Register to continue reading for free

Japan Retail: renewed optimism for footwear demand?

Japan’s retail landscape is transforming, driven by the strong performance of the online channel. Despite overall inflationary pressure, retail sales as a whole and footwear imports are on an upward trend, boosted by a weaker US dollar against the yen. With footwear prices finally showing signs of recovery, there is cautious optimism for renewed demand in the short term, even as rising interest rates weigh on consumer confidence

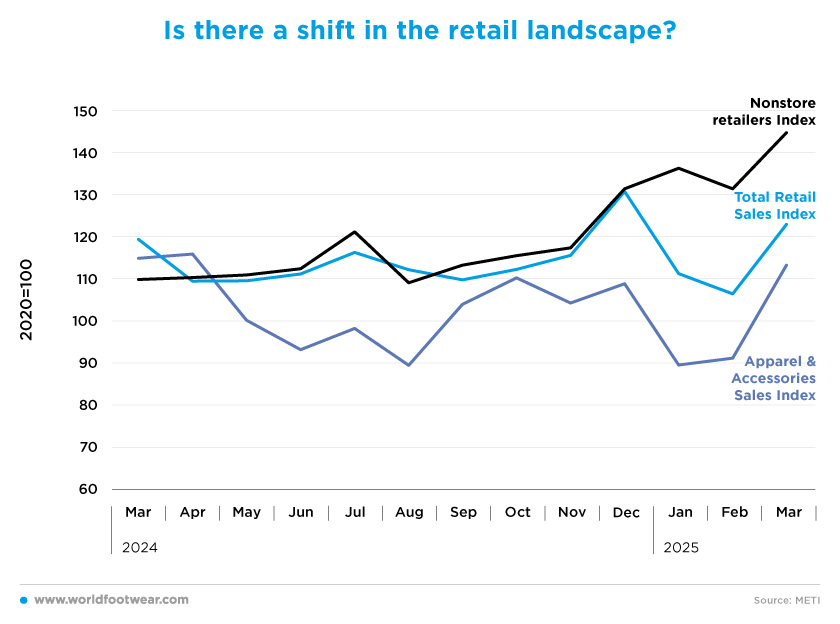

Is there a shift in the retail landscape?

By the end of 2024, e-commerce was showing a good growth trend, in line with total retail sales. However, since the beginning of 2025, this retail channel has performed better than others – online retail sales have increased by 10% since December 2024.

According to GlobalData, the e-commerce market in Japan is expected to grow by 7.7% in 2025, reaching 206.8 billion US dollars. This growth is driven by increased consumer preference for online shopping and strong mobile usage.

“Japan is amongst the leading e-commerce markets in the Asia-Pacific region, trailing just behind China,” said Shivani Gupta, senior banking and payments analyst at GlobalData. “This is supported by high mobile and online penetration, as well as a strong preference for online shopping due to its ease and time-saving benefits,” she added. (retailasia.com).

As for the apparel and accessories sector, its retail sales performance has lagged behind that of the wider Japanese retail sector. Although the trend has been similar, the reality is that it has fallen short of total retail sales since May 2024. On a brighter note, however, retail sales in this sector have increased by 26.5% since January, suggesting a potential shift in future demand.

Companies such as Asics Corp. have got off to a successful start this year. Its net sales in the first quarter of 2025 were 208.3 billion yen, which is a 19.7% increase on the 174.1 billion yen recorded in the first quarter of 2024.

(…) “We are very pleased to see the growth across our divisions, fueled by strong response and demand for a number of our products in the various categories,” Koichiro Kodama, president and chief executive officer of Asics North America, commented in a statement. “As the year continues, and even when faced with uncertainties, we remain strongly committed to the success of our industry and supporting and collaborating with our key partners” (wwd.com).

