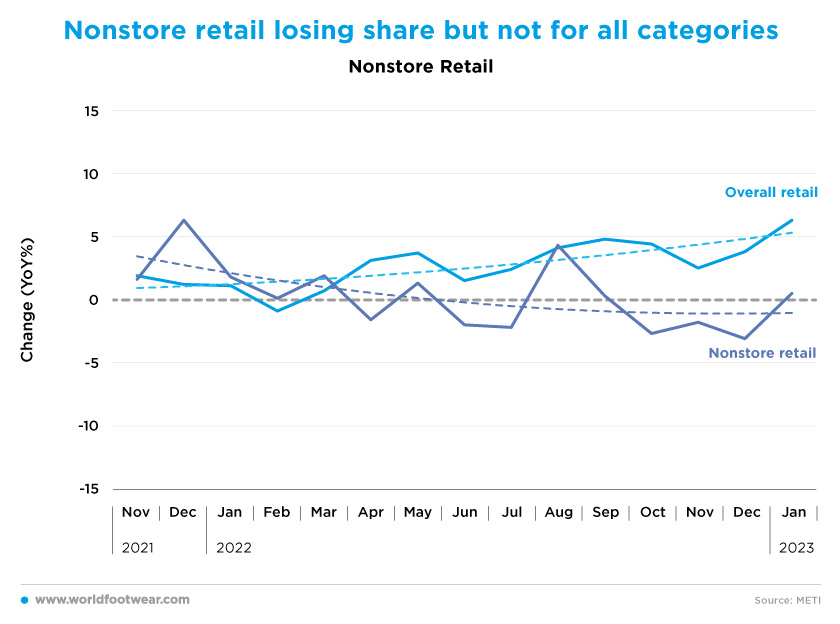

Non-store retail losing share, but not in all categories

The growth rate of overall retail is following a trend upwards, closing January at 6.3%, exceeding the 4.5% consumer price growth rate, corresponding to almost 2 percentage points of gain in volume. In contrast, Non-store Retail, where e-commerce holds the biggest share, is decelerating, ending the same period with a growth rate of 0.5%. As a result, the share of Non-store in overall retail decreased from 7.6% to 6.8% (measured by METI data), year-over-year, and most likely declined in real terms due to adverse price effects hurting both channels.

Yet, such overall conclusions may not apply to the fashion categories. ZoZo, the largest fashion e-commerce in Japan, announced that its Gross Merchandise Value in the third quarter ending on the 31st of January increased by 8.3%, as compared to the same period of last year, with operating profits jumping more than 15%, year-over-year, despite the growth of expenses to attract and promote customers (corp.zozo.com).