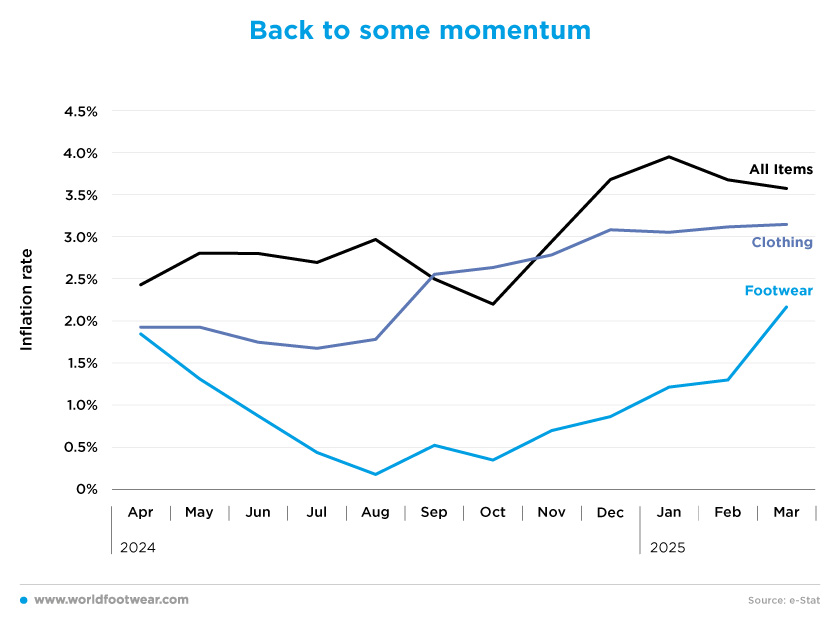

Back to some momentum

After reaching figures close to 0% (0.02% in August 2024), footwear prices in Japan are finally growing at a rate of around 2% (2.2% in March 2025). Compared with clothing, footwear prices are even more volatile. Prices in the clothing sector have increased at rates above 3% since the end of last year (3.1% in March 2025), and they did not experience the same sluggishness in price increases last year.This comes at a time when Japan is dealing with an inflationary crisis, something that hasn’t been seen for many years. In February, Japan’s headline inflation stood at 3.7%, remaining above the Bank of Japan’s target for almost three years as persistently high food prices impacted households.

Anyway, the footwear sector does not seem to have been affected by the same virus. With the new wave of inflation and the increase in retail sales over the last few months, footwear retailers are hoping that demand will increase, and prices will rise once again.

The core consumer prices index (CPI) is expected to decelerate to 2.2% from 2.6% in March, the lowest level in three months, but still at or above the 2% target of the Bank of Japan (BoJ) for more than two years (money.usnews.com). “The recent rise in food and gasoline prices likely affected household views on the price outlook”, a BOJ official told in a briefing (reuters.com).

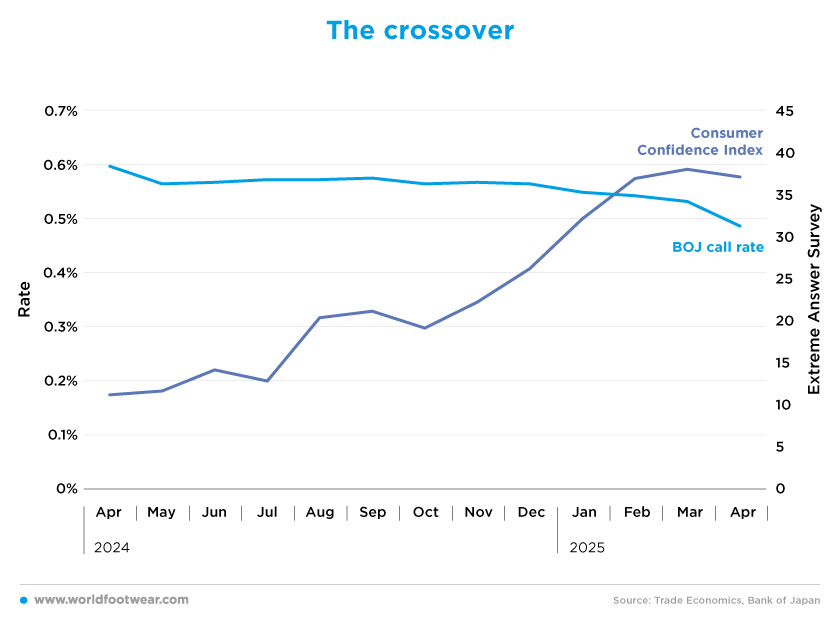

The crossover

The crossover has finally happened. Although consumer confidence in Japan has been slowly decreasing over the past 12 months, the BOJ has simultaneously been ramping up interest rates. As expected, the variables have now traded places.The central bank’s rate has always been linked to the level of investment, consumption and confidence among the citizens of each economy; therefore, when this rate crosses certain figures, there are clear effects on the other variables. With the BOJ increasing rates (the highest being 0.59% in March), consumers are starting to feel the implications, and their confidence in the future economic situation of their households has decreased by about 11% since January.

Consumer spending, which accounts for more than half of GDP, was largely flat. Spending on food is declining amid continuing inflation. “Consumer sentiment is weakening”, pointed out Ryosei Akazawa, Japan’s economic and fiscal policy minister (asia.nikkei.com).

Nevertheless, Bank of Japan Deputy Governor Shinichi Uchida also stated that the central bank will continue to raise interest rates if economic growth accelerates again and underlying inflation is on track to reach the 2% target (reuters.com).

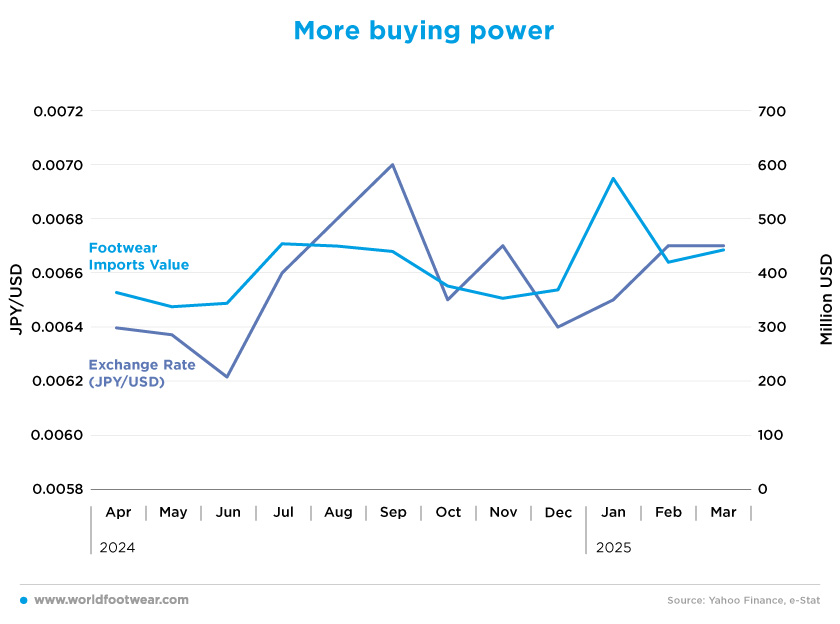

More buying power

In the first quarter of 2025, Japan imported 1.4 billion dollars’ worth of footwear (168 million pairs), representing a 19% increase compared to the same quarter last year. The average import price also increased from 7.96 to 8.57 US dollars.Last year, Japanese footwear imports increased by 5.5% in yen terms, but decreased by 2% in US dollar terms. This difference is mainly explained by the exchange rate between the two currencies, and the opposite is now happening. Despite importing more in value terms, Japanese importers have also increased the number of pairs imported, as the US dollar has depreciated over the past few months due to the ongoing trade war. Since December 2024, the yen has increased in value by 7.8% compared to the dollar.

The latest government data shows that imports probably rose by 9.0% year-on-year in April, swinging from a 5.1% annual decline the previous month. Consequently, the trade balance (exports minus imports) was expected to show a deficit of 339.5 billion yen (2.18 billion US dollars) by the 22nd of May (money.usnews.com